If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period (SEP), you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

What is the monthly premium for Medicare Part B?

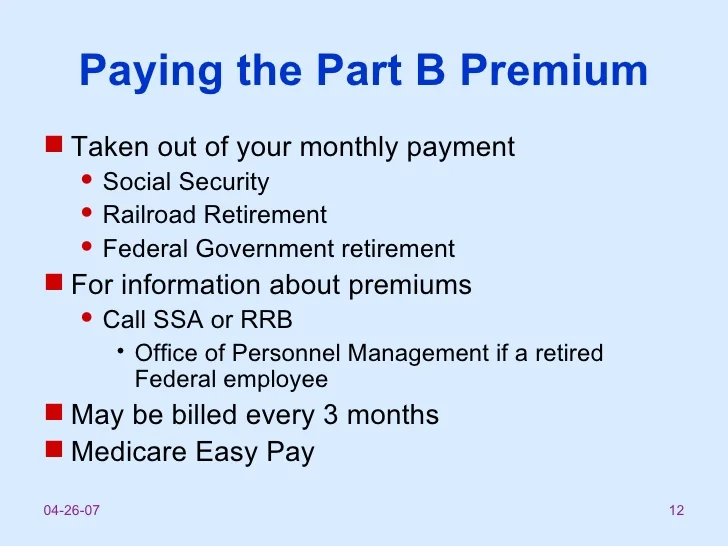

4 ways to pay your Medicare premium bill: Pay online through your secure Medicare account (fastest way to pay). Log into (or create) your secure Medicare account to use this free service to ... Sign up for Medicare Easy Pay. With this free service, we’ll …

How is the premium calculated for Medicare Part B?

Log into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit, card, or from your checking or savings account. Our service is free. Contact your bank to set up an online bill payment from your checking or savings account. Not all banks offer this service, and some charge a fee.

What are the rules for Medicare Part B?

To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back. If you keep the card, you agree to …

How do I pay my monthly Medicare Part B premium?

Dial (800) 950-0608 for help finding affordable Medicare coverage. Just the essentials... Medicare Part B is very rarely “free”, there are monthly premiums most people have to pay for their Medicare Part B coverage There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely

How do I get reimbursed for Medicare Part B?

Is Medicare Part B free for anyone?

How do I get my $144 back from Medicare?

Does Medicare Part B cost depend on income?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

How do you pay for Medicare Part B if you are not collecting Social Security?

Is Medicare Part B going up 2022?

Is there really a $16728 Social Security bonus?

What is the Medicare Part B deductible for 2021?

How can I increase my Social Security benefits after retirement?

- Work for 35 Years. ...

- Wait Until at Least Full Retirement Age. ...

- Sign Up for Spousal Benefits. ...

- Receive a Dependent Benefit. ...

- Monitor Your Earnings. ...

- Avoid a Tax-Bracket Bump. ...

- Apply for Survivor Benefits. ...

- Check for Mistakes.

Is Medicare Part B premium automatically deducted from Social Security?

What is deducted from your monthly Social Security check?

Does Social Security count as income for Medicare premiums?

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

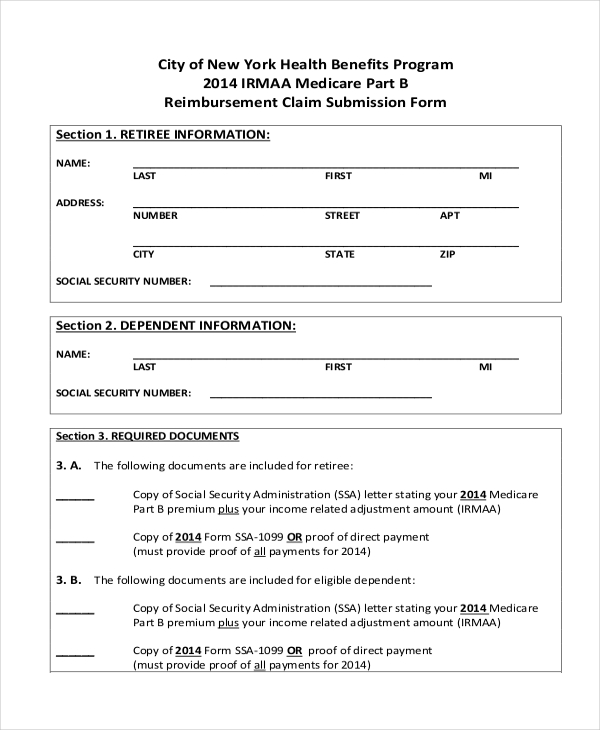

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

How to contact Medicare helpline?

For more information, contact the Medicare helpline 24 hours a day, seven days a week at 1-800- MEDICARE (1-800-633-4227) , TTY 1-877-486-2048.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

How to drop Part B?

To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature.

What happens if you drop Part B and keep Part A?

If you’re dropping Part B and keeping Part A, we’ll send you a new Medicare card showing you have only Part A coverage. Write down your Medicare Number in case you need to go to the hospital or get Part A-covered services until your new card arrives.

What services does Medicare cover?

Your costs for health care: You may have to pay all of the costs for services that Medicare covers, like hospital stays, doctors’ services, medical supplies, and preventive services.

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

Is working income counted in Medicare?

Certain income from working may not be counted in this estimate, as the Qualified Medicare Beneficiary program uses the supplemental security income guidelines for calculating countable income, so up to half of your working income may not be included.

Can you count your house as supplemental security income?

Some of your assets may not be counted, such as your house, car, or other household items, because this stipulation also follows the supplemental security income guidelines for countable assets.

What happens if you don't pay Medicare Part B?

If you don't pay your monthly Medicare Part B premiums through Social Security, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you'd only pay the amount with the giveback benefit deducted.

How to find Part B buy down?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B monthly premium is $148.50. Beneficiaries also have a $203 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What does it mean to be dually eligible for Medicare?

If you're dually eligible, it means you have both Medicare and Medicaid.

Can you enroll in Medicare Advantage if you have Medicaid?

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Does Medicare give back Medicare?

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Do retirees get Medicare Part B?

However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...