- You are 65 or older.

- You're under 65, permanently disabled, and receive disability benefits from Social Security or the Railroad Retirement Board.

- You have end-stage renal disease (ERSD).

- You have ALS (Amyotrophic Lateral Sclerosis), also known as Lou Gehrig's disease.

Do I qualify for Medicaid in Ga?

Oct 14, 2021 · You may be eligible for Medicare in Georgia if youre a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you:2 You are 65 or older. Youre under 65, permanently disabled, and receive disability benefits from Social Security or the Railroad Retirement Board.

What is the income limit for Medicaid in Georgia?

You may be eligible for Medicare in Georgia if you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you: 2. You are 65 or older.

What are the requirements for Medicaid in Georgia?

Sep 16, 2018 · How to apply for Medicare in Georgia Visit the Social Security website. Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday, 7AM to 7PM. If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772 (TTY users call 312-751-4701), ...

Who qualifies for Georgia Medicaid?

Basic Eligibility. You think you are pregnant. You are a child or teenager. You are age 65 or older. You are legally blind. You have a disability. You need nursing home care.

Who is eligible for Medicare Georgia?

Medicare is health insurance for people age 65 or older, under age 65 with certain disabilities, and any age with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

What is the maximum income to qualify for Medicaid in GA?

Not be eligible for any other Medicaid program or managed care program. Meet family gross income requirements of no more than 211 percent of the federal poverty level (FPL)....Eligibility.Family SizeMaximum Monthly IncomeMaximum Yearly Income1$2,135$25,6162$2,895$34,7313$3,654$43,8464$4,114$51,961

How do you know if I will qualify for Medicare?

You qualify for full Medicare benefits if:You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•Nov 15, 2021

What is the highest income to qualify for Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Qualifying Individual (QI) policy helps pay your Medicare Part B premium.

What's the income limit for food stamps in GA?

SNAP Income Eligibility Standards for Fiscal Year 2022Effective October 1, 2021 – September 30, 20224$2,8715$3,3636$3,8557 more rows•Oct 5, 2021

Is Medicaid free for seniors?

You may qualify for free or low-cost care through Medicaid based on income and family size. In all states, Medicaid provides health coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities.

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Do I have to pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Does income affect Medicare?

Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage. If you make a higher income, you'll pay more for your premiums, even though your Medicare benefits won't change.Nov 16, 2021

About Medicare in Georgia

Medicare beneficiaries in Georgia may choose to enroll in Original Medicare, Part A and Part B, which is administered by the federal government. Al...

Types of Medicare Coverage in Georgia

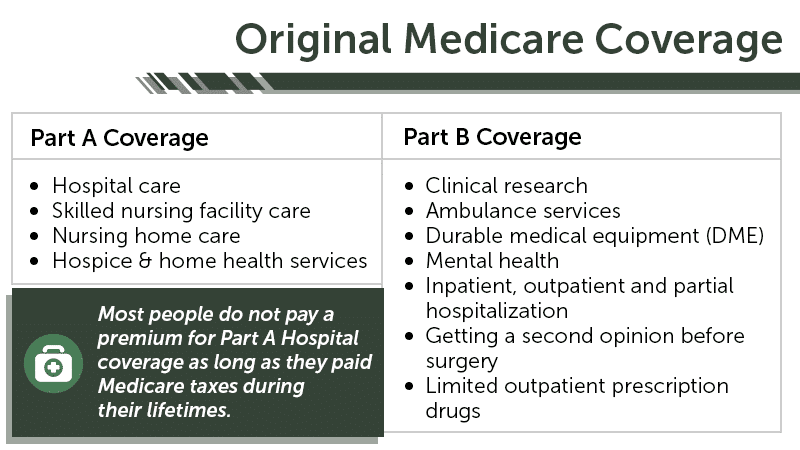

Original Medicare provides inpatient hospital care coverage under Medicare Part A, and doctor services, some preventive care, and durable medical e...

Local Resources For Medicare in Georgia

1. Medicare Savings Programs in Georgia: Beneficiaries whose income is below a certain limit may qualify for assistance from a Medicare savings pro...

How to Apply For Medicare in Georgia

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.You apply for M...

How to apply for medicare in Georgia?

You apply for Medicare in Georgia as you would in any state: by visiting your local Social Security Administration office, registering online, or enrolling over the phone. Visit the Social Security website. Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday, 7AM to 7PM.

How many Medicare Supplement Plans are there in Georgia?

Most states (including Georgia) can offer up to 10 Medicare Supplement plans. Each plan is labeled by a letter, such as Plan G. The plan benefits are standardized, meaning that Plan G coverage is the same no matter where you purchase it, but the price of a plan may be different from one insurance company to another.

What is Medicare Advantage?

Alternatively, you can choose Medicare Advantage (available through private Medicare-approved insurance companies), which must offer everything that’s covered under Part A and Part B (except for hospice care), and may include other benefits such as routine dental services and prescription medication coverage.

What is GeorgiaCares?

Georgia State Health Insurance Counseling and Assistance Program: GeorgiaCares is a volunteer-based program that provides information to Medicare beneficiaries and their caregivers. These services are complimentary and supported in part by a grant from the Center for Medicare and Medicaid Services.

Does Medicare Supplement cover gaps?

Medicare Supplement plans are insurance policies that may be purchased to cover “gaps” in Part A and Part B coverage like premiums, deductibles, copayments, and coinsurance.

What is the number to call for Social Security?

Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778) , Monday through Friday, 7AM to 7PM. If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772 (TTY users call 312-751-4701), Monday through Friday, 9AM to 3:30PM.

Does Medicare Part D cover prescription drugs?

Not every plan may be available in each county, and costs may vary. Again, you may want to make sure the plan you choose covers any medications you’re taking.

What are the requirements for Medicaid in Georgia?

The basic GA Medicaid requirements all applicants must meet in order to qualify for Medicaid are the following: Applicants must be residents of Georgia. Applicants must be either citizens of the United States or legal residents of the United States. Applicants must be classified as low-income and fall within the income limit established by ...

How long does Medicaid last in Georgia?

The newborn health care assistance lasts for 13 months, or within the first month the baby is born until right after he or she turns one year of age.

What age do you have to be to qualify for medicaid?

Therefore, if an adult is between the ages of 19 and 65, he or she will need to meet additional qualifications beyond having a low income. Anybody who meets Medicaid income requirements and is between 19 and 65 years old must also be pregnant, disabled or blind to qualify for benefits.

What is the income limit for Medicare?

Qualified Medicare Beneficiary (QMB): The income limit is $1,064 a month if single or $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if an enrollee owes them – it also pays for their Part A premiums.

What is the maximum home equity for Medicaid?

In 2020, states set their home equity limits based on a federal minimum home equity interest of $595,000 and a maximum of $893,000.

What is Medicare Savings Program?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In Washington, D.C., this program pays for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary (QMB): The income limit is ...

Does Georgia have Medicaid?

Medicaid fills the gap in Medicare coverage for long-term care, but its complex eligibility rules can make qualifying for benefits difficult. What’s more – eligibility rules vary significantly from state to state. Georgia uses a “ special income limit ” for Medicaid nursing home benefits and HCBS.

What is Medicaid spend down?

When an applicant is approved for the spend-down, Medicaid calculates the portion of their monthly income above the income limit (known as “excess income”). Enrollees activate their spend-down coverage by showing they have medical bills equal to this excess income.

How much can a spouse keep on Medicaid?

If only one spouse needs Medicaid, the other spouse is allowed to keep up to $128,640. Certain assets are never counted, including many household effects, family heirlooms, certain prepaid burial arrangements, and one car. Nursing home enrollees cannot have more than $595,000 in home equity. Back to top.

When can you recover Medicaid?

States are required to attempt to recover Medicaid’s payments for long-term care related costs beginning at the age of 55. States can choose to also recover all other Medicaid benefits. This is called estate recovery.

What is Medicaid in Georgia?

Georgia Medicaid Definition. Medicaid is a wide-ranging, jointly funded state and federal medical assistance program for low-income people of all ages. Many groups of people are covered, including children, families, and pregnant women, but on this page, the focus will be on Medicaid eligibility for Georgia senior residents ...

What is CSRA in Medicaid?

This, in Medicaid speak, is referred to as the Community Spouse Resource Allowance (CSRA). As with the income allowance, the asset allowance is not relevant for non-applicant spouses of those applying for aged, blind and disabled Medicaid.

How to contact DCFS?

Contact information can be found here. Alternatively, one can call DCFS at 1-877-423-4746. Medicaid applicants can complete the application process online at Georgia Gateway. Finally, local Area Agency on Aging offices can also provide Medicaid program information and assist with the application process.

What is institutional nursing home?

1) Institutional / Nursing Home Medicaid – is an entitlement, which means anyone who is eligible will receive assistance. Benefits are provided only in nursing homes. 2) Medicaid Waivers / Home and Community Based Services (HCBS) – there is an enrollment cap. This means the state limits the number of participants.

Does the stimulus check count as income?

Covid-19 stimulus checks (previous and subsequent) do not count as income and do not impact Medicaid eligibility. When only one spouse of a married couple is applying for nursing home Medicaid or a HCBS Medicaid waiver, only the income of the applicant is counted.

What are countable assets?

Countable assets include cash, stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable).

What is NFLOC in nursing home?

A nursing facility level of care (NFLOC) is required for nursing home Medicaid and for home and community based services via a waiver. Furthermore, some waiver program benefits may have additional eligibility requirements specific to the particular benefit.