Medicare Part A is free if you:

- Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S.

- Are eligible for Railroad Retirement benefits

- Or, have a spouse that qualifies for premium -free Part A

Who qualifies for premium-free Medicare Part A?

If you are over 65 and qualify for Medicare, you are eligible for premium-free Part A if you or your spouse have at least 40 calendar quarters of work in a job where you paid payroll taxes to Social Security, or are eligible for Railroad Retirement benefits.

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

What is Medicare eligibility criteria?

Centers for Medicare and Medicaid Services (CMS) announced that it updated its lung cancer screening eligibility guidelines for people ... as the expanded criteria includes more individuals from Brown and Black communities. The Lung Association’s 2021 ...

Is Medicare Part a premium free?

The reality is, no part of Medicare is free. Though, the reason we talk about premium-free Part A is because most Americans pay Medicare taxes in their working years, providing them the opportunity to enjoy no additional Part A premiums after enrolling in Medicare. You qualify for premium-free Part A if: You are 65 or older (a few exceptions apply)

Does everyone get Medicare Part A for free?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

What makes someone eligible for Medicare Part A?

Some people may be 65 but ineligible for premium-free Medicare Part A. For instance, a person who did not work for 40 quarters and pay Medicare taxes would not be eligible. If a person has paid Medicare taxes for 30–39 quarters, they can pay a reduced premium for Medicare Part A, at $259 per month.

What is premium-free Medicare Part A?

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free at age 62?

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years (40 quarters) and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs.

Do you pay for Part A Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can I get AARP health insurance at 62?

Full AARP membership is available to anyone age 50 and over.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How much is Medicare Part B deductible?

The most common monthly Part B premium is $148.50. If you have a high income, you'll pay more. In 2021, the Medicare Part B deductible is $203.

What is the Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Is Medicare free?

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums. However, it's possible to receive assistance for your Medicare Part A and Part B premiums, copays, ...

How many quarters of work do you need to get Medicare Part A?

Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium -free Part A.

What is QMB in Medicare?

If you or your spouse worked fewer than 30 quarters (7.5 years) If your income is low, you may be eligible for the Qualified Medicare Beneficiary (QMB) program, which pays for your Medicare Part A and B premiums and other Medicare costs.

How much is Social Security premium 2021?

In 2021, your monthly Part A premium will be: $0.

Is Medicare Part A free?

Register. Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium -free Part A. [bsa_pro_ad_space id=3]

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

How old do you have to be to get Medicare?

Your spouse that paid Medicare taxes must be at least 62 years old for you to be eligible. Married – you must be married for at least 1 year prior to receiving benefits. Divorced – if you were married for at least 10 years and you are now single, you are eligible through your former spouse.

What happens if you don't sign up for Medicare?

First, if you decide not to sign up for Medicare in your Initial Enrollment Period, you will be subject to late enrollment penalties . These penalties grow each year that you don’t sign up for Medicare and they stick around for life. And second, if you don’t enroll in Part A, you don’t have any hospital coverage at all.

How much is Medicare 2021?

In 2021, the premium is $471 a month. Don’t forget that you will also want to calculate the other parts of Medicare into your monthly premiums as a whole. For example, you cannot have Part A without also having Part B coverage. The current 2021 Part B premium for most people is $148.50 a month.

Does Medicare Part B require a premium?

Though we haven’t discussed Part B, it is important to know that these eligibility requirements only pertain to Medicare Part A. Medicare Part B and D will almost always require a premium to be paid regardless of your work history.

What is a coinsurance for Medicare?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much will Medicare cost in 2021?

If a person is not eligible for premium-free Part A, they can buy it. In 2021, the premiums range from $259–$471. The cost depends on how much taxes a person paid during a certain amount of calendar quarters:

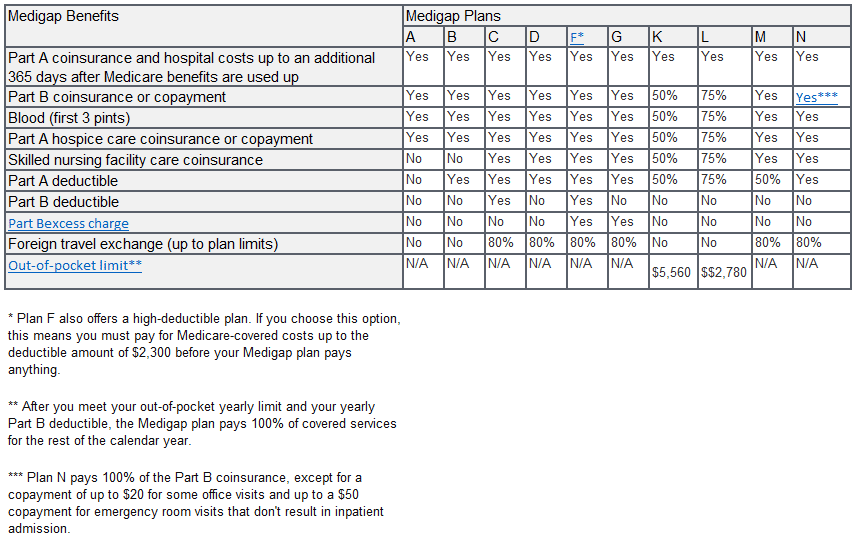

What is a Medigap policy?

Medigap is health insurance sold by private insurance companies. It is designed to supplement original Medicare coverage by paying costs that original Medicare does not cover. A Medigap policy may pay a person’s healthcare costs, such as coinsurance, deductibles, and copays. However, Medigap is not free, and a person may have to pay ...

How long do you have to work to get FICA?

Employers deduct payroll taxes from each paycheck, under the Federal Insurance Contributions Act (FICA). If a person or their spouse has worked for 10 years or more they will generally have paid the full FICA tax by payroll deduction, and meet the conditions to get premium-free Medicare Part A.

What is the age limit for working quarters?

One condition is that the person has worked a certain amount of calendar quarters, and also be aged 65 or older. The income of a person’s parent, spouse, or child can also count towards eligibility. Worked calendar quarters are ‘earned’ through payroll taxes.

Does Medicare Part A cost?

Medicare Part A is generally no cost, although some people may need to pay the monthly premium. Original Medicare includes Part A, hospital insurance, and Part B, medical insurance. Most people do not pay the premium for Medicare Part A. However, there are exceptions when a person may have to pay the Part A premium.

Does Medicare Advantage have a monthly premium?

Zero- premium Medicare Advantage plans have no monthly premium, although a person may still need to pay for the Part B premium. However, zero-premium plans may have higher deductibles, copays, or additional out-of-pocket costs compared to an Advantage plan with a monthly premium.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

What is the minimum income for a married couple in 2020?

Your income must be no more than the federal poverty level to be eligible for this program, which was an annual income of $12,760 for a single person and an annual income of $17,240 for a married couple in 2020.