Log in to milConnect. Click on the “Obtain proof of health coverage” button. Or click on Correspondence/Documentation and choose "Proof of Coverage."

What tax form shows proof of insurance?

This includes:

- Insurance cards

- Explanation of benefits

- Statements from insurer

- W-2 or payroll statements that state health insurance deductions

- Records of advanced payments of premium tax credit

- Any statement that confirms you (or a family member) had health coverage

- Form 1095 information forms

How do you show proof of health insurance?

- Insurance cards.

- Explanation of benefits.

- W-2 or payroll statements that show insurance deductions.

- Records or advance payments of the premium tax credit and other statements indicating that the taxpayer or a member of his or her family had health coverage.

How do I provide proof of insurance?

- effective date of your liability insurance coverage

- policy number of your liability insurance coverage

- 3-digit code of your insurance company

How to obtain proof of insurance?

You may need to send up to 2 of the following documents:

- birth certificate

- passport

- full or provisional driving licence

- adoption certificate

- home office or travel document

- work permit

- certificate of naturalisation

- marriage or civil partnership

- certificate of service in Her Majesty’s Forces or merchant navy

- identity or medical card

Does Medicare send out 1095-B forms?

Medicare is sending a Form 1095-B to people who had Medicare Part A coverage for part of

How do I get my 1095-B form?

If you are filing taxes for an individual mandate state and do not have a copy of your 1095B, you may download one immediately from your member website or request one by calling the number on your ID card or other member materials.

Do Medicare recipients get a 1095 A?

If you were enrolled in Medicare: For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

How can I get my 1095-C form online?

View your Form 1095-C onlineLog in to the appropriate product below to view your Form 1095-C online.ADP® iPay Statements. Employee Login. ... ADP Portal. Employee Login. ... See all logins.Contact your HR department. If you are not sure which ADP product to log in to, or need a login, please talk to your company's HR department.

How do I get a copy of my 1095-B form online?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

What do I do if I didn't get my 1095-B?

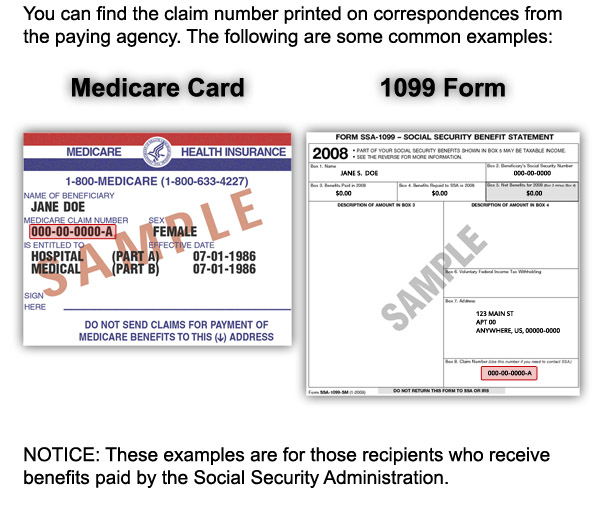

Call 1-800-MEDICARE (1-800-633-4227) to ask for a copy of your IRS Form 1095-B.

Do I need a 1095-C if I am on Medicare?

No. If you have Medicare & supplemental insurance (and did/did not receive 1095-B and 1095-C forms for your healthcare coverage), then you do not need to file them. Just indicate that you had that type of insurance during the software interview questions.

Why can't I find my 1095a online?

If you purchased coverage through the Marketplace and you have not received your Form 1095-A, you should contact the Marketplace from which you received coverage. You should wait to receive your Form 1095-A before filing your taxes. You can – and should - file as soon as you have all the necessary documentation.

What is the difference between a 1095-A and a 1095-B?

Form 1095-A, Health Insurance Marketplace Statement, is provided by the Marketplace to individuals who enrolled or who have enrolled a family member in health coverage through the Marketplace. Form 1095-B, Health Coverage, is provided by insurance companies and other coverage providers.

Who sends out 1095-C?

large employersForm 1095-C is sent out by large employers who are required to offer health insurance coverage as a provision of the ACA. This applies to employers with 50 or more full-time equivalent employees (ie, Applicable Large Employers). Form 1095-C is sent to the IRS and to full-time employees (30+ hours per week).

Do I need my 1095-C to file my taxes?

Do I need my Form 1095-C to file my taxes? No, you do not need to send a copy of your 1095-C to the IRS when filing your tax return. However, you should keep the form with your tax records.

How do I get my 1095-C form 2021?

Employees who do not consent to receive their tax documents electronically will receive a copy of their 2021 1095-C form by U.S. Mail to their home address. Employees should log in to Workday to verify that their home address is up to date.

What is the difference between proof of insurance and coverage?

Proof of insurance may take the form of an identification card that is valid on its face. Coverage involves the terms of the policy and whether the policyholder is current on its obligations under the plan.

Why is proof of insurance important?

Proof of insurance is important because it is part of the requirements for treatment. Medical care providers join networks and agree to treat patients for prices that are lower than their standard rates. The presence of proof of insurance guides the patient’s costs.

What is an insurance card?

Insurance cards are proof of enrollment and a record number to get more information. Explanation of Benefits (EOBs) are required statements from an insurer to policyholder detailing benefits under the plan. Letters, bills, and statements from insurers. Payroll records that show health insurance deductions.

What are the forms of qualified coverage?

The forms of qualified coverage include qualified health plans, employer-sponsored insurance, Medicare Advantage, Original Medicare, Medicaid, and CHIP.

What is a 1095-A?

Form 1095-A, Health Insurance Marketplace Statement. This form goes out to every policyholder that purchased insurance through the Marketplace or a state exchange. The form identifies each covered person and the times during which they had coverage. Form 1095-B, Health Coverage.

What is the box on a 1040?

The Standard Form 1040 has a box that taxpayers must check. It asks whether the individuals on the return had a full year of coverage. To check this box, one has to have proof of coverage for the year. This proof comes from several sources, as listed below. The IRS policy towards this proof was that it was essential to processing the return. That policy is in a state of change or modification. Since the changes have ripened into a firm policy, one should be aware of the rules as well as the possibility of changes.

What is the IRS policy towards proof?

The IRS policy towards this proof was that it was essential to processing the return. That policy is in a state of change or modification. Since the changes have ripened into a firm policy, one should be aware of the rules as well as the possibility of changes.

What is a 1095 form?

This is known as a 1095 form which provides details about the amount along with the period of time you received coverage. A 1095 form acts as proof of your health insurance and is useful to keep for your own personal records.

Who should receive a 1095-B?

Form 1095-B. Individuals and their families who do not receive a Form 1095-A or Form 1095-C should receive a Form 1095-B. This includes people who receive insurance from health care providers, government agencies and smaller employers who are not required to send the other types of forms. For example, you may receive a 1095-B if you bought health ...

Why are 1095s important?

During the first years of the Affordable Care Act (ACA), 1095 forms were more important as they would allow the IRS to verify health insurance coverage. If the IRS identified gaps in health coverage, then you would be required to pay the tax penalty for not having minimum essential coverage.

What is a 1095-A?

Form 1095-A. You would receive the Form 1095-A if you were enrolled in a marketplace health plan during the tax year. The form is a statement from the marketplace (either the HealthCare.gov federal marketplace or one of the state-run health care exchanges) acknowledging you were enrolled in medical insurance coverage, ...

How to reconcile 1095A?

To reconcile this information, check the 1095-A form: 1 If you used more credits than you were due, then you would owe additional tax on the difference between the two amounts. 2 If you used less than you were eligible for, then you would receive a tax refund on the difference.

When is the 1095-A deadline?

The deadline for the marketplace to provide you with a Form 1095-A is Jan. 31. The deadline for insurers, companies and government agencies to deliver forms 1095-B and 1095-C has been extended to March 4.

Is the 1095 tax form still valid for 2020?

In 2020, the tax penalty for lacking coverage is no longer in effect. But, as mentioned above, the forms are still useful for filing tax returns and claiming tax deductions. Like a W-2 that includes information about an individual's income, the Form 1095 contains information about health insurance for the previous year.

Protect your Medicare Number like a credit card

Only give personal information, like your Medicare Number, to health care providers, your insurance companies or health plans (and their licensed agents or brokers), or people you trust that work with Medicare, like your State Health Insurance Assistance Program (SHIP) State Health Insurance Assistance Program (SHIP) A state program that gets money from the federal government to give free local health insurance counseling to people with Medicare. ..

Carrying your card

You’ll need the information on your Medicare card to join a Medicare health or drug plan or buy Medicare Supplement Insurance (Medigap), Medicare Supplement Insurance (Medigap) An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare). so keep your Medicare card in a safe place.

How do you get another Medicare card?

My card is lost or damaged — Log into (or create) your Medicare account to print an official copy of your Medicare card. You can also call us at 1-800-MEDICARE (1-800-633-4227) to order a replacement card. TTY users can call 1-877-486-2048.

How to complete a health insurance form?

HOW IS THE FORM COMPLETED? Complete the first section of the form so that the employer can find and complete the information about your coverage and the employment of the person through which you have that health coverage. The employer fills in the information in the second section and signs at the bottom.

What to do if you get group health insurance through another person?

If you get group health plan coverage through another person, like a spouse or family member, write their Social Security Number. Once you complete Section A: Once Section A is completed, give this form to your employer to complete Section B.

How long do you have to be in a special enrollment period to get Medicare?

In order to apply for Medicare in a Special Enrollment Period, you must have or had group health plan coverage within the last 8 months through your or your spouse’s current employment. People with disabilities must have large group health plan coverage based on your, your spouse’s or a family member’s current employment.

What is section A in Medicare?

SECTION A: The person applying for Medicare completes all of Section A. Employer’s name: Write the name of your employer. Date: Write the date that you’re filling out the Request for Employment Information form . Employer’s address: Write your employer’s address. Applicant’s Name:

What is a group health plan?

A group health plan is any plan of one or more employers to provide health benefits or medical care (directly or otherwise) to current or former employees, the employer, or their families. If yes, give the date the coverage began. Write the month and year the date the applicant’s coverage began in your group health plan.

Who is required to send out a 1095-C?

Form 1095-C. Form 1095-Cis sent out by large employers who are required to offer health insurance coverage as a provision of the ACA. This applies to employers with 50 or more full-time equivalent employees. Form 1095-C is sent to the IRS and to the employees.

Who sends out 1095-A?

Form 1095-A is sent out by the health insurance exchanges (HealthCare.gov or a state-based exchange, depending on the state). This form is mailed to the IRS and to the policyholder.

What is a 1095-A?

Form 1095-A is your proof that you had health insurance coverage during the year , and it’s also used to reconcile your premium subsidy on your tax return, using Form 8962 (details below).

What to do if 1095-A is delayed?

If delivery of your 1095-A is delayed or the information on it is incorrect, you can contact your exchange. For the 2020 plan year, however, the rules are different. People who received excess premium tax credits in 2020 do not have to repay them to the IRS, and do not even have to file Form 8962 at all.

What does 1095-C mean?

For example, if you work for a large company and have access to coverage from your employer, but you opted to buy coverage in the exchange instead, you’d receive Forms 1095-A and 1095-C (the 1095-C would indicate that you were offered employer-sponsored coverage, even though you declined it).

Is Form 8962 required for 2020?

The information on Form 1095-A is used to complete Form 8962 (again, Form 8962 is not required for 2020 if you would have had to repay some or all of the premium tax credit; not filing it for 2020 will not affect subsidy eligibility in future years).

When will the IRS issue 1095-B?

The latest extension, detailed in IRS Notice 2020-76, gives insurers and employers until March 2, 2021, to distribute Forms 1095-B and 1095-C to plan members and employees.