If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period (SEP), you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

Full Answer

Which Medicare Part B plan is best?

- Part A (Hospital Insurance): covers a portion of hospitalization expenses and hospice care.

- Part B (Medical Insurance): applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

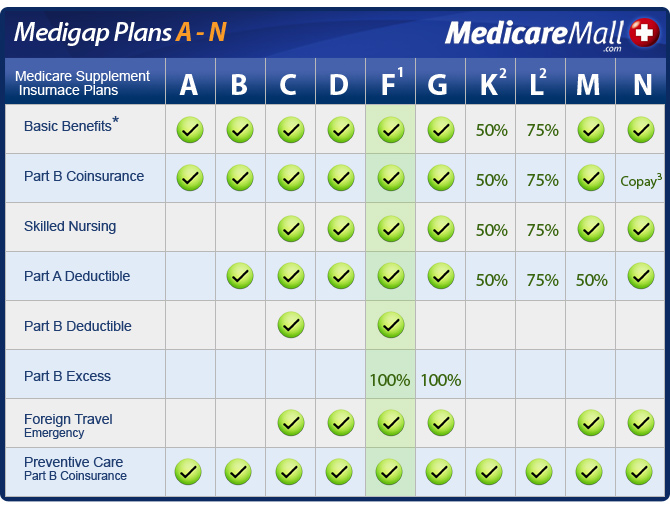

- Medicare Supplement (Medigap) Insurance: can cover copayments, coinsurance and deductibles - gaps in your insurance.

What is the best Medicare Part B supplement policy?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What is the best alternative to Medicare Part B?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

How to choose the best Medicare supplement plans?

How to choose the best Medicare supplement plans. The best Medicare supplement plan for you will depend on which Original Medicare parts you need filled and the cost of the plan.You should choose the supplement policy that provides the best benefits for you and fills in the coverage gaps where you expect to spend the most on health care.

How do I start Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

How do I add Part B to my Medicare online?

You can use one of the following options to submit your enrollment request under the Special Enrollment Period: Go to “Apply Online for Medicare Part B During a Special Enrollment Period” and complete CMS-40B and CMS-L564. Then upload your evidence of Group Health Plan or Large Group Health Plan.

Is Medicare Part B the same as a supplemental plan?

What does Medicare Supplement Plan B cover? Medicare Supplement (Medigap) Plan B is not the same as Medicare Part B, which is part of Original Medicare (along with Medicare Part A). Medigap Plan B serves to fill in the gaps in coverage left by Original Medicare, Part A and Part B.

Who gets Medicare Part B automatically?

If you're still getting disability benefits when you turn 65, you won't have to apply for Part B. Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday.

How long does it take for Medicare Part B to be approved?

You can also call the Social Security Administration at 1-800-772-1213 or go to your local Social Security office. It takes about 45 to 90 days to receive your acceptance letter after submitting your Medicare application.

Can I add Medicare Part B anytime?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

What types of services are covered by Medicare Supplement plan B?

Part B covers things like:Clinical research.Ambulance services.Durable medical equipment (DME)Mental health. Inpatient. Outpatient. Partial hospitalization.Limited outpatient prescription drugs.

Does Medicare Supplement plan B Cover Part B deductible?

So, what isn't covered by Medicare Supplement Plan B? It does not cover the Part B annual deductible or Part B excess charges, skilled nursing facility stays or emergency healthcare during foreign travel. That doesn't mean you are without some coverage for a skilled nursing facility stay if you choose a Plan B policy.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Do you have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Who pays first Medicare?

Rules on who pays first. Medicare pays first if you: Have retiree insurance, i.e., from former employment (you or your spouse). Are 65 or more, have group health coverage based on employment (you or your spouse), and the company employs 20 people or less.

How many employees does a group health plan have?

Your group health plan pays first if you: Are 65 or more, have group health coverage based on employment (you or your spouse), and the company employs 20 people or more . Are under 65 and have a disability, have coverage based on current employment (you or a family member), and the company has 100 employees or more.

Can you have both Medicare and private insurance?

It is acceptable to be covered by both Medicare and a private health insurance plan simultaneously. This does not imply duplicate coverage but rather a coordination between the two plans based on established rules of who pays first. The company that pays first is considered the primary insurance plan. The secondary insurance carrier then reviews the claim to determine benefits for covering the unpaid portion.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

Is working income counted in Medicare?

Certain income from working may not be counted in this estimate, as the Qualified Medicare Beneficiary program uses the supplemental security income guidelines for calculating countable income, so up to half of your working income may not be included.

Can you count your house as supplemental security income?

Some of your assets may not be counted, such as your house, car, or other household items, because this stipulation also follows the supplemental security income guidelines for countable assets.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What does Plan B cover?

Plan B covers everything Plan A covers. It also covers 100% of the Medicare Part A deductible.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

What is Medicare subsidized by?

In the simplest terms, Medicare is a health insurance plan subsidized by the federal government. It was originally created to help Social Security beneficiaries receive healthcare services, but it’s now been expanded to cover everyone who is:

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is Medicare Part B?

Click to Unmute. This opens in a new window. Medicare Part B is the medical insurance portion of Medicare coverage. Medicare Part B covers two type of medical service - preventive services and medically necessary services. Preventative services are those needed to detect potentially severe diseases and keep them from advancing.

What is Part B medical insurance?

In effect, by addressing medical necessity, Part B medical insurance covers the services and items proven to be effective for patients. With each passing year, standards of care continue to expand as new clinical research and technological innovations arise. In brief, preventative services include screenings and tests.

How does Medicare Part B help?

Medicare Part B contributes greatly to the national effort to limit the impact of severe disease through early detection and treatment. Not only does Part B reduce costs with preventive services, it also promotes the social medicine concepts of community wellness and availability of health education resources. Part B Medical Insurance Coverage.

What is Medicare approved amount?

Officially, the Medicare-approved amount is the maximum that can be charged by a provider who accepts assignment from Medicare. Under Part B, this applies to doctor services, outpatient therapy and durable medical equipment, like oxygen tanks and wheelchairs. Formerly, out of pocket costs had no limits.

What is the philosophy of Medicare?

Overall, the philosophy of Medicare is to treat mental illness as any other physical condition.

When does Part B start?

If past your IEP window of opportunity, signing up for Part B during the GEP will mean coverage begins on the first day of July of that year.

Does Medicare cover mental health screenings?

Overall, the philosophy of Medicare is to treat mental illness as any other physical condition. In general, Part B covers the following mental health screenings and care categories: Part B can cover follow-on care related to a hospital stay in fields like detoxification and treatment for drug and alcohol addictions.