There are actually four options to qualify for a Medicare Savings Program:

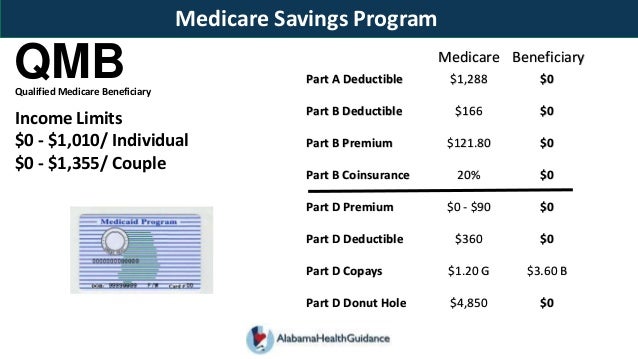

- Qualified Medicare Beneficiary (QMB). QMB pays all of your Part A premiums (if you have them). ...

- Specified Low-Income Medicare Beneficiary (SLMB). SLMB covers your monthly Part B premium. ...

- Qualified Individual (QI). QI covers your monthly Part B premium, but has a slightly higher income limit to qualify. ...

- Qualified Disabled and Working Individual (QDWI). ...

Full Answer

What is the income limit for Medicare savings program?

Medicare Savings Program financial eligibility guidelines © 2022 Medicare Rights Center Helpline: 800-333-4114 www.medicareinteractive.org To qualify for a Medicare Savings Program (MSP), you must meet your state’s income and asset limits. Listed below are the baseline federal income and asset limits for each MSP.

How do you qualify for Medicare savings program?

Who is eligible for Social Security Medicare Savings Program? Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability benefits. People with certain disabilities or permanent kidney failure (even if …

Can Medicare take my savings?

To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs and Part D Extra Help. You can also contact a licensed insurance agent, like the ones at GoHealth.

Who qualifies for Medicare extra help?

Applying for the Medicare Savings Program You may apply using one of the following options: Online at www.washingtonconnection.org Complete a paper application. Forms and publications Medicare Savings Program brochure Application for Medicare Savings Program

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

What is Texas Medicare savings program?

If you are eligible, a Texas Medicare Savings Program (MSP) might be able to help. Medicaid administers MSPs to help people with limited income and resources. These programs help those who qualify to afford Medicare in Texas.

What is the Medicare savings program in NC?

Medicare Savings Programs are special Medicaid programs for people receiving Medicare who have limited income and resources. They are free programs which assist you in paying Medicare premiums and cost sharing amounts.

What is the highest income to qualify for Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Qualifying Individual (QI) policy helps pay your Medicare Part B premium.

What is the income limit for QMB in Texas?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 a month if single and $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if a beneficiary owes them – it also pays their Part A premiums.Oct 4, 2020

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is the income limit for Medicare in NC?

The monthly income limits to be eligible for HCBS in North Carolina are $1,064 (single) and $3,000 (if married and both spouses are applying). In North Carolina in 2020, spousal impoverishment rules allow spouses who don't have Medicaid to keep an allowance of up to $3,216 per month.Oct 4, 2020

What is the income level to qualify for Medicaid in North Carolina?

Who is eligible for North Carolina Medicaid Program?Household Size*Maximum Income Level (Per Year)1$18,0752$24,3533$30,6304$36,9084 more rows

What is the income threshold for Medicaid in NC?

Who is eligible for NC Medicaid/Health Choice?Monthly Income Limits: Medicaid for Infants and Children1$2,254$1,4282$3,049$1,9313$3,843$2,4344$4,638$2,9382 more rows•Apr 2, 2022

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Is Social Security considered income for Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is Social Security Medicare Savings Program?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited inc...

Who is eligible for Social Security Medicare Savings Program?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability...

How do I apply for Social Security Medicare Savings Program?

Once you know which benefits you may be eligible for, go to the Medicare Benefits page to apply online.You may also call your State Medicare Progra...

How can I contact someone?

For more information about Medicare, visit CMS’s Medicare page. Visit SSA's Publications Page for detailed information about SSA programs and polic...

How old do you have to be to get Social Security?

Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability benefits. People with certain disabilities or permanent kidney failure (even if under age 65). Meet standard income and resource requirements.

What are the requirements for MSP?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability benefits. People with certain disabilities or permanent kidney failure (even if under age 65). Meet standard income and resource requirements.

Can a state determine if an individual qualifies for MSP?

Only the state can determine if an individual qualifies for coverage under one of the programs. Many states apply different standards and methods to determine MSP eligibility. Some states, for example, have no resources for these programs or figure the income and resources differently.

Key Takeaways

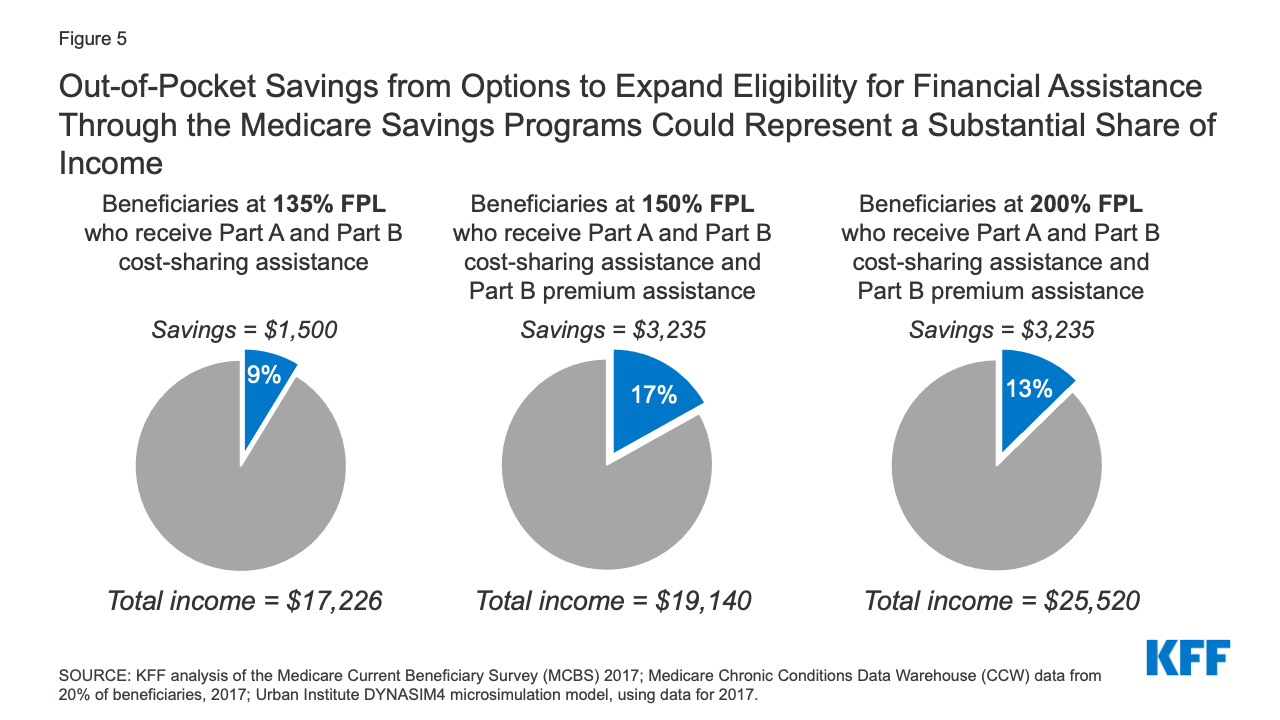

Medicare Savings Programs (MSP) help pay the medical costs for Medicare beneficiaries who have limited income and resources.

What Are the 4 Medicare Savings Programs?

There are four Medicare Savings Programs, and each is designed to help adults with different levels of income and resources. If you have Original Medicare (Parts A and B) and have trouble paying your medical bills, one of these four programs may be able to help you:

What Is the Income Limit for the Medicare Savings Program?

Each MSP was created to help different groups of people pay for their Medicare costs. Because of this, each Medicare Savings Program has different income and resource limits you’ll need to meet to qualify. These limits get adjusted each year. For 2021, the Medicare Savings Program income and resource limits are:

Who Is Eligible for Medicare Savings Program?

Remember, what is Medicare Savings Program built to do? MSPs are designed to help people with limited incomes and resources afford Medicare health coverage. Because each MSP is administered at the state level, there may be different qualifying factors based on where you live.

How to Apply to the Medicare Savings Program

To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs and Part D Extra Help. You can also contact a licensed insurance agent, like the ones at GoHealth.

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending on which Medicare Savings Program you qualify for. Just like with income limits, your state may accept your application if your resources are higher than the limits allowed.

Sources

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

What states have QI?

If you live in any of the following states, please note the differences in program names: 1 Alaska: QI is called SLMB Plus 2 Connecticut: QI is called ALMB 3 Maryland: QI is called SLMB II 4 North Carolina: QMB, SLMB, and QI are called MQB, MQB-B, and MBQ-E, respectively 5 Nebraska: Federal QMB is replaced with full Medicaid; SLMB and QI are both referred to as QMB 6 New Hampshire: QI is called SLMB-135 7 Oregon: SLMB and QI are called SMB and SMF respectively 8 Wisconsin: QI is called SLMB Plus

What is balance billing?

Balance billing refers to the cost for a service that remains after Medicare pays. If you’re a QMB, your providers should not be billing you directly for the balance after Medicare pays them for your service. Yet, if you’re an SLMB or a QI, there is no rule against your doctor’s office sending you a bill for the balance of your service.

What is countable resource?

The term countable resources mean any money in bank accounts (checking or savings), stocks, and bonds. Your home, one car, a burial plot, up to $1,500 already saved for burial expenses, and personal belongings aren’t included when countable resources are considered.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

On this page

The Medicare Savings Program (MSP) can provide assistance with premium costs, copayments, deductibles, and coinsurance for individuals who are entitled to Medicare and meet program requirements.

Information about how to qualify

To find out if you qualify for a Medicare Savings Program (MSP), view the income chart in this brochure.

How often do you need to renew your MSP?

If you are approved, you will need to renew (recertify) your MSP every year. If you do not receive a notice in the mail to recertify, contact your local Medicaid office and ask what you need to do to make sure you receive your MSP benefits in the following year.

How long does it take to get a copy of my medicaid application?

If you are at a Medicaid office, ask that they make a copy for you. You should be sent a Notice of Action within 45 days of filing an application. This notice will inform you of your application status.

How long does it take for a Part B to be paid back?

If you receive an approval : And are found eligible for SLMB or QI, the state will pay your Part B premium starting the month indicated on your Notice of Action. However, it may take several months for the Part B premium ($148.50 in 2021) to be added back to your monthly Social Security check.

What is a QMB on Social Security?

If qualified, you will no longer have this premium amount deducted from your Social Security benefit. Qualified Medicare Beneficiary ( QMB): Pays for Medicare Part A premium for people who do not have enough work history to get premium free Part A. QMB also pays the Part B premium, deductibles and coinsurances.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is Medicare Savings Program?

A Medicare Savings Program can help pay some out-of-pocket costs, including: Your monthly Medicare Part B premium. Prescription drug costs through the Part D Extra Help program, which you automatically qualify for with a Medicare Savings Program.

When will Medicare limits change?

These new limits make more people eligible for these programs. *These amounts may change as of March 1, 2020. **These amounts may change as of January 1, 2021. To see if you qualify for a Medicare Savings Plan, see the Medicare Savings Program application.