How would I decide if a Medicare Part D plan is the right choice for me?

- Prepare—Gather information about your current drug coverage and needs.

- Compare—Compare Medicare drug plans based on cost, coverage, and customer service.

- Decide—Decide which plan is best for you, and join.

Full Answer

What are the best Medicare Part D plans?

Mar 06, 2021 · How to find your best Medicare Part D prescription drug plan for the cost A deductible is the amount you pay for your prescription drugs before your plan begins to pay. Medicare puts a limit on... A copayment is a dollar amount you pay every time you fill a prescription drug. A coinsurance is a ...

How to find the best Medicare Part D drug plan?

You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S. To help pay your out-of-pocket costs in Original Medicare (like your 20% coinsurance), you can also shop for and buy supplemental coverage. Note

What are the Best Part D plans?

Jan 06, 2022 · Medicare’s Part D is all about prescription drugs. This coverage is purchased through a private health insurance company approved by Medicare, and there is a monthly premium to pay, no matter how many prescriptions you use—just like Part B. The average cost for this premium is $34 as of early 2018.

Who offers Medicare Part D plans?

Sep 27, 2017 · These vary according to the plan you choose. Which leads to that big first choice: Go with original Medicare or enroll in an Advantage plan? See “Pros and Cons” to help you make your decision. 2. Fill the gaps. In 2003, Congress addressed one of the key gaps in Medicare coverage: the costs of prescription medicine. It approved the creation of Medicare Part D, …

How do I know which Medicare Part D plan is right for me?

Take your list to the Medicare Plan Finder at Medicare.gov. It can show you which Part D drug plans are available in your area and which of those plans cover your drugs. (You can also use the Plan Finder each year to check your current Part D plan and see if better options are available.)Oct 14, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What should I look for in a prescription drug plan?

Want your drug expenses to be balanced throughout the year, look at plans with no or a low deductible, or with additional coverage in the coverage gap. Take a lot of generic prescriptions, look at plans with “tiers” that charge you nothing or low copayments for generic prescriptions.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Why are Medicare Part D plans so expensive?

If you have a health condition that requires a “specialty-tier” prescription drug, your Medicare Part D costs may be considerably higher. Medicare prescription drug plans place specialty drugs on the highest tier. That means they have the most expensive copayment and coinsurance costs.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Does Medicare Part D cover prescriptions?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Is Elixir a good Medicare Part D plan?

Elixir RxPlus is a 3.0 Star Rated Part D Plan for People on Medicare in Maryland. The Centers for Medicare & Medicaid Services (CMS) evaluated this Medicare Part D plan's previous year performance and rated it 3.0 out of 5 stars (Average) for quality.Oct 10, 2021

What is Medicare Advantage Plan?

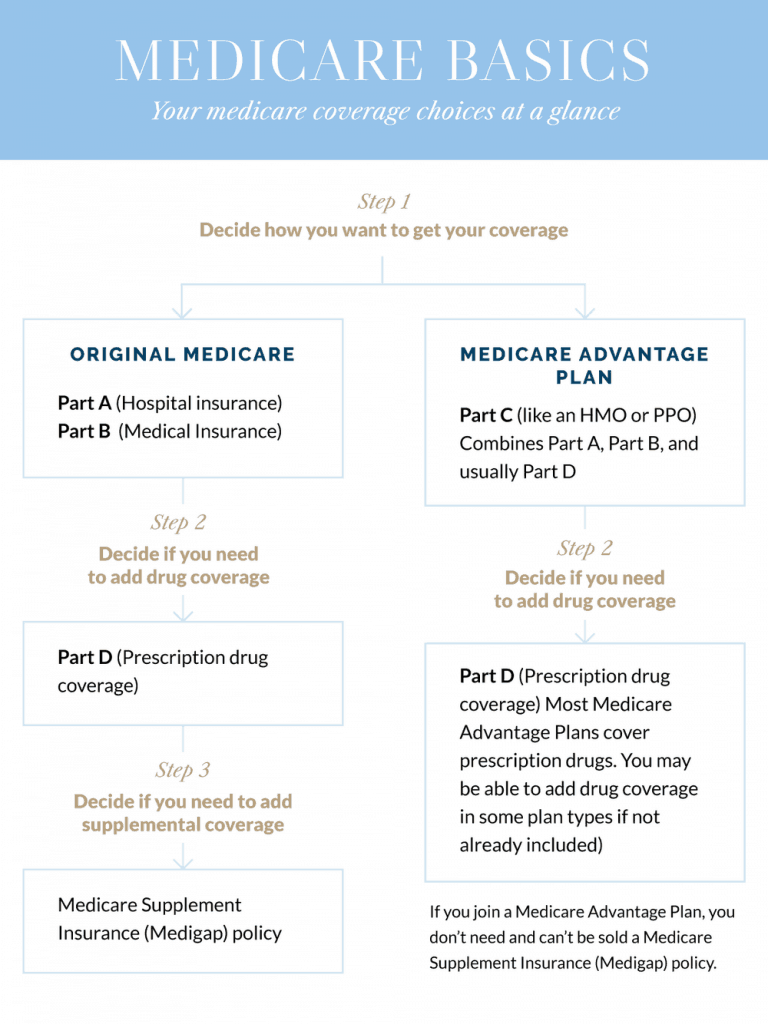

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

What is Medicare tier?

Look at Medicare drug plans with “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions.

What is a low monthly premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Part D?

Medicare Part D. Medicare Part D plans provide coverage for many prescription drugs. There are many different types of Medicare Part D plans, and each one offers its own formulary, which is the list of drugs covered by the plan. How it works with Original Medicare: Part D plans are used alongside Original Medicare or a Medicare Advantage plan ...

What is a Part D plan?

The Part D plan provides the prescription drug coverage that Original Medicare and some Medicare Advantage plans do not. You might consider this type of Medicare plan if: You want to have some help paying for your prescription drug costs. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online ...

What is the difference between Medicare Part A and Part B?

Step 1: Determine which Medicare plan coverage option you want. Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage .

Does Medicare Advantage work with Original Medicare?

How it works with Original Medicare: While you will still remain enrolled in Original Medicare, your Medicare Advantage plan will be used as your primary form of coverage. You might consider this type of Medicare plan if: You aren’t entirely satisfied with Original Medicare coverage and want to have additional health insurance benefits.

What are the benefits of Medicare Advantage?

Some of these additional benefits can include coverage for prescription drugs, dental, hearing, vision and more.

What is a Medigap plan?

Medigap plans can help provide coverage for some of the out-of-pocket expenses that are tied to Original Medicare. These can include Medicare deductibles, coinsurance, copayments and more. There are 10 different types of standardized Medigap plans available in most states, and each type of plan offers its own combination of benefits.

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. These plan types include Medicare HMO plans, Medicare PPO plans and others. Learn more about the different types of Medicare Advantage plans to help you decide which one might be the best fit for you. Medicare Part D plans can also come in different types of formats, ...

What do you need to know about Medicare?

Medicare Basics: 11 Things You Need to Know. As if those choices aren’t cryptic and confusing enough, thanks to Medicare’s byzantine rules and draconian penalties, the decisions that newcomers make early on, including when they first enroll in the program, can have lasting effects in the form of higher premiums or coverage restrictions down ...

What is a Medigap plan?

Medigap plans fall under the traditional Medicare umbrella, letting you go to any doctor or hospital that accepts Medicare. Administered by private insurers rather than the federal government, Advantage plans work like managed care, with fixed networks of providers and hospitals.

How long does Medicare penalty last?

The penalty, Medicare says, lasts “for as long as you have Part B” — in other words, for life. Although Part D is optional, the premium increases 1% for each month you delay enrolling; it too lasts for life.

Can you miss your Medicare enrollment deadline?

One of the costliest Medicare traps to fall into is missing your initial enrollment deadline, and it’s easy to do. Having been told that it’s better to postpone claiming Social Security, most Americans don’t realize that the reverse is true for Medicare, where you are penalized if, at age 65, you don’t have qualifying health coverage and don’t enroll on time.

What is the average Medicare premium for 2021?

The average basic premium in 2021 will be $30.50. As with Part B, the premium rises with income. Whether you get prescription drug coverage through an Advantage or standalone plan, Part D has two phases: initial and catastrophic, each with different thresholds to meet before medications are covered.

What happens if you don't have Medicare?

For Part B, you’ll be hit with a 10% increase in the monthly premium for each 12-month period that you were eligible to enroll but didn’t.

Does Medicare cover Part B?

7 Things Medicare Doesn't Cover. Part B, along with Part A, which covers inpatient care at a hospital or skilled nursing facility, are the meat and potatoes of Medicare coverage.

Step #1 – Know Your Initial Eligibility

- Two situations exist when selecting your part D plan for the first time. The first one is when you turn age 65. Your part D Medicare prescription drug eligibility is a 7 month period which begins 3 months before the month you turn 65, the month you turn 65, and the 3 months after the month you turn 65. See the diagram below. This period is known as...

Step #2 – Know Your Prescription Drugs

- If you take prescription drugs, you should know if they are generic or not. You should have a good idea of how much you are spending yearly. If you don’t, your insurance carrier or your pharmacy should have a portal on its website where you can check. Knowing how much you have been spending puts you in a position to potentially lower your drug costs. We’ve worked with Medicar…

Step #3 – Compare Plans

- The part D prescription drug plan market is very competitive. Carriers want your business. However, many specialize as well. For instance, some plans predominantly focus on the generic drug markets. Other carriers help Medicare beneficiaries save money through the “donut hole”. By knowing where you are cost-wise from step #2, you can make informed decisions on the right pl…

Step #4 – Enroll and Make Changes as Necessary

- As we mentioned, you can enroll during your initial enrollment period. If you have creditable coverage elsewhere, you can defer your enrollment penalty-free until you are ready to enroll. If you don’t enroll when eligible or have creditable coverage, you will face a late enrollment penalty. This penalty is 1% X the national base beneficiary premium X number of full, uncovered months. If yo…