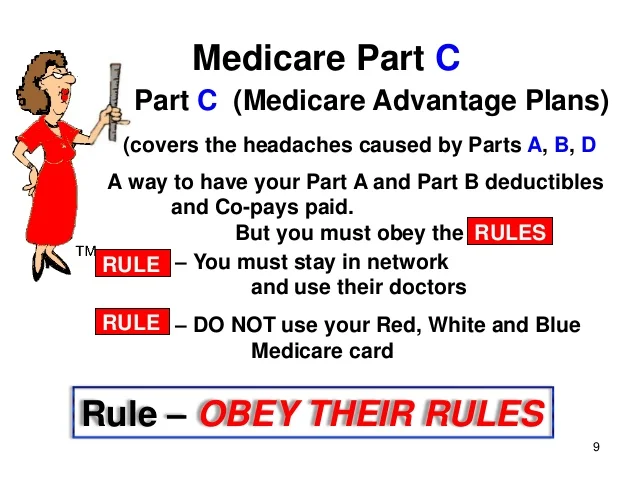

You can purchase Medicare Advantage (MA), or Medicare Part C, plans from a private insurance provider that offers them. Plans differ from company to company but they all must adhere to Medicare rules, and they must be provided by a company that is Medicare-certified.

- Use Medicare's Plan Finder.

- Visit the plan's website to see if you can join online.

- Fill out a paper enrollment form. Contact the plan to get an enrollment form, fill it out, and return it to the plan. ...

- Call the plan you want to join. ...

- Call us at 1-800-MEDICARE (1-800-633-4227).

What does Medicare Plan C cover?

Other extra benefits that Medicare Part C may cover include:

- Routine dental care including cleanings, x-rays, and dentures

- Routine vision care including contacts and eyeglasses

- Routine hearing care including hearing aids

- Fitness benefits including exercise classes

How much does Medicare Part C plan cost?

The cost of a Medicare Part C (also commonly called “Medicare Advantage”) plan can be quite low relative to the cost of other types of health insurance. The Centers for Medicare and Medicaid Services (CMS) estimates that the average premium for a Medicare Part C plan in 2021 is just $21 per month.

What is a Medicare supplement plan C?

Medicare Supplement Plan C is a type of supplemental health insurance that can be purchased by people who already have Medicare. These plans are designed to fill in the gaps in the original Medicare program. Easy Article Navigation What Does Medicare Supplement Plan C Cover? What Plan C Doesn’t Cover

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

How do you get Medicare Part C?

To be eligible for a Medicare Part C (Medicare Advantage) plan:You must be enrolled in original Medicare (Medicare parts A and B).You must live in the service area of a Medicare Advantage insurance provider that's offering the coverage/price you want and that's accepting new users during your enrollment period.

When can you get Medicare Part C?

65When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring one of the 3 months before you turn 65The first day of the month you turn 65During the month you turn 65The first day of the month after you ask to join the plan1 more row

Does Medicare have a plan C?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Is Medigap plan C still available?

Medigap Plan C is a popular supplement option because it covers so many of the out-of-pocket costs associated with Medicare. Starting on January 1, 2020, Plan C was discontinued. You can keep Plan C if you already have it. You can still enroll in Plan C if you were eligible for Medicare on or before December 31, 2019.

Can I add Medicare Part C anytime?

You can join anytime, but once you join, your chance to make changes using this SEP ends. You joined a plan, or chose not to join a plan, due to an error by a federal employee. Join a Medicare Advantage Plan with drug coverage or a Medicare Prescription Drug Plan.

Can you add Medicare Part C at any time?

It runs from October 15 to December 7 each year. You can add, change, or drop Medicare Advantage plans during the AEP, and your new coverage starts on January 1 of the following year.

Is plan G better than plan C?

What's the Difference Between Plan C vs. Plan G? If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

What happened to Medicare Part C?

Medicare Part C has not been discontinued. However, Medigap Plan C is no longer available to new Medicare enrollees from January 1, 2020. Medicare is a federal insurance plan for people aged 65 and older. It pays for many healthcare services.

What is the difference between Medigap and Medicare Advantage plans Part C?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

Does Medicare Part C automatically renew?

Your Medicare Advantage, or Medicare Part C, plan will automatically renew unless Medicare cancels its contract with the plan or your insurance company decides not to offer the plan you're currently enrolled in.

When does Medicare Advantage return to original plan?

Medicare Advantage enrollees have an annual opportunity to prospectively disenroll from any Medicare Advantage plan and return to Original Medicare between January 1 and February 14 of every year. This is known as the Medicare Advantage Disenrollment Period (MADP).

What is Medicare Advantage Plan?

A Medicare Advantage Plan (like an HMO or PPO) is a health coverage choice for Medicare beneficiaries. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B ...

How does Medicare work?

Medicare gives the plan an amount each year for your health care, and the plan deposits a portion of this money into your account. The amount deposited is less than your deductible amount, so you will have to pay out-of-pocket before your coverage begins.

What is a special needs plan?

Special Needs Plans (SNP) Health Maintenance Organizations (HMO) – A type of Medicare Advantage Plan that is available in some areas of the country. Plans must cover all Medicare Part A and Part B health care. Some HMOs cover additional benefits, like extra days in the hospital.

What is a PPO in Medicare?

Your costs may be lower than in Original Medicare. Preferred Provider Organizations (PPO) – A type of Medicare Advantage Plan in which you pay less if you use doctors, hospitals, and providers that belong to the network. You can use doctors, hospitals, and providers outside of the network for an additional cost.

What is a SNP plan?

Special Needs Plans (SNP) – A special type of plan that provides more focused health care for specific groups of people, such as those who have both Medicare and Medicaid, who reside in a nursing home , or who have certain chronic medical conditions.

When does Medicare 7 month period end?

When you first become eligible for Medicare (the 7-month period begins 3 months before the month you turn age 65, includes the month you turn age 65, and ends 3 months after the month you turn age 65).

What is Medigap Plan C?

Medigap Plan C is designed to provide enrollees with fewer out-of-pocket expenses because it covers a portion of the remaining balance of hospital or doctor bills not covered by Original Medicare (Parts A and B), such as Medicare deductibles, copayments, and coinsurance.

What is Medicare Part A deductible?

At its most basic level, this plan specifically covers the following costs and benefits: Medicare Part A deductible. Part A hospital and coinsurance costs (up to an additional 365 days after Medicare benefits are exhausted) Part A hospice care copayment or coinsurance. Part B deductible. Part B copayments and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

When to buy Medigap insurance?

The ideal time to purchase any Medigap policy is during your open enrollment period, which is a six-month period that begins the month you turn 65 and enroll in Medicare Part B. During this time period, insurance companies cannot decline coverage, even if you have pre-existing conditions or are in poor health.

What is excess charge in Medicare?

If you have Original Medicare, and the amount a health care provider is legally allowed to charge is greater than the Medicare-approved amount, the difference is called an excess charge. With Plan F, excess charges will be taken care of, while with Plan C they become the beneficiary’s responsibility.

Does Medigap Plan C make a difference?

Medigap Plan C can make a substantial difference in out-of-pocket costs and coverage. If any of the following scenarios apply to you, it’s worth considering Plan C supplemental coverage:

Is Charlie on Medicare?

Charlie has been eligible for Medicare for a few years, but he's just now retiring at age 71 and enrolling in Medicare for the first time. He plans to spend much of his free time traveling the world, so coverage while abroad is at the top of his needs list.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is not included in Medigap Plan C?

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesn’t accept assignment — meaning they won’t accept the Medicare-approved amount as full payment for covered services.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

What is the difference between Medicare and Medicare Part B?

The difference between what Medicare pays for a certain medical service, and what your doctor or provider charges for it, is the Medicare Part B excess charge, which you’re responsible for paying out-of-pocket. In some cases, you may be charged up to 15% more than the Medicare-approved amount for a service.

What is Medicare Part C?

How Part C works. Takeaway. Medicare Part C, also called Medicare Advantage, is an insurance option for people who are eligible for Medicare. These plans are offered through private insurance companies. You don’t need to buy a Medicare Part C plan. It’s an alternative to original Medicare that offers additional items and services.

How old do you have to be to get Medicare?

To enroll in original Medicare (to be eligible for Part C), in general, you must qualify by: Age. You must be at least age 65 or older and a U.S. citizen or legal permanent resident for a minimum of 5 contiguous years. Disability.

When is Medicare open enrollment?

Finally, there’s also the Medicare Advantage open enrollment period. This is from January 1 to March 31 each year. However, this period only lets you make changes to your plan if you’re already enrolled in a Medicare Advantage plan.

What is Medicare Part C?

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B. There are several different types of Medicare Advantage plans, such as HMO plans and PPO plans. Each type of plan may feature its own ...

What are the requirements to qualify for Medicare Advantage?

There are 2 general eligibility requirements to qualify for a Medicare Advantage plan (Medicare Part C): 1. You must be enrolled in Original Medicare ( Medicare Part A and Part B). 2. You must live in the service area of a Medicare Advantage insurance provider that is accepting new users during your application period.

How much is Medicare Advantage 2021?

In 2021, the weighted average premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month. 1. 89 percent of Part C plans available throughout the country in 2021 cover prescription drugs, and 54 percent of those plans feature a $0 premium.

How long does Medicare enrollment last?

When you first become eligible for Medicare, you will be given an Initial Enrollment Period (IEP). Your IEP lasts for seven months. It begins three months before you turn 65 years old, includes the month of your birthday and continues on for three more months.

When is the Medicare open enrollment period?

The Medicare AEP lasts from October 15 to December 7 each year. During this time, you may be able to sign up for, change or disenroll from a Medicare Advantage plan.

Does Medicare Part A have an out-of-pocket limit?

Medicare Part A and Part B don't include an out-of-pocket spending limit. Medicare out-of-pocket costs can add up quickly if you're faced with a long-term inpatient hospital stay or undergo extensive medical care that requires high coinsurance or copay costs.

Can you get Medicare Advantage if you have ESRD?

If you have ESRD, you may also be able to enroll in a Medicare Special Needs Plan (SNP). A Special Needs Plan is a certain type of Medicare Advantage plan that is designed for people with specific health care conditions or circumstances.

What does Part C cover?

Most Part C plans also have prescription drug coverage (Part D), and many have extra coverage for dental, vision, and hearing care.

How much does Medicare pay for medical care?

If you have Original Medicare insurance coverage, you generally pay 20 percent of the final Medicare-approved cost for your health care services. Depending on your MA plan, you may pay copays for medical services at the time of your treatment.

How many people are covered by Medicare Advantage?

Today in the United States, there are over 20 million people who rely on a Medicare Advantage (Part C) plan for their Medicare coverage for health care. That means that one out of every three Medicare beneficiaries has a Part C policy.

Is Medicare Part B included in MA premium?

Even if you have an MA plan, you must also continue paying your Original Medicare Part B monthly premium. This is a separate charge and is not included in your MA’s monthly premium.

Do you have to pay for Medicare if you have an MA plan?

When you reach your plan’s out-of-pocket maximum, you do not have to pay for any other services covered under Original Medicare Part A or Part B for the rest of that year. If you have an MA plan, you cannot purchase other Medicare supplemental insurance like a Medigap plan, for example.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

Is Plan G a comprehensive plan?

In that case, you may want to consider joining Plan G. It’s a comprehensive plan, covering many of the costs associated with Original Medicare. Original Medicare is a fee-for- service health insurance program available to Americans aged 65 and older and some individuals with disabilities.