To find the right Medicare plan for you or someone else, check eligibility and coverage outlines through Medicare.gov or contact your local healthcare insurance agent or benefits representative.

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What is the best Medicare Choice?

Only 15 weekdays are left for Medicare recipients to choose or change their plans. Only 15 days left for choosing the best Medicare coverage | News | annistonstar.com Thank you for reading! Please log in, or sign up for a new account andpurchase a subscription to continue reading. Sign Up Log In Purchase a Subscription

When can I Change my Medicare plan?

You can change from your current Part D plan to a different one during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During the open enrollment period, you can change plans as often as you want. Your final choice will take effect on January 1. of the following year.

How to switch from Medicare Advantage to Original Medicare?

- Call the Medicare Advantage plan you wish to leave and ask for a disenrollment form.

- Call 1-800-MEDICARE (1-800-633-4227) to request that your disenrollment be processed over the phone. TTY users should call 1-877-486-2048. ...

- Call the Social Security Administration or visit your Social Security Office to file your disenrollment request.

What is the most widely accepted Medicare plan?

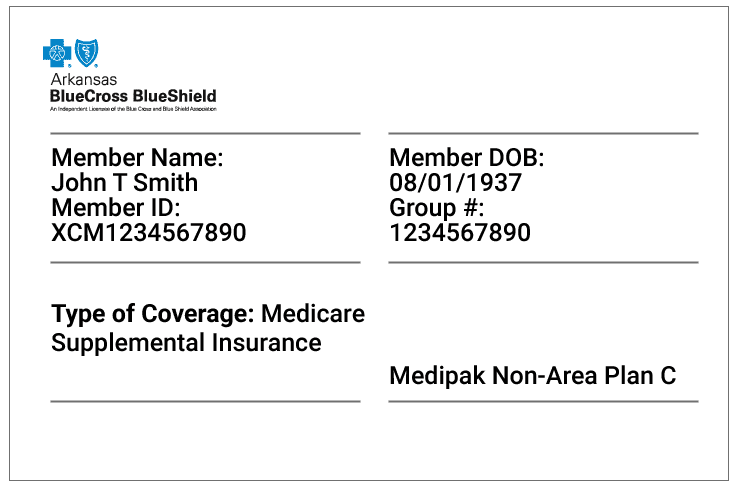

Plan C. While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans. The most popular Medigap plans include: 49% of all Medigap beneficiaries are enrolled in Plan F.

Who has the best Medicare package?

Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states. That said, there is no single “best plan.” Your needs and preferences will determine the best choice for you.

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What parts of Medicare do I need?

Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare. Part D covers prescription drug benefits.

What is Medicare plan G and F?

Plans F and G are known as Medicare (or Medigap) Supplement plans. They cover the excess charges that Original Medicare does not, such as out-of-pocket costs for hospital and doctor's office care. It's important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Who Has the Best Medicare Advantage plan for 2022?

For 2022, Kaiser Permanente ranks as the best-rated provider of Medicare Advantage plans, scoring an average of 5 out of 5 stars. Plans are only available in seven states and the District of Columbia.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What to consider before picking a Medicare plan?

Here are six things to consider before picking a Medicare plan: 1. Coverage options. First, take a look at your current coverage .

What happens if you don't get Medicare?

If you don’t get these benefit payments, you’ll get a bill. If you choose to get the Medicare Plan D coverage for prescription drugs, you’ll also pay a monthly premium. The actual cost of this coverage depends on plans available in your area.

How many Medicare plans are there in the US?

Today, people age 65 and older have more choices in Medicare coverage than previous generations. Most Americans have more than 25 plans to choose from, each with different premiums, copays, and alliances with medical providers and pharmacies.

Does Medicare Part A cover hospital care?

For most people, Medicare Part A, which covers hospital care, will be provided to you at no charge. Part B, which covers medical care, is an elected plan that involves a monthly premium.

Does Healthline Media offer insurance?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on March 1, 2019.

Basic Background on Medicare

On July 30, 1965 President Lyndon B. Johnson made Medicare into law. This new program allowed seniors (and later, disabled younger Americans) to receive healthcare they needed by providing “approved” insurance plans to fit their needs. It was (and is) subsidized by the federal government, which means that our taxes help fund the Medicare program.

Different Parts of Medicare

According to medicare.gov, the basic components of Medicare are as follows:

So, Which Medicare Plan is Right for You?

Now that you have some understanding of the parts of Medicare and what they cover, it’s time to talk about choosing the right plan (s) for you. Here are a few factors to consider when choosing a Medicare plan:

Comparing Costs for Original Medicare and Other Plans

The biggest consideration for many people approaching 65 isn’t necessarily the plan: it’s how much it’s going to cost. This is where things can get confusing.

Why is my Medicare agent no longer available?

Your agent is no longer available, due to illness or death. But unless there is a good reason for changing agents, you want to avoid doing so. Medicare is a wonderful benefit you’ve earned through many years of hard work.

What happens when you find your agent?

When you found your agent, you went through a process of explaining everything to him or her. Being a fiduciary, you have agent/client confidentiality and nothing you say can be disclosed to any other party with the exception of your insurance company or Medicare.

What to do when your needs have shifted?

Whatever the reason, your needs have shifted. The first thing you want to do is call your agent. Keep in mind that since your agent helps many people, he or she may not only know what plans and programs can help, but might also have knowledge of other resources he or she can share.

Do you have to call Medicare and Social Security?

You don’t have to do this on your own. Many people try to by calling Medicare and Social Security. However, keep in mind that CMS (Centers for Medicare and Medicaid Serves) and SSA (the Social Security Administration) are behemoth organizations. While they strive to provide the best service possible, they are not designed to provide one-on-one ...

Is it hard to get health insurance at 65?

Turning 65 can be strenuous, because you must make choices you are not familiar with. The health insurance provided by employers, while it may look the same, plays by different rules. If you don’t know the new rules, it’s easy to make the wrong choice or be misled. But it doesn’t end after your Initial Enrollment Period (IED).

Does the Plan Offer Enough Coverage?

Health insurance is not a “one-size-fits-all” type of insurance. Your coverage needs may be different than your neighbors’ or friends’, and it is important that any plan you consider has the coverage limits you need. Make sure that any services your potential Medicare covers has high enough limits to cover you.

What is Covered?

There are Medicare plans that are designed to cover different areas of health care. An Original Medicare plan covers:

Does the Cost Fit Your Budget?

The point of Medicare is to save you money on health care. Paying too much can be detrimental to your savings. Medicare is primarily based on your income, so the higher income you have, the more you may pay for your Medicare. Medicare premiums may vary more for Medicare Advantage plans than for Original Medicare, so be conscious of the costs.

Is Your Doctor Covered?

Unfortunately, not all doctors are covered under Medicare. When looking for a Medicare plan, you will find that plans often have limitations on healthcare providers that are accepted under the plan. Insurers often allow you to check whether or not your healthcare provider is covered under their plans. If not, you may have a hard decision to make.

Do You Need Additional Coverage?

Supplemental coverage is available for Original Medicare and Medicare Advantage plans for those who need extra coverage. A Medigap policy allows you to have coverage for extra expenses not covered by Original Medicare, such as deductibles and coinsurance. Medigap policies are not available for Medicare Advantage plans.

What are the Ratings?

Always check the ratings on an insurer before signing a policy. Speak with people who have had personal experience. You want coverage that fits you, but you also want an insurer that understands your needs. Your insurance agent should be approachable and make you feel comfortable as you strive to take care of your health.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.