20 Medicare Supplement Insurance Marketing Ideas

- Be a Question-Answerer. Many folks have questions about Medicare plans, coverages, and benefits. ...

- Host a Seminar. You can drive many new leads by serving a larger group of those seeking your question-answering skills by hosting a local seminar.

- Attend Events. ...

- Ask for Referrals. ...

- Partner for Referrals. ...

- Network for Referrals. ...

- Set Up Co-Registration. ...

Full Answer

How to sell Medicare supplements?

Learning how to sell Medicare Supplements all starts with finding a sales system to replicate. There is no reason to try to reinvent the wheel! Determine if you want to do this all on your own or with a team.

How do Medicare supplements work?

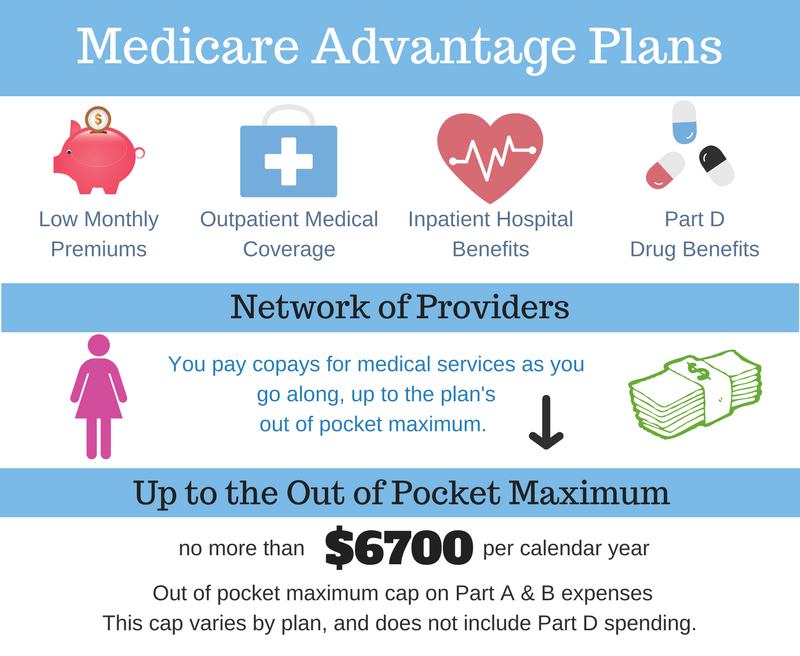

Learn how Medicare Supplements work. Medicare benefits such as Medicare Supplement insurance plans are sold by private insurance companies to cover the liability of the 20% and deductibles associated with Original Medicare. The typical Med Supp client coverage scenario looks like this:

Why should you offer multiple Medicare supplement companies?

Plus, it’s a great example of how important being an independent agent is to your clients. If you only worked for Humana in the first, your clients wouldn’t have the choice to save $38 per month while going to the same doctors and hospitals. Clearly, offering multiple Medicare supplement companies is a no-brainer!

What should your clients expect to pay for Medicare supplements?

Your client should expect to pay monthly premiums for Original Medicare Part B, their Supplement and their Part D drug plan. It’s a triple whammy! Medicare Supplements are accepted by any doctor that accepts Medicare, so there are few restrictions for the doctors and specialist your clients can see.

How do you make money selling Medicare supplements?

Generally, insurance agents often earn two types of commissions when selling Medicare plans: A dollar amount per application (Medicare Advantage and prescription drug plans) or a percentage of the premium sold (Medicare Supplements).

How do I learn to sell Medicare?

To sell Medicare Advantage plans, you'll have to complete the America's Health Insurance Plans (AHIP) certification in addition to each carrier's compliance and product certifications. These certifications exist to help protect seniors and reward agents who do things the right way.

What is the commission for Medicare Supplements?

Medicare Supplement Commissions The average Medicare Supplement commission rate is 22% with a 12-month advance. The average yearly premium for Medicare Supplement plans is $1,600, which has a renewal rate of $29.33/month. Agents can earn renewal commissions for at least six years.

How do I get Medicare clients?

⍟ 14 Ways to Generate Medicare Supplement LeadsBuild & Maintain a Website. ... Social Media Presence. ... Video Marketing. ... Blogging, Writing Articles. ... Email. ... Online Events: Live webinars, podcasts. ... Direct Requests / Client Referrals. ... Lead Swapping Partnerships (Asking other professionals for referrals)More items...

What are three main ways Medicare sales occur?

There are three different types of Medicare products sold by agents and brokers: Medicare Supplement plans (Also called Medigap plans), Medicare Advantage plans and Medicare Part D Rx plans.

What is an FMO?

FMO — Field Marketing Organizations A field marketing organization (FMO) is basically the same as an independent marketing organization (IMO). FMOs are typically top-level organizations that are licensed to sell health insurance products in most, if not all, states.

Is being a Medicare agent worth it?

Medicare agents have significant earning potential and a promising future of stable career growth – but it's not just about the money. Medicare agents also get to help others while taking control of their own careers. For the right person, Medicare sales can be a very rewarding and lucrative career.

Do Medicare agents get residuals?

As an insurance agent, you need a residual income base to create a career with long-term sustainability. Medicare can be that residual income. You can build a 6 figure income by steadily selling Medicare for as little as 3-4 years.

What is the Medicare commissions for 2022?

For 2022, the initial MA commissions increased from $370 to $394. This represents a 6.5 percent increase. Renewal commissions for Puerto Rico and the Virgin Islands increased from $185 to $197.

How do I get more Medicare referrals?

How to Build a Referral NetworkIllustrate consistent short-term value. Start with what you have. ... Run maintenance with quality customer service. A good insurance agent helps beneficiaries find good plans. ... Deliver on promises in the long-run. Empty promises are what can tarnish your personal brand.

How can I get free Medicare leads?

5 Ways to generate Free Medicare LeadsAsk for Referrals. Referrals or word of mouth may be the oldest, best, and least expensive ways for insurance agents to generate Medicare leads and grow your business. ... Form Community Partnerships. ... Create a Digital Presence. ... Host and Network with Seniors at Events. ... Personal Contact.

Can you solicit Medicare Advantage prospects through email?

The only caveat: If you are initiating contact via email, you're required to include an opt-out opportunity. Direct unsolicited contact, such as text and direct messaging over social media, falls into the same category as unsolicited phone calls and door-to-door solicitation. This means it is not permitted.

Get our latest Sales eBook

25 pages of sales and marketing tips for open enrollment. It’s FREE and updated annually with the most current marketing trends.

1. Be a Question-Answerer

Many folks have questions about Medicare plans, coverages, and benefits. Even those who turned 65 years ago, may come across new questions, as the laws governing the program continue to change and update.

2. Host a Seminar

You can drive many new leads by serving a larger group of those seeking your question-answering skills by hosting a local seminar. Your seminar could be on Medicare itself, or, it could be on a related topic, such as senior health, nutrition, retirement planning, or anything else of interest to Medicare prospects in your area.

3. Attend Events

You may not find immediate Med Supp leads at a closed workshop or tradeshow, but you can use your attendance at such events to generate future leads.

4. Ask for Referrals

If you have an existing book of business, particularly within the Medicare Supplement market, referrals can be a great way to expand your Med Supp business. It’s easy because your loyal clients already trust you, which helps build trust with new referral leads.

5. Partner for Referrals

If you have a cousin, neighbor, or friend in another line of business, you might look into striking up a referral partnership. The easiest route involves exchanging business cards to stock in each other’s shops. But you could both get more out of a partnership by asking your clients for permission to trade info with your referral partner.

6. Network for Referrals

If you don’t have cousins, friends, or neighbors with client-based businesses, you can always make new friends in the business community to find potential referral partners. Try socializing with other local professionals like CPAs, lawyers, financial planners, churches, pharmacies, and so on.

What is Medicare Supplement insurance?

Original Medicare Part A & B + Medicare Supplement + Part D. Medicare Supplement insurance is also referred to as a Medigap policy by CMS. These names are interchangeable. Your client should expect to pay monthly premiums for Original Medicare Part B, their Supplement and their Part D drug plan.

How long does Medicare Supplement pay commission?

Here are the two most important things you need to know about Medicare Supplement commissions. Medicare Supplements pay the same commission for seven years.

How long does Medicare Part B last?

Your clients IEP begins 3 months before the month they turn 65, their birth month and ends 3 months after. Below are some common examples of Medicare Part B covered services: Doctor’s visits. Ambulance services.

Why are Medicare sales so high?

Most companies pay the same commission for seven years and some even pay for life. Plus, Medicare sales are at an all-time high because of the aging population.

How long does it take to get a six figure income from selling Medicare?

Selling Medicare can steadily help you build a six-figure residual income in as little as 3-4 years. At that point, you’ll have a great six-figure salary.

How much is Part B insurance?

Part B premiums can be as low as $134 or as high as $428.60. The range in price is directly correlated to your client’s income. If for some reason your client doesn’t elect Part B on time, they will be subject to a late enrollment penalty of 10% for every full 12 months they delay enrollment.

Does Medicare Part B have a deductible?

The Medicare Part B enrollment penalty can be waived in instances where the proposed insured has credible coverage, for example, they have existing coverage through an employer. Lastly, Medicare Part B has an annual deductible of $183 (2017 data). This deductible must be met before Medicare will begin paying.

Getting Started Selling Medicare Supplements Is Easier Than Ever Before!

If you want to sell Medicare Supplements, you don’t need to spend hours scouring the internet for the basics, like what license is needed to sell Medicare Supplements (just your health insurance license!), how to get licensed and contracted, the best Medigap plans, or sales tips.

Discover Fresh Ways to Market & Sell Medicare Supplement Plans

Have some experience with selling Medigap plans? How’s your closing rate? Inside the guide, we share multiple tried and true strategies for targeting ideal Medicare Supplement clients, marketing your services online and offline, narrowing down the right plan, pitching it, and more.

Unlock Higher Commissions Without Paying for Them Another Way

How much do agents make selling Medicare Supplements? With the right training, tips, and effort, it’s reasonable to say that you could be making a six-figure annual salary from Medicare Supplement sales alone after just a few years! Our guide covers the sales tools that can help you work efficiently (free access links included!), expand your client base, and turn a bigger profit.

Enjoy the Free, Complete Training & Sales Support You Desire & Deserve!

At Ritter Insurance Marketing, our primary goal is to help agents grow their businesses quickly, efficiently, and compliantly.

What is Medicare Part A?

If a client chooses this route, they will sign up for Medicare Part A. It’s provided free of charge to seniors who paid Medicare taxes during their working years. Part A covers inpatient care and some nursing facility expenses.

What age does Medicare cover?

Here’s our abbreviated recap of the current state of the Medicare program. This government-run health insurance program is available primarily to Americans aged 65 and older, as well as certain other folks with specific disabilities or diseases.

Do Medicare leads have a cellphone?

Most of your Medicare leads had a cellphone before today’s high schoolers were even born. Some may have been texting since they were under 50. Twitter, Facebook, and iPhones came out more than ten years ago. This is one way that today’s Medicare customers are different from past customers.

Can seniors apply for Medicare Supplement?

Seniors will still be able to apply for Medicare supplement coverage after this six-month window, however, it could mean they will pay a higher premium for coverage, or if they have serious medical issues, they could be turned down for coverage. Thus, for seniors looking for affordable and reliable benefits, earlier is better.

Is Medicare supplement coverage regulated?

Medicare supplement coverage is regulated at the state level, and so this means insurance agents often target leads within a particular state or a few states.

Do Medicare leads read fine print?

Today’s Medicare leads also aren’t afraid of reading the fine print, with their reading glasses, of course, and asking you pointed questions. These consumers like to make well-informed buying decisions.

What percentage of Medicare beneficiaries are in Original Medicare?

Plus, only 34 percent of Medicare beneficiaries are enrolled in a Medicare Advantage plan, meaning 66 percent of Medicare beneficiaries are in Original Medicare and could be eligible for a Med Supp!

What states have the same medsup plan?

Med Supp plans are standardized, meaning plans with the same letter offer the same benefits, from carrier to carrier and in all states, except Massachusetts, Minnesota, and Wisconsin. The main factor that sets same-lettered plans apart from carrier to carrier is their monthly premiums, or rates.

Do carriers update their Med Supp?

Carriers update their Med Supp rate sheets and applications all the time . It’s extremely important for you to always have the most up-to-date copies of these items to present during appointments, so we recommend getting them straight from the source: carriers’ agent or broker portals.

What is Medicare Supplement?

Medicare Supplements cover the gaps in Medicare. When put together with a Medicare plan, a Medica re Supplement plan provides almost total comprehensive coverage. Meaning there should be minimal financial obligation for deductibles and co-pays. 2.

What is Medicare for 65?

Medicare is the Federally-funded health insurance program for people who are 65 and older. Also, it is for those who have been on disability after a period of time. It provides a basic level of health insurance for hospitalization and physician care.

What is the T-67+ market?

And focusing on the T-67+ market is a surefire way for a new Medicare Supplement agent to focus his energy. A significant benefit of selling Medicare Supplements to people turning 67 is that you don’t have to know a lot about Medicare.

What is the turning 67 market?

The “turning 67 market” is where we have somebody who’s had Medicare for several years. At a minimum, most folks are turning 67 or older, into their 70s and even 80s. The people we try to meet with have been in good health for the most part and love their Medicare Supplement. Therein lies the opportunity….

Is it easier to sell Medicare Advantage or Supplements?

For a new agent to selling Medicare products, there’s a LOT more that goes into selling Medicare Advantage than Medicare Supplements. It’s much easier – and arguably more lucrative – to START selling Medicare Supplements out the gate…. EXCLUSIVELY.

Do seniors have more options than Medicare Supplements?

However, seniors have more options than Medicare Supplements to reduce out-of-pocket hospitalization and doctor expenses. Let’s get a simple overview of both options. 1. Medicare Supplements. As you know, the first supplemental option are Medicare Supplements.

Is Medicare comprehensive?

The critical thing to understand is that on its own, Medicare is not comprehensive. Medicare recipients have the potential for large, out-of-pocket deductibles due if hospitalized. In addition, Medicare only covers 80% of Part B expenses, meaning Medicare recipients must pay the 20% copay, which has no ceiling.

What is marketing in CMS?

Marketing refers to using materials to draw someone’s attention to a specific plan and then influence them to select it. Any marketing materials that have a carrier’s name on them or refer to a particular plan must be approved by CMS.

Can you market to MA enrollees?

You cannot market to potential MA enrollees in the following ways: Approaching someone in a common area (parking lot, hallway, etc.)

Can you market to age ins?

You can, however, market to age-ins (people turning 65). Educational events must be explicitly advertised as educational – no marketing or sales activities are allowed. Marketing and sales events are designed to steer potential enrollees toward a plan or set of plans.

Can you get Medicare Advantage without a goal?

You can’t get to your destination without following a map, and you can’t be successful in Medicare Advantage marketing without a goal. Before you start any marketing plan, write down your goals. Then, you can use the materials at your disposal to help you reach them.