- Check your timing. "Timing is one of most important decisions a person can make," says Diane Omdahl, co-founder and president of 65 Incorporated. ...

- Learn about your options. ...

- Look closely at prescription drug coverage. ...

- Pick your plan. ...

- Enroll.

How do I decide what Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Is there a site that compares Medicare plans?

The plan comparison tool on Medicare.gov and some private comparison sites allow you to enter your regular prescriptions to help determine plan coverage and cost.

What insurance company has the best Medicare plans?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Who can help me choose a Medicare Advantage plan?

Get Extra Help Get personalized help with choosing a Part D or Medicare Advantage plan from your local State Health Insurance Assistance Program (SHIP). Go to shiptacenter.org or call 800-633-4227 for local contacts.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Blue Cross Blue Shield Medicare?

BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options. Though quality and costs vary by company and by specific plan within those companies, most BCBS plans offer decent value and benefits across a range of health plan options.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Medicare Plan Finder Tool?

The Medicare Plan Finder Tool will let us search for Medicare Advantage plans in your county based on your preferences. Some people prefer Medicare HMO plans for the lowest premiums. Others prefer Medicare PPO plans because they are more flexible and have out of network benefits if needed.

Is Medicare Supplement the same as Medicare Advantage?

You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan. They are not the same – in fact, they work very differently.

What are the two types of Medicare?

There are two types of Medicare plans: Original Medicare and Medicare Advantage. According to Medicare.gov, Original Medicare is a government-provided, fee-for-service plan that is made up of two parts: Part A is hospital insurance and Part B is medical insurance.

What is Medicare Advantage?

Medicare Advantage is a plan offered by a private insurance company that contracts with Medicare. These plans include Part A and Part B coverage, and may be set up as an HMO, PPO, fee-for-service or other type of plan. They typically include prescription drug coverage and may offer vision, dental and other services. [.

What is the difference between Medicare Part A and Medicare Part B?

Original Medicare comprises two parts: Medicare Part A, which provides coverage for most costs related to hospital stays , and Medicare Part B, which covers doctor visits, lab work, outpatient services and preventive care. Part A is free to most people who qualify ...

How much is Medicare Advantage premium?

The Centers for Medicare and Medicaid Services (CMS) says the average Medicare Advantage premium is expected to be about $30 a month for 2018, a slight dip from 2017. CMS also is predicting that enrollment in MA plans will reach an all-time high next year of 20.4 million people.

When did Medicare Part C start?

So in 1997 it created Medicare Part C, or what is known today as Medicare Advantage plans.

How much does Medicare cover for hospital stays?

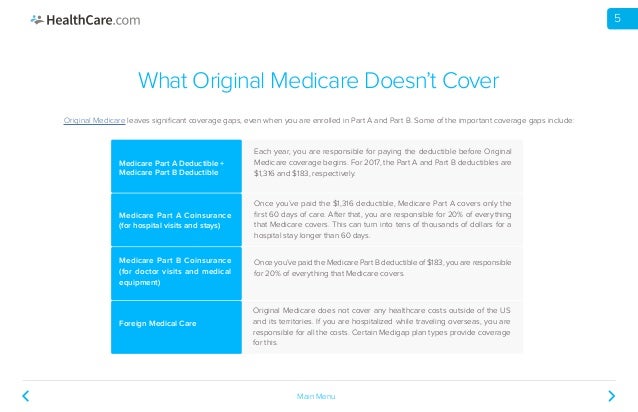

There are many other costs you need to cover under Medicare. For example, Medicare Part A covers 100 percent of the first 60 days of a hospital stay. But for original Medicare enrollees, you must cover a deductible for each hospital stay. In 2017 that deductible was $1,316.

What happens if you don't enroll in Part D?

If you choose not to enroll in Part D when you're first eligible, you likely will pay a penalty when you do sign up, unless you’ve had creditable drug coverage from another source. One challenge: Part D plans vary widely. For example, two plans may have very different copays for the same drug.

Do health care needs change as you age?

But the decision isn’ t just financial; your health care needs and preferences often evolve as you age. As your needs change, you might be better off with different coverage. People do change each year, and more probably should.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

What is Medicare tier?

Look at Medicare drug plans with “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions.

What is a low monthly premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

What to do if you have Medicare Advantage?

If you have a Medicare Advantage plan, review the types of medical care you received over the past year, and try to predict the types of care you’ll receive in 2019.

How does Medicare Plan Finder work?

The Medicare Plan Finder will reveal how much you’re likely to pay for premiums plus co-payments over the year. Likewise, if you’re shopping for a Medicare Advantage plan instead, look carefully at plans’ coverage and co-payments for the types of medical care you usually use.

When will Medicare open enrollment start?

Even if your current coverage isn’t changing, it’s still a good idea to compare all of your options during open enrollment, and a great way to do this is with the Plan Finder at Medicare.gov, which posted details about all of the 2019 plans starting on October 1.

Is Mutual of Omaha part D?

Or new plans may be introduced in your area that are a better match for you. Mutual of Omaha is entering the Part D market in several states, for example, and more insurers are introducing prescription drug plans or Medicare Advantage plans with lower premiums. Because you can change plans every year, you can focus specifically on your drugs ...

How much does Medicare Advantage cost?

The average Medicare Advantage premium is about $30 per month, but some plans have $0 premiums because they may have some of the smallest provider networks and generally require higher co-payments for doctor’s visits, hospital stays and other types of care. Sponsored Content. Read:

Does Medicare Advantage cover hearing aids?

With Medicare Advantage, some plans offer coverage that traditional Medicare doesn’t , such as for vision and dental care or hearing aids. Compare the value of those extras. One of the biggest trends in Part D prescription-drug plans is for insurers to offer low-premium policies with preferred pharmacies.

How much is Part D insurance?

The average Part D premium for 2019 will be $32.50 per month. That’s actually $1 less than 2018’s average, primarily because several large insurers are offering low-premium plans (sometimes less than $20 per month) with preferred pharmacies. (More on preferred pharmacies in a moment.)

Can you sign up for Medicare if you are retired?

Yes. Medicare enrollment periods can be confusing. They can differ depending on when you retire and by different types of Medicare. You really need to understand the signup windows so you’re not pressured to make a decision at the point of a gun, figuratively speaking.

Is Medicare Advantage more expensive than Original?

There are several issues. One is money. Original Medicare is going to be more expensive. Medicare Advantage is going to be less expensive and it often covers things that Original Medicare does not; some of these plans have vision, dental and hearing coverage. Some have zero premiums for people of modest means.

Does Medicare cover snowbirds?

But you also need to look at your health care needs and lifestyle preferences to make a decision. If you travel a lot or you’re a snowbird, Medicare Advantage plans often won’t cover you when you’re out of your geographic area.

Does Medicare cover travel?

Consider these questions and how often you’ll need to see providers or get prescriptions filled while traveling. In most cases, Original Medicare won’t cover your care while you’re outside the United States, so be sure you understand your options. Learn about traveling with Medicare.

What is premium health insurance?

Health insurance terms to know. Premium: The amount that you pay for your health plan. You usually pay it monthly, quarterly or yearly. Deductible: The amount you pay for covered health care services before your health plan starts to pay.

Do all health plans use providers?

All health plans use provider networks, and you’ll save money when you use providers in your plan’s network. That’s because we’ve negotiated discounted prices with our in-network providers—so they charge less when they treat our members.

What is a copay?

Copay: A fixed amount ($15, for example) you pay for a covered health care service, usually when you receive the service. Coinsurance: Your share of the costs of a covered health care service. For most care, you pay any deductibles before coinsurance kicks in.

What are the different types of Medicare Advantage plans?

The four most common types of Medicare Advantage plans are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs*), Private Fee-For-Service Plans (PFFs) and Special Needs Plans (SNPs). You may already be familiar with some of these plan types by having a similar plan sponsored through your employer.

Does Medicare Advantage cover hospice?

Medicare Advantage is required to cover everything that Original Medicare covers, which the exception of hospice care, which Part A still covers. When choosing a Medicare Advantage plan you may have many options for plan type, coverage and cost. Keep in mind that not all Medicare Advantage plans are available in all areas.

What is an HMO?

HMO (Health Maintenance Organization ): generally requires you to select a primary care doctor and get a referral to see a specialist. You’re generally not covered for services you receive outside the plan’s network of Medicare providers.

Does Medicare cover dental?

Medicare Part A usually only covers emergency or complicated dental procedures. Other coverage a Medicare Advantage plan may provide that Medicare Part A and Part B usually do not cover: Routine hearing services and hearing aids. Routine eye exams and eyewear. Fitness programs.

What is SNP in Medicare?

SNP: A Special Needs Plan is for people in certain circumstances , such as people in a nursing home or people with a severe or disabling chronic condition. The plan may tailor the benefits to the needs of the people it serves. Read more about different types of Medicare Advantage plans.

What is a copayment?

Copayment or coinsurance. A copayment is usually a set dollar amount, for example, $45, that you must pay when you receive a specific medical service. Coinsurance is a different kind of cost-sharing. It’s a percentage (such as 20%) of the total cost of a doctor visit.

What is the benefit of Medicare Advantage?

This is a maximum amount that you pay in a year before the plan begins to pay 100% of your health-care costs. If you expect to use medical services a lot, you may want to pay close attention to your plan’s out-of-pocket maximum.