What is the best Medicare supplement insurance?

As of 2021, you’ll have to pay up to $2,370 for Medicare coinsurance, copays, and deductibles before your insurance kicks in. Plan G and Plan N do not pay the Part B deductible, which will be $233.6 in 2022. Plan N will cover 100% of your Part B coinsurance, with the exception of copays of up to $20 for some office visits and up to $50 for ...

What are the top 5 Medicare supplement plans?

Aug 17, 2021 · When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later. The official CMS Medigap comparison table will help you figure out which policy best fits your situation. The policies differ in their coverage of deductibles, skilled nursing care, …

What is the best Medicare insurance plan?

Get the basics. When you first enroll in Medicare and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is the best Medicare plan for You?

What You Need to Know. We’ll explain key items as we go, but expect to hear about Part A and Part B deductibles a lot—they’re big factors to consider when choosing your plan. We’ll also go over excess charges, foreign travel emergencies, coinsurance, co-payments, and more. How much of these items your chosen plan covers will have a big ...

How do I know which Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the most common form of supplemental Medicare coverage?

Medigap Plan FThe most popular Medicare Supplement Insurance plan is Medigap Plan F, according to the most recent statistics from America's Health Insurance Plans (AHIP). Due to recent legislation affecting Medigap plans, however, Plan G is quickly becoming the most popular Medicare Supplement plan for new Medicare beneficiaries.Oct 6, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Does Medicare Part G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the difference between Medicare Supplement and Advantage plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What Are the Different Types of Medicare?

Let’s start with Original Medicare. Original Medicare is made up of Medicare Parts A and B. Part A provides coverage for hospitalizations, hospice care, some skilled nursing facility care, and home health care. Part B provides physician and outpatient services, as well as preventive care. Government cost-sharing is in place for both parts A and B.

What Is Medigap?

Medigap, also known as Medicare Supplement, is a private insurance policy that can be bought to help pay for things that Original Medicare doesn’t cover. These secondary coverage plans are only available with Original Medicare.

Who Is Eligible for Medigap?

You’re eligible for Medigap if you are already enrolled in Original Medicare Parts A and B and don’t have a Medicare Advantage plan. You must also meet one of the following conditions:

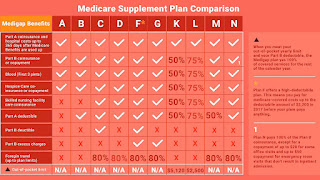

Medigap Comparison

In order to compare Medicare supplement plans, you need to know that there are ten standardized Medigap plans, denoted by the letters A through N and that plans with the same letter must have the same basic benefits regardless of insurer.

What costs are not covered by original Medicare?

By itself, original Medicare (Parts A and B) generally pays about 80% of the cost for doctors, hospitals, and medical procedures. The patient is responsible for paying the rest, and there is no limit on out-of-pocket expenses.

What does the standard Medigap coverage provide?

In general, Medigap covers your coinsurance bill once you’ve paid the Medicare deductible. Some plans (B, D, G, and N) pay your Part A deductible as well. (Plans C and F also pay the Part A deductible but aren’t available to new enrollees.)

When is the best time to buy a Medigap policy?

In most cases, the best time to buy a Medigap policy is during your open-enrollment period. This period may start either in the month you turn 65 and enroll in Medicare Part B, or when your employer-provided group healthcare coverage ends and you enroll in Part B.

How do I identify which Medigap plan I need?

When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later .

How do I shop for a Medigap policy?

There are a few ways to find out what policies are available in your area.

The bottom line

Medigap plans help cover costs related to Medicare Parts A and B that you'd otherwise pay yourself. The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

Which Plan Is Right for You?

With 10 Medigap plans to choose from, figuring out which one is right for you might feel overwhelming.

What You Need to Know

We’ll explain key items as we go, but expect to hear about Part A and Part B deductibles a lot—they’re big factors to consider when choosing your plan. We’ll also go over excess charges, foreign travel emergencies, coinsurance, co-payments, and more.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is Medicare Plan Finder Tool?

The Medicare Plan Finder Tool will let us search for Medicare Advantage plans in your county based on your preferences. Some people prefer Medicare HMO plans for the lowest premiums. Others prefer Medicare PPO plans because they are more flexible and have out of network benefits if needed.

Is Medicare Supplement the same as Medicare Advantage?

You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan. They are not the same – in fact, they work very differently.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

What is deductible insurance?

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

Is Medicare Supplement insurance mutually exclusive?

Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are mutually exclusive; this means that you will have to choose between Medicare Advantage vs Medicare Supplement. Also, it may be illegal for a private insurer to sell you one plan knowing you ...

Do you pay Medicare out of pocket?

You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage. If the above equation seems like too many pieces to put together, you may appreciate the simplicity of a Medicare Advantage plan.

How long after enrolling in Medicare can I sign up for Medigap?

When to Enroll in Medigap. You can sign up for a Medigap plan during the six months after you enroll in Medicare Part B. During that time, you can purchase any Medigap policy that is sold in your state.

Who is eligible for Medigap?

Who Is Eligible for a Medigap Policy? To qualify for Medigap, you’ll need to have Medicare Part A and Medicare Part B. In general, individuals who are 65 and older are eligible for Medicare. If you have a Medicare Advantage plan, which is sometimes referred to as Medicare Part C, Medigap coverage is not available.

What is a Medigap policy?

Medigap policies are extra insurance you can buy if you have Medicare. These plans are designed to help pay for some of the costs that are not covered by Medicare Part A and Medicare Part B. “Original Medicare leaves deductibles, copays and coinsurance behind for the beneficiary to pay for approved medical care and services,” says Danielle K.

What is the advantage of Medigap?

A key advantage of Medigap policies lies in the network of health providers you’ll be able to visit. “A Medigap policyholder can see any doctor who accepts Medicare,” says Shaun Greene, head of business operations at HealthPocket.

Does Medigap cover dental?

Medigap plans only cover one person, so if you’re married, you and your spouse will need to purchase separate policies. The plans do not cover prescription drugs, hearing aids, vision services, dental care or long-term care. [. Read:

Is Plan N more cost effective than Plan G?

“If you are pretty healthy and don't go to the doctor often, Plan N may be a more cost-effective option than Plan G ," Roberts says. "If you go to the doctor once a month, Plan G would likely be more cost-effective than Plan N.".

Does Medigap save money?

With a Medigap policy, you could potentially save thousands of dollars in medical bills. Here’s a look at how Medigap insurance works, what to consider when choosing a policy and the best time to enroll. Medicare Out-of-Pocket Costs You Should Expect to Pay.