To receive reimbursement in these cases, you’ll need to submit a reimbursement form. You can find a copy of the Patient’s Request for Medical Payment form to download, complete and mail in at the CMS website. You’ll also need to include an itemized bill from the health care provider.

Full Answer

How to calculate a DRG?

Calculating DRG payments involves a formula that accounts for the adjustments discussed in the previous section. The DRG weight is multiplied by a “standardized amount,” a figure representing the average price per case for all Medicare cases during the year. Find out all about it here.

How is DRG reimbursement calculated?

- Hospital payment = DRG relative weight x hospital base rate.

- There are several formulas that allow payment transfers and calculations according to several groups.

- Formular for calculating MS-DRG.

- Hospital payment = DRG relative weight x hospital base rate.

How are DRG rates calculated?

- Previous DRG Simulations. Note: The SFY 2019-20 Provider Specific Results have been updated with data reflecting the impact of changes to projected hospital inpatient reimbursement, by hospital and in the ...

- DRG Transitional Payments

- DRG Payment Options. ...

- Reimbursement Plans. ...

- Meeting Archive

How many special pay DRGs are there?

The list remains at 280 DRGS impacted by the rule. The special payment policy had DRGs 987, 988 and 989 added and now has 40 MS DRGs on the list that qualify for special payments. 8. The increase of the MS-DRGs are for vaginal delivery, Cesarean Section procedures and antepartum care and procedures.

How is Medicare DRG payment calculated?

The MS-DRG payment for a Medicare patient is determined by multiplying the relative weight for the MS-DRG by the hospital's blended rate: MS-DRG PAYMENT = RELATIVE WEIGHT × HOSPITAL RATE.

What is Medicare DRG reimbursement?

Diagnosis-Related Group Reimbursement. Diagnosis-related group reimbursement (DRG) is a reimbursement system for inpatient charges from facilities. This system assigns payment levels to each DRG based on the average cost of treating all TRICARE beneficiaries in a given DRG.

How do DRG payments work?

In a DRG system, hospitals are paid a flat payment for each discharge, and by discharge here we mean the end of a hospital stay. The terminology would be that patients are admitted at the beginning of their stay when they enter the hospital and then discharged at the end when they leave.

What criteria are used to determine payment under the DRG system?

This payment is based on the number of full-time equivalent residents, number of hospital beds, and number of discharges. The base payment rate is multiplied by the adjustment factor for Indirect Medical Education plus the Disproportionate Share Hospital (DSH).

Is DRG a bundled payment?

Medicare's diagnosis-related groups (DRGs), which were introduced in 1983, are essentially bundled payments for hospital services, categorized by diagnosis and severity.

How do DRGs impact reimbursement for services?

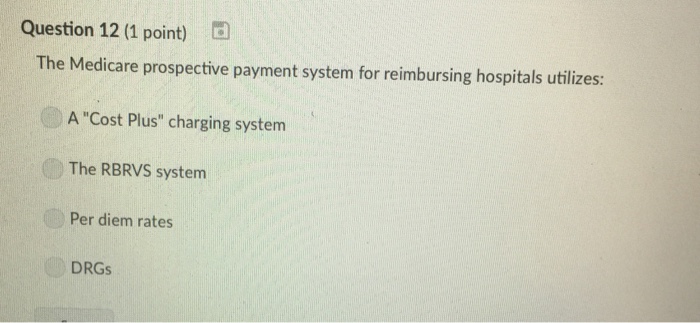

The introduction of DRGs shifted payment from a “cost plus profit” structure to a fixed case rate structure. Under a case rate reimbursement, the hospital is not paid more for a patient with a longer length of stay, or with days in higher intensity units, or receiving more services.

What are the 3 DRG options?

There are currently three major versions of the DRG in use: basic DRGs, All Patient DRGs, and All Patient Refined DRGs. The basic DRGs are used by the Centers for Medicare and Medicaid Services (CMS) for hospital payment for Medicare beneficiaries.

What are the pros and cons of DRG?

The advantages of the DRG payment system are reflected in the increased efficiency and transparency and reduced average length of stay. The disadvantage of DRG is creating financial incentives toward earlier hospital discharges. Occasionally, such polices are not in full accordance with the clinical benefit priorities.

How are hospitals reimbursed by Medicare?

Hospitals are reimbursed for the care they provide Medicare patients by the Centers for Medicare and Medicaid Services (CMS) using a system of payment known as the inpatient prospective payment system (IPPS).

Does Medicare and Medicaid use DRGs to reduce costs?

Almost all State Medicaid programs using DRGs use a system like Medicare's in which participation in the program is open to all (or almost all) hospitals in the State and the State announces the algorithm it will use to determine how much it will pay for the cases.

What is the difference between DRG and CPT?

DRG codes are used to classify inpatient hospital services and are commonly used by many insurance companies and Medicare. The DRG code, the length of the inpatient stay and the CPT code are combined to determine claim payment and reimbursement. You cannot search our site using DRG codes at this time.

What is the purpose of DRGs?

The purpose of the DRGs is to relate a hospital's case mix to the resource demands and associated costs experienced by the hospital.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly. If you’re worried about paying for them after your Medicare coverage ends, talk to your doctor, nurse, or social worker.

How long does Medicare cover after kidney transplant?

If you're entitled to Medicare only because of ESRD, your Medicare coverage ends 36 months after the month of the kidney transplant. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly.

What is a prodrug?

A prodrug is an oral form of a drug that, when ingested, breaks down into the same active ingredient found in the injectable drug. As new oral cancer drugs become available, Part B may cover them. If Part B doesn’t cover them, Part D does.

What happens if you get a drug that Part B doesn't cover?

If you get drugs that Part B doesn’t cover in a hospital outpatient setting, you pay 100% for the drugs, unless you have Medicare drug coverage (Part D) or other drug coverage. In that case, what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your plan’s network. Contact your plan to find out ...

What is Part B covered by Medicare?

Here are some examples of drugs Part B covers: Drugs used with an item of durable medical equipment (DME) : Medicare covers drugs infused through DME, like an infusion pump or a nebulizer, if the drug used with the pump is reasonable and necessary.

Does Medicare cover transplant drugs?

Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

Does Medicare change drug coverage?

The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options. If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider.

MS-DRG Definitions Manual and Software

We are providing a test version of the ICD-10 MS-DRG GROUPER Software, Version 39, so that the public can better analyze and understand the impact of the proposals included in the FY 2022 IPPS/LTCH PPS proposed rule. This test software reflects the proposed GROUPER logic for FY 2022.

HCPCS-MS-DRG Definitions Manual and Software

The 21 st Century Cures Act requires that by January 1, 2018, the Secretary develop an informational “HCPCS version” of at least 10 surgical MS-DRGs.

How to contact Medicare DRG?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. Your Medicare DRG is based on your severity of illness, risk of mortality, prognosis, treatment difficulty and need for intervention as well as the resource intensity necessary to care for you. Here’s how it works:

What does DRG mean in Medicare?

A DRG dictates how much Medicare pays the hospital if you’re admitted as an inpatient. However, keep in mind that your DRG does not affect what you owe for an inpatient admission when you have Medicare Part A coverage, assuming you receive medically necessary care and that your hospital accepts Medicare.

Why was the DRG system created?

The DRG system was created to standardize hospital reimbursement for Medicare patients while also taking regional factors into account. Another goal was to incentivize hospitals to become more efficient. If your hospital spends less money taking care of you than the DRG payment it receives, it makes a profit.

What is Medicare DRG?

What exactly is a Medicare DRG? A Medicare DRG (often referred to as a Medicare Severity DRG) is a payment classification system that groups clinically-similar conditions that require similar amounts of inpatient resources. It’s a way for Medicare to easily pay your hospital after an inpatient stay.

How is a DRG determined?

How is a Medicare DRG determined? A Medicare DRG is determined by the diagnosis that caused you to become hospitalized as well as up to 24 secondary diagnoses (otherwise known as complications and comorbidities) you may have. Medical coders assign ICD-10 diagnosis codes to represent each of these conditions.

What is a DRG in 2021?

April 27, 2021. A Medicare diagnosis related group (DRG) affects the pre-determined amount that Medicare pays your hospital after an inpatient admission. Understanding what it means can help you gain insight into the cost of your care. As you probably know, healthcare is filled with acronyms. Although you may be familiar with many ...

What happens if you require extra hospital resources because you are particularly sick?

If you require extra hospital resources because you are particularly sick, your hospital may also receive an outlier payment that goes above and beyond the normal DRG based payment.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How to change Medicare Advantage plan?

You can switch Medicare plans and make changes to your coverage during the Annual Election Period (AEP), which runs from October 15 to December 7 each year. During this period, you can: 1 Enroll in a Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription Drug plan for the first time. 2 Switch from one Medicare Part D Prescription Drug Plan to another. 3 Disenroll from your Medicare Part D Prescription Drug Plan. 4 Switch from one Medicare Advantage Prescription Drug plan to another. 5 Disenroll from your Medicare Advantage Prescription Drug plan and go back to Original Medicare. You can then add on a stand-alone Medicare Part D Prescription Drug Plan.

What to do if your Medicare plan is denied?

If your request for a formulary exception is denied, you may want to switch to a different Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription Drug plan. Of course, before you switch plans, make sure the new Medicare plan covers the medications you need by checking the plan’s formulary.

What is a formulary in Medicare?

A formulary is a list of prescription drugs covered by the Medicare plan. Every Medicare Prescription Drug Plan and Medicare Advantage Prescription Drug plan has one, although the specific medications included by each plan’s formulary will vary. Formularies may change at any time; you’ll be notified by your Medicare plan if necessary.

How long does it take for Medicare to respond to an expedited formulary exception?

If you submit an expedited request, your Medicare plan must respond within 24 hours with its decision.

How long does it take for Medicare to make a decision on non-formulary medication?

For a standard formulary exception request, your plan will make its decision and notify you within 72 hours of receiving the prescribing doctor’s statement.

What are some examples of medications that are not covered by Medicare?

Some examples of medications that may not be covered by Medicare include: Weight loss or weight gain medications . Medications used to treat cold or cough symptoms. Fertility medications. Vitamins and minerals (with the exception of prenatal vitamins or fluoride preparation products)

What to do if you have a non covered prescription?

If the non-covered prescription drug is a brand-name medication, ask your doctor if there are any generic equivalents that would work as well as the non-covered medication. You can also ask your doctor if there are any other prescription drugs your Medicare plan does cover that would be effective for treating your health condition.

What is a DRG in Medicare?

A DRG, or diagnostic related group, is how Medicare and some health insurance companies categorize hospitalization costs and determine how much to pay for your hospital stay. Rather than pay the hospital for each specific service it provides, Medicare or private insurers pay a predetermined amount based on your Diagnostic Related Group.

Why is DRG payment important?

The DRG payment system encourages hospitals to be more efficient and takes away their incentive to over-treat you. However, it's a double-edged sword. Hospitals are now eager to discharge you as soon as possible and are sometimes accused of discharging people before they’re healthy enough to go home safely. 6 .

What was the DRG in the 1980s?

What resulted was the DRG. Starting in the 1980s, DRGs changed how Medicare pays hospitals. 3 .

What was included in the DRG bill?

Before the DRG system was introduced in the 1980s, the hospital would send a bill to Medicare or your insurance company that included charges for every Band-Aid, X-ray, alcohol swab, bedpan, and aspirin, plus a room charge for each day you were hospitalized.

What happens if a hospital spends less than the DRG payment?

Your age and gender can also be taken into consideration for the DRG. 2 . If the hospital spends less than the DRG payment on your treatment, it makes a profit. If it spends more than the DRG payment treating you, it loses money. 4 .

What is DRG system?

The DRG system is intended to standardize hospital reimbursement, taking into consideration where a hospital is located, what type of patients are being treated, and other regional factors. 4 . The implementation of the DRG system was not without its challenges.

How long does it take for Medicare to penalize a hospital?

Medicare has rules in place that penalize a hospital in certain circumstances if a patient is re-admitted within 30 days. This is meant to discourage early discharge, a practice often used to increase the bed occupancy turnover rate. 7 . How to Fight a Hospital Discharge.