How do I find out my Medicare reimbursement rate?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.Jan 20, 2022

Is the Medicare 2021 fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

What is Medicare reimbursement fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.Dec 1, 2021

Is the 2020 Medicare fee schedule available?

The Centers for Medicare and Medicaid Services (CMS) has released the 2020 Medicare Physician Fee Schedule final rule addressing Medicare payment and quality provisions for physicians in 2020. Under the proposal, physicians will see a virtually flat conversion factor on Jan. 1, 2020, going from $36.04 to $36.09.Nov 1, 2019

Did Medicare reimbursement go up in 2022?

On Dec. 16, the Centers for Medicare and Medicaid Services (CMS) announced an updated 2022 physician fee schedule conversion factor of $34.6062, according to McDermott+Consulting. This represents a 0.82% cut from the 2021 conversion factor of $34.8931.Feb 7, 2022

Is the Medicare 2022 fee schedule available?

The Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Physician Fee Schedule and Quality Payment Program final rule on Nov. 2 .Nov 5, 2021

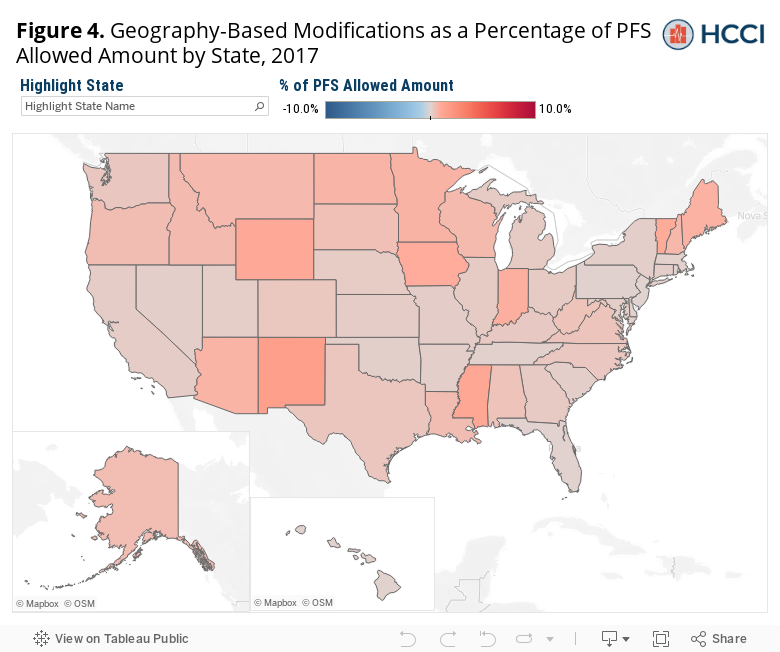

Do Medicare reimbursement rates vary by state?

Over the years, program data have indicated that although Medicare has uniform premiums and deductibles, benefits paid out vary significantly by State of residence of the beneficiary. These variations are due in part to the fact that reimbursements are based on local physicians' prices.

What components make up Medicare physician fee schedule?

The Centers for Medicare and Medicaid Services (CMS) uses the Medicare Physician Fee Schedule (MPFS) to reimburse physician services. The MPFS is funded by Part B and is composed of resource costs associated with physician work, practice expense and professional liability insurance.

What is the reimbursement rate for CPT?

For example, in 2020, use of evaluation CPT codes 97161-97163 resulted in a payment of $87.70; that payment increases to $101.89 in 2021. Similarly, payment for reevaluation CPT code 97164 will also increase this year, from $60.30 in 2020 to $69.79.Jan 6, 2021

How does CMS reimbursement work?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

What is the difference between CPT and HCPCS?

The CPT codes used to bill for medical services and items are part of a larger coding system called the Healthcare Common Procedure Coding System (HCPCS). CPT codes consist of 5 numeric digits, while HCPCS codes ...

What is Medicare reimbursement rate?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare ...

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How much more can a health care provider charge than the Medicare approved amount?

Certain health care providers maintain a contract agreement with Medicare that allows them to charge up to 15% more than the Medicare-approved amount in what is called an “excess charge.”.

Is it a good idea to check your Medicare bill?

It’s a good idea for Medicare beneficiaries to review their medical bills in detail. Medicare fraud is not uncommon, and a quick check of your HCPCS codes can verify whether or not you were correctly billed for the care you received.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

How much does Medicare pay for medical services?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent ...

Why use established rates for health care reimbursements?

Using established rates for health care reimbursements enables the Medicare insurance program to plan and project for their annual budget. The intent is to inform health care providers what payments they will receive for their Medicare patients.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

What is the original objective of Medicare?

The original objective was to establish a uniform payment system to minimize disparities between varying usual, customary, and reasonable costs. Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare.

How much can Medicare increase from current budget?

By Federal statute, the Medicare annual budget request cannot increase more than $20 million from the current budget.

Who needs to be a participant in Medicare?

To receive reimbursement payments at the current rates established by Medicare, health care professionals and service companies need to be participants in the Medicare program.

Does Medicare accept all recommendations?

While Medicare is not obligated to accept all of the recommendations, it has routinely approved more than 90 percent of the recommendations. The process is composed of a number of variables and has been known for lack of transparency by the medical community that must comply with the rates.

Introduction

The first chart below summarizes the payment method for the various types of payers, and the second chart provides links to spreadsheets, documents, and web pages where actual Medicare payment rates can be found.

NOTE

Actual payment methodologies may contain exceptions, special calculations, and adjustments for various factors (geography, local wage rates, hospital type, etc.).

Key Takeaways

The Physician Fee Schedule Look-up Tool provides a way to easily search services covered by the Medicare Physician Fee Schedule.

Example 1

To start your search by visiting this website and click on “ Begin Search ”: https://www.cms.gov/medicare/physician-fee-schedule/search/overview

Example 2

Let’s start a new search. This time we are going to look up two HCPCS codes, one for individual DSMT, which is G0108, which is also billed in 30-minute increments, and then we will keep group DSMT, which is G0109 .