- Work with an accountant or tax professional. Tax laws are subject to change, and can be complex. ...

- Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax ...

- Take the allowable tax deductions. While you must pay the full amount of Social Security and Medicare taxes if you are self-employed, you can also claim a few tax ...

- Pay any tax remaining. The amount you owe in Social Security and Medicare taxes equals the standard tax percentages of your income minus any deductions you are eligible for.

How to pay Social Security and Medicare taxes?

How to Pay Social Security and Medicare Taxes. 1. Work with an accountant or tax professional. Tax laws are subject to change, and can be complex. Talk to an accountant or tax professional if you ... 2. Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves ...

How do I Prove my Social Security and Medicare taxes withheld?

A copy of your Form W-2 to prove the amount of social security and Medicare taxes withheld, If applicable INS Form I-538, Certification by Designated School Official, and

How are Social Security and Medicare calculated?

These amounts are based on an employee's wages. Social Security is calculated by multiplying the wage amount by 6.2% and Medicare is calculated by multiplying the wage amount by 1.45%.

How do I enter additional Medicare tax on Form 1040?

You paid total cash wages of $1,000 or more in any calendar quarter of 2019 or 2020 to all household employees. See the instructions for line 11 for payments of social security taxes reported on Schedule H (Form 1040) that may be deferred. Enter the total Additional Medicare Tax from line 18 of Form 8959 on line 5.

Do you pay Social Security and Medicare on 1099?

In addition to paying federal and state income taxes, independent contractors, the self-employed, freelancers, and anyone who receives a 1099 are also responsible for paying self-employment income taxes, i.e, Social Security and Medicare taxes.

How do I get form 4029?

▶ Go to www.irs.gov/Form4029 for the latest information. ▶ Before you file this form, see the instructions under Who may apply on page 2. ▶ This exemption is granted only if the IRS returns a copy to you marked “Approved.” Caution: Approval of Form 4029 exempts you from social security and Medicare taxes only.

Does 1040 ES include Social Security and Medicare?

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

How do I pay Social Security and Medicare taxes for self-employed?

Schedule SE (Self-Employment Tax). You can get these forms from the IRS on their website at www.irs.gov. Send the tax return and schedules, along with your self-employment tax, to the IRS. Even if you don't owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

What is the difference between form 4361 and 4029?

These approved forms are indicated in the software on screen SE (on the Taxes tab) by checking the boxes IRS Approved Form 4361 – Minister claims exemption from SE tax or IRS Approved Form 4029 – Members of religious group exempt from Social Security and Medicare taxes.

What is a form 4361?

File Form 4361 to apply for an exemption from self-employment tax if you have ministerial earnings and are: An ordained, commissioned, or licensed minister of a church; A member of a religious order who has not taken a vow of poverty; or. A Christian Science practitioner.

Do I need to fill out 1040-ES?

The 1040-ES worksheet does not need to be sent to the IRS, instead it should be kept with your tax records for the year.

What is Form 1040-ES used for?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Why do I have a 1040-ES form?

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

How do I pay Medicare if I am self-employed?

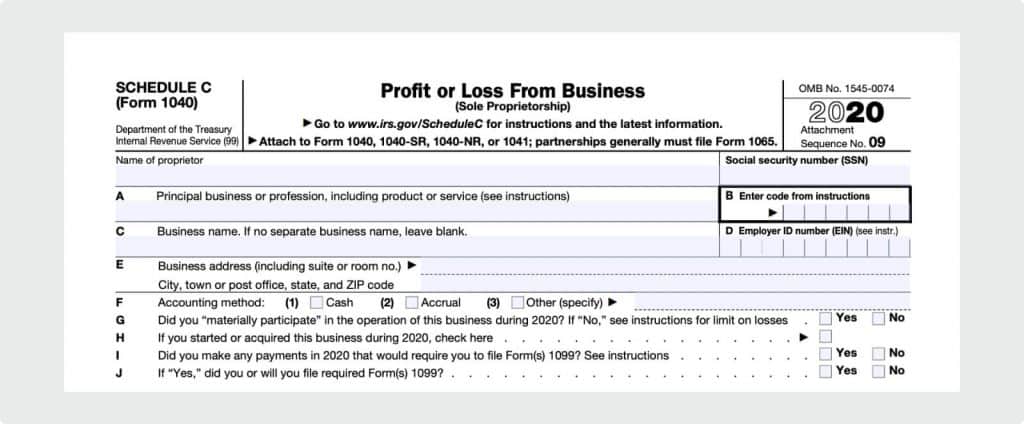

You file a Schedule C (Form 1040) to report profit or loss from self-employment and Schedule SE (Form 1040) to calculate your Social Security and Medicare taxes. The Social Security tax rate for 2022 is 12.4 percent on self-employment income up to $147,000.

How do you pay into Social Security with a 1099?

Income you earn on a 1099 is not subject to tax withholding, including the Social Security Insurance tax. However, this doesn't mean you don't have to pay it. Instead, you calculate your SSI tax on a Schedule SE with your federal tax return.

How do I pay into Social Security when self-employed?

Their employer deducts Social Security taxes from their paycheck, matches that contribution, sends taxes to the Internal Revenue Service (IRS), and reports wages to Social Security. However, self-employed people must report their earnings and pay their Social Security taxes directly to the IRS.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

Is Social Security split 50/50?

It is not split 50/50. Pay both FICA and SECA Social Security taxes, if necessary. If you have both wages from an employer and income from self-employment, Social Security taxes are paid on your wages first, but only if your total income is more than $127,200.

Do you pay FICA taxes if you are self employed?

If you earn wages from an employer, these are called Federal Insurance Contributions Act (FICA) taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act (SECA), you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need ...

Where to file Form 843?

File Form 843 (with attachments) with the IRS office where your employer's Forms 941 returns were filed. You can locate the IRS office where your employer files his Form 941 by going to Where to File Tax Returns.

Is self employment taxed as wages?

Self-Employment Tax. Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Do non-residents pay taxes on self employment?

However, nonresident aliens are not subject to self-employment tax. Once a nonresident alien individual becomes a U.S. resident alien under the residency rules of the Internal Revenue Code, he/she then becomes liable for self-employment taxes under the same conditions as a U.S. citizen or resident alien. Note: In spite of the general rules ...

Do Social Security and Medicare taxes apply to wages?

social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer.

Can you make Social Security payments if no taxes are due?

Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Do you pay Social Security taxes to one country?

The agreements generally make sure that social security taxes (including self-employment tax) are paid only to one country. You can get more information on the Social Security Administration's Web site.

Do you have to deduct taxes on Social Security?

Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How many deposit schedules are there for Social Security?

In general, you must deposit federal income tax withheld, and both the employer and employee social security and Medicare taxes. There are two deposit schedules, monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use. To determine your payment schedule, ...

When do you need to deposit a 940?

The tax must be deposited by the end of the month following the end of the quarter. You must use electronic funds transfer ( EFTPS) to make all federal tax deposits.

Does the employer pay a FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee's wages. Report your FUTA taxes by filing Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return.

What line do I claim a 1040-SS credit on?

Form 1040-SS filers who report household employment taxes from Schedule H (Form 1040) on Form 1040-SS may be eligible to claim a credit on Part I, line 12, to cover the costs of providing required qualified sick leave wages and qualified family leave wages.

When is the 1040-SS due?

You are allowed an automatic 2-month extension to file your return and pay your tax if you are outside the United States and Puerto Rico on the day Form 1040-SS is due (April 15, 2021, for calendar year taxpayers).

How to file extension for 1040-SS?

If you got an automatic extension of time to file Form 1040-SS by filing Form 4868 or by making a payment, enter the amount of the payment or any amount you paid with Form 4868. If you paid by credit or debit card, don’t include on line 12 the convenience fee you were charged. On the dotted line next to line 12, enter "Form 4868" and show the amount paid.

How long do you have to file a 4868?

If you can't file your return within the automatic 2-month extension period, in most cases you can get an additional 4 months to file your return, for a total of 6 months. File Form 4868 by the extended due date allowed by the 2-month extension (June 15, 2021, for calendar year taxpayers).

What happens if you file a joint tax return?

If you file a joint return, both you and your spouse generally are responsible for the tax and any interest or penalties due on the return. This means that if one spouse doesn't pay the tax due, the other may have to.

How long can you file taxes after a disaster?

Certain taxpayers affected by federally declared disasters may be eligible for an automatic 60-day extension for filing returns, paying taxes, and performing other tasks required by the IRS. For more information, see Pub. 547.

When is the extension for 1040-SS due?

To get this automatic extension, you must file Form 4868, by the regular due date of your return (April 15, 2021, for calendar year taxpayers). You can file Form 4868 either by paper or electronically through IRS e-file. For details, see the instructions on Form 4868.

What makes a worker an "employee"

A business may hire a worker as an independent contractor, but the worker may be classified as a paid employee by the Internal Revenue Service, depending on how their position is structured.

When to use Form 8919

Perform services for a company that aren’t those of an independent contractor as defined by the IRS, and Social Security and Medicare taxes were not withheld from your pay

Don't use Form 4137

Prior to the introduction of Form 8919, workers may have used Form 4137 to report Social Security and Medicare amounts. Since 2008, usually only tipped employees use Form 4137 to report Social Security and Medicare amounts on allocated tips and those not reported by their employers.

Refund of Taxes Withheld in Error

- Determine the amount of your income subject to Social Security and Medicare taxes. If you are paying Social Security (SS) and Medicare taxes on your own, it is most likely because you are self-employed. To calculate your tax, you must first add up all of the income you earned. However, exclude:[1] X Trustworthy Source US Social Security Administration Independent U.…

- Calculate the amount you owe in Social Security taxes. Currently, Social Security taxes amou…

Self-Employment Tax

International Social Security Agreements

References/Related Topics

- If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement....