Can I be turned down for a Medicare Advantage plan?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What patient population is generally excluded from joining a Medicare Advantage plan?

End-Stage Renal DiseasePeople who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

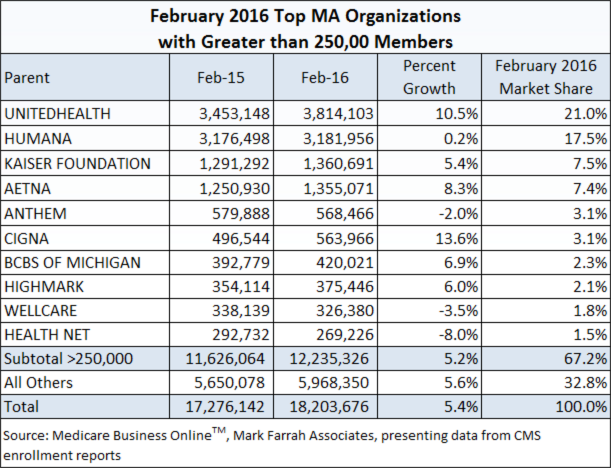

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Can I switch from original Medicare to Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Which company has the best Medicare Advantage plan?

The Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have earned the title of an AM Best A Rated Company.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Do Medicare Advantage plans have a lifetime limit?

Medicare Advantage plans have no lifetime limits because they have to offer coverage that is at least as good as traditional Medicare, says Vicki Gottlich, senior policy attorney at the Center for Medicare Advocacy in Washington, D.C. “There has never been a cap on the total amount of benefits for which Medicare will ...Aug 23, 2010

Does Medicare have a maximum lifetime benefit?

A. In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What is Medicare Advantage Plan?

Medicare Advantage plans are an alternative way for people to receive their Medicare Part A (hospital) and Part B (medical) benefits from private insurance companies approved by Medicare.

What age do you have to be to get Medicare Advantage?

Most people qualify for Medicare Part A and Part B when they turn age 65 or have received disability benefits from the Social Security Administration or Railroad Retirement Board ...

Do I have to pay Medicare Part B premium?

You must pay the Medicare Part B premium. Typically, you are still responsible for paying your Medicare Part B premium when you enroll in a Medicare Advantage plan. An exception may exist for people with limited incomes that qualify them for a Part B premium government subsidy. In addition to the Medicare Part B premium, ...

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is Medicare Advantage?

Medicare Advantage is private insurance's counterpart to Original Medicare. It's a great alternative for receiving your Medicare coverage. Rather than purchasing individual components through Original Medicare, Medicare Advantage bundles benefits from Part A and Part B and can even include drug coverage, vision, dental, hearing, ...

How long does Medicare Advantage last?

If you’re new to Medicare, you’ll want to enroll in an MA Plan during your Initial Enrollment Period (IEP). This period lasts for seven months— three months before the month when you turn 65, and three months after.

How to find my Medicare number?

Go to the Medicare Plan Finder. If you'd like to save your search results, choose the "Log in or Create Account" option and enter your Medicare number, email address, and other information. If you just want to do a quick search, select "Continue without logging in."

When is the open enrollment period for Medicare?

There’s also a Fall Open Enrollment Period (October 15 through December 7) during which you may sign up. Learn about enrollment periods and when they apply to you.

How to change Medicare Advantage plan?

The Medicare Open Enrollment Period, also known as the Annual Election Period (AEP), runs yearly from October 15 to December 7, during which Medicare beneficiaries can apply for Medicare Advantage plan coverage. Beneficiaries can make the following changes to their coverage during this two-month period: 1 Switch from Original Medicare to Medicare Advantage 2 Switch from a Medicare Advantage plan back to Original Medicare 3 Switch from a Medicare Advantage plan to a different Medicare Advantage plan in their service area 4 Switch from a Medicare Advantage plan that doesn’t include drug coverage to one that does, and vice versa

What is Medicare Advantage?

Medicare Advantage plans are provided through private insurance companies and offer the same benefits as Original Medicare, with some also offering prescription drug coverage and vision, dental or hearing care.

How long does it take to enroll in Medicare Advantage?

Enrolling in a Medicare Advantage plan during your Initial Enrollment Period. When you first become eligible for Medicare, you have a 7-month Initial Enrollment Period (IEP) to enroll in Medicare. Then once enrolled in Part A and Part B, you can sign up for a Medicare Advantage plan (also known as Medicare Part C).

When does IEP end?

If you are aging into Medicare, then your IEP begins 3 months before the month that you turn 65 and ends 3 months after the month you turn 65. For example, if you age into Medicare in May, then your Initial Enrollment Period begins February 1st and ends August 31st. People with End-Stage Renal Disease generally cannot enroll in a Medicare Advantage ...

What happens if you miss the enrollment period?

If you missed the other enrollment periods, you generally have to wait for the next Annual Election Period. However, there are certain special circumstances that could qualify you for a Special Enrollment Period, such as: You moved out of your current Medicare Advantage plan’s service area. You are eligible for Medicaid.

When is Medicare open enrollment?

The Medicare Open Enrollment Period, also known as the Annual Election Period (AEP), runs yearly from October 15 to December 7 , during which Medicare beneficiaries can apply for Medicare Advantage plan coverage.

What is Medicare SNP?

Medicare SNPs are a type of Medicare Advantage Plan (like an HMO or PPO). Medicare SNPs limit membership to people with specific diseases or characteristics. Medicare SNPs tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve. Find out who can join a Medicare SNP.

What is end stage renal disease?

End-Stage Renal Disease (Esrd) Permanent kidney failure that requires a regular course of dialysis or a kidney transplant. and need out-of-area dialysis. Medicare SNPs typically have specialists in the diseases or conditions that affect their members.

What is Medicare and Medicaid?

If you have Medicare and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

Does Medigap cover copays?

This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.