Full Answer

What are my Medicare insurance options in Montana?

Nov 24, 2021 · To find out more about how to terminate Medicare Part B or to schedule a personal interview, contact us at 1-800-772-1213 (TTY: 1-800-325-0778) between Monday through Friday from 8:00 am – 7:00 pm. You can also contact your nearest Social Security office .

How do I apply for Medicare and Social Security in Montana?

Sep 16, 2018 · Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday, 7AM to 7PM. Apply in person at a local Social Security office. Call the Railroad Retirement Board if you worked at a railroad.

How do I get help with Medicaid in Montana?

We also regulate all Medicare Supplement insurance sold in Montana and publish a yearly price comparison booklet where all plans sold in Montana are compared side-by-side. You can find all of these resources below. Montana also offers trained, in-person assistance at locations throughout the state to answer questions you can’t answer on your own.

How does Medicare work in Montanans?

You can use the Healthcare.gov Income Levels and Savings tool to find out what you might qualify for. The best way to find out what you qualify for is to apply. If you want to apply for food and cash assistance at the same time, apply at apply.mt.gov or call the Montana Public Assistance Helpline at 888-706-1535.

How do I remove myself from Medicare?

How to drop your Medicare drug planCall us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.Mail or fax a signed written notice to the plan telling them you want to disenroll.Submit a request to the plan online, if they offer this option.Call the plan and ask them to send you a disenrollment notice.

Can I discontinue my Medicare?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.24 Nov 2021

Can I drop Medicare coverage at any time?

No, you can't switch Medicare Advantage plans whenever you want. But you do have options if you're unhappy with your plan. You can jump to another plan or drop your Medicare Advantage plan and change to original Medicare during certain times each year. You may be eligible to change plans at other times, too.

How do I cancel Medicaid?

Call or visit your state's Medicaid office. Going directly to your local Medicaid office often is the easiest way to cancel your coverage. You'll have the benefit of working with a trained staff member who can assess your situation and make sure your coverage is cancelled correctly.30 May 2021

How do I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.8 Jul 2015

Can I cancel Medicare Part B if I have other insurance?

A. Yes, you can opt out of Part B. (But make sure that your new employer insurance is “primary” to Medicare.

How do I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.27 Oct 2014

Can you cancel Medicare Part B at any time?

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.

How do I return to Original Medicare?

How to switchTo switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins.To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

Can I decline Medicaid?

You must complete, sign, and return the Request to Decline Medicaid Health Coverage to the Department of Human Services' Economic Security Administration. Review the information on this form carefully.

How long does Medicaid last?

10. How Long Will My Medicaid Benefits Last? Your benefits will last as long as you remain eligible.31 Aug 2020

Can I change my health insurance plan after enrollment?

Changing health insurance after open enrollment: Can I switch anytime? In most cases, you can only sign up for or update your health insurance during the annual Open Enrollment Period. However, if you experience certain qualifying life events, you may also become eligible for a Special Enrollment Period.

What is Medicare Advantage in Montana?

Some Medicare insurance options in Montana include: Medicare Advantage plans (Medicare Part C): Medicare Advantage plans are Medicare insurance offered through private insurance companies that have contracted with Medicare. These plans are required to cover at least the same level of coverage as Original Medicare, Part A and Part B.

What are some of the things that are not included in Medicare?

Some types of coverage aren’t included in Original Medicare, such as prescription drugs, routine vision and dental, and overseas coverage. You may be able to get some of those benefits covered through Medicare plans that are offered through private insurance companies that contract with Medicare.

What is Medicare in Montana?

Original Medicare is the government-run health insurance program for adults 65 and older, as well as some individuals under 65 with certain disabilities or conditions. Original Medicare comes in two parts. Medicare Part A covers inpatient hospital and skilled nursing facility care, as well as nursing home care ...

How to contact the Railroad Retirement Board?

Call the Railroad Retirement Board if you worked at a railroad. You can reach the RRB at 1-877-772-5772 (TTY users should call 312-751-4701), Monday through Friday, 9AM to 3:30PM. It may be a good idea to consider all of your Medicare options before enrolling in a plan.

How long do you have to be a US citizen to qualify for medicare?

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.

Does Montana have Medicare Supplement?

Medicare Supplement (Medigap): Montana residents enrolled in Medicare Part A and Part B may choose to join a Medicare Supplement plan to cover “gaps” in their health-care costs, like copayments, deductibles, and overseas emergency health coverage. Private insurance companies may offer up to 10 standardized Medigap policy options, ...

Does Montana have Medicare?

Medicare Savings Programs in Montana: Montana residents with limited income or assets may be able to get help with Medicare premium s, copayments, coinsurance, and deductibles. To find out if you’re eligible and to apply for these programs, contact your local Medicaid office.

How long do you have to apply for Medigap?

You can/must apply for a Medigap policy no later than 63 calendar days from the date your coverage ends. Plan G is not a guarantee issue for special enrollment periods.

What is the state health insurance program?

Called the State Health Insurance Assistance Program (or SHIP), this state-wide program offers trained, in-person assistance throughout the state. Call 1-800-551-3191 for more information or check out the SHIP website.

Can you buy Medicare Advantage in Montana?

Some Montanans choose to buy a Medicare Advantage plan, which rolls the services provided by Medicare Part A and Part B into one plan administered by a private health insurance company. Add it all up and there’s a lot to consider as you approach 65.

HELP Plan

Montana’s HELP Plan provides a variety of health care benefits including dental, vision, and prescription drugs, as well as other services, with low monthly premiums.

Medicaid

Montana’s HELP Plan provides a variety of health care benefits including dental, vision, and prescription drugs, as well as other services. Medicaid also offers benefits not normally covered by Medicare, like nursing home care and personal care services Medicaid members will receive a Montana Access to Health card.

Healthy Montana Kids

Healthy Montana Kids (HMK) provides a free or low-cost health insurance plan which provides coverage to eligible Montana children up to age 19. Covered services include medical, dental, eyeglasses, and other related services.

Veterans

Military veterans and their families are among the Montanans who may be eligible for the HELP Plan or Medicaid. More information about Eligibility for Veterans

What is passport to health?

Passport to Health (Passport): Choose your primary care provider. Passport is the primary care case management ( PCCM) program for Montana Medicaid and HMK Plus members. The Passport programs support Medicaid and HMK Plus members, as well as, providers to establish a strong doctor/patient relationship and ensure the appropriate use of services.

How long does Medicaid pay for prescriptions?

Medicaid will pay for a 34-day supply of drugs. Members may get a 90-day supply of some drugs at the time for heart disease, high blood pressure, or birth control. Early refills may be authorized if the person who writes the prescription changes your dose.

How to contact Medicaid for passport?

If you need help choosing your Passport provider or have questions regarding Passport, call the Medicaid/HMK Plus Member Help Line at 1-800-362-8312, M-F, 8am-5pm. Remember, you will need a referral (approval) from your Passport provider before you can see most other healthcare providers.

What happens if you don't show up for a scheduled appointment?

When members do not show up for a scheduled appointment, it creates an unused appointment slot that could have been used for another member. It is very important to keep appointments and call the provider in advance if you cannot make it to a scheduled appointment.

When does the dental benefit start?

The benefit year runs from July 1 through June 30. You will have to pay for services that are not covered and for those services that go over the $1,125 dental treatment limit for the following list of treatments: Restorative (fillings, crowns), Periodontal (gum disease issues), and. Oral surgery (extractions).

Can you bill a provider for no show appointments?

Medicaid providers cannot bill a member for no-show/missed appointments. However, a provider may discharge a member from their practice after so many no-show/missed appointments. The provider must have the same policy for Medicaid members as non-Medicaid members, and must notify Medicaid members that the policy exists.

Do prescription drugs need prior authorization?

Many prescription drugs are covered. Some prescription drugs may need prior authorization. To find out if a drug you need is covered or to find out if a drug needs prior authorization, talk to your pharmacist or the person who prescribed the drug.

How much home equity do you need to have for Medicaid in Montana?

Montana requires applicants for Medicaid LTSS to not have more than $595,000 in home equity. Applicants for Medicaid nursing home care and HCBS cannot transfer or give away assets for less than their value during without incurring a penalty period in Montana.

What is the income limit for HCBS in Montana?

Montana’s income limit for HCBS is $783 a month if single and $1,566 a month if married (and both spouses are applying). In Montana in 2020, spousal impoverishment rules allow the non-Medicaid spouses of LTSS recipients to keep an allowance that is between $2,155 and $3,216 per month.

How much can you get Medicaid in Montana?

Applicants can qualify for Medicaid for the aged, blind and disabled with incomes up to $783 a month if single and $1,175 a month if married in Montana. In Montana, applicants with income above the eligibility limit for Medicaid can enroll in the Medicaid spend-down. Medicare beneficiaries with low incomes may qualify for assistance ...

What is the maximum home equity for Medicaid in Montana?

In 2020, states set this home equity level based on a federal minimum of $595,000 and maximum of $893,000.

How long does Medicaid spend down last in Montana?

In Montana, the Medicaid spend-down is usually approved for one month increments , with the submission of additional medical expenses required for further coverage.

What is a ship counselor?

SHIP counselors may also be able to offer referrals to local agencies for services like home care and long-term care.

How much does Medicaid ABD cover?

Medicaid ABD also covers one eye exam and one pair of eyeglasses every 12 months. Income eligibility: The income limit is $783 a month if single and $1,175 a month if married. (This is the same income limit as Supplemental Security Income .) Asset limits: The asset limit is $2,000 if single and $3,000 if married.

What happens if you lose Medicare coverage?

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join.

How to switch to Medicare Advantage?

To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins. To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE. Unless you have other drug coverage, you should ...

How many people in Montana are on Medicare in 2021?

The Centers for Medicare & Medicaid Services (CMS) reported the following information on Medicare trends in Montana for the 2021 plan year: A total of 237,162 residents of Montana are enrolled in Medicare. The average Medicare Advantage monthly premium decreased in Montana compared to last year — from $48.58 in 2020 to $42.42 in 2021.

What is Medicare Montana?

Medicare Montana is a health insurance program funded by the government. It provides healthcare coverage for people age 65 and older and those who have certain chronic illnesses or a disability.

What is Medicare Supplement in Montana?

Medicare supplement plans in Montana. Medicare supplement (Medigap) plans help cover the gaps in original Medicare coverage. These costs might include copays and coinsurance, as well as coverage for services that original Medicare doesn’t cover at all. You can purchase these plans in addition to having parts A and B.

What is Medicare Advantage in Montana?

Medicare Advantage in Montana. Medicare Advantage (Part C) plans are offered through private insurance companies rather than the government. This means you’ll have a lot more options in terms of covered services and how much you’ll pay for them. Medicare Advantage plans in Montana may cover:

What is the phone number for Medicare in Montana?

Medicare (800-633-4227) . You can call Medicare for more information about plans offered, and for more tips on comparing Advantage Plans in your county. Montana Department of Public Health and Human Services, Senior and Long-Term Care Division (406-444-4077).

What companies offer Medigap in Montana?

Many companies offer Medigap plans in Montana. In 2021, some of the companies offering Medigap plans throughout the state include: AARP – UnitedHealthcare. Blue Cross Blue Shield of Montana. Colonial Penn. Everence Association Inc. Garden State. Humana.

What are the services covered by Medicare?

all hospital and medical services covered by original Medicare parts A and B. prescription drugs. dental, vision, and hearing care. fitness memberships. some medical transportation services. Medicare Advantage plans are offered by a number of health insurance carriers based on your location.

What Are My Medicare Options in Montana?

Much like other parts of the United States, the options available in Montana include Part C, Medigap, Part D, and more. Some people may choose to only have Medicare and a Part D plan; but, for more comprehensive coverage, you can include Medigap. An alternative to that would be enrolling in Part C or a Medicare Advantage plan.

What is the Best Medicare Supplement Plan in Montana?

The same top 3 Medigap plans attract enrollees from all over the nation. Each policy boasts access to any Medicare doctor in the United States, easy claims approvals, and little to no out of pocket costs. These popular plans are Plan F, Plan G, and Plan N. Another policy that could be beneficial is Medigap High Deductible Plan G.

How Much Do Medicare Supplements Cost in Montana?

Someone in Montana, new to Medicare can expect Medigap plan costs to be around $120 a month for Plan G. But, the price is going to depend on which plan and carrier you select. Also, age, gender, and zip code can play a factor in Medigap costs. You may find a cheaper policy or a more expensive plan.

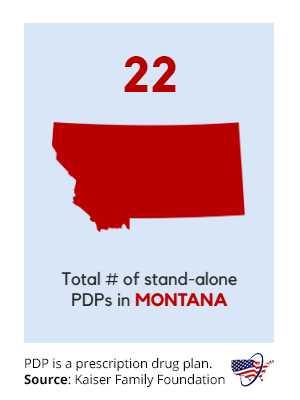

Part D Plans Plans for Medicare in Montana

There are 29 stand-alone Medicare Part D options available in Montana. But, one of those options is going to benefit you more than the others.

Montana Medicare Advantage Plans

18% of beneficiaries in Montana enrolled in a Medicare Advantage plan. While the monthly premium costs may be lower each month, Medicare Advantage Plans come with restrictions and coverage limitations. Also, you may find the out of pocket costs seem to nickel and dime you.

How to Apply for Medicare in Montana

The biggest question in insurance is, would you rather pay more now and less later or less now and more later. Only you can answer that question.

What is the Montana Big Sky Medicaid waiver?

1) HCBS Waiver – this home and community based services Medicaid waiver , also known as the Montana Big Sky Medicaid Waiver, provides benefits to physical disabled adults and seniors who require a nursing home level of care, but choose to live at home or in the community, including assisted living facilities and adult foster care homes. Benefits include private duty nursing, home modifications, specialized medical equipment, and adult day health care. Personal care assistance is also available and program participants are able to select the caregiver of their choosing.

What is the medically needy path in Montana?

1) Medically Needy Pathway – In Montana, the Medically Needy Pathway, also called a Spend-Down Program, allows those who are categorically aged, blind and disabled who would otherwise be over the income limit to qualify for Medicaid if they have high medical expenses.

What is the maximum maintenance allowance for 2021?

As of January 2021, the maximum monthly maintenance needs allowance is $3,259.50 / month (this figure will increase in January of 2022). This spousal allowance is strictly for married couples with one spouse applying for nursing home Medicaid or home and community based services via a Medicaid waiver.

What are countable assets?

Countable assets (also called resources) include cash, stocks, bonds, investments, promissory notes, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility purposes, there are many assets that are not counted.

What is Medicaid in Montana?

Medicaid is a wide-ranging health insurance program for low-income individuals of all ages. Jointly funded by the state and federal government, health coverage is provided for varying groups of Montana residents, including pregnant women, parents and caretaker relatives, adults without dependent children, disabled individuals, and seniors.

How long is the look back period for medicaid in Montana?

This is because in Montana, Medicaid has a “Look-Back” period of 5 years, and if one is in violation, a period of Medicaid ineligibility will result. 2) Medicaid Planning – the majority of persons considering Medicaid are “over-income” or “over-asset” or both, but still cannot afford their cost of care.

How much is combined life insurance in 2021?

Combined life insurance policies are limited to a total face value of $5,000 (in 2021), and one’s primary home, given the Medicaid applicant lives in the home (or has intent to return to it), and the applicant’s equity interest in the home is not greater than $603,000 (in 2021) is also exempt.