There are three main methods that Medicare supplement plan companies use to set their rates. These are community-rated (no age-rated), issue-age-rated (initial age-rated), and attained-age-rated. Even when companies use the same rating method, the actual premiums will likely vary widely between the companies.

Full Answer

What is the average cost of Medicare supplement plans?

Jan 20, 2022 · The best way to get a feel for Medicare Supplement Insurance rates is to compare quotes from insurance companies in your area. You can compare rates from multiple companies for free online in just a few steps. Compare Medicare Supplement Insurance plans in your area. Find a plan Or call 1-800-995-4219 to speak with a licensed insurance agent.

What are the top 5 Medicare supplement plans?

May 06, 2022 · AM Best 2021 rating: A+. Medigap plans offered: A, F, HD-F, G and N. Also offers Medicare Part D for prescription drug coverage. In business for over 100 years, Mutual of Omaha offers coast-to ...

What is the best Medicare supplement insurance plan?

Dec 06, 2021 · Because Medicare Supplement Insurance plans are sold by private insurance companies, plan rates will vary from one market to the next. In 2018, the average monthly premium rate of Medigap Plan G in New York was $304 per month. In the same year, the average monthly cost of Medigap Plan G in Iowa was only $102. 1.

How much do Medicare supplements increase each year?

Feb 26, 2020 · How to choose the best Medicare Supplement plan. The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month. The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where …

How do you rate Medicare plans?

What are the top 3 most popular Medicare supplement plans in 2021?

- Blue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ...

- AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ...

- Humana.

What are the top 3 Medicare supplement plans?

What is the highest rated supplemental insurance?

- Best Overall: Mutual of Omaha.

- Best User Experience: Humana.

- Best Set Pricing: AARP.

- Best Medigap Coverage Information: Aetna.

- Best Discounts for Multiple Policyholders: Cigna.

What is the deductible for Plan G in 2022?

Is it better to have Medicare Advantage or Medigap?

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan F and Plan G?

Do Medigap premiums increase with age?

Who is the largest Medicare supplement provider?

How do I choose a good Medigap plan?

What is the average cost of supplemental insurance for Medicare?

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

Does Medigap offer discounts?

Some insurance companies may offer Medigap plan discounts for women, non-smokers, married couples, those who pay their premium for the entire year and more. Be sure to ask your plan provider if they offer any discounts before you sign up for a Medigap plan.

How do insurance companies determine their rates?

Insurance companies use different pricing structures to determine rates 1 Community-rated plans charge the same rate for every plan member, regardless of age. For example, a 75-year-old Medigap beneficiary with a community-rated plan will pay the same rate as a 65-year-old beneficiary with the same plan. 2 Issue-age-rated plans have rates based on the age at which you purchased the plan. Your premium rate will be fixed and it won’t change as you age. While your initial Medigap rate could be higher than a community-rated plan, it could potentially cost less in the long term. 3 Attained-age-rated plans have rates that increase as you age. As you get older, your Medigap rate will gradually go up.

Is Plan F available for 2020?

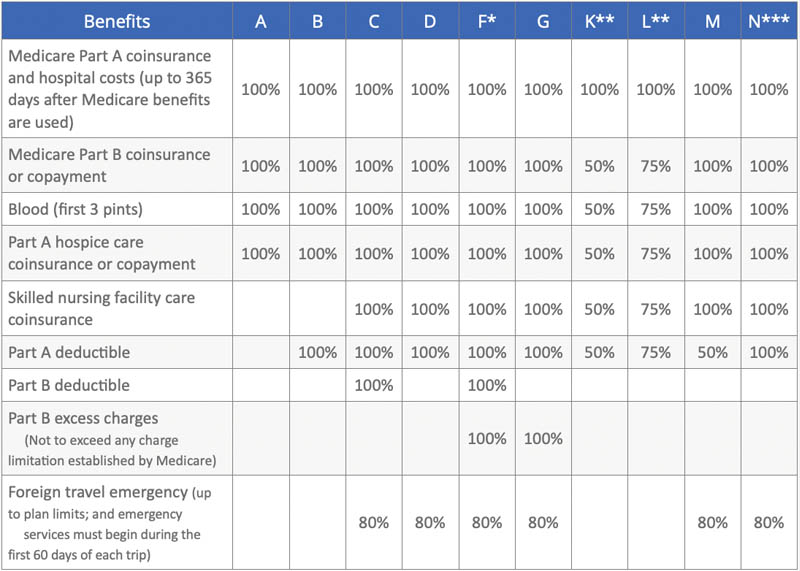

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

Is United Medicare Advisors a good company?

United Medicare Advisors has an excellent reputation. The company enjoys accreditation and an "A+" rating from the Better Business Bureau. Also, we found more than 20,000 5-star ratings from customers who appreciate their quality service and significant savings over other brokers. Clients said that the information they received was thorough and genuinely focused on their individual circumstances, not on pushing a particular service or plan. People also praised the friendly, helpful reps and describe their experiences as being quick, easy, and a perfect match for their insurance needs.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Does United Medicare Advisors offer online quotes?

So, while United Medicare Advisors does not show you an online quote, they absolutely deliver the goods with the lowest priced Medicare Supplement Plans we found. This is because of their vast access to both the bigger names in the industry as well as smaller, reputable companies you might not have heard of before.

Is Aetna a good provider of Medicare Supplement?

Strong choice. While it's up to you to determine if you want to purchase your Medicare Supplement Plan directly from Aetna or through a broker that offers additional services, you can be assured that Aetna is likely to give you one of the lowest premiums. Aetna is a trustworthy provider of Medigap plans. See Plans.

Is Medicare Supplement Insurance the only alternative?

Medicare Supplement Insurance isn’t the only alternative available for beneficiaries who are worried about covering those out-of-pocket costs remaining after Medicare pays its share. Medicare Advantage plans, also known as Medicare Part C, are health plans issued by a private insurer that cover your Medicare Part A and Part B benefits.

Does Massachusetts have Medicare Supplement?

Medicare Supplement Plans in Massachusetts. Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan. Both plans cover basic benefits:

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

Is it important to compare Medicare Supplement Plans?

There are a lot of Medicare Supplement Plans available, so it’s important to compare the same plan across multiple companies. For example, if you’re looking at Plan C, compare Plan C plans across multiple insurance companies. Here are a few questions to ask when shopping around:

What factors influence Medicare Supplement Plan premiums?

Some of these are discounts, medical underwriting, high deductible plan options, what state you live in, and extra coverages offered by the company .

When will Medicare be available in 2021?

July 9, 2021. Medicare plans themselves, specifically Medicare Part A and Medicare Part B, have premiums set by the government. However, Medigap, or Medicare Supplement plans, have rates that are different as they are offered by authorized private insurance companies and have different coverages available. Source: Getty.

Is Medicare Supplement overrated?

As noted above, Medicare Supplement rate increase history is highly overrated based on the following features: Rate increase history does not dictate future rate increase. Most insurance companies are only in the market for a few years and their increases are not enough data to make a reasonable determination.

What is a claim experience rate increase?

Claims experience rate increase are based on the claims that an insurance company receives in a year vs what the collect in premiums from their clients within a specific group.

How to evaluate insurance companies?

They best way to evaluate a company boils down to four things: 1 Rate – Does the insurance company charge closer to the lower end of the market or the higher end? 2 Customer Service – You want an insurance company that provides great service to its members with a team that is knowledgeable about their products and responds quickly when you contact them. 3 Time in Market – Personally, I don’t offer companies with less than four years of market history. Most of the companies that I offer have at least 20 years in the Michigan Medicare Supplement market. They tend to have better claims experience and are managed for long term stability. 4 The Agent – The truth is if you’ve been with a Medicare Supplement company for more than 5 years, there tends to be a better rate for you. You should work with an insurance agent that keeps an eye on your policy after your purchase one and is available after the sale for customer service questions.

Who is Travis Price?

Travis Price is a licensed Health and Life Insurance agent that specializes in Medicare insurance programs and Life Insurance. He comes from Traverse City, MI where he resides with his wife, two dogs, and two cats. At any moment, he knows his pets can overthrow he and his wife; taking over the household.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.