How to choose the best Medicare supplement plans?

Jan 06, 2022 · The more you educate yourself on a topic, the more you learn that “free” isn’t truly free. This also applies to Medicare Advantage plans, they are not actually free. The money to pay for it has to come from somewhere. Medicare Advantage Plans are Not Free. To understand the concept, we first need to understand what a Medicare Advantage plan is.

What is the best and cheapest Medicare supplement insurance?

There are a few different times you can shop for a $0 monthly premium Medicare Advantage Plan. Your Initial Enrollment Period (IEP) for Medicare begins 3 months before the month of your 65th birthday, including your birthday month, and continues through the 3 months after the month of your 65th birthday.

Which Medicare supplement plan should I buy?

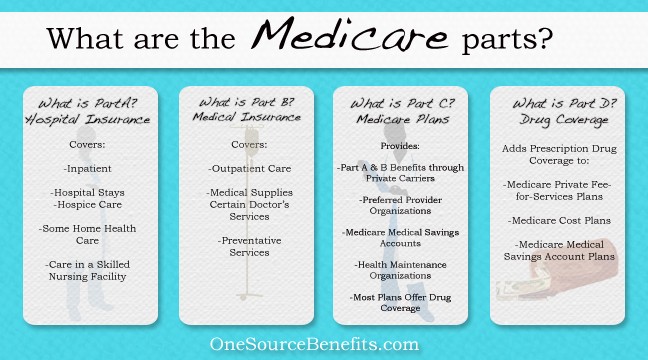

Medigap is Medicare Supplement Insurance that helps fill "gaps" in. Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and ...

Are Medicare supplement insurance plans worth it?

Nov 15, 2021 · No, Medicare Supplements are not free. However, they can free you from paying out of pocket costs when you use your Part A and Part B benefits. Since Original Medicare leaves you responsible for deductibles and coinsurance, Medigap plans fill in those gaps in coverage.

Are there any Medicare supplement plans that are free?

What are $0 premium plans?

Are Medicare supplemental plans based on income?

How do you qualify to get 144 back from Medicare?

Why do some Medicare plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.Oct 6, 2021

What is the cheapest Medicare plan?

Can I get Medicare Part B for free?

Why is my Medicare supplement so expensive?

What is the average cost of supplemental insurance for Medicare?

Is there really a $16728 Social Security bonus?

Will Social Security get a $200 raise in 2021?

What is the income limit for extra help in 2021?

Is Medicare Advantage free?

Of course, no Medicare plan is really free. You may still pay deductibles and copays for covered services and you’ll still have to pay the Part B premium. But depending on your own personal healthcare needs, a Medicare Advantage plan may be worth it for the added benefits.

How much is Medicare Advantage monthly?

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. That's right—zero dollars per month. And that usually includes coverage for services that aren’t covered under Original Medicare.

Does Medicare Advantage pay out of pocket?

That means you may have to pay more money out of pocket if you see a doctor outside the plan’s network.

What are the benefits of Medicare Advantage?

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because: 1 To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.#N#That means you may have to pay more money out of pocket if you see a doctor outside the plan’s network 2 Many Medicare Advantage plans offer preventive care and disease management programs to help people better manage their health, and healthy patients generally have lower healthcare costs. 3 If a particular Medicare Advantage plan ends up spending less than the flat fee it gets from the government, it can pass the savings on to members.#N#That may mean offering plans with a monthly plan premium of $0 or providing additional benefits, such as dental, vision and/or prescription coverage

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Is Medicare free in 2021?

Updated on April 5, 2021. Many people believe Medicare is free once they age in at 65. Some people are under the impression their payroll taxes will ultimately pay for Medicare costs in full. This is not entirely true, and for some, this news can be very stressful and worrisome. If Medicare is in your near future, ...

Is Medicare a pay as you go policy?

Once you’re on Medicare, some costs may be a “pay as you go.” Just like many other health insurance policies, Medicare has deductibles and coinsurances. Medicare isn’t free, and Part B only pays 80% of outpatient expenses; so, you’re responsible for the remaining 20%.

Does Medicare have a deductible?

Just like many other health insurance policies, Medicare has deductibles and coinsurances. Medicare isn’t free, and Part B only pays 80% of outpatient expenses; so, you’re responsible for the remaining 20%.

How much is Part B insurance in 2021?

Most Part B enrollees have a standard monthly premium that can change from year to year. For 2021, the standard monthly premium is $148.50. Premiums reflect income. Therefore, if you’re in a higher income bracket, you will pay more for coverage.

Do you have to pay Part C premiums?

Yes, some Part C plans don’t require a monthly premium, but that doesn’t make them entirely free. You will still need to pay your Part B premium. These plans are tricky. They may offset the zero-dollar premiums by requiring higher copayments and coinsurance.

What is a Part D plan?

Part D plans are voluntary plans with premiums that vary in cost per month from state to state. The cost of your medications will depend on the type of drug and usage; you may need to spend a lot or only a little bit on your medications.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

Does Medicare Supplement cover out-of-pocket expenses?

Medicare Supplement plans aren’t meant to provide stand-alone health coverage; these plans just help with certain out-of-pocket costs that Original Medicare doesn’t cover. If you’re under 65 and have Medicare because of disability, end-stage renal disease, or amyotrophic lateral sclerosis, your eligibility for Medicare Supplement coverage may ...

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period — for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

Does Medigap cover prescriptions?

Since Medigap plans don’t include prescription drug benefits, if you’re enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) helps cover some of these out-of-pocket costs, which helps individuals better plan for their insurance costs. Learn more about Medigap below.

Does Medicare Supplement cover out of pocket costs?

Medicare Supplement Insurance. Medicare Supplement Insurance can help cover some of Medicare's out-of-pocket costs. In most states there are 10 standardized Medigap plans to choose from, each providing coverage for a unique mix of basic benefits.

What are the costs of Medicare?

Even if a product or service is covered by Medicare, there are some costs you may have to pay out of pocket, including: 1 Part A deductible: $1,484 per benefit period (in 2021) 2 Part A coinsurance for hospital stays past 60 days: Starting at $371 per day and increasing after 91 days 3 Part B Deductible: $203 per year (in 2021) 4 Part B coinsurance: 20 percent of the Medicare-approved amount for a service

How much is Medicare out of pocket?

Even if a product or service is covered by Medicare, there are some costs you may have to pay out of pocket, including: Part A deductible: $1,484 per benefit period (in 2021) Part A coinsurance for hospital stays past 60 days: Starting at $371 per day and increasing after 91 days.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Take advantage of your state's one-on-one counseling program

If you have a complicated question about Medicare, or just want some help talking through your options, you should take advantage of the free one-on-one counseling available through your state's State Health Insurance Assistance Program (SHIP)

See all our Medicare information

We've collected the information you need to manage your Medicare benefits. How to sign up for the first time. How to decide between Medicare Advantage and Medigap. How to pick the best Advantage or prescription drug plan.