Steps for Reporting a Death to Medicare

- Gather your loved one’s information Before you call, gather your loved one’s information. ...

- Call Social Security To report the death, you can call Social Security directly. You can call toll-free at 1-800-772-1213 between 7 AM and 7 PM on weekdays. ...

- Check their monthly benefits

How do you notify Medicare of a death?

What To Do When Someone Dies – Social Security, Medicaid, And Other Benefits

- Social Security Insurance (SSI) As the spouse, executor, or responsible family member, it is your responsibility to make sure that the Social Security department is notified as soon as possible ...

- Veteran’s Benefits. ...

- Medicare / Medicaid. ...

- Medicaid Estate Recovery. ...

Who notifies Medicare of death?

You will need the deceased’s Social Security number and date of birth. The Social Security office automatically notifies Medicare of the death. If the deceased was receiving Social Security payments, the payment for the month of the death must be returned to Social Security.

Who should be notified of death?

- Survivors bear the burden of inevitable responsibilities. ...

- Offer to call a friend or family member who will come to support the survivor — and stay until the support person arrives.

- Offer to help contact others who must be notified (until a support person arrives to help with this duty.)

How do I report the death of a Medicare beneficiary?

What You’ll Need:

- You need to be the listed beneficiary on the policy. This means that your loved one chose you to receive the benefit in the event of their death.

- You need to know who the insurance provider is and the policy number.

- You need a copy of the death certificate from the funeral home. ...

Does Medicare stop when someone dies?

Medicare will cancel Medicare Part A and Part B coverage when you report a beneficiary's death to Social Security. If the deceased had a Medicare Advantage plan, or a stand-alone Medicare Part D prescription drug plan, Medicare will notify the plan.

How do you notify the Social Security Administration when someone passes away?

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

Does Social Security notify banks of death?

If a payment was issued after the person's death, Social Security will contact the bank to ask for the return of those funds. If the bank didn't already know about the person's death at that point, this request from Social Security will alert them that the account holder is no longer living.

Who is entitled to $255 Social Security death benefit?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

Do you have to notify Medicare when someone dies?

Medicare. You will need to inform Medicare that your loved one has died. There is a simple form you'll need to fill in, so that the Department of Human Services can update its records.

Can you use a deceased person's bank account to pay for their funeral?

Many banks have arrangements in place to help pay for funeral expenses from the deceased person's account (you should contact the bank to find out more). You may also need to get access for living expenses, at least until a social welfare payment is awarded.

How do you get the $250 death benefit from Social Security?

Form SSA-8 | Information You Need To Apply For Lump Sum Death Benefit. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

What happens to a bank account when someone dies?

Most joint bank accounts include automatic rights of survivorship, which means that after one account signer dies, the remaining signer (or signers) retain ownership of the money in the account. The surviving primary account owner can continue using the account, and the money in it, without any interruptions.

What should you not do when someone dies?

Top 10 Things Not to Do When Someone Dies1 – DO NOT tell their bank. ... 2 – DO NOT wait to call Social Security. ... 3 – DO NOT wait to call their Pension. ... 4 – DO NOT tell the utility companies. ... 5 – DO NOT give away or promise any items to loved ones. ... 6 – DO NOT sell any of their personal assets. ... 7 – DO NOT drive their vehicles.More items...•

Why is the death benefit only $255?

In 1954, Congress decided that this was an appropriate level for the maximum LSDB benefit, and so the cap of $255 was imposed at that time.

Who qualifies for funeral grant?

You must be one of the following: the partner of the deceased when they died. a close relative or close friend of the deceased. the parent of a baby stillborn after 24 weeks of pregnancy.

Who claims the death benefit?

Who reports a death benefit that an employer pays? That depends on who received the death benefit. A death benefit is income of either the estate or the beneficiary who receives it.

What to do when someone dies?

When someone dies, you need to ensure you’re making all of the right arrangements. One of these crucial steps is to notify Social Security if your loved one was a Medicare beneficiary. While the funeral home typically does this on your loved one’s behalf, it’s good to stay on top of this yourself, just in case.

What is the number to call if you have a Medicare claim?

You can call toll-free at 1-800-772-1213 between 7 AM and 7 PM on weekdays. When you call, let them know you are reporting the death of a loved one who was a Medicare recipient. Alternatively, you can let your funeral home know that your loved one was a Medicare recipient.

What happens if you don't notify Social Security?

Failing to notify Social Security could result in fraud, as payments or benefits could be wrongly distributed after death. Also, it’s in the estate’s best interest to report the death as soon as possible.

What happens if you don't report a death?

Therefore, if you don’t report the death promptly, you may need to return funds to the government.

What does notifying Medicare do?

By notifying Medicare, you’ll also gain access to the survivor or burial benefit, which can help ease the financial burden of death. Taking care of these steps might be complicated, but it’s a final act of kindness for someone you love. Sources. “Report a death.”.

Do you cash a check after death?

If they received a check that month or any month after that, do not cash it. The check will need to be returned to Social Security as soon as possible, along with any other benefits paid after death. For example, suppose they died in August, and you didn’t report the death until September.

Can you get a one time burial benefit from Social Security?

Not only will this halt any payments into Medicare coverage, but it usually also triggers the one-time Social Security burial benefit. This money can be put towards funeral or burial expenses and is typically given to the surviving spouse or children. The sooner you can report the death, the better.

Why is it important to report a death to Medicare?

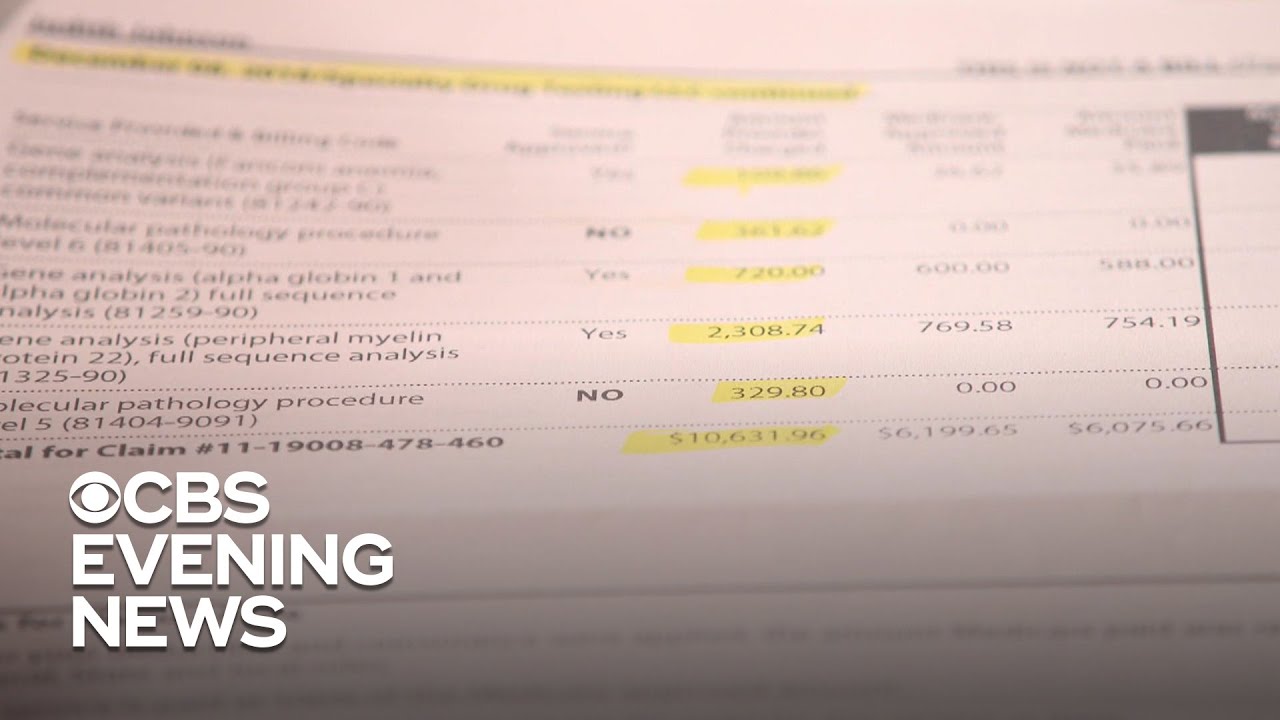

Dealing with a recent death is often difficult, but reporting a death to Medicare is crucial so that the deceased won’t continue to be charged for their Medicare Part B premium, and to help prevent fraud.

What to do when someone passes away?

Several of the steps you should take when someone passes can also alert you of whether you need to contact an insurance carrier. For instance, when you go to the deceased’s bank to close or change their account, you can also ask for the past few monthly statements.

Can you cancel Medicare if you die?

Reporting a death to Medicare doesn’t cancel these plans. You’ll need to contact the carrier or carriers to notify them, and they may require proof of death, such as a death certificate or obituary from a newspaper.

Does Medicare pay for funeral expenses?

Medicare won’t cover funeral costs or pay any money to surviving family members. However, Social Security pays a one-time death benefit of $255 (in 2020), and family members may receive survivor benefits under certain circumstances. Benefits can’t be applied for online; you’ll need to call Social Security, or go to your local office.

Can you report a death to Medicare?

While there isn’t a Medicare death benefit, reporting a death to Medicare is still a necessary step in the process of settling affairs when someone passes away. You can allow the funeral home to handle this for you, or you can contact Social Security yourself.

How to verify death of a beneficiary?

Contact the Social Security Administration immediately by phone or in person. Provide verification of the deceased's death. In many cases, the funeral home that handles the burial arrangements reports the beneficiary's death to the Social Security Administration. You must provide a certified copy of the death certificate.

When do you have to return Social Security if you die in March?

Social Security payments are paid a month behind; if a person dies in March, you must return any benefits received in April. Supplemental Security Income or SSI checks are payable in the month of the death. For example, a check received in April is for the month of April.

Does Medicare notify the beneficiary of a death?

Medicare notifies the beneficiary's Medicare drug and health plan providers once Social Security is informed of the beneficiary's death. The beneficiary is then removed from Medicare and any Social Security payments received end upon verification of the beneficiary's death.

Who monitors Medicare?

Medicare is administered and monitored by the Centers for Medicare and Medicaid Services , but you must contact the Social Security Administration to report the death of a Medicare beneficiary, if you are acting on the beneficiary's behalf.

What are the rights of a medicaid beneficiary?

That said, you do have rights and there are stipulations regarding just what Medicaid can legally do, including: 1 Not going after the surviving spouse for money or asset recovery while he or she is alive. 2 Not going after children under the age of 21 who are disabled for asset recovery (once children reach 21 however, they may be subject to estate recovery action). 3 Restrictions on whether or not Medicaid can take a home if a sibling with equity interest in the property has lived there for at least one year prior to the deceased’s institutionalization. 4 Restrictions on whether or not Medicaid can take a home if an adult child (ren) has lived at the property for at least two years, with or without equity interest, and who helped care for the aged parent.

What happens when you notify Social Security of a deceased person's death?

When you notify the Social Security Administration of the deceased’s passing, that information will be provided to both Medicare and Medicaid, which means you won’t have to take any additional steps to notify those agencies.

What is the responsibility of a spouse after death?

Social Security Insurance (SSI) As the spouse, executor, or responsible family member, it is your responsibility to make sure that the Social Security department is notified as soon as possible after the death of a benefits recipient . In many cases the funeral director will either alert you to this requirement, ...

What are the benefits of a veteran who died?

Veteran’s death benefits take two forms: immediate burial assistance, and longer-term pensions.

What age can a spouse be disabled?

Surviving spouse if disabled and over the age of 50. Surviving spouse if caring for the deceased’s disabled child, or child under 16. Surviving children under the age of 18. Surviving children with a disability that began before the age of 22.

How long does it take for a death certificate to be processed?

It can take a few weeks or even months after the death is reported for the changes to be processed by the agency. If the deceased has been receiving payments or direct deposits, or if you have been receiving them on their behalf, be sure not to touch the money.

Where can a deceased person be buried?

The deceased may also be eligible to be buried in one of the national cemeteries or local state cemeteries. In such a case, the government will issue a headstone and the grave site, but the survivors or estate will be required to cover the costs of a funeral, body preparation, and/or cremation.

What is the first step to notify Medicaid of a death?

Steps for Notifying Medicaid of a Death. When a loved one dies, one of the first government entities that needs to be informed is the Social Security Administration . Once this is done, the death will become a part of both Medicaid and Medicare’s records. No other action needs to be taken to alert Medicaid of the death.

How to get your affairs in order?

Get Your Affairs in Order 1 Put all of your essential documents and paperwork in one place. Check the paperwork each year to see if anything needs to be updated. While you may want to secure the documents, make sure your loved ones know how to access them. 2 Tell a trusted family member where you put all your important papers (as well as where the key is if the file cabinet is locked). If you would rather keep this information private until after you die, leave the information with a lawyer. 3 Tell your family members your end-of-life plans. Do you want to be buried or cremated? Where do you want your final remains to rest for eternity? What songs do you want at your funeral, and what color casket do you want?

What happens if your aunt goes to a nursing facility?

Here’s a scenario to help you understand what may happen: If your aunt was in a nursing facility for the last three years of her life, her Social Security check probably went straight to the facility to help cover her costs. Medicaid may have paid for the remaining costs associated with her care.

What happens if my aunt dies with Medicaid?

If your aunt died with any assets , that money is used to “pay back” Medicaid. This process differs from state to state. The assets may come from a house being sold or an inheritance that your aunt received prior to her death. It may also come from her personal belongings.

What is Amazon's Medicaid program?

Medicaid is a program that provides health coverage to 68.8 million people, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. The program is administered by states and is funded by both state and federal tax dollars.

How to keep your documents private after death?

If you would rather keep this information private until after you die, leave the information with a lawyer. Tell your family members your end-of-life plans.

Can you take assets from a deceased person?

This is not allowed. If the assets were given to individuals within the last few years of the deceased loved one’s life, Medicaid might require that those assets are returned to the organization. Some states may even take items bequeathed by the deceased to an individual in an attempt to cover some of the costs.

What happens if Social Security pays a deceased person?

If Social Security pays the deceased's benefit for that month because it was not notified of the death in time, the survivors or representative payee will have to return the money.

When do Social Security benefits end?

Benefits end in the month of the beneficiary’s death , regardless of the date, because under Social Security regulations a person must live an entire month to qualify for benefits. There is no prorating of a final benefit for the month of death.

Who is responsible for reporting a beneficiary's death?

A representative payee — a person or organization appointed by Social Security to manage benefit payments for someone no longer able to do so — is also responsible for reporting a beneficiary’s death as part of their larger duty to notify Social Security of any event affecting that person’s payments.