IRS Form 4029 is an application for exemption from Social Security and Medicare taxes and a waiver of benefits from those programs. However, there are a few catches: You must be a member of a religious group that teaches against insurance (for conscientious reasons – not because they believe it won’t be around to pay you benefits).

Full Answer

How to pay Social Security and Medicare taxes?

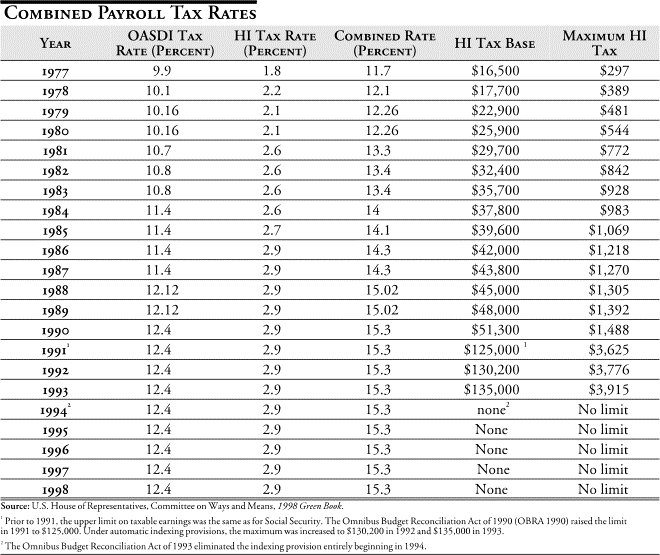

If your wages and tips are subject to either social security tax or the Tier 1 part of railroad retirement tax, or both, and total at least $142,800, do not pay the 12.4% social security part of the SE tax on any of your net earnings. However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

Who does not have to pay Social Security tax?

· Employees pay Social Security taxes of 6.2% of their eligible earnings up to a wage limit. In 2020, the wage limit was $137,700. If your wages exceed that limit, you stop paying Social Security...

Do I have to pay taxes on half of my social security?

· Self-employed workers who make less than $400 annually do not need to worry about paying Social Security taxes. 8 High-income individuals are also exempt from paying the tax on any earnings over...

Do I have to pay Medicare tax if I am self-employed?

· Employees pay Social Security taxes of 6.2% of their eligible earnings up to a wage limit. In 2020, the wage limit was $137,700. If your wages exceed that limit, you stop paying Social Security taxes at that point. What you might not know is that you are not the only one paying Social Security taxes. Your employer must match the amount you pay.

How do I avoid Social Security and Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Can I refuse to pay Social Security taxes?

Most people can't avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers. Just like the income tax, most people can't avoid paying Social Security taxes on their employment and self-employment income.

Can I remove Medicare tax from my paycheck?

No, you can't deduct the Medicare tax from your income tax return. Once you have Medicare, you may be able to deduct Medicare premiums from your return if you itemize your return and/or you're self-employed.

How do I opt out of Social Security?

You'll handle opting out of social security by filling out a specific government form known as Form 4361. Just remember that this only applies to the income you get as part of your vocational ministry.

How do you become exempt from Social Security?

To request an exemption from Social Security taxes, get Form 4029—Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits from the Internal Revenue Service (IRS). Then, file the form with the Social Security Administration (address is on the form).

How do I avoid taxes on my paycheck?

If you want to temporarily stop tax withholding from your paycheck, you'll need to file a new Form W-4 with your employer.

Why am I getting taxed for Medicare?

Why Do You Have to Pay a Medicare Tax? The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It's one of two trust funds that pay for Medicare. The HI Trust Fund pays for Medicare Part A benefits including inpatient hospital care, skilled nursing facility care, home health care and hospice care.

Why was Social Security put in place?

But Social Security was put into place partly because people don’t save on their own. If the current state of personal finances in America is any indication, we’d likely have millions of poverty-stricken elderly due to a lack of financial discipline.

Do you have to be conscientiously opposed to receiving public insurance?

You have to be conscientiously opposed or have religious beliefs that are opposed to receiving benefits from public insurance based on the performance of your duties as a minister, christian science practitioner, or member of a religious order.

Is the exemption for disability limited?

Basically, not many people will qualify and the exemption is fairly limited (in terms of compensation affected). However, there is another form that serves a similar purpose, but it is even more limited than this one.

Will the rest of us pay Social Security?

The Rest of Us Will Just Have to Deal with It. There are no other ways to remain a U.S. Citizen and not pay Social Security and Medicare taxes unless you’re willing to move out of the country. But the real question is whether Social Security will actually run out of benefits by the time today’s young people retire.

Do you have to pay Social Security if you have another job?

If you have another job, you’ll still have to pay Social Security and Medicare taxes on those earnings and you’ll be eligible for benefits based on those earnings. Again, this exemption is very limited in terms of who qualifies and in its scope.

How to keep Social Security benefits free from taxes?

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income so low it falls below the thresholds to pay tax. However, few choose to live in poverty just to minimize their taxes. A more realistic goal is to limit how much tax you owe.

How much of Social Security is taxable?

Up to 50% of Social Security income is taxable for individuals with a total gross income including Social Security of at least $25,000, or couples filing jointly with a combined gross income of at least $32,000.

Why are survivor benefits not taxed?

Survivor benefits paid to children are rarely taxed because few children have other income that reaches the taxable ranges. The parents or guardians who receive the benefits on behalf of the children do not have to report the benefits as income. 4

What is included in Social Security income?

That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and any other taxable income. Then, any tax-exempt interest is added.

How many states tax Social Security?

There are 13 states which tax Social Security benefits in some cases. If you live in one of those states—Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia—check with the state tax agency. 8 9 As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

When did Social Security pay taxes?

Social Security payments have been subject to taxation above certain income limits since 1983. 1 No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

Can you manage your withdrawals from a conventional savings account?

A similar effect can be achieved by managing your withdrawals from conventional savings, money market accounts, or tax-sheltered accounts.

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Do you pay Medicare on your wages?

However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

What happens if you don't pay taxes?

When you don’t pay on time, you will likely be subject to penalties and interest. There are penalties for not filing a return and higher penalties for fraudulently failing to file your return. The IRS can take steps to collect the money they think you owe, too. They can garnish wages if you have W-2 wages.

What happens if you don't have 6.2% deduction on your paycheck?

An expensive medical emergency may pop up. Without having that 6.2% deducted automatically from your paycheck, that money may end up going toward these other expenses.

Why is payroll tax considered payroll tax?

This tax is considered a payroll tax because it comes out of your paychecks if you’re an employee.

What happens when you get your first paycheck?

When you received your first paycheck, you were probably in for a rude awakening. You knew you’d have to pay taxes. You likely had no idea how many taxes you really had to pay for living in the United States. You may have expected to pay federal income taxes and state income taxes. Jump To:

What is the main benefit of Social Security?

The main Social Security benefit everyone thinks of is retirement . Social Security may also provide access to other benefits. These include disability benefits, dependent benefits and survivors benefits for surviving spouses or children.

Can non-resident aliens avoid paying taxes?

Certain nonresident aliens may be able to avoid paying these taxes, though.

Do you have to be working to avoid paying taxes?

You must be working in an official capacity and be working on official business related to your employment to avoid paying these taxes.

How much of Social Security do elderly people get?

Among elderly beneficiaries, 50% of married couples and 70% of unmarried recipients receive 50% or more of their retirement income from Social Security. 1 . Most American taxpayers do not qualify for an exemption, though they do exist for a small number of people.

What is Social Security enrollment?

Enrollment is connected to the Social Security numbers of workers and taxpayers within the U.S. All Social Security benefits were created as part of a social safety net designed to reduce poverty and provide care for the elderly and disabled.

How much is the tax exemption for 2022?

All individuals are exempt from paying the tax on wages above a certain threshold ($147,000 in 2022).

Do religious orders pay taxes?

Members of religious orders who have taken a vow of poverty are exempt from paying self-employment taxes on work performed for the order and don't need to request a separate exemption. However, if the order elects to be covered under Social Security, then taxes would apply.

Can religious groups be exempt from Social Security?

Members of certain religious groups may be exempt from Social Security taxes. To become exempt, they must waive their rights to benefits, including hospital insurance benefits. They must also be a member of a religious sect that provides food, shelter, and medical care for its members, and is conscientiously opposed to receiving private death ...

Do self employed people pay Social Security taxes?

Self-employed workers who make less than $400 annually do not need to worry about paying Social Security taxes. 7

Do you pay taxes on Social Security?

The Social Security program automatically enrolls most U.S. workers, but a few groups are exempt from paying taxes into the Social Security system.

How to pay Social Security and Medicare taxes?

Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax form). File Schedule C (Profit or Loss from a Business) as well as Schedule SE (Self-Employment Tax). All of these forms are available from the IRS's website, and include instructions for filling them out. [7]

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

What is the FICA rate?

The FICA rate is 6.2% of wages paid up to $128,400. This may change for 2019.

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How to apply for religious exemption for Social Security?

Certain recognized religious groups opposed to Social Security and Medicare can apply for the exemption by filling out IRS Form 4029.

How does self employment affect Social Security?

Your net earnings from self-employment are reduced by half the amount of Social Security tax you owe. This replaces the portion that your employer would have paid, which is not treated as taxable income.

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

What is the tax rate for Social Security?

Together, the Social Security and Medicare programs make up the Federal Insurance Contributions Act (FICA)tax rate of 15.3%. Currently, the Social Security taxis 12.4% — half of which is paid by the employer, with the other 6.2% paid by the worker through payroll withholding.

Do self employed people have to pay Social Security?

And for many older Americans who haven’t saved enough on their ownfor retirement, Social Security may be the only money they have to rely on.

Can religious groups pay Social Security?

Members of some religious groups can be exempt from paying in to Social Security under certain circumstances . For starters, they must belong to a recognized religious sect that is conscientiously opposed to accepting healthcare or retirement benefits under a private plan. In addition, these organizations must have an established record, going back to 1950, of providing their members reasonable provisions for food, shelter and medical care. Qualifying religious sects include Mennonites and the Amish.

Do you have to pay Social Security taxes?

Almost everyone has to pay into Social Security in the U.S. Only a few are exempt from Social Security taxes, but who are they and why are they exempt?

Do children under 18 have to pay Social Security?

Children under 18 who work for their parents in a family-owned business also do not have to pay Social Security taxes. Likewise, people under 21 who work as housekeepers, babysitters, gardeners or perform similar domestic work are exempt from this tax. 3) Employees of Foreign Governments and Nonresident Aliens.

Does not paying into Social Security increase your take home pay?

The Bottom Line. Although not paying into the Social Security program can increase your take-home pay, it can also lead to less supplemental income in retirement.

Do public employees have Social Security?

These days, most public employees have Social Security coverage — and thus pay into the system out of their paychecks — but there are still a few exceptions. These include public workers who participate in a government pension plan comparable to Social Security. In addition, federal workers, including members of Congress, ...

How much is the Part A premium?

For those who worked and paid taxes for at least 30 quarters, the Part A monthly premium in 2019 is $240. Those with fewer than 30 quarters will pay $437 a month.

Will Tom pay more for Part B?

And, if Tom is a higher-income beneficiary, he will pay even more for Part B. Had Tom known then what he knows now, he would have paid his taxes. Note: This is a clarification of the post, originally published May 15, 2019. Five Of Europe's Most Underrated Seaside Cities.