Can you still purchase a Medicare Plan F?

How do I get Medicare F?

Can I get Medicare Plan F in 2020?

How much does AARP Plan F cost?

Is AARP plan f still available?

Why was Plan F discontinued?

Can you switch from Plan F to Plan G in 2021?

What is Medicare Plan F being replaced with?

What is the difference between Plan F and Plan G?

Why do doctors not like Medicare Advantage plans?

Will Plan F rates increase?

What is the most comprehensive Medicare supplement plan?

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Can I still get Plan F?

People who were eligible for Medicare prior to 2020 will continue to have the option to buy Plan F. This is regardless if you enrolled in Medicare...

What is the average cost for Medicare Plan F?

Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we fin...

What is Medicare Plan F Coverage?

It covers all of your cost-sharing for Medicare Part A and B services. Medicare must approve and pay for the service before your Medicare Plan F po...

Does Medicare Plan F cover prescription drugs?

All Medigap plans cover medications administered in the hospital or in a clinical setting. However, Medigap plans do not cover retail prescriptions...

Does Medigap Plan F cover dental, vision and hearing benefits?

No Medigap plan covers routine dental, vision or hearing services either. However, there are many great standalone plans that you can enroll in to...

Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, su...

What is the most popular Medicare Supplement plan?

The best Medigap plans in 2022 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no...

What are the top 10 Medicare Supplement insurance companies in 2022?

This absolutely varies by region. Since Medicare Supplement insurance plans are standardized, you don’t have to worry about benefits being differen...

Should I switch from Plan F to Plan G?

This depends on what your Plan F premium is and where you live (you may have to answer health questions). However, you get lower premiums for Plan...

What is covered by Plan F?

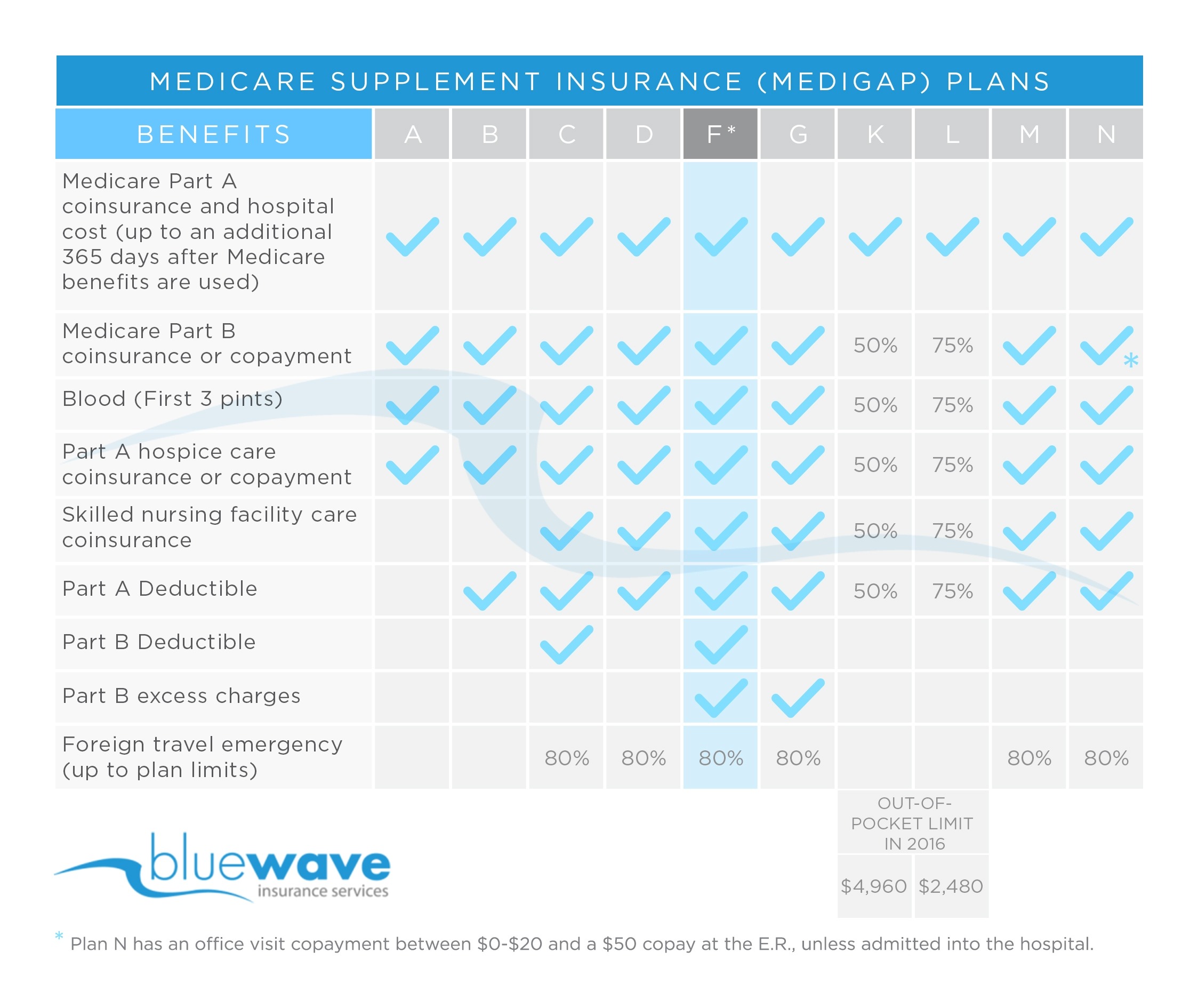

The extensive coverage of Plan F includes the following: 100% of the deductibles for Parts A and B. 100% of the Part A coinsurance. Hospital expenses up to an extra 365 days after a person uses all available Medicare benefits. 100% of the copayment or coinsurance for Part A hospice care. 100% of the copayment or coinsurance for Part B.

How much is a Plan F deductible?

Plan F offers a high deductible version of the policy where an individual pays the deductible amount of $2,370 before the Medigap benefits take effect. They must also pay a $250 deductible for emergency healthcare costs they encounter when traveling in foreign countries.

What are the other Medigap plans?

As an alternative to Plan F, there are some other Medigap plans available. These include Plans A, B, D, G, K, L, M, and N. All of these plans provide the same primary benefits, but may also include some additional ones. Those that offer more coverage usually have higher premiums.

What is the deductible for Medicare in 2021?

Some states offer a high-deductible version of Plan F. This means a person must first pay all Medicare costs up to $2,370, which is the deductible in 2021. Similar to other Medigap plans, Plan F does not cover prescription drugs or extra benefits, such as dental and vision.

What is Plan F for travel?

80% of foreign travel emergency healthcare costs up to the plan limits. In addition, Plan F covers 100% of Part B excess charges. These expenses refer to the amounts providers charge that are higher than Medicare-approved costs. Some states offer a high-deductible version of Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Which Medigap plan is the most closely resembled?

Plan G is the option that most closely resembles Plan F. Before buying a Medigap plan, a person may wish to take a careful look at the differences in their coverage, as insurance companies may offer the same plans but with different pricing.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare Supplement plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.)

What insurance carriers are in Plan G?

Our agency works with about 30 carriers in every state. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2021. You’ll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

What happens if you don't have a medicaid supplement?

Here’s an example: if you have no Supplement, you would owe a $1,484 deductible (Part A deductible in 2021) when you go to the hospital. You would also pay 20% of expensive procedures like surgery because Part B only pays 80%. If you had a Medigap F policy, though, all of these would be paid for by your insurance.

How much does Medicare cost for a 65 year old?

Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we find pricing around $120 – $140/month for a female turning 65, but it’s always important to get quotes for Medicare Plan F cost in your area.

Which Medicare Supplements are good value?

However, there are other Medicare Supplements that provide great value as well, such as Plan G and Plan N.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Does Medicare Supplement Plan F cover Part A?

If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. It’s the most comprehensive Medicare Supplement insurance plan among the 10 standardized plans available in most states. So you might wonder, “Why is Plan F going away?”

Do you have to take action if you have Medicare Supplement Plan F?

Still, you may have choices in Medicare Supplement insurance plans. Make the best coverage decision for yourself. If you have a Medicare Supplement Plan F, you don’t have to take any action because your coverage is still active.

Is Plan F a high deductible?

Plan F has a high-deductible version. A Medicare Supplement high-deductible Plan G may now be available in some states.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

When will Medicare plan F be available?

Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020. If you already had Plan C or Plan F before 2020, you will be able to keep your plan.

What is the benefit of choosing Plan F?

One potential benefit of choosing Plan F is that it covers many out-of-pocket Medicare costs. The chart below shows how Plan F compares with of other types of Medigap plans. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What are the factors that affect Medigap rates?

Other factors such as age, gender, smoking status and health can also affect Medigap plan rates.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

How much is the 2021 F deductible?

In 2021, high-deductible Plan F offers an annual deductible of $2,370, meaning you are responsible for paying the first $2,370 worth of covered expenses before the plan’s coverage begins.

How much is Plan K 2021?

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What is the best alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesn’t cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so that’s a good alternative to Plan F.

What is deductible insurance?

As a reminder, your deductible is the out-of-pocket cost you must pay toward covered health services before your insurance company starts paying for care. Both insurance plans have identical coverage.

When is the best time to buy Medicare Supplement?

Although Plan F has been eliminated for new enrollees, Decker explains that the best time to purchase any Medicare supplement is during the initial enrollment period when you first become eligible for Medicare. That begins three months before your 65th birthday and ends three months after. Otherwise, pre-existing health conditions could prohibit you from purchasing a plan later during the annual open enrollment period.

Is Medicare Plan F still available?

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Is Medicare Supplement Plan F available?

Medicare Supplement Plan F is a Medigap policy that’s no longer available to new Medicare members, but Original Medicare beneficiaries who were eligible before 2020 may be able to get a plan.

When did Medicare Plan F end?

However, Medicare Plan F was discontinued as of Jan. 1, 2020. People who had purchased Plan F before Jan. 1 were grandfathered in and new plans were eliminated from that point on.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

What is the most popular Medicare Supplement Plan?

Get Medigap Plan F . As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medicare recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

What is Medicare Supplement?

Medicare Supplement is an additional insurance policy you can buy to help cover costs that Original Medicare (Parts A and B) doesn’t. Medicare Advantage is a way to receive Part A and B, as well as additional benefits such as dental care, eye exams, and prescription drug coverage, all in one package.

What does Plan F cover?

Like other Medicare Supplement plans, Plan F covers Part A and Part B costs that you’d otherwise have to pay out of pocket. To learn what costs other parts of Medicare cover, read our Ultimate Medicare Guide.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

How long do you have to enroll in Medigap after you get your Part B?

This is your Medigap Open Enrollment Period. You have 6 months after your Part B coverage starts to buy a policy. During this time, you can buy any Medigap policy sold in your state, even if you have health problems.

Can you charge more for Medigap?

Limited situations when insurance companies must sell you certain Medigap policies, cover your pre-existing health conditions, and can’t charge you more because of health problems.

Is the price of a lettered plan the same?

The benefits in each lettered plan are the same, no matter which insurance company sells it. Price is the only difference between policies with the same letter sold by different companies. Costs can vary widely between companies, so contact more than one company to get an estimate.

Can you buy a Medigap policy?

you may also want to buy a Medigap policy to help pay your share of costs. In most states, there are only a few Medigap standardized plans to pick from. But, there can be many insurance companies that sell policies for the same plan.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs, it is also the most popular.

Which states do not offer Medicare Supplement Plan F?

Massachusetts, Minnesota, and Wisconsin have state-specific policies and do not offer Medicare Supplement Plan F.

How much did Medicare pay out of pocket in 2016?

On average, Medicare beneficiaries paid $5,460 out of pocket on healthcare expenses in 2016, but people without supplemental insurance paid even more ($7,473). 1 This is where Medicare Supplement Plan F and other Medigap plans can be beneficial. These plans pay down the expenses left behind by Part A and Part B, including deductibles, copays, ...

How much does AARP cost in 2021?

Enrollment in Medicare Supplement Plan F requires AARP membership, which in 2021 is $16 unless signing up for automatic renewal which makes it $12. Membership comes with added perks, including financial planning services, shopping discounts, and more. Once you are a member, you can reach out to UnitedHealthcare to sign up for Plan F and, if you're interested, one of the company's highly-rated Medicare Part D plans for prescription drug coverage. Reach out to a representative seven days a week, or chat with an agent online at its website. The site is easy to use and provides a wealth of information about Medicare and Medicare Supplement Plans. The company did not provide a quote to us over the phone because we were not applying for a plan.

What states have high deductible plan F?

High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia. Because a number of independent companies work under the BCBS name, there is no go-to contact number to call to enroll in Medicare Supplement ...

How to request a quote for Cigna?

To request a quote or enroll in Cigna Plan F, call the company or fill out the form on its website that requires basic personal information, including your start dates of Medicare Parts A and B. Plans vary based on your age, gender, medical conditions, and address. The plans are based on an attained-age model in the majority of states it services. Under this format, prices increase regularly based on your age. If you are also looking for a Medicare Part D Plan to round out your Medicare coverage, Cigna has several plans to meet your needs.

How to enroll in Humana Plan F?

To enroll in Humana Plan F, call Monday through Friday or request a telephone appointment using a simple online form on its website. You will need to include your start dates for Medicare Parts A and Part B and your desired start date for Medicare Supplement coverage. Humana requires a formal application for cost estimates and does not provide any rates over the phone. Its pricing, like many other Medicare Supplement companies, is based on attained age. This means you will pay more for your plan as you age. To round out your Medicare coverage, you can also sign up for dental and/or vision coverage not otherwise covered by Original Medicare and consider enrollment in one of its Medicare Part D prescription drug plans, many of which are rated 4-stars and above.