How To Choose A Medicare Advantage Plan, Based On Supplemental Benefits

- Know your health needs. Look at your healthcare spending habits for last year. What services did your current plan cover? Which did you have to fund?

- Compare costs and benefits. The mere fact that a Medicare Advantage plan covers a supplemental benefit you use does not necessarily mean you should purchase that plan.

- Understand your plan. Covering supplemental benefits is not enough. The plan must be the right choice for your needs and lifestyle.

- costs that fit your budget and needs.

- a list of in-network providers that includes any doctor(s) that you would like to keep.

- coverage for services and medications that you know you'll need.

- Centers for Medicare & Medicaid Services (CMS) star rating.

How do I choose the best Medicare Advantage plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

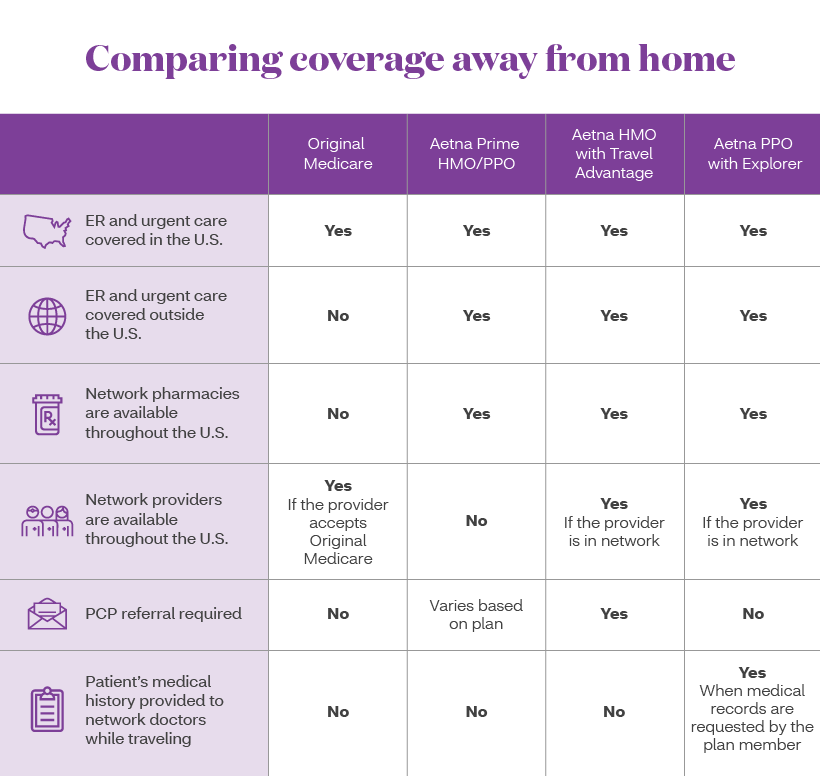

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

How to choose the right Medicare Advantage plan?

When evaluating plans, ask the following kinds of questions to ensure all requirements can be met:

- What are my medication needs? ...

- Will my current preferred doctors or specialists be covered?

- How much money can I afford to spend on premiums each month? ...

- Will my travel plans affect my coverage needs?

- Do I need any plan extras, such as vision, dental, or hearing coverage?

- Am I eligible for a Special Needs Plan?

Why Advantage plans are bad?

disadvantage of medicare advantage plans

- Networks

- Referrals

- Prior Authorizations

- Frequent Expenses

- Out-of-Pocket Maximums

- Plan Changes

- Medicare is no longer managing your healthcare

How can I enroll in a Medicare Advantage plan?

To enroll in a Medicare Advantage (Part C) plan, you must:

- Have Medicare Parts A and B

- Live in the Medicare Advantage plan’s service area

- Not have End-Stage Renal Disease

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Do Medicare Advantage plan premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What will Medicare not pay for?

Medicare doesn't provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500.

Do Medicare Advantage plans replace Original Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

Is Medicare Advantage cheaper than Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

How much does Medicare Advantage cost?

The find a plan tool lists the following cost information with the plans: These costs can range from $0 to $1,500 and above, depending on your home state, the plan type, and the plan benefits.

Why do Medicare Advantage plans have 5 star ratings?

The CMS have implemented a 5-star rating system to measure the quality of health and drug services provided by Medicare Advantage and Medicare Part D (prescription drug) plans. Every year, the CMS releases these star ratings and additional data to the public.

What are the different types of Medicare Advantage plans?

When beginning your search for a Medicare Advantage (Part C) plan, it’s important to know the differences between each type of plan. You’ll probably see some or all of the following types of plans when reviewing your options: 1 Health Maintenance Organization (HMO) plans. These plans are primarily focused around in-network healthcare services. 2 Preferred Provider Organization (PPO) plans. These plans charge different rates depending on whether the services are in network or out of network. (A “network” is a group of providers who contract to provide services for the specific insurance company and plan.) These may provide more options to receive out-of-network care. 3 Private Fee-for-Service (PFFS) plans. These plans let you receive care from any Medicare approved provider who will accept the approved fee from your plan. 4 Special Needs Plans (SNPs). These plans offer additional help for medical costs associated with specific chronic health conditions. 5 Medicare Savings Account (MSA) plans. These plans combine a health plan that has a high deductible with a medical savings account.

What does Medicare Advantage cover?

All Medicare Advantage plans cover what original Medicare covers — this includes hospital coverage (Part A) and medical coverage (Part B). When you choose a Medicare Advantage plan, you first want to consider what type of coverage you need in addition to the coverage above.

What is a PPO plan?

(A “network” is a group of providers who contract to provide services for the specific insurance company and plan. )

What is Supplemental Benefits?

By Nadia-Elysse Harris. Supplemental benefits are additional benefits available with Medicare Advantage that you can't get with a traditional Medicare plan. Here's how to use these benefits to guide your plan decision. Medicare Advantage plans frequently offer supplemental benefits.

Can you get dental insurance with Medicare?

These are additional benefits—such as dental and vision care, some alternative health services, and transportation—that you can't get with original Medicare. In 2019, federal law changed, expanding the number of benefits that Medicare Advantage can cover.

Does Medicare Advantage cover out of pocket?

In 2019, federal law changed, expanding the number of benefits that Medicare Advantage can cover. This means that Medicare Advantage might now cover services you once paid for out-of-pocket.

Does Medicare Advantage cover supplemental benefits?

The mere fact that a Medicare Advantage plan covers a supplemental benefit you use does not necessarily mean you should purchase that plan. If the costs of the plan are greater than the total healthcare savings you can expect, or if the plan offers lower quality coverage for other healthcare needs, it's not the right fit.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How much are the Medicare Advantage plans?

Medicare Advantage costs vary based on the insurer, state and type of plan and coverage.

What supplemental benefits do the Medicare Advantage plans offer?

Medicare Advantage plans commonly offer prescription drug, dental and vision coverage.

Is Original Medicare a better choice for you?

Most Americans have more than a dozen Medicare Advantage plan options. However, some areas, especially rural locations, have limited or no possibilities. In these cases, you may have no choice but to choose Original Medicare.