Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How do you qualify for Medicare savings program?

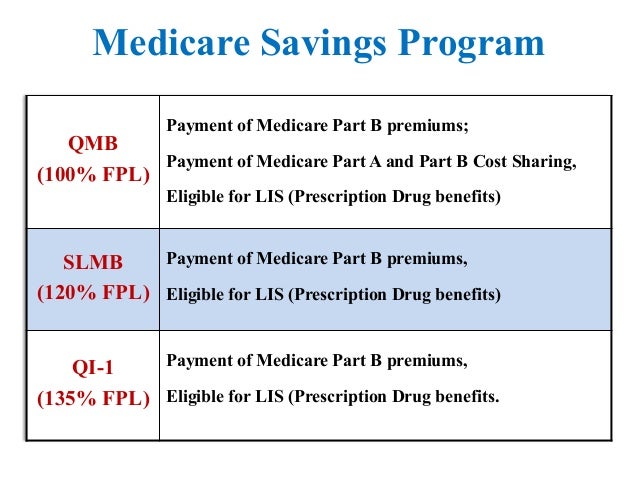

The Medicare Savings Programs (MSPs) are a set of benefits that are administered by state Medicaid agencies and help people pay for their Medicare costs. MSPs are divided into several programs: The Qualified Medicare Beneficiary (QMB) Specified Low-Income Medicare Beneficiary (SLMB) Qualifying Individual (QI) Qualified Disabled Working Individual (QDWI)

What is the income limit for Medicare savings program?

Participants must meet certain income and resource levels and have Medicare Part A to qualify. If requirements are met, Medicare and state Medicaid programs work together to provide assistance through Medicare Savings Programs. There are four different Medicare Savings Programs. Each has a unique income and resource eligibility limit.

Can Medicare take my savings?

Jun 23, 2021 · Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a...

What are the benefits of Medicare savings program?

How to Apply to the Medicare Savings Program. To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs …

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

Do you have to have limited resources to qualify for an MSP?

In addition to the income limits, you must have limited resources to qualify for an MSP.

Does QMB pay for Part A?

A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium.

Key Takeaways

Wondering how to get help with Part A & B costs? You may qualify for the Medicare Savings Programs (MSPs).

What are Medicare Savings Programs?

These are Medicaid-administered benefits that help cover Medicare premiums and out-of-pocket costs, such as deductibles and coinsurance. Who qualifies for Medicare Savings Programs? MSPs are available for Medicare beneficiaries with limited incomes and resources who do not qualify to be fully enrolled in Medicaid.

What is the income limit for Medicare Savings Programs?

It depends. The four programs are listed below, along with what each one pays for and the income and resource level limits that must be met to qualify. If you want to know, “Do I qualify for Medicare Savings Programs?”, this chart can provide an answer*.

Get help with Part D Prescription Drug Costs

Does Medicare pay for prescriptions? Yes— Medicare Part D is available to help cover the cost of prescription drugs. This benefit is offered through private, Medicare-approved plans. Most people enrolled in a Part D plan have out-of-pocket expenses.

What is Extra Help from Medicare?

Extra Help is a federal program that helps people with limited income and resources pay for their Part D premiums and drug costs. What exactly does Extra Help with Medicare cover? Most people who qualify will pay:

Qualifying for Extra Help with Medicare Costs

You may be wondering, “Am I qualified for Medicare Extra Help?” There are different levels of Extra Help available, depending on income and assets. People with a lower income and fewer assets get more help with their Medicare drug plan costs.

Need help sorting through your Medicare choices?

Are Medicare Advantage plans worth it? Does Medicare cover cataract surgery? What home health care is covered by Medicare? If you have questions and need help navigating your Medicare options, we can help.

What can Medicare save you?

Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

Who funds Medicare savings programs?

These four Medicare savings programs are funded by the federal government but operated by Medicaid in each state:

What to do if medicaid denies application?

If Medicaid denies your application, you may be able to file an appeal. Here are some steps you can take to apply for a Medicare savings program: Familiarize yourself with the kinds of questions you may be asked when you apply. The form is available in multiple languages.

What documents are needed to apply for Medicare?

Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

Why are Medicare benefits created?

These programs were created because not everyone reaches retirement age with the same ability to handle expenses like Medicare premiums, copays, coinsurance, deductibles, and the cost of prescription drugs. In 2018, the U.S. Census Bureau predicted that by 2034, 77 million Americans will be 65 years or older.

How old do you have to be to qualify for QDWI?

To qualify for the QDWI program, you must be disabled, working, and under 65 years old. If you went back to work and lost your premium-free Medicare Part A coverage, and if you’re not getting medical help from your state right now, you may be eligible for the QDWI program. You must enroll each year.

Key Takeaways

Medicare Savings Programs (MSP) help pay the medical costs for Medicare beneficiaries who have limited income and resources.

What Are the 4 Medicare Savings Programs?

There are four Medicare Savings Programs, and each is designed to help adults with different levels of income and resources. If you have Original Medicare (Parts A and B) and have trouble paying your medical bills, one of these four programs may be able to help you:

What Is the Income Limit for the Medicare Savings Program?

Each MSP was created to help different groups of people pay for their Medicare costs. Because of this, each Medicare Savings Program has different income and resource limits you’ll need to meet to qualify. These limits get adjusted each year. For 2021, the Medicare Savings Program income and resource limits are:

Who Is Eligible for Medicare Savings Program?

Remember, what is Medicare Savings Program built to do? MSPs are designed to help people with limited incomes and resources afford Medicare health coverage. Because each MSP is administered at the state level, there may be different qualifying factors based on where you live.

How to Apply to the Medicare Savings Program

To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs and Part D Extra Help. You can also contact a licensed insurance agent, like the ones at GoHealth.

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending on which Medicare Savings Program you qualify for. Just like with income limits, your state may accept your application if your resources are higher than the limits allowed.

Sources

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance.

What is the monthly income for Medicare?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for.

How to apply for MSP?

Before applying for an MSP, you should call your local Medicaid office for application steps, submission information (online, mail, appointment, or through community health centers and other organizations), and other state-specific guidelines. Call your State Health Insurance Assistance Program (SHIP) to find out if you are eligible for an MSP in your state.

What is the Medicare Rights Center?

If you live in New York, the Medicare Rights Center can help you enroll in various Medicare cost-savings programs. Please answer a few questions to see if we can connect you with a trained benefits enrollment counselor.

How long does it take to get a copy of my medicaid application?

If you are at a Medicaid office, ask that they make a copy for you. You should be sent a Notice of Action within 45 days of filing an application. This notice will inform you of your application status.

How long does it take to get a notice of action from Medicaid?

If you do not receive a Notice of Action within 45 days, contact the Medicaid office where you applied.

What to do if you are denied an MSP?

If you receive a denial and are told you do not qualify for an MSP, you have the right to request a fair hearing to challenge the decision.

Does the federal government give free counseling?

Each state offers a State Health Insurance Assistance Program (SHIP), partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How to check if you are eligible for MSP?

To check if they are eligible for an MSP, a person can apply by contacting their state’s Medicaid office.

What is QMB insurance?

The QMB program pays for Medicare Part A and Part B premiums, along with cost-sharing expenses such as deductibles, coinsurance, and copays for people with limited resources and income. Healthcare providers cannot bill an individual who receives QMB benefits, and Medicare pays the provider. However, a person may have a copay for Medicare Part D ...

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How long does it take to get a medicaid card?

Generally, processing an application may take 45 days, and a person can appeal if Medicaid denies their application.

What happens if your income is too high for one program?

If a person’s income is too high for one program, then a different program with a higher income limit may suit them. Each of the four programs has different benefits and eligibility requirements.