Submitting Medicare secondary claim - cms 1500 primary insurance info If there is insurance primary to Medicare for the service date (s), enter the insured’s policy or group number within the confines of the box and proceed to items 11a-11c. Items 4, 6, and 7 must also be completed.

Full Answer

How to deal with Medicare as a secondary insurance?

- Vision: Your medical plan will not cover you for vision care. ...

- Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. ...

- Disability: Short- and long-term disability plans are a type of secondary insurance coverage. ...

Is Medicare a secondary payer?

Medicare is a secondary payer when the beneficiary is covered by group insurance, Workers' Compensation, or if other third-party liability (no-fault, liability) applies. For detailed information on CMS's Medicare Secondary Payer guidelines, refer to the CGS web page, ' CMS Guidelines and Resources for Medicare Secondary Payer (MSP) ', for links to the various CMS MSP regulations.

How to appeal a Medicare claim denial decision?

Questioning a Medicare Claim

- The first level of appeal, described above, is called a “redetermination.”

- If your concerns aren’t resolved to your satisfaction at this level, you can file an appeal form with Medicare to advance your request to the second “reconsideration” level in which ...

- The third level of appeal is before an administrative law judge (ALJ). ...

How to complete required Medicare questionnaire?

It can also include:

- A review of your medical and family history.

- Developing or updating a list of current providers and prescriptions.

- Height, weight, blood pressure, and other routine measurements.

- Detection of any cognitive impairment.

- Personalized health advice.

- A list of risk factors and treatment options for you.

How do I submit a secondary claim to Medicare?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

Does Medicare accept paper secondary claims?

The primary insurer must process the claim in accordance with the coverage provisions of its contract. If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, to Medicare for consideration of secondary benefits.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

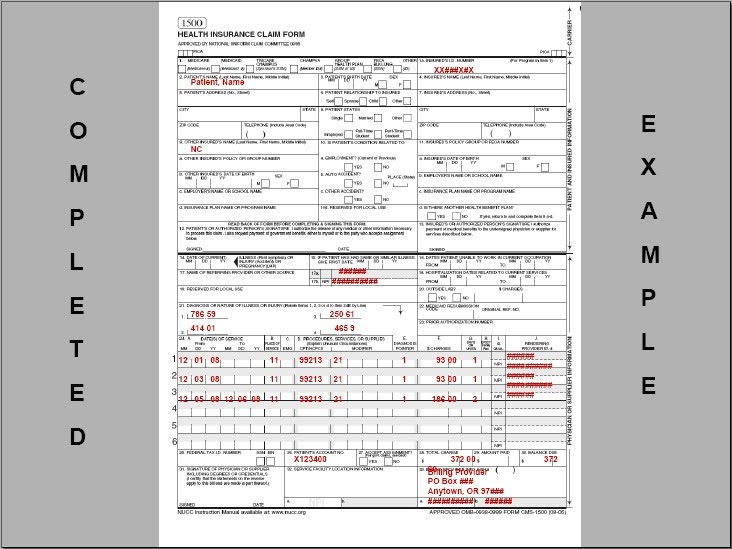

How do you fill out CMS 1500 when Medicare is secondary?

0:239:21Medicare Secondary Payer (MSP) CMS-1500 Submission - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere when the insured. And the patient are the same the biller enters the word. Same if medicare isMoreHere when the insured. And the patient are the same the biller enters the word. Same if medicare is primary this item is left blank.

Where do I send Medicare Part B claims?

Mailing AddressesWho to WriteAddresses and Additional InformationAppealsClaimsJ15 — Part B/HHH Claims CGS Administrators, LLC PO Box 20019 Nashville, TN 37202Congressional InquiriesCGS Administrators, LLC J15 Part A/B Correspondence PO Box 20018 Nashville, TN 3720212 more rows

What is the payer code for Medicare secondary?

Use payer code Z for Medicare. Payer codes (Code IDs): A = Working Aged beneficiary/spouse with an EGHP (beneficiary age 65 or over) – Beneficiary must be enrolled in Part A for this Provision to apply (VC 12) B = ESRD beneficiary with EGHP in MSP/ESRD 30-month coordination period (VC 13)

How does Medicare Secondary Payer work?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

When submitting a secondary claim what fields will the secondary insurance be in?

Secondary insurance of the patient is chosen as primary insurance for this secondary claim; primary insurance in the primary claim is chosen as secondary insurance in the secondary claim. Payment received from primary payer should be put in 'Amount Paid (Copay)(29)' field in Step-2 of Secondary claim wizard.

Is Medicare Secondary Payer questionnaire required?

CMS electronic tools help identify and verify MSP situations. Get more information in Medicare Secondary Payer Manual, Chapter 3, Section 20 or contact your MAC. Providers must keep completed MSP questionnaire copies and other MSP information for 10 years after the service date.

What goes on box 24c on CMS-1500?

Box 24c. EMG indicator (also called emergency indicator) is a carryover from the older CMS-1500 form and is unlikely to be required on current claims. If needed, however, you can add the 'EMG' field via the service line Column Chooser. Acceptable values are Y or N.

What goes in box 24c on HCFA?

24c. EMG-Emergency Enter a Y in the unshaded area of the field. If this is not an emergency, leave this field blank. 24d.

What goes in box 33B on a CMS-1500?

non-NPI identity of the Billing providerBox 33b contains the non-NPI identity of the Billing provider. The source for the actual non-NPI value is the text entered into the field labeled 'Box 33B:' under the 'HCFA-1500/UB-92' tab of the Payers screen (of the payer to whom this claim is being sent).

Does Medicare accept handwritten claims?

Medicare to Reject Handwritten Claims. Providers who wish to continue to submit paper claims may do so as long as they are printed and as long as the only handwriting included in the claim is in a signature field. Software programs are available that will allow providers to print information into a CMS 1500 form.

Does Medicare accept electronic claims?

How to Submit Claims: Claims may be electronically submitted to a Medicare Administrative Contractor (MAC) from a provider using a computer with software that meets electronic filing requirements as established by the HIPAA claim standard and by meeting CMS requirements contained in the provider enrollment & ...

Does Medicare accept corrected claims electronically?

You can send a corrected claim by following the below steps to all insurances except Medicare (Medicare does not accept corrected claims electronically). To submit a corrected claim to Medicare, make the correction and resubmit it as a regular claim (Claim Type is Default) and Medicare will process it.

Does noridian Medicare accept paper claims?

Claims may be filed to electronically (this applies to most Medicare providers) or on paper (if certain conditions or exceptions exist).

Submitting MSP Claims via FISS DDE or 5010

All MSP claims submitted via FISS DDE or 5010 must report claim adjustment segment (CAS) information. In FISS DDE, the CAS information is entered on the "MSP Payment Information" screen (MAP1719), which is accessed from Claim Page 03 by pressing F11. This is in addition to the normal MSP coding information.

Correcting MSP Claims and Adjustments

Return to Provider (RTP): MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11.

Medicare Secondary Institutional (Part A) Claim

1. Complete the fields as required on the Institutional claim form. See Section 2 for more information on the Institutional claim completion.

Medicare Secondary Professional (Part B) Claim

1. Comple te the fields as required on the Professional claim form. See Section 2 for more information on the Professional claim completion

What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer. This booklet gives an overview of the MSP provisions and explains your responsibilities in detail.

What happens if you don't file a claim with the primary payer?

File proper and timely claims with the primary payer. Not filing proper and timely claims with the primary payer may result in claim denial. Policies vary depending on the payer; check with the payer to learn its specific policies.

Why does Medicare make a conditional payment?

Medicare may make pending case conditional payments to avoid imposing a financial hardship on you and the patient while awaiting a contested case decision.

How long does it take to pay a no fault claim?

For no-fault insurance and WC claims, “paid promptly” means payment within 120 days after the no-fault insurance or WC carrier got the claim for specific items and services. Without contradicting information, you must treat the service date for specific items and services as the claim date when determining the paid promptly period; for inpatient services, you must treat the discharge date as the service date.

Can Medicare make a payment?

Medicare can’t make payment when payment “has been made or can reasonably be expected to be made” under liability insurance (including self-insurance), no-fault insurance, or a WC law or plan of the United States, called a primary plan.

Can Medicare deny a claim?

Medicare may mistakenly pay a claim as primary if it meets all billing requirements, including coverage and medical necessity guidelines . However, if the patient’s CWF MSP record shows another insurer should pay primary to Medicare, we deny the claim.

When a provider receives a reduced no fault payment because of failure to file a proper claim, what is

When a provider receives a reduced no-fault payment because of failure to file a proper claim, (see Chapter 1, §20 for definition), the Medicare secondary payment may not exceed the amount that would have been payable if the no-fault insurer had paid on the basis of a proper claim.

How often do you need to collect MSP information?

Following the initial collection, the MSP information should be verified once every 90 days. If the MSP information collected by the hospital, from the beneficiary or his/her representative and used for billing, is no older than 90 calendar days from the date the service was rendered, then that information may be used to bill Medicare for recurring outpatient services furnished by hospitals. This policy, however, will not be a valid defense to Medicare’s right to recover when a mistaken payment situation is later found to exist.

Is GHP primary to Medicare?

Do you have employer group health plan (GHP) coverage through yourself, a spouse, or family member if dually entitled based on Disability and ESRD? If yes, the employer GHP may be primary to Medicare. Continue below.

Can a beneficiary recall his/her retirement date?

During the intake process, when a beneficiary cannot recall his/her precise retirement date as it relates to coverage under a group health plan as a policyholder or cannot recall the same information as it relates to his/her spouse, as applicable, hospitals must follow the policy below.

Does Medicare require independent labs?

The Centers for Medicare & Medicaid Services (CMS) will not require independent reference laboratories to collect MSP information in order to bill Medicare for reference laboratory services as described in subsection (b) above. Therefore, pursuant to section 943 of The Medicare Prescription Drug, Improvement & Modernization Act of 2003, CMS will not require hospitals to collect MSP information in order to bill Medicare for reference laboratory services as described in subsection (b) above. This policy, however, will not be a valid defense to Medicare’s right to recover when a mistaken payment situation is later found to exist.

Can you send a claim to Medicare with multiple primary payers?

Claims with multiple primary payers cannot be sent electronically to Medicare.

Submitting MSP Claims Via Fiss DDE Or 5010

Additional Information

- Paper (UB-04) claims can only be submitted to CGS for Black Lung related services, or when a provider meets the small provider exception, (CMS Pub. 100-04, Ch. 24§90).

- When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial...

- Paper (UB-04) claims can only be submitted to CGS for Black Lung related services, or when a provider meets the small provider exception, (CMS Pub. 100-04, Ch. 24§90).

- When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial...

- When submitting non-group Health Plan (no fault, liability, worker's compensation) claims for services unrelated to the MSP situation, and no related diagnosis codes are reported, do not include an...

Correcting MSP Claims and Adjustments

- Return to Provider (RTP):MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11. Adjustments: Providers may submit adjustments to MSP claims via 5010 or FISS …

References

- Change Request 8486- Instructions on Using the Claim Adjustment Segment (CAS) for Medicare Secondary Payer (MSP) Part A CMS-1450 Paper Claims, Direct Data Entry (DDE), and 837 Institutional Claims...

- CMS Medicare Secondary Payer Manual (Pub. 100-05) Ch. 5 §40.7.3.2