Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax form). File Schedule C (Profit or Loss from a Business) as well as Schedule SE (Self-Employment Tax). All of these forms are available from the IRS's website, and include instructions for filling them out.

Full Answer

How do you calculate self employment?

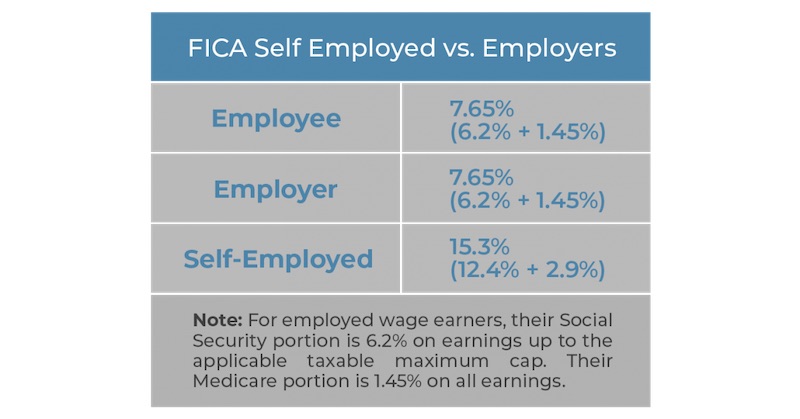

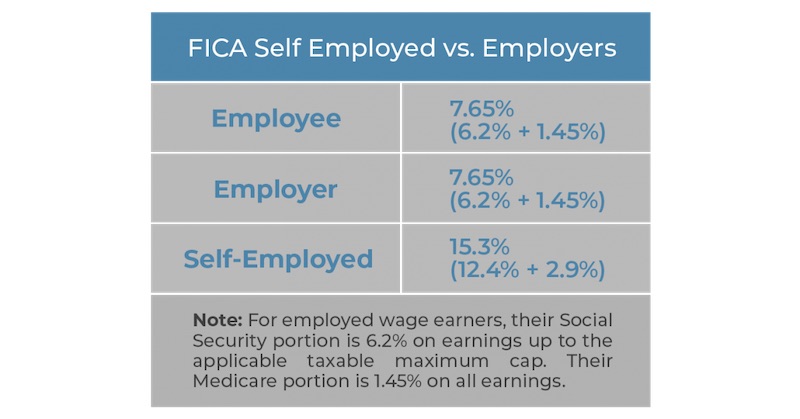

If you’re self-employed, you pay the combined employee and employer amount. This amount is a 12.4% Social Security tax on up to $147,000 of your net earnings and a 2.9% Medicare tax on your entire net earnings. If your earned income is more than $200,000 ($250,000 for married couples filing jointly), you must pay 0.9% more in Medicare taxes.

What is the tax bracket for self employed?

Apr 29, 2020 · The amount of SECA tax is calculated and included in the owner's personal tax return in several steps: Step 1: The business owner's taxable income is calculated, depending on the type of business owned, as described above. Step 2: This income is used to calculate self-employment tax by using Schedule SE.

What is the tax rate for self employment?

When you’re self-employed, however, that task—as well as the full amount of the taxes—shifts entirely onto your shoulders. Currently, that means you have to pay 12.4 percent for Social Security and 2.9 percent for Medicaid. If you earn more than $200,000, for taxpayers filing as single, or $250,000, for married taxpayers filing jointly, you’ll have to pay an extra 0.9 percent …

What counts as self employment?

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax" is used, it only refers to …

How do I pay Social Security taxes when self-employed?

Schedule SE (Self-Employment Tax). You can get these forms from the IRS on their website at www.irs.gov. Send the tax return and schedules, along with your self-employment tax, to the IRS. Even if you don't owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

How much does a self-employed individual pay for Social Security and Medicare tax?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

Do you pay into Social Security if you are self-employed?

Key Takeaways. Self-employed workers must pay both the employee and employer portions of Social Security taxes. Reducing your income by taking every available deduction will reduce your taxes, but it will also reduce the size of your Social Security benefit payment in retirement.

Do you pay Social Security and Medicare on 1099?

Here's a simple rule: If you work as an independent contractor, it's up to you to pay income and self-employment taxes (Social Security and Medicare taxes) on the payments you receive.

What taxes do I pay if self-employed?

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

How do I pay Social Security taxes on a 1099?

Income you earn on a 1099 is not subject to tax withholding, including the Social Security Insurance tax. However, this doesn't mean you don't have to pay it. Instead, you calculate your SSI tax on a Schedule SE with your federal tax return.

Do you pay Medicare tax on Social Security income?

There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

Is all 1099 income subject to self-employment tax?

Yes, if you have 1099 income you are considered to be self-employed, and you will need to pay self-employment taxes (Social Security and Medicare taxes) on this income.Jan 25, 2021

What is the tax for self employed?

must pay taxes to fund Social Security and Medicare. For self-employed individuals, this is called Self-Employment Tax, sometimes called SECA Tax. It's similar to FICA taxes (Social Security and Medicare taxes paid by employees and employers). 1 .

What is the taxable income of a self employed owner of a sole proprietorship?

The taxable income of a self-employed owner of a sole proprietorship or single-member LLC is the net income (profits) of the business, as calculated on Schedule C of the owner's personal tax return. The taxable income of a partner in a partnership, a member of a multiple-member LLC is based on their share of the company's income.

How is SECA tax calculated?

The amount of SECA tax is calculated and included in the owner's personal tax return in several steps: Step 1: The business owner's taxable income is calculated, depending on the type of business owned, as described above. Step 2: This income is used to calculate self-employment tax by using Schedule SE.

What is Schedule SE?

Schedule SE is used to calculate your self-employment tax liability for your tax return. This calculation includes a deduction of half the amount of tax from your adjusted gross income. This deduction reduces your self-employment tax liability, but it doesn't change the amount for benefit calculations. Social Security Tax.

Is self employment income included in Social Security?

But that also means that self-employment income isn't included in your Social Security benefit calculations for that year. You may want to minimize the SECA tax (using tax avoidance NOT tax evasion ). But your business income may be your ticket to Social Security benefits in retirement.

Is self employed a partner?

You are self-employed for self-employment tax purposes, according to the IRS, if you: Carry on a trade or business, including being a sole proprietor or independent contractor, You are a partner in a partnership, or. You are otherwise in business for yourself, even if it's part-time. 2 .

Is a part time business considered self employed?

You are also self-employed if you are a member (owner) of a limited liability company (LLC). But you aren't considered self-employed if you are a shareholder of a corporation or S corporation.

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

Do you pay FICA taxes if you are self employed?

If you earn wages from an employer, these are called Federal Insurance Contributions Act (FICA) taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act (SECA), you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need ...

Is Social Security split 50/50?

It is not split 50/50. Pay both FICA and SECA Social Security taxes, if necessary. If you have both wages from an employer and income from self-employment, Social Security taxes are paid on your wages first, but only if your total income is more than $127,200.

Who is Darron Kendrick?

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This article has been viewed 26,463 times.

How much does an employer contribute to Social Security?

Typically, the employer contributes 6.2 percent of your income (up to a maximum amount) into Social Security and 1.45 percent into Medicare; you pay the other 6.2 percent of Social Security tax plus 1.45 percent of your income for Medicare. Generally, your employer will deduct these amounts from your paycheck and forward them to ...

How much do you have to pay for Social Security?

Currently, that means you have to pay 12.4 percent for Social Security and 2.9 percent for Medicaid. If you earn more than $200,000, for taxpayers filing as single, or $250,000, for married taxpayers filing jointly, you’ll have to pay an extra 0.9 percent for Medicare. In general, none of these taxes are considered deductible from your overall ...

What are the challenges of self employment?

One of the challenges is that you’re responsible for all of your taxes. If you’re employed by someone else, the employer takes your Social Security and Medicare taxes out of your paycheck for you so that you don’t have to pay them separately. If you’re self-employed—whether you’re working as an independent contractor, a member of a partnership, or as a business owner, even part time—the IRS collects Social Security and Medicare directly from you. These make up what is known as the self-employment tax.

What is estimated tax?

Estimated taxes are filed using Form 1040ES—Estimated Tax for Individuals. This form includes vouchers that you can print off and use to mail in your estimated tax payments throughout the year. You can also pay your taxes online with the Electronic Federal Tax Payment System, provided by the IRS.

What is Schedule C on a 1040?

The Schedule C is where you report your business earnings and expenses and calculate your net profit or loss. You’ll also include your estimated tax payments on the Form 1040, deducting them from your total tax obligation to calculate any remaining tax due.

What happens if you pay less than 90 percent of your earnings?

Even if you make quarterly payments, you could be penalized if you pay less than 90 percent of the current year’s earnings and you also pay less than 100 percent of last year’s earnings.

Is self employment tax deductible?

In general, none of these taxes are considered deductible from your overall business overhead. This is the self-employment tax, and it does not take into account federal or state income taxes.

What is self employment tax?

In general, anytime the wording "self-employment tax" is used, it only refers to Social Security and Medicare taxes and not any other tax (like income tax). Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business.

What is estimated tax?

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals PDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR.

What is a small business tax workshop?

The Small Business Taxes: The Virtual Workshop is composed of nine interactive lessons designed to help new small business owners learn their tax rights and responsibilities. The IRS Video Portal contains video and audio presentations on topics of interest to small businesses, individuals and tax professionals.

What is the most common form of business?

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation.

What is a sole proprietorship?

You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business) Back to top.

When did the Small Business and Work Opportunity Tax Act of 2007 start?

For tax years beginning after December 31, 2006, the Small Business and Work Opportunity Tax Act of 2007 (Public Law 110-28) provides that a "qualified joint venture," whose only members are a married couples filing a joint return, can elect not to be treated as a partnership for Federal tax purposes. Back to top.

Do self employed people pay taxes?

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

How much tax do you pay if you are self employed?

If you are self-employed, you pay self-employment tax (SECA) based on your net income (profit) from your business. You pay this tax the rate of 12.6% of that income. You don't have to pay this tax as you go since you don't have to withhold it from your business income. You don't get a paycheck from your business since you are not an employee.

What is a self employed individual?

A self-employed individual can be someone who runs a business as a sole proprietor, LLC owner, or partner in a partnership. You may not have a formal business structure, but you report your business taxes on Schedule C with your personal tax return.

What is FICA tax?

FICA tax is Social Security/Medicare tax on employment ; Self-employment tax (sometimes called SECA) is Social Security/Medicare tax on self-employment. Also note that your employer pays half of the FICA tax due, while you as a self-employed individual must pay the entire amount of Social Security/Medicare on your self-employment income.

What line is the $3720 on my 1040?

The $3720 you owe as self-employment tax is included on Line 27 of your personal Form 1040, and is included with any income tax you owe to determine your total tax bill for the year. If your income from employment and self-employment is greater than the Social Security maximum, you still must continue to pay Medicare tax.

Do you have to pay taxes on self employment?

You must pay self-employment tax on the net profit of your employment if you still owe these taxes after considering your total income for the year. You must pay these taxes on your total income. But you can't over-pay unless your employer has made a calculation error. Here's a more detailed explanation of how the process ...

Is Medicare taxed if you are self employed?

If you are self-employed and you also earn wages or salary from employment, your Social Security and Medicare eligibility and total self-employment tax is affected. You are self-employed if you are making money in your own business, as an independent contractor, freelancer, sole proprietor, partner in a partnership, ...

Do business owners pay quarterly estimated payments?

Many business owners make quarterly estimated payments, including estimated amounts for self-employment tax along with estimated income tax. You could also increase your federal and state income tax withholding from your employment to cover this additional cost.

How much of your income is paid to Social Security?

If you hold a wage-paying job, you pay 7.65 percent of your gross income into Social Security and Medicare, via FICA payroll-tax withholding. Your employer makes a matching contribution. Updated December 28, 2020.

What is the Social Security tax rate for 2021?

The Social Security tax rate for 2021 is 12.4 percent on self-employment income up to $142,800. You do not pay Social Security taxes on earnings above that amount. There is no such cap for Medicare contributions; you pay the Medicare tax rate of 2.9 percent on all profits from self-employment. A portion of your SECA tax can be taken as ...