When looking at Medicare fee schedules, be sure that you are using the most up-to-date listing. For example, the MPFS is updated quarterly by CMS. Once you have found the correct fee schedule on the CMS website, go to the overview page of the MPFS look-up tool, found here. This section has a step-by-step selection process and the user can customize different searches.

Full Answer

What is the Medicare physician fee schedule?

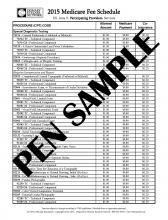

The Medicare fee schedule defines the maximum amount that Medicare will reimburse for a service. The Medicare fee schedule is part of Medicare and pays for physician services based on a list of more than 7,000 unique codes. Not every code will have a reimbursement amount. CMS categorizes services as primary and secondary services.

How to calculate fee schedule?

Why doctors resist raising fees

- Uncertainty. Many doctors neglect to update their fees because they are uncertain how frequently they should and/or how to do it.

- Patient attitudes. Patients tell us every day how expensive our fees are, and we know that for the average family, dentistry can be a significant expense.

- Fear of nonacceptance. ...

- Lack of control. ...

What is the Medicare allowable?

allowable charge) if Medicare had processed the claim, and you are responsible for paying the remainder of the billed charges. U.S. Department of Veterans Affairs (VA) VA providers cannot bill Medicare and Medicare cannot pay for services received from the VA. If you are eligible for both TFL and VA benefits, you

What is Medicare schedule D?

- Biggest Medicare changes for 2022

- Medicare proposes limited coverage of controversial new Alzheimer's drug

- AARP interview: new Medicare chief outlines her vision

How does the Medicare fee schedule work?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

How do I find my Medicare fee schedule?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

How are fee schedules determined?

Most payers determine fee schedules first by establishing relative weights (also referred to as relative value units) for the list of service codes and then by using a dollar conversion factor to establish the fee schedule.

What does LC mean in Medicare fee schedule?

Limiting chargeLimiting charge - The maximum amount that non-participating providers may bill their Medicare patients on non-assigned claims. The limiting charge is equal to 115 percent of the non-participating allowance.

Is the 2021 Medicare fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

What's a fee schedule?

fee schedule (plural fee schedules) A list or table, whether ordered or not, showing fixed fees for goods or services. The actual set of fees to be charged.

What are the types of fee schedules?

In general, there are typically three levels of fee schedules: Medicare, Medicaid, and Commercial. The different levels of fee schedules offer varying levels of payment rates to the physician and are determined separately by the various involved parties.

What are Medicare Part B payments based on and how is the allowable charge calculated?

What are the Medicare Part B payments based on, and how is the allowable charge calculated? It is based on diagnosis- related group (DRG's), they determine appropriate reimbursement.

What does PC TC indicator 3 mean?

CPT or HCPCS codes assigned a CMS PC/TC Indicator 3 are identified as standalone codes that describe the technical component (i.e., staff and equipment costs) of selected diagnostic tests for which there is an associated code that describes the professional component of the diagnostic tests only.

What does PC TC indicator 1 mean?

Diagnostic TestBased on the CMS PC/TC indicators, UnitedHealthcare considers the Technical Component to be a service or procedure that has a: • CMS PC/TC Indicator 1 (Diagnostic Test), and is reported with modifier TC; or • CMS PC/TC Indicator 3 (Technical Component Only Codes) and is reported without modifier TC.

What does PC TC indicator 7 mean?

Modifier TC cannot be used with these codes. The total RVUs for laboratory physician interpretation codes include values for physician work, practice expense, and malpractice expense. 7: Physical therapy service, for which payment may not be made.

What is Medicare fee schedule?

The organization that manages the Medicare program, Centers for Medicare & Medicaid Services (CMS), describes the Medicare fee schedule as a comprehensive list of maximum fees used by Medicare to reimburse physicians, other healthcare providers and suppliers.

What percentage of Medicare deductible do you pay when you visit a doctor?

After meeting the Part B deductible, patients will usually pay 20% of the Medicare-approved amount for most services delivered by a physician.

What is AFS in Medicare?

The Ambulance Fee Schedule (AFS) is a national fee schedule for ambulance services provided as part of the Medicare benefits under the provisions of Part B. These services include volunteer, municipal, private, independent and institutional providers as well as skilled nursing facilities.

When is the Medicare Physician Fee Schedule Final Rule?

The Medicare Physician Fee Schedule Final Rule for the calendar year of 2020 has been displayed at the Federal Register since November 1, 2019. It includes payment policies, rates and other elements for services provided under the Medicare Physician Fee Schedule (MPFS).

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the 2021 Medicare PFS final rule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the CY 2020 PFS final rule?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

Why is Medicare fee higher than non-facility rate?

In general, if services are rendered in one's own office, the Medicare fee is higher (i.e., the non-facility rate) because the pratitioner is paying for overhead and equipment costs. Audiologists receive lower rates when services are rendered in a facility because the facility incurs ...

What is the Medicare Physician Fee Schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor (relative value unit or RVU) is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the (a) professional component (i.e., work as expressed in the amount of time, technical skill, physical effort, stress, and judgment for the procedure required of physicians and certain other practitioners); (b) technical component (i.e., the practice expense expressed in overhead costs such as assistant's time, equipment, supplies); and (c) professional liability component.

Why do audiologists get lower rates?

Audiologists receive lower rates when services are rendered in a facility because the facility incurs overhead/equipment costs. Skilled nursing facilities are the most common applicable setting where facility rates for audiology services would apply because hospital outpatient departments are not paid under the MPFS.

What are the two categories of Medicare?

There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program.

Does Medicare pay 20% co-payment?

All Part B services require the patient to pay a 20% co-payment. The MPFS does not deduct the co-payment amount. Therefore, the actual payment by Medicare is 20% less than shown in the fee schedule. You must make "reasonable" efforts to collect the 20% co-payment from the beneficiary.

Do non-participating providers have to file a claim?

Both participating and non-participating providers are required to file the claim to Medicare. As a non-participating provider you are permitted to decide on an individual claim basis whether or not to accept assignment or bill the patient on an unassigned basis.

Can speech therapy be provided at non-facility rates?

Therapy services, such as speech-language pathology services, are allowed at non-facil ity rates in all settings (including facilities) because of a section in the Medicare statute permitting these services to receive non-facility rates regardless of the setting.

How to determine payment rate for a service?

To determine the payment rate for a service, CMS systems multiply the sum of the geographically adjusted RVUs by a CF in dollars. The statute specifies the formula by which the CF is updated on an annual basis.

Why does Medicare adjust each of the 3 RVUs?

Medicare adjusts each of the 3 RVUs to account for geographic variations in the costs of practicing medicine in different areas of the country. Each kind of RVU component has a corresponding GPCI adjustment.

What is a CMS 460?

s enrolled in Medicare and signed the Form CMS-460, Medicare Participating Physician or Supplier Agreement, agreeing to charge no more than Medicare-approved amounts and deductibles and coinsurance amounts. Participating professionals and suppliers submit assigned claims.

When did Medicare PFS change?

Effective January 1, 2017, the Medicare Access and CHIP Reauthorization Act of 2015 repealed the previous formula to update the Medicare PFS and replaced it with several years of increases to overall payments for PFS services. In conjunction with that change, the law created the QPP, which rewards the delivery of high-quality and cost-ecient beneficiary care.

How to change search criteria?

If you wish to change the search criteria, type in a new code or other factor at the top of the page and then click on Search fees. To download, or copy the link for your search results, select 1 of these options below the Search Results table.

Key Takeaways

The Physician Fee Schedule Look-up Tool provides a way to easily search services covered by the Medicare Physician Fee Schedule.

Example 1

To start your search by visiting this website and click on “ Begin Search ”: https://www.cms.gov/medicare/physician-fee-schedule/search/overview

Example 2

Let’s start a new search. This time we are going to look up two HCPCS codes, one for individual DSMT, which is G0108, which is also billed in 30-minute increments, and then we will keep group DSMT, which is G0109 .

What is a CMS 460?

in Medicare and have signed the Form CMS-460, “Medicare Participating Physician or Supplier Agreement,” agreeing to charge no more than Medicare approved amounts and deductibles and coinsurance amounts. Participating professionals and suppliers submit assigned claims.

Does Medicare accept CMS 460?

Medicare but have decided not to sign the Form CMS-460. They accept assignment on a case-by-case basis. For services paid under the MPFS, there is a 5 percent reduction in the Medicare approved amounts for nonparticipants, and there is a limit on what the health care professional/supplier may charge the beneficiary (LIMITING CHARGE).

Is CPT a trademark?

CPT is a registered trademark of the American Medical Association. Applicable FARSDFARS Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use.

Who is paid under MPFS?

In addition, suppliers such as Mammography Centers are paid according to the MPFS. Institutional providers such as hospitals, Comprehensive Outpatient Rehabilitation Facilities (CORFs), and Skilled Nursing Facilities (SNFs) are paid for some services under the MPFS depending on the institution type and service.

Do multiple endoscopy procedures apply to the same family?

The multiple endoscopy rules apply to a family before ranking the family with other procedures performed on the same day (for example, if multiple endoscopies in the same family are reported on the same day as endoscopies in another family or on the same day as a non-endoscopic procedure).