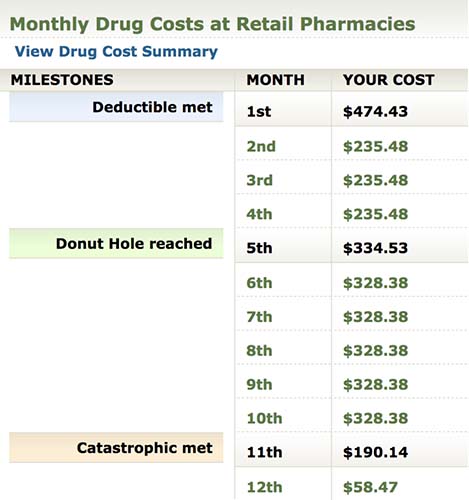

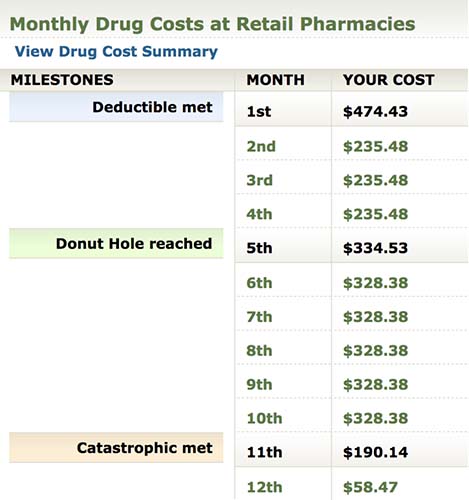

It is possible to get out of the Medicare donut hole. Once you spend a set amount of money out of your pocket, you’ll reach a benefit stage called catastrophic coverage. In 2020, if you spend $6,350, you reach the catastrophic coverage stage for Part D.

Is there still a donut hole in Medicare?

The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

Why there's a hole in a doughnut?

According to Food52, the boring theory behind why doughnuts have holes is because it was necessary . Once bakers started adding egg yolks to their doughnut recipes, the dough became super rich, which made it difficult to cook the pastries evenly. The center would be gooey and raw while the edges would be crisp.

Why is there a hole in a doughnut?

Highlights

- Turns out that it was a deliberate move by a certain American sailor

- The most popular theory is credited to Captain Hanson Gregory

- Doughnuts were referred to as fried cakes

How big is the Medicare Donut Hole?

You only enter the Medicare donut hole (coverage gap) if you and your plan spend a certain combined amount of money within a calendar year. In 2021, this amount is $4,130. Here’s what counts toward the Medicare donut hole: Any discount you get on brand-name drugs.

How does one get out of the Medicare Part D donut hole in 2020?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole. See if you qualify and apply today.

How long does it take to get out of the donut hole?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Will the Medicare donut hole ever go away?

Key Takeaways. The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

Are there any ways to avoid the Medicare Part D donut hole?

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Purchase your brand name drugs at another pharmacy and pay the insurance copay. This strategy will reduce your out-of-pocket costs in Stage 2, and often keep you from falling in the Stage 3 donut hole.

What happens when the donut hole ends in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Did the Affordable Care Act close the donut hole?

The Affordable Care Act is closing the “donut hole” over time, by first providing a one-time $250 check for those that reached the “donut hole” in 2010, then by providing discounts on brand-name drugs for those in the “donut hole” beginning in 2011, and additional savings each year until the coverage gap is closed in ...

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What will the donut hole be in 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

How do you get out of the Medicare coverage gap?

Health or prescription drug costs that you must pay on your own because they aren't covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.

Does Medigap cover the donut hole?

But Medigap plans don't include any drug coverage at all. Rather, you'll need to get a standalone prescription drug plan and therefore, the donut hole would still apply.

Do all Medicare Part D plans have a donut hole?

Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.” Not everyone will enter the “donut hole,” and people with Medicare who also have Extra Help will never enter it.

What is the Medicare donut hole?

Back to the visual donut image. Picture a donut with a hole in the middle. Maybe it’s an old fashioned style, chocolate glazed, vanilla frosted with sprinkles, apple cider or any other flavor of your choice. Now that we’ve got your attention, let’s continue.

What is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

Did the Medicare donut hole go away in 2020?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Can I avoid the Medicare donut hole?

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,130 in 2021. Once you hit that amount, you enter the Medicare coverage gap.

Do Medicare Advantage plans cover the Medicare donut hole?

Some Medicare Advantage plans may offer extended gap coverage for enrollees in the Medicare donut hole, though you should check with your specific plan for more details.

Initial coverage limit

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Extra Help considerations

Some people enrolled in Medicare qualify for the Medicare Extra Help program based on their income. This program helps people pay for their prescription drug costs.

Generic drugs

For generic drugs, only the amount you actually pay counts toward your OOP threshold. For example:

Brand-name drugs

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What happens after I exit the donut hole?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: Five percent of a drug’s cost or a small copay.

1. Consider switching to generic drugs

These are often less expensive than brand-name drugs. If you’re taking a brand-name drug, ask your doctor about generic drugs.

Brand-name prescription drugs

Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. Some plans may offer you even lower costs in the coverage gap.

Generic drugs

Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

If you think you should get a discount

If you think you've reached the coverage gap and you don't get a discount when you pay for your brand-name prescription, review your next " Explanation of Benefits" (EOB). If the discount doesn't appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.