Specified Low-Income Medicare Beneficiary (SLMB) program If you make less than $1,308 a month and have less than $7,970 in resources, you can qualify for SLMB. Married couples need to make less than $1,762 and have less than $11,960 in resources to qualify.

Full Answer

Do I qualify for Medicare premium assistance due to low income?

May 06, 2021 · You can calculate your annual premium by multiplying your monthly premium by 12. For example, if your monthly premium is $55, your annual premium would be $660. Some Medicare Advantage plans have $0 monthly premiums. A second cost you may consider when looking for a low cost Medicare Advantage plan are the deductibles. Some plans have medical …

Can I get Medicare Part D If I have low income?

OVERVIEW. A Cost Contract provides the full Medicare benefit package. Payment is based on the reasonable cost of providing services. Beneficiaries are not restricted to the HMO or CMP to receive covered Medicare services, i.e. services may be received through non-HMO/CMP sources and are reimbursed by Medicare intermediaries and carriers.

How can I reduce my Medicare Part B premiums?

Dec 01, 2021 · This section contains information on eligibility for the Low-Income Subsidy (also called "Extra Help") available under the Medicare Part D prescription drug program. It includes information on those who are automatically deemed eligible, as well as those who must apply to be determined eligible.

What are the three Medicare Part B cost reduction programs?

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community. Lower prescription costs. Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Who is eligible for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

Is Medicare Part B free for anyone?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare Part B cost depend on income?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I get my Part B premium back?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How much is the Medicare Part B reimbursement?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

What is Medicare Part B premium reduction?

The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount. Even though you're paying less for the monthly premium, you don't technically get money back.Jan 14, 2022

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What is the eligibility requirement for Medicare Part B quizlet?

Terms in this set (59) anyone reaching age 65 and qualifying for social security benefits is automatically enrolled into the Medicare part A system and offered Medicare Part B regardless of financial need.

Does Social Security count as income for Medicare premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are Medicare Part B premiums going up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Social Security considered income for Medicare?

For purposes of the Medicare Prescription Drug Discount Card, we have defined “income” as money received through retirement benefits from Social Security, Railroad, the Federal or State Government, or other sources, and benefits received for a disability or as a veteran, plus any other sources of income that would be ...

When do transition plans have to notify CMS?

Plans are responsible for following all contracting, enrollment, and other transition guidance released by CMS. In its initial, December 7, 2015 guidance, CMS specified that transitioning plans must notify CMS by January 31 of the year preceding the last cost contract year. In its May 17, 2017 guidance, CMS revised this date to permit ...

What is the Medicare Access and CHIP Reauthorization Act of 2015?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) amends the cost plan competition requirements specified in section 1876 (h) (5) (C) of the Social Security Act (the Act).

What is cost contract?

A Cost Contract provides the full Medicare benefit package. Payment is based on the reasonable cost of providing services. Beneficiaries are not restricted to the HMO or CMP to receive covered Medicare services, i.e. services may be received through non-HMO/CMP sources and are reimbursed by Medicare intermediaries and carriers.

What is SSI benefits?

A monthly benefit paid by Social Security. SSI is for people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits.

What is the PACE program?

PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

How to lower prescription costs?

To lower your prescription drug costs, you can: Ask about generic drugs—your doctor can tell you if you can take a generic drug instead of a brand-name drug or a cheaper brand-name drug. Look into using mail-order pharmacies. Compare Medicare drug plans to find a plan with lower drug costs. Apply for.

How to contact Medicare for a new drug?

Or, you can contact. Medicare's Limited Income Newly Eligible Transition (NET) Program at 1-800-783-1307 for more information (TTY: 711).

What is Medicare copay?

This program helps pay for your Medicare drug coverage, such as plan premiums, deductibles, and costs when you fill your prescriptions, called copays or coinsurance.

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , a program to help pay drug costs for people with limited income and resources. Find out if your state offers help paying for drug costs. Find out if the company that makes your ...

What happens if you don't qualify for extra help?

If you don't qualify for Extra Help, your state may have programs that can help with drug coverage costs. Contact your Medicaid office or your State Health Insurance Assistance Program (SHIP) for more information.

Is Medicaid covered by Medicare?

Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.

Is SSI the same as disability?

A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits. If you don’t automatically qualify, you can apply for Extra Help at any time.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

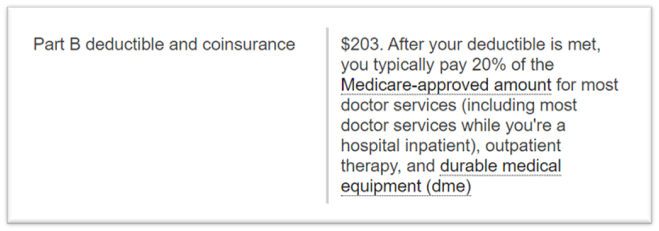

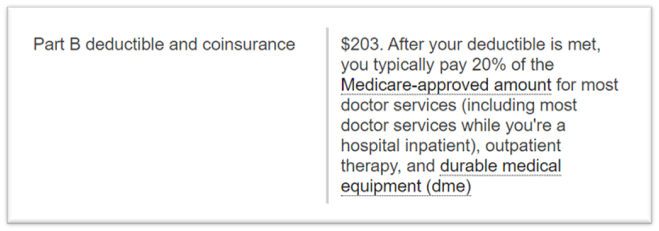

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.

How to save money on Medicare?

There are even more ways to save money on your Medicare costs, including joining a Medicare Advantage plan that may offer the benefits you need at a price you can afford .

What if you don't qualify for QMB?

Those who do not qualify for either the QMB or SLMB programs may still be eligible for the Qualifying Individual Program, which pays for Medicare Part B premiums and qualifies you for Medicare Extra Help.

What is QMB program?

If you earn just a little too much to qualify for the QMB program, you may qualify for the Specified Low-Income Medicare Beneficiary program. This program helps pay Medicare Part B premiums and qualifies you for Medicare Extra Help.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Does Social Security ask for proof of income?

Social Security will ask for proof of your higher income then versus now. If you can show that your income is lower than before, Social Security may reduce those premiums for you and lower or cancel your IRMAA.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

Which MA plan works best for people with Medicare and Medi-Cal?

If you choose an MA plan, the MA plan that works best for people with both Medicare and Medi-Cal is the Special Needs Plan (SNP) for dual eligibles or D-SNP. If you’re enrolled in a D-SNP, you do not have copays, coinsurance or premiums associated with other types of MA plans.

How much does a person need to be to qualify for Medi-Cal?

To qualify for SSI, you must be age 65 or older, blind or disabled. Your countable monthly income may not exceed $954.72 for an individual or $1,598.14 for a couple (higher income levels apply for individuals who are blind).

What is Cal MediConnect?

Cal MediConnect is a demonstration program with the goal of integrating care for people with both Medicare and Medi-Cal. The demonstration is happening in 7 selected counties: Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Mateo and Santa Clara, and began on various dates depending on the county.

What is Medicare Part D?

2. Prescription Drugs. If you are receiving both Medicare and Medi-Cal benefits, the Medicare Part D drug benefit will provide your prescription-drug coverage instead of Medi-Cal. You must be enrolled in a Medicare Part D drug plan or a Medicare Advantage prescription drug plan to get these benefits.

How much does Medi-Cal pay for SOC?

For example, if you have an individual monthly income of $1,300, Medi-Cal subtracts $600 for a SOC of $700 . This means you must pay at least $700 in covered medical expenses and/or health care premiums in a given month before Medi-Cal covers any of your health care costs for that month.

How much does Medi-Cal pay for medical expenses?

Your SOC is determined according to your monthly income, using the following formula: Medi-Cal subtracts $600 (for an individual) or $934 (for a couple) from your monthly income, and any other health-insurance premiums you may be paying.

What is Medi-Cal for Medicare?

Medi-Cal (for People with Medicare) Medi-Cal, the Medicaid program in California, provides health coverage to people with low-income and asset levels who meet certain eligibility requirements. While there are several ways to qualify for Medi-Cal, this section focuses only on Medi-Cal beneficiaries who also qualify for Medicare — individuals who are ...