Is there a recommended way to pay monthly Medicare Part D premiums?

- Social Security check deduction,

- Bank Draft (Electronic Funds Transfer or EFT),

- Credit Card payment,

- Direct Billing, or

- Coupon Book paid with a personal check.

Full Answer

What is covered by Medicare Part D?

all Part D vaccines, the beneficiary must be provided access to such vaccines when the physician prescribes them for an appropriate indication reasonable and necessary to prevent illness in the beneficiary. Part D Payment for Vaccines in Provider Settings . Part D plans are required to provide access to vaccines not covered under Part B.

Who is eligible for Medicare Part D?

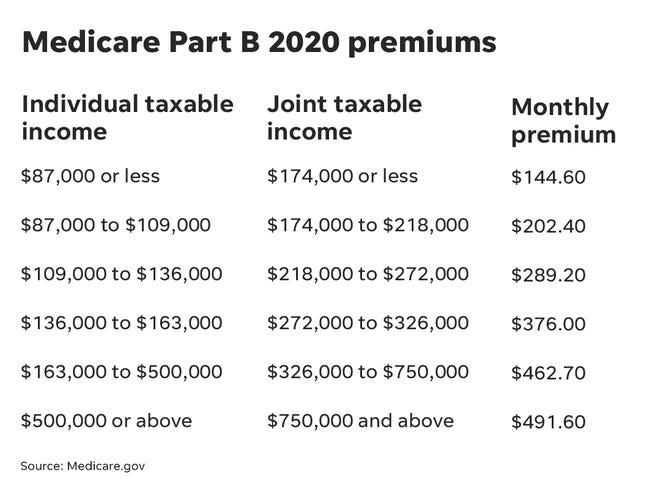

If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you’re married and file jointly), you’ll pay an extra amount in addition to your plan premium …

How do you qualify for Medicare Part D?

The following factors influence how much you’ll pay for Medicare Part D and prescription drugs: Deductible. According to guidelines, the deductible for any Part D plan must not exceed $480 in 2022. You can choose plans with a $0 deductible based on your medications. Some Part D plans, for example, waive the deductible on tier 1 and 2 medications.

When to apply for Medicare Part D?

An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

How do I pay Part D premiums?

To be enrolled on Part D, you must enroll through one of the prescription drug companies that offers the Medicare Part D plan or directly through Medicare at www.Medicare.gov. You can pay premiums directly to the company, set up a bank draft, or have the monthly premium deducted from your Social Security check.

Can you buy Medicare Part D by itself?

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

How do I pay for Medicare?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

Is Medicare Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Can I pay Medicare monthly instead of quarterly?

Can I instead pay monthly? Hi, Probably not. Part B Medicare premiums are billed on a quarterly basis if they can't be withheld from a person's benefits, although if a person is also paying premiums for Part A of Medicare then they're billed monthly.Oct 16, 2019

Can you pay Medicare over the phone?

Log into (or create) your Medicare account. Select “My premiums,” then, “Payment history.” Call us at 1-800-MEDICARE (1-800-633-4227).

How do I pay Medicare Part B monthly?

There are 5 ways to make your Medicare payments:Pay by check or money order. ... Pay by credit card or debit card. ... Pay through your bank's online bill payment service. ... Sign up for Medicare Easy Pay, a free service that automatically deducts your premium payments from your savings or checking account each month.More items...

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the call for Part D?

The beneficiary or physician can call the Part D Plan to discuss what the cost sharing and allowable charges would be for the vaccine as part of the plan’s out-of-network access or inquire as to the availability of any alternative vaccine access options. Plan contact information is available at

What is a Part D plan?

Part D plans are required to provide access to vaccines not covered under Part B. During rulemaking, CMS described use of standard out-of-network requirements to ensure adequate access to the small number of vaccines covered under Part D that must be administered in a physician’s office. CMS’ approach was based on the fact that most vaccines of interest for the Medicare population (influenza, pneumococcal, and hepatitis B for intermediate and high risk patients) were covered and remain covered under Part B. Under the out-of-network process, the beneficiary pays the physician and then submits a paper claim to his or her Part D plan for reimbursement up to the plan’s allowable charge. As there likely would be no communication with the plan prior to vaccine administration, the amount the physician charges may be different from the plan’s allowable charge, and a differential may remain that the beneficiary would be responsible for paying. As newer vaccines have entered the market with indications for use in the Medicare population, Part D vaccine in-network access has become more imperative. Requiring the beneficiary to pay the physician’s full charge for a vaccine out of pocket first and be reimbursed by the plan later is not an optimal solution, and CMS has urged Part D plans to implement cost-effective, real time billing options at the time of administration. With consideration to improve access to vaccines under the Drug Benefit without requiring up-front beneficiary payment, in May 2006, CMS issued guidance to Part D sponsors to investigate alternative approaches to ensure adequate access to Part D vaccines. CMS emphasized a solution incorporating real-time processing, given that cost sharing under Part D for non-full subsidy beneficiaries can differ depending upon where the beneficiary is in the benefit (e.g., deductible, coverage gap, and catastrophic range). CMS has outlined the following options to Part D sponsors for their consideration in a letter dated 12/1/06. (See

What is covered under Part B?

Part B covers influenza vaccine, pneumococcal vaccine and Hepatitis B vaccine for intermediate and high risk beneficiaries, The Part B program also covers vaccines that are necessary to treat an injury or illness. For instance, should a beneficiary need a tetanus vaccination related to an accidental puncture wound, it would be covered under Part B. However, if the beneficiary simply needed a booster shot of his or her tetanus vaccine, unrelated to injury or illness, it would be covered under Part D. Medicare Part B does not cover administration of Part D vaccines

Is a 351 a part D?

Any vaccine licensed under section 351 of the Public Health Service Act is available for payment under the Part D benefit when it is not available for payment under Medicare Part B (as so prescribed and dispensed or administered). Unlike other Part D Drugs that may be excluded when not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member, Part D vaccines may be excluded from coverage only when their administration is not reasonable and necessary for the prevention of illness. Therefore, although a Part D plan’s formulary might not list all Part D vaccines, the beneficiary must be provided access to such vaccines when the physician prescribes them for an appropriate indication reasonable and necessary to prevent illness in the beneficiary.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

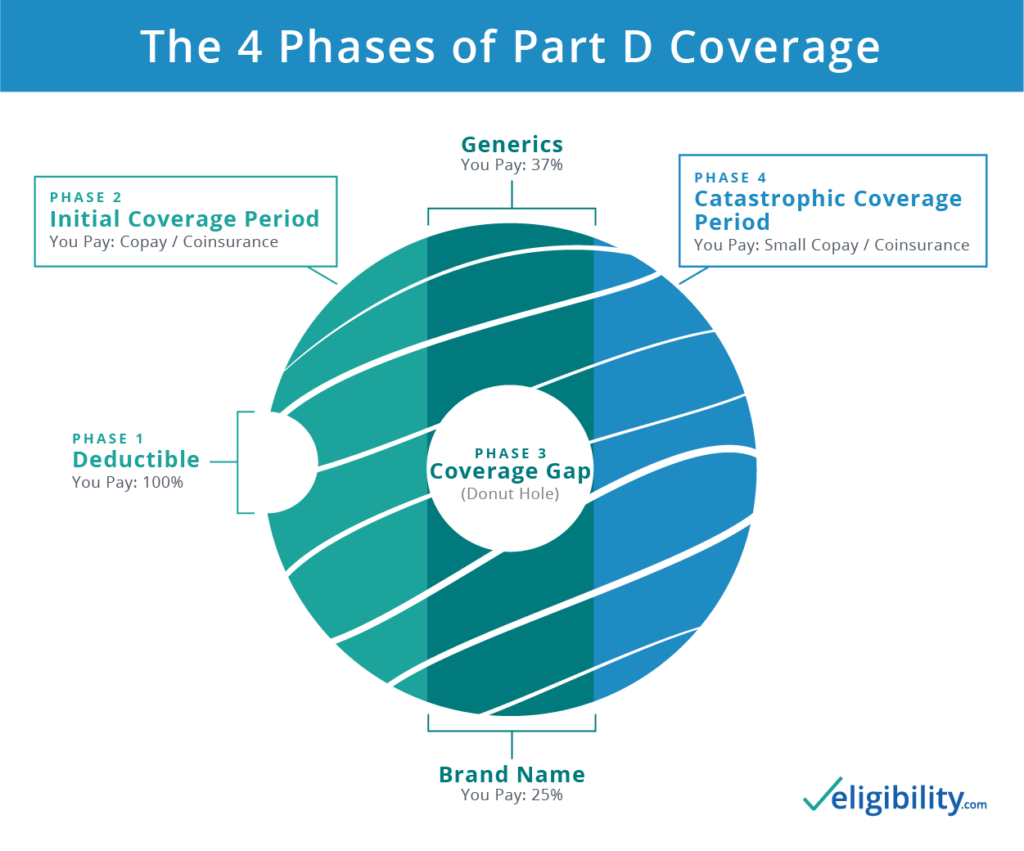

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.