How can I reduce my Medicare premiums?

Aug 12, 2021 · The first way to control Medicare premiums is to be aware of the ways that you can influence your income. After the age of 63 (assuming that you start Medicare at age 65), maximizing pre-tax contributions to retirement plans, IRAs, HSAs, and other tax-deferred vehicles can help to reduce your income below one of these premium thresholds.

How to save money on your Medicare premiums?

Assuming your MAGI in retirement will be less than $88,000, you can eliminate the additional premium. That is over $1,400 in savings. Return Form SSA-44 to your local Social Security Office Here is how to reduce your Part B premiums: complete form SSA-44, which can be found on the Social Security Administrations website, SSA.gov/forms.

Could Medicare premiums lower your taxes?

Nov 27, 2020 · In some cases, reducing your income by just one dollar could slash your Medicare premiums by 40%, per year. If you are married, the surcharge will apply to both spouses regardless of their...

Can I avoid paying more in Medicare premiums?

Apr 07, 2022 · To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person. Local offices fully reopened April 7 after being closed to walk-in traffic for more than two years due to the COVID-19 pandemic , but Social Security recommends calling in …

How do I get my Medicare premium reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Do Medicare premiums decrease with income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

At what income level does Medicare premium increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How often do Medicare premiums change?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

Why is my Medicare premium so high?

CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system. Some of the higher health care spending is being attributed to COVID-19 care.Nov 15, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What is the Medicare MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

Is Medicare free for seniors?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

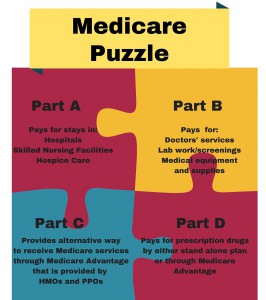

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Have questions about Medicare premiums?

How is your Medicare B premium set? And how can you lower your Medicare premium if your income declines in retirement? Today the Fearless Advisor explains all!

Your Medicare Part B premiums are based on your income from 2 years back

What I am referring to is how Medicare Part B premiums are determined. Part B is often referred to as “Medical Insurance.” (Please bear with me as there are going to be some acronyms used by the Social Security Administration.) These premiums are determined by your modified adjusted gross income or MAGI from two years ago.

Good news! Yes, you can request a reduction in Medicare Part B Premiums

Now that you are aware that the cost of Part B premiums can increase with your income, lets discuss when you may need to ask for a reduction in your premiums. The time is when you have a life-changing event, and your income is reduced. This commonly happens when someone retires at age sixty-five or later.

Return Form SSA-44 to your local Social Security Office

Here is how to reduce your Part B premiums: complete form SSA-44, which can be found on the Social Security Administrations website, SSA.gov/forms.

F5 Financial is here to answer your questions

If you need assistance or have questions in this area, the team here at F5 Financial would be happy to listen and support your family. Feel free to reach out to us at F5 Financial. Thanks for joining us!

Why does my income decrease?

Your income will most likely need to have decreased because of a life event such as a new marriage, divorce, death of a spouse, or even retirement. Use form SSA-44, which outlines the requirements. I’m a big fan of year-end tax planning for everyone.

What is AGI on 1040?

That number will include your capital gains and loss from investments, earnings, self-employment income, as well as tax deductions for certain retirement plan contributions. It will not include the standard deduction or other tax deductions you have taken on your Schedule A.

Does Medicare surcharge mean higher premiums?

To be clear, paying higher Medicare premiums will not translate into better coverage or care . The Medicare surcharge simply means that recipients will have varying premiums for the same service and coverage. I still need to point out that even those at the highest income brackets will still typically pay less for Medicare than they would for private insurance. The biggest surcharges will start to kick in for singles with incomes of more than $500,000, in 2019, or married couples with incomes above $750,000.

Can self employed people deduct Medicare premiums?

The easiest way is to contribute to your workplace 401 (k) plan. Self-employed individuals should be able to deduct their Medicare premiums. More tax deductions should result in a lower AGI overall, which could help lower future Medicare surcharges.

How much can you donate to a charity IRA?

Consider making a charitable donation from your IRA. You are allowed to donate up to $100,000, per year, this way.

Is Medicare based on income?

For those of you who don’t know, your Medicare premiums are based on your income. The formula for Medicare premiums contains cliffs, leading to dramatically higher premiums if you make just one extra dollar in a given tax year. Similarly, some adjustments for inflation for 2021 can further complicate planning for your Medicare premiums.

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.

What is Social Security tax?

Social Security uses tax information from the year before last — typically the most recent data it has from the IRS — to determine if you are a “higher-income beneficiary.”. If so, you will be charged more than the “standard,” or base, premium for Medicare Part B (health insurance) and, if you have it, Part D (prescription drug coverage).

Use a wealth management firm to secure real money that can be put to good use enjoying your hard-earned retirement

When you apply for Medicare Part B, the Social Security Administration (SSA) examines the most recent federal tax return provided to it by the IRS.

This scenario may repeat itself in 2017 with Medicare Part B and D premiums based on 2015 pre-retirement income

In the event the SSA determines that you must pay any surcharge amounts, you will receive a letter showing your higher premiums and the reason for the determination. If you feel that your current situation does not warrant these IRMAAs, you can appeal.

How much will Medicare cost in 2021?

In 2021, most people pay for $148.50 per month for Medicare Part B. If your income is higher than those amounts, your premium rises as your income increases. For example, if your annual income in 2019 was more than $500,000 as a single taxpayer or more than $750,000 as a married couple, your 2021 Part B premium would be $504.90 for Medicare Part B ...

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an extra charge added to your monthly premiums for Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage). The income surcharge doesn’t apply to Medicare Part A (hospital insurance) or Medicare Part C, also known as Medicare Advantage. IRMAA charges are based on your income.

What are the life changing events?

The following events qualify as life changing for purposes of calculating an IRMAA: 1 marriage 2 divorce 3 spouse’s death 4 reduced hours or loss of your job 5 loss of income-generating property 6 reduction or loss of your pension 7 settlement from an employer

What is a reverse mortgage?

A reverse mortgage is where you can use the equity in your own home to pay for living expenses.

How long ago was IRMAA based on taxes?

Your IRMAA is based on tax returns from 2 years ago. If your circumstances have changed over those 2 years, you can file a form to let Medicare know about the reduction in your income.

Can you use 401(k) to buy an annuity?

A qualified longevity annuity contract might also help. The IRS allows you to use traditional IRA, 401 (k), 403 (b), and 457 (b) funds to purchase an annuity that provides regular income to you but reduces the amount of your required minimum distribution.

How old do you have to be to take a minimum distribution?

If you’re 70 years and 6 months old or older and have retirement accounts, the IRS requires you to take minimum distribution from the account each year. If you don’t need this money to live on, you may want to donate the distribution to a 501 (c) (3) charitable organization.