How many Medicare supplement insurance ratings should I review?

Since each agency has different metrics, you should try to review at least two ratings for each Medigap insurance carrier. Medicare Supplement Insurance plans (also known as Medigap ) are sold by private insurance companies to cover some of Original Medicare's out-of-pocket costs.

How do I choose the best Medicare supplement insurance companies?

The best medicare supplement insurance companies offer competitive pricing and modern, easy-to-use website interfaces. They also make it easy to reach customer service agents and offer discounts to their customers.

How is the cost of a Medicare supplement plan determined?

The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it.

Is a Medicare supplement plan right for me?

Yes. A Medicare Supplement plan can help cover what Medicare can’t-from prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

What type of rating is New York Empire Blue Cross Med Supps based on?

A (Excellent) ratingAbout Empire BlueCross BlueShield New York The company (Anthem) has an A (Excellent) rating through AM Best. This proves that if they're an option for you, they will strive to, and have proved to, provide high-class service.

What is the most popular Medigap insurance company?

BCBS tied for the top score on the American Customer Satisfaction Index for health insurers. BCBS companies offer Medigap policies in all 50 states and Washington, D.C.

How are Medigap policies rated?

Attained age-rated Medigap pricing always calculates your premium based on your current age (the age you have “attained”), no matter how long you have had your policy. This means that when you first buy your policy, your premium will be based on your current age, with older people paying more.

Is empire the same as Anthem?

The company operates as Anthem Blue Cross in California, where it has about 800,000 customers and is the largest health insurer. It operates as Empire BlueCross BlueShield in New York State and as Anthem Blue Cross and Blue Shield in 10 states....Anthem (company)TypePublicWebsitewww.antheminc.comFootnotes / references13 more rows

Can I change Medigap plans anytime in NY?

When Can You Switch Your Medigap Policy? The first time during which you can switch your Medigap policy without worrying about being rejected for coverage is during the Medigap Open Enrollment Period, a six-month period when you are 65 or older and have just enrolled in Medicare Part B.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How do I choose a Medigap company?

How to Sign Up for Medigap PlansEnroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

Who is Aflac's largest competitor?

Aflac competitors include Liberty Mutual Insurance, Humana, Allstate, State Farm Insurance and Aetna. Aflac ranks 1st in CEO Score on Comparably vs its competitors.

What is the most popular Medigap plan for 2021?

Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

What Are the Best Rated Medicare Supplement Companies in 2022?

Now that you’re familiar with the top 10 well-known Medicare Supplement companies, we’ll let you know which five are the highest rated. There are several official types of ratings for insurance companies but in this article, we’ll focus on the AM Best and S&P ratings. A high rating with both of these agencies indicates a company’s financial stability and offering of high-quality insurance products.

Why do Medicare premiums vary?

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age, location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

What is the importance of choosing a company with a reputation for excellent customer service?

We’re always thinking about ways to save money, but what about time? Choosing a company with a reputation for excellent customer service will provide value throughout the enrollment process and the entire life of your policy.

Is Mutual of Omaha the same as Medigap?

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Is it good to choose an established insurance company?

Lastly, you’ll benefit from selecting a policy from an established company. The insurance companies that started long ago and stand the test of time tend to be those offering products with which clients are satisfied.

How is Medicare Supplement Plan cost determined?

The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it. When researching different companies, be sure to ask how they price their policies. 10 Learning which factors they base their pricing on will help you determine both the costs for you today and what to expect in the future if your health situation changes.

What Does a Medicare Supplement Plan Typically Cost?

Without providing detailed personal information, most providers are unable to release estimated costs. However, most plans begin in the range of $100 per month, and many providers offer discounts for a variety of qualifiers (such as being female or a non-smoker, or if you have more than one policy from that provider).

When Can I Buy a Medicare Supplement Plan?

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled. You may be subject to a medical underwriting examination, which is a detailed review of your medical history.

Is a Medicare Supplement Plan Worth It?

Yes. A Medicare Supplement plan can help cover what Medicare can’t—from prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits. Even getting one ER visit covered can be a huge benefit financially.

Why is AARP the best Medicare supplement?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your employer's insurance and may require coverage after the age of 65.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

When is the best time to buy a Medicare Supplement?

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can't be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts. 12

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

When will Medicare Supplement Plan F be available?

Medicare Supplement Plan F and Plan C are not available for sale to Medicare beneficiaries who became eligible for Medicare on or after Jan. 1, 2020.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

What is Medicare Supplement Insurance Plan?

If you’re concerned that Original Medicare is leaving gaps in your coverage and you’re paying too many fees, consider a Medicare Supplement Insurance Plan, also known as Medigap. Medigap plans can cover copays for Parts A and B, as well as any excess Part B charges.

Which is better: Medicare or New York?

You have numerous options when you want to choose a Medicare plan. Those who only require minimal health care coverage may find that Original Medicare is their best option. New York’s Medicare Advantage program may be a better choice if you have more extensive health care needs. Medicare Advantage Plans can provide you with the coverage you need, along with additional benefits, such as vision, hearing, dental. Some Medicare Advantage Plans also include prescription drug coverage. You might find that you benefit from purchasing a separate supplemental or prescription drug coverage plan.

How much does Medicare cost in New York City in 2021?

Seniors aged 65 and older and disabled individuals are eligible for Medicare, the federal health care insurance plan. Over 2,000,000 New Yorkers are enrolled in Original Medicare. Medicare Part A can cost as much as $471 per month, depending upon how long you paid Medicare taxes in the past, ...

What are the different types of Medicare Advantage Plans in New York?

New York has four types of Medicare Advantage Plans, including HMO, PPO, PFFS, and SNP plans. You can only select Medicare Advantage Plans that are available in the New York county where you live. If you move, you’ll need to enroll in a new plan.

What is AAA in New York?

Area Agencies on Aging provide a variety of services for seniors in communities across New York. Every county in New York has a local office. AAA offices can provide you with access to a variety of benefits and information about health care choices, including Medicare and resources that can help you with issues, such as wills, estate planning, and health care proxies. AAA offices also help with transportation to medical appointments, provide nutritious meals to needy seniors, and work with other organizations in their communities to promote the needs and interests of older New Yorkers.

How many HIICAP counselors are there in New York?

Located in Offices for the Aging across New York, more than 500 HIICAP counselors are available to answer your questions about your health care options, including Medicare, Medicaid Advantage, Medigap, Supplemental Insurance Plans, and long-term care insurance. This organization provides free, unbiased information for seniors, their families, or their caregivers to help them find the option that best suits their medical situation.

Does Medicare cover prescription drugs?

While Original Medicare doesn’t provide coverage for prescription drugs, you can add a Part D plan for a separate fee. The cost of the plan depends on several factors, including your pharmacy, the drug’s tier, and whether the company that manufactures the drug offers financial assistance to lower its cost.

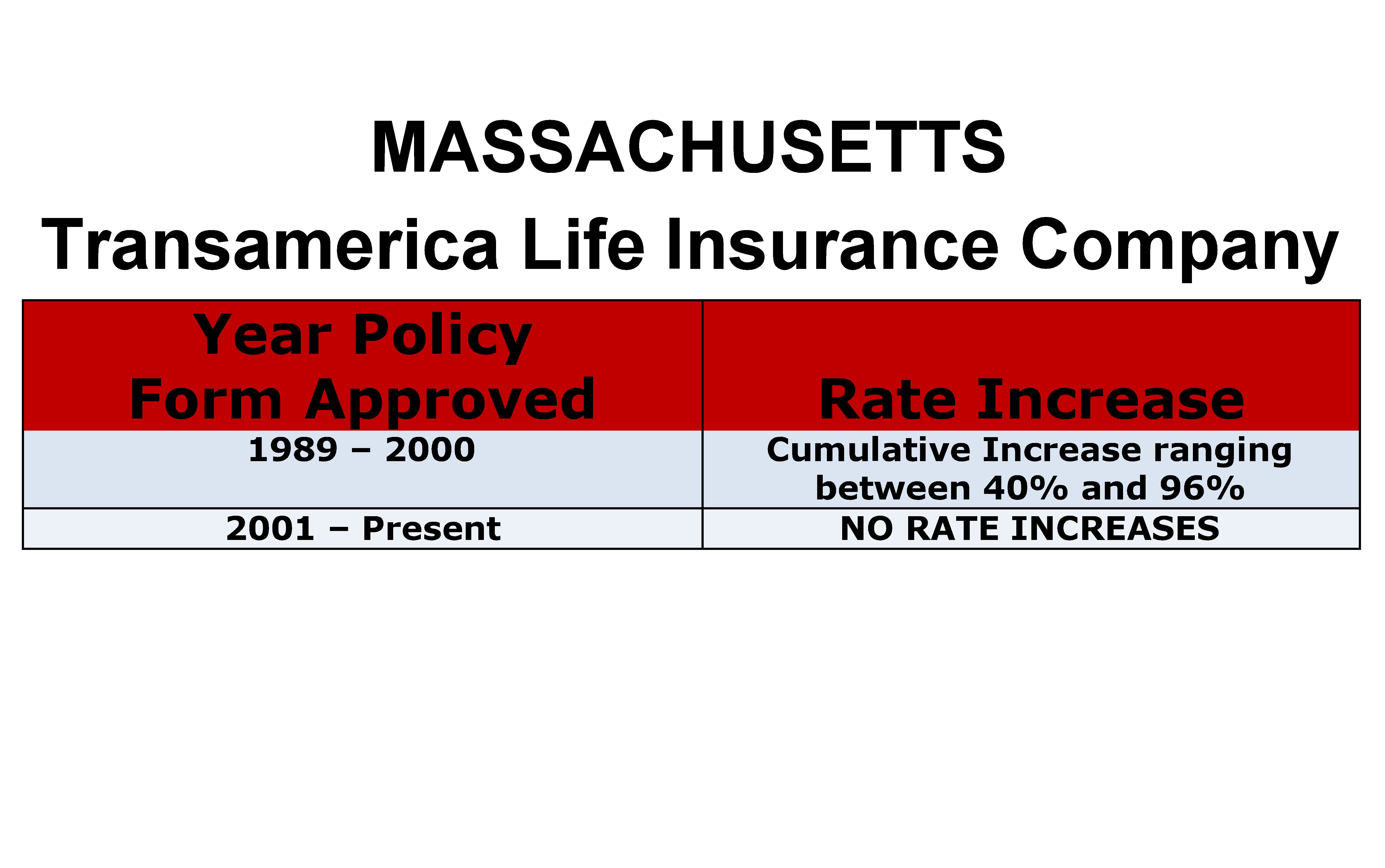

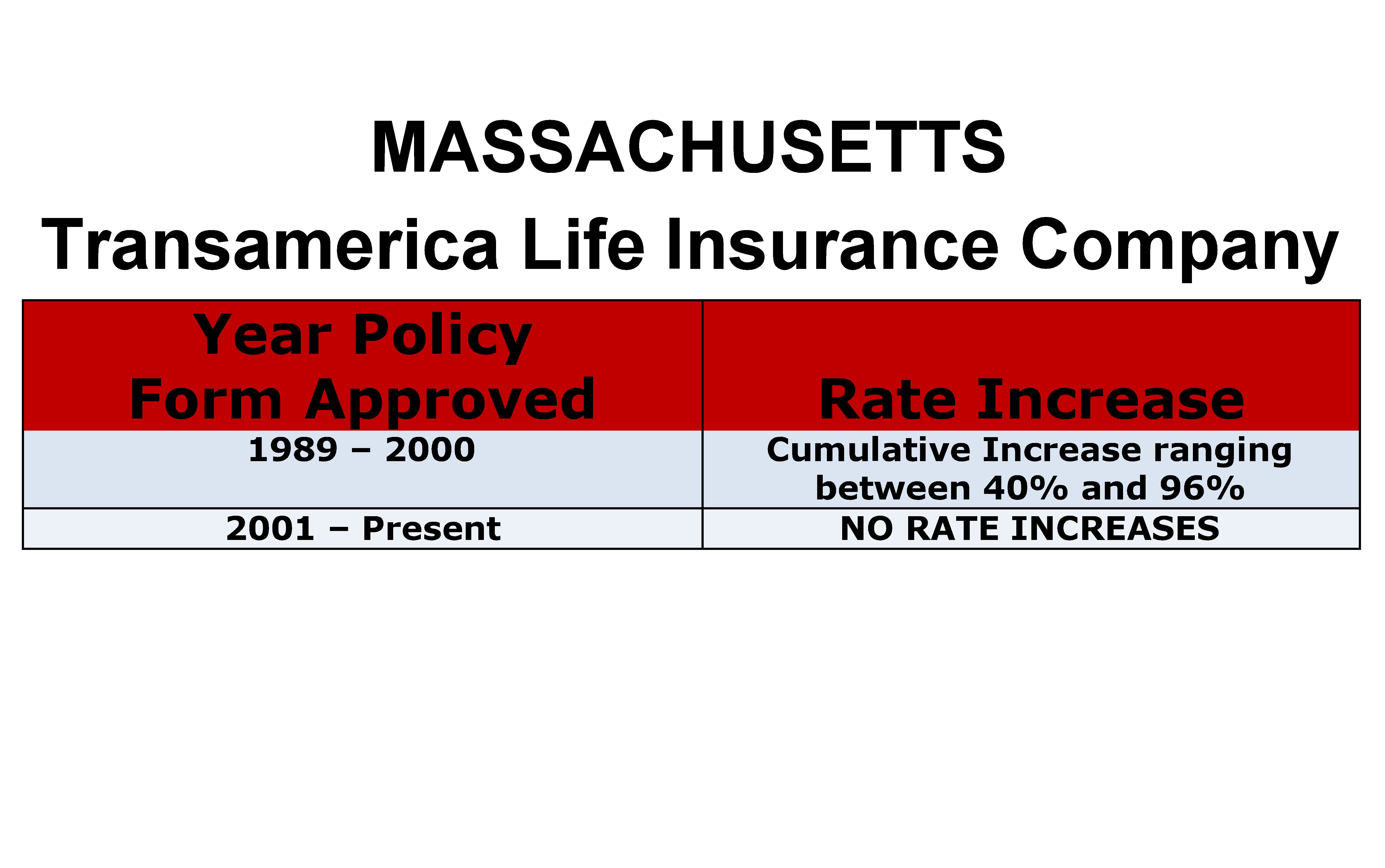

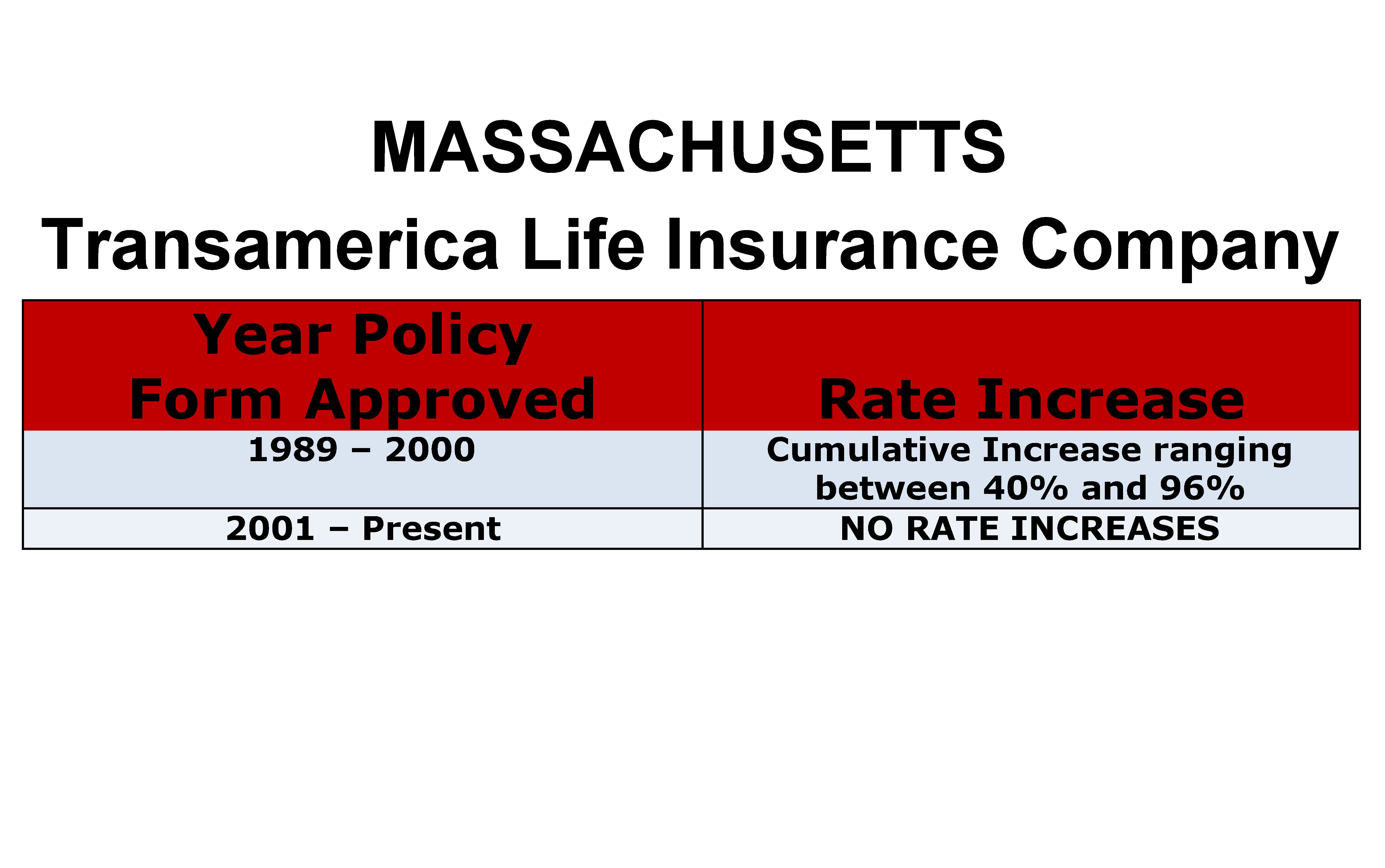

Medicare Supplement Insurance Carrier and Rate Look-Up

Visit our DFS Portal and enter your zip code for a list of Medicare supplement insurance carriers and their current monthly rates.

Medicare Advantage Plans

Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what plans are available, plan benefits and premium rates, contact CMS directly or visit CMS Medicare website.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

Which company provides Medicare Supplement Plan G?

When it comes to price transparency, Aetna is the clear winner. It uses attained-age pricing and is the only company on the list to provide rates for Medicare Supplement Plan G right on its website. From the homepage, select your state in the dropdown box to view Medicare Supplement State Insurance Plans, and with a few more clicks you can easily generate an Outline of Coverage PDF file with rate information for the plan based on age, gender, and ZIP code. Rates vary by location.

What states does BCBS offer Medicare Supplement?

Altogether, BCBS offers Medicare Supplement Plan G in 44 states, excluding Alabama, Hawaii, Massachusetts, Minnesota, Utah, and Wisconsin. High-Deductible Plan G is available in 16 states, including Alaska, Arkansas, Illinois, Iowa, Maryland, Michigan, Montana, New Mexico, North Carolina, Oklahoma, South Carolina, South Dakota, Texas, Virginia, Washington, and Wyoming.

What is Humana website?

The Humana website discusses many Medicare topics, including eligibility, coverage, and costs for each part of Medicare. It is instinctive to navigate and can be a great resource for common questions about the program. You can turn to its mobile app, MyHumana, to access your benefits on the go.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

When did Medicare discontinue plans?

The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

What is the Medicare number?

Additionally, the following telephone numbers are available: Medicare Service Center: (800) MEDICARE (800-633-4227) ...

Why are medical insurance premiums higher than CPI?

It is possible that premiums will rise at a much higher rate than the CPI if medical services are utilized at a high rate, if the number of high priced diagnostics such as MRIs are utilized more often, if there is a high number of lengthy hospital stays, etc.

How does the Department decide whether to approve a rate increase?

Under the prior approval statute, the Department may disapprove or modify an insurer’s request for a premium rate increase if it is unreasonable , excessive , inadequate or unfairly discriminatory. Many factors are considered in making this determination. The Department reviews the Medical Loss Ratio (MLR), or past claims experience under the policy. The MLR reflects the cost of medical care and prescription drugs used by the policyholders in the previous year (the Department often reviews claims history more than one year back). The Department also reviews “utilization,” which is how often policyholders use medical services and prescription drugs, and how the insurer “trends” that claims experience and utilization into the future. The Department will also look at the insurer’s history of rate changes, its financial condition, administrative costs, profits and other sources of revenue, and any other factor the insurer uses to calculate its premium increase.

What is “medical loss ratio” or “MLR” and why does it matter?

The MLR is a comparison of how much of your premium goes towards paying medical claims compared to how much the insurer pays for administrative costs and keeps as profits. For example, an 82% MLR would mean that 82% of the total premiums paid by policyholders was going towards paying claims, and the other 18% was kept by the insurer for administrative expenses and profits.

Why do my premiums increase every year?

Medical costs are driven by everything from increases in hospital charges and doctor salaries to greater use of medical care to new technologies and prescription drugs. These all drive your premiums. As noted above, in New York, a minimum of 82 * cents of every premium dollar in the small group employer and individual insurance markets must go to pay medical claims costs.

Does the Department consider affordability when deciding on rate requests?

Yes, the Department’s goal is to approve the lowest rates possible while preserving the financial solvency of the health insurer. Approving rates that are inadequate could lead to an insurer being unable to pay claims altogether.

Do consumers have an opportunity to comment on premium increases?

Yes, New York permits consumers to submit comment on premium increases online or by mail.