Full Answer

How do I avoid paying the Medicare levy?

If you have an entitlement statement, be sure to complete “M2 – Medicare Levy Exemption” on your tax return which allows you to avoid paying the levy. You or your tax agent can apply for a medicare entitlement statement. More information can be found on the Services Australia website here.

What is the Medicare levy and who has to pay it?

Generally, the Medicare Levy (2% of your taxable income) must be paid by all Australian residents receiving free health care ( Medicare ), unless you qualify for a reduction or exemption.

How do I get my Medicare levy refunded?

As long as your tax return was lodged within the last two years we can submit an amended tax return to the ATO and get any medicare levy you already paid refunded to you. You can reach out to us on [email protected] or 1300 693 829 and our team will talk you through the process.

Can I get a reduction or exemption from the Medicare levy?

You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances. You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare levy. The Medicare levy is collected from you in the same way as income tax.

How do I get around Medicare levy?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

How do I avoid Medicare levy in Australia?

There are just two main ways to avoid paying the levy and they do not apply to many Australians:You're a low income earner. Some low income earners (depends on your annual income) do not have to pay the levy or receive a reduction on the levy rate.You have a Medicare Entitlement Statement.

What cover do you need to avoid Medicare levy?

If you are subject to the Medicare Levy Surcharge and you have a family, everyone in your family, including all dependent children, must have private hospital cover to avoid having to pay the Medicare Levy Surcharge.

Does everyone pay the 2% Medicare levy?

Not everyone is required to pay the Medicare levy surcharge, but if you're single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

Do I have to pay Medicare levy if I have private health?

Maintaining a sufficient level of Private hospital cover will help you avoid paying the MLS. All of our Hospital and bundled Hospital and Extras covers will allow you to avoid paying the surcharge. However, if you don't have Private Hospital cover, you may have to pay the MLS which is in addition to your Medicare levy.

Why am I paying the Medicare levy?

The Medicare levy surcharge seeks to encourage higher income earners to take out private hospital cover, and to use the private health system where possible to reduce demand on the Medicare system.

What happens if you don't have private health insurance after 30?

For every year you don't have private health insurance after the age of 30, it will cost you an extra 2 per cent on top of your premiums if you finally buy a policy.

What is the Medicare levy threshold 2021?

2021-22 Medicare Levy Income Thresholds Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2021-22 year. Single seniors and pensioners threshold: increases from $36,705 to $36,925. Singles threshold increases from $23,226 to $23,365.

What's the difference between medicare levy and medicare levy surcharge?

Generally, the Medicare Levy (2% of your taxable income) must be paid by all Australian residents receiving free health care (Medicare), unless you...

Am I eligible for medicare levy exemption?

According to the Australia Taxation Office (ATO), some foreign residents and low-income earners generally do not have to pay the whole or part of t...

How does health insurance help to avoid medicare levy surcharge?

You can avoid paying the MLS if you purchase a hospital policy from a registered private health insurance company in Australia. For a plan to be su...

How do I avoid the Medicare levy surcharge?

To avoid paying the Medicare levy surcharge, you’ll generally need to apply for an eligible Hospital policy before the first of July. To find the r...

How does the Medicare levy surcharge work?

If you earn more than $90,000 per year and you do not have an hospital plan in place, then you’ll generally be required to pay an additional levy....

Do I have to pay Medicare levy surcharge if I have private health insurance?

No, typically if you’ve purchased and maintained an eligible Hospital policy you won’t need to pay the Medicare levy surcharge. However, if you can...

Who is exempt from paying the Medicare levy?

Generally, you’ll be exempt from paying the levy if you earn less than the average threshold limit, are a foreign resident or meet specific medical...

How is Medicare levy collected?

The Medicare levy is collected from you in the same way as income tax. Generally, the pay as you go amount your employer withholds from your salary or wages includes an amount to cover the Medicare levy. We calculate your actual Medicare levy when you lodge your income tax return. Find out about:

What is Medicare levy?

Medicare levy. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances.

Do I have to pay MLS for Medicare?

In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS ) if you, your spouse or dependant children don’t have an appropriate level of private patient hospital cover and your income is above a certain amount.

Can I get a reduction on my Medicare levy?

You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare levy.

When do you have to apply for Medicare levy?

To avoid paying the Medicare levy surcharge, you’ll generally need to apply for an eligible Hospital policy before the first of July. To find the right Hospital plan for your requirements, call us at 1300 795 560 to speak with a specialist or fill in the quote form below.

How much is Medicare levied?

Whereas the Medicare Levy Surcharge (MLS), which is between 1% to 1.5% of your taxable income, is usually only paid by people who do not have a hospital policy from a registered private health insurer.

What is an exemption category for Centrelink?

Exemption category. Receive a sickness allowance from Centrelink. Circumstance / Condition. All your dependents (incl. spouse) is in one of the exemption categories or paid the Medicare Levy. At least one dependent is not in the exemption category and doesn’t have to pay the Medicare Levy. Exemption category.

How much is a hospital policy excess?

For a plan to be sufficient, the hospital policy excess, also known as co-payment, must be equal to or less than $500 for single policies and $1000 for a couple/family policy. Extras cover only will not exempt you from paying the surcharge.

Can foreign residents receive Medicare?

Foreign residents, or. Not entitled to receive Medicare benefits, or. Meet specific medical requirements. You might be wholly or partly exempt from the Medicare tax if you experienced one of the exemption categories for all or part of the year, while also meeting one of the circumstances in the right-hand column.

Do I have to pay Medicare surcharge if I have private insurance?

Do I have to pay Medicare levy surcharge if I have private health insurance? No, typically if you’ve purchased and maintained an eligible Hospital policy you won’t need to pay the Medicare levy surcharge. However, if you cancel your policy or it lapses, then you may need to pay the surchage.

The challenge of funding Medicare

As with all healthcare systems, funding Medicare since its inception has proved to be a challenge. The initial Medicare levy of 1% was insufficient as demand, improved treatment, and increased life expectancy have put pressure on the system.

How much is the Medicare Levy Surcharge?

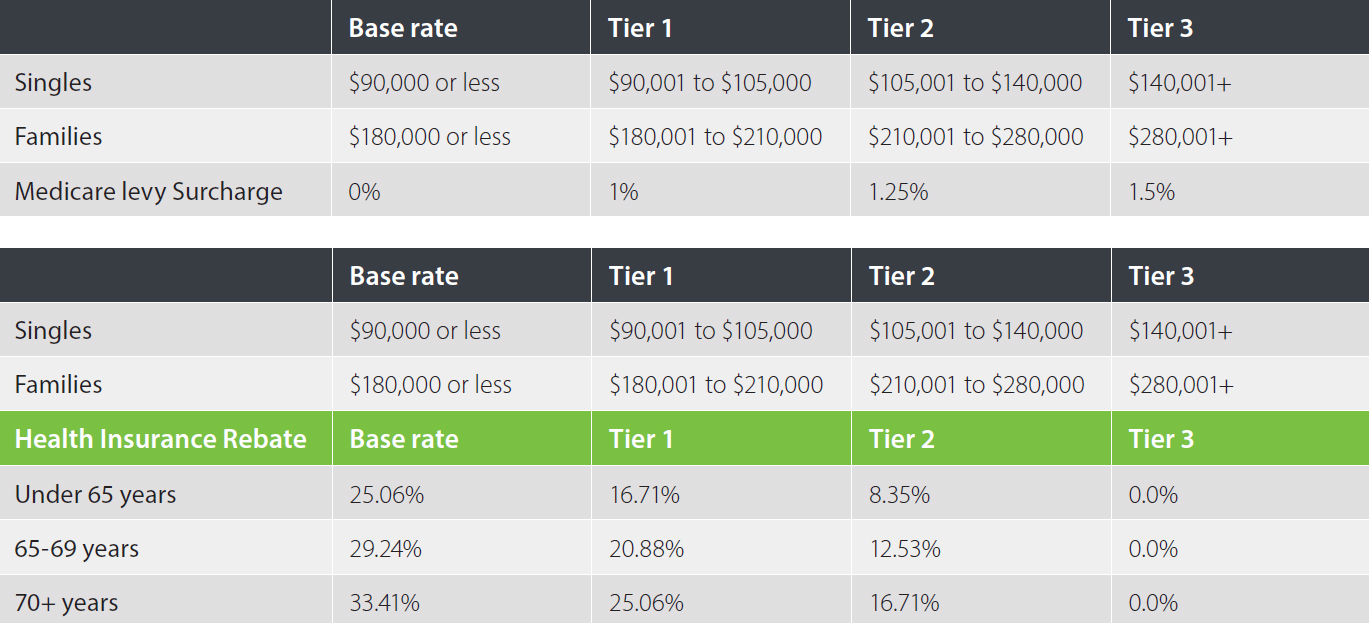

As we have stated, the amount of MLS you’ll pay is dependent on how much you earn, either on your own if you’re single, or as a family.

How to avoid the Medical Levy Surcharge

The government originally designed the MLS to encourage high earners to take out private healthcare and therefore ease the burden on Medicare, making it more effective and accessible for low earners who cannot afford private care.

The benefits of private healthcare

Even if private healthcare costs more than you would save by avoiding the MLS, there are some good reasons why it may still be worth taking out.

Get in touch

At bdhSterling, we have a wealth of experience in helping clients with all aspects of their financial planning.

What is the Medical Levy Surcharge?

The Medical Levy Surcharge applies to anyone who doesn’t have private hospital insurance and fits the following criteria:

How is the surcharge calculated?

Of course, if you know you need to pay the surcharge, the next step is working out how much that will work out as. There are several different income brackets that require different surcharge payments, so you need to know your exact annual income to know which bracket you will fit into.

How Can I Avoid the Surcharge?

If you already have an income that falls within these brackets, or think you might soon, you might be looking for ways to avoid the surcharge. With more and more businesses taking off and people looking to boost their income with fresh ideas for female entrepreneurs, more and more people might find themselves in this situation.

Does Medicare reduce your taxable income?

Medicare levy reduction for low-income earners. The amount of Medicare levy you pay is reduced if your taxable income is below a certain threshold. In some cases, you may not have to pay the levy at all. The thresholds are higher for low-income earners, seniors and pensioners. If your taxable income is above the thresholds, ...

Can I get a Medicare levy reduction if my income is above the threshold?

If your taxable income is above the thresholds, you may still qualify for a reduction based on your family taxable income. You can use the Medicare levy calculator to work out your Medicare levy payable.

Do I have to pay Medicare levy 2020?

In 2020–21, you do not have to pay the Medicare levy if: your taxable income is equal to or less than $23,226 ($36,705 for seniors and pensioners entitled to the seniors and pensioners tax offset). The amount of Medicare levy you pay will be reduced if: your taxable income is between $23,226 and $29,033 ...

Can you get a Medicare levy reduction if you don't qualify?

If you do not qualify for a reduction in the Medicare levy, you may still qualify for a Medicare levy exemption. Your Medicare levy is reduced if your taxable income is below a certain threshold.

When is Medicare tax surcharge automatically applied?

This is automatically applied when your tax return is processed at the end of each financial year. Could you be paying the. Medicare Levy Surcharge? The Medicare Levy Surcharge (MLS) is a tax affecting singles with a taxable income over $90,000, and couples/families with a taxable income over $180,000, and don't have hospital cover.

What is Medicare surcharge?

It’s a tax penalty for higher income earning Australians who do not have private hospital cover but earn over a certain taxable income.

How many levels of private health insurance are there?

Private cover is available in four levels – basic, bronze, silver and gold.

Is Medicare mandatory in Australia?

However, unlike the MLS, which is for higher income earners only, the Medicare Levey is compulsory for all Australian taxpayers, regardless of total taxable income (with some exemptions). The Medicare Levy helps fund our world-class public health system to which all Australian taxpayers are required to contribute two per cent ...

Is private health insurance equal?

However, not all basic private health insurance policies are equal – or indeed eligible. Be sure to shop around and do your sums to ensure the policy you choose is appropriate and will leave you in a better financial position than it would to pay the MLS at the end of the financial year.

Can you get a partial exemption from MLS?

But before you rush out and get yourself an eligible basic health insurance policy before the end of the financial year to avoid paying the MLS, take note: If you’ve held hospital cover for only part of the tax year, then you’ll only have partial exemption from the MLS.

Do you have to pay MLS for suspended medical insurance?

This means you’ll have to pay the surcharge for all the days you did not have private hospital cover. This is also true for temporarily suspensions on existing private health cover. If you suspended payments to your health insurer to travel overseas, for example, you’ll have to pay the MLS for the days you suspended your policy.

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

How much Medicare does a part time employee pay?

Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000. An employee earning $100,000 pays $2,000 in Medicare Levy. These amounts are all in addition to your regular income taxes based on your tax bracket.

What is Medicare entitlement statement?

This is a statement the Department of Human Services issues to people who are not entitled to received Medicare benefits based on their visa type. You can apply for a statement if you fit any one of the following categories: