- Have Medicare Surcharges Reassessed. Most people pay a standard rate for Medicare. If you’re a high-income taxpayer, you pay more. ...

- Get Medicare Advantage Part B Premium Reduction. Everyone must pay a premium for Part B. Some advantage plans have a built-in premium reduction. ...

- Get a Medicare Low-Income Subsidy. Many people don’t realize there’s a subsidy available to reduce Part D premiums and out of pocket costs for medications.

- Deduct Medicare Premiums from Your Taxes. You can deduct certain medical expenses on your tax return. Deductible medical expenses include premiums you paid for Parts B, D, and Medicare Advantage.

- Use Your HSA to Pay Your Medicare Premiums. If you have money in a health savings account, you can use it to pay your Part B, Part D, or Medicare ...

- File a Medicare IRMAA Appeal. ...

- Pay Medicare Premiums with your HSA. ...

- Get Help Paying Medicare Premiums. ...

- Low Income Subsidy. ...

- Medicare Advantage with Part B Premium Reduction. ...

- Deduct your Medicare Premiums from your Taxes. ...

- Grow Part-time Income to Pay Your Medicare Premiums.

How can I reduce my Medicare premiums?

Those eight events are:

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage (Retirement)

- Work Reduction (Partial-Retirement)

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment (if your employer went through bankruptcy or reorganization that caused your income to change)

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

How to stop Medicare deduction?

- Qualified Medicare Beneficiary Program (QMB). Helps to pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. ...

- Specified Low Income Medicare Beneficiary Program (SLMB). Helps to pay premiums for Part B. ...

- Qualified Individual Program (QI). ...

- Qualified Disabled and Working Individuals Program (QDWI). ...

How to appeal a higher Medicare Part B premium?

There are 7 qualifying life-changing events:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

How can I reduce my Medicare spending?

Expand Bundled Payments and Promote New Payment Models – $5 billion to $50 billion. ... Reduce Preventable Readmissions and Unnecessary Complications – Up to $10 billion. ... Reduce Payments to Post-Acute Providers – $25 billion to $75 billion.More items...•

How do I get Medicare Part B reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

How do I get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Why am I paying so much for Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why is Medicare Part B so expensive?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What is Part B premium reduction mean?

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

What does Part B give back mean?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

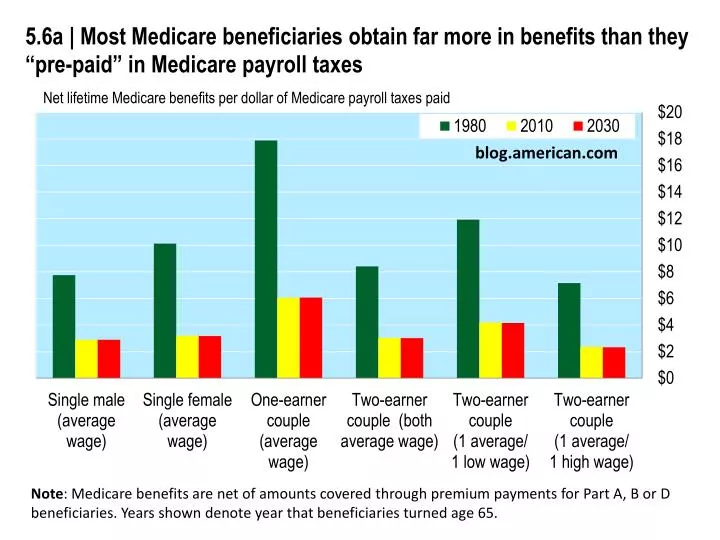

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

What is the penalty for not having Medicare in 2020?

As such, if you go 15 months without coverage, you'll face a penalty of $4.90 per month in 2020. 3. Secure tax-free retirement income. The standard monthly premium for Part B in 2020 is $144.60. But if you're a higher earner on Medicare, you'll pay even more.

What is the surcharge on my insurance premiums?

Once your income exceeds $87,000 as a single tax filer, or $174,000 as a joint filer, you'll be subject to what's known as an IRMAA (income-related monthly adjustment amounts) surcharge on your premiums, the exact amount of which will depend on what your earnings look like. On the other hand, if you're able to lower your income enough to avoid ...

How long does Medicare Part B last?

Your initial window to enroll in Medicare spans seven months. It begins three months before the month of your 65th birthday, and it lasts for three months following that month. If you don't enroll during that initial period, you can sign up at a later point in time -- but you might pay more.

How long do you have to enroll in Medicare?

In that case, you get a special eight-month enrollment period to sign up for Medicare that begins once you separate from your employer, or once your group coverage goes away -- whichever happens sooner. As long as you enroll during that eight-month window, you'll avoid a Part B penalty. 2. Don't go too long without Part D coverage.

How much is the penalty for not paying Part B?

For each 12-month period you go without Part B coverage upon being eligible, you'll be charged a 10% penalty on your Part B premiums that will remain in effect permanently. As such, it really pays to sign up on time. IMAGE SOURCE: GETTY IMAGES.

Do you pay less for Medicare Part B?

On the other hand, if you're able to lower your income enough to avoid that surcharge, or lower it enough to put yourself in a lower surcharge tier, you'll pay less for Part B. A good way to go about that is to line up tax-free income sources that won't raise your earnings threshold for Medicare premium surcharges.

Is Medicare Part A free for seniors?

Seniors on Medicare know all too well that the costs associated with it can be burdensome. While Medicare Part A, which covers hospital care, is usually free for enrollees, Parts B and D, which cover preventive/outpatient care and prescriptions, respectively, and comprise the remainder of seniors' coverage under original Medicare, ...

How to lower Medicare payments

Each year, the Social Security Administration determines IRMAA, taking into consideration the most recent tax return available.

What is Medicare?

Those age 65 and older are eligible for Medicare, which is a federal health insurance program.

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.

When to convert Roth IRA to Medicare?

Floyd recommends planning ahead by doing Roth IRA conversions early — preferably by age 63 (or two years before starting Medicare if you’re staying on an employer plan after age 65) so the conversion income won’t trigger the IRMAA.

When will the GH2 brackets be adjusted for inflation?

And beginning in 2020, these brackets will be adjusted for inflation, in the same way that COLA is calculated for Social Security, says Jae Oh, the managing principal of GH2 Benefits and the author of "Maximize Your Medicare.".

Does Medicare use your MAGI?

Medicare uses your MAGI from two years earlier to determine if you’ll pay that extra charge in 2020. “I hear of so many people who are caught by surprise by the IRMAA,” says Elaine Floyd, director of retirement and life planning at Horsesmouth. “This is really an essential part of tax and retirement planning because it can add thousands ...

How to request a reduction in Medicare premium?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.

What is Social Security tax?

Social Security uses tax information from the year before last — typically the most recent data it has from the IRS — to determine if you are a “higher-income beneficiary.”. If so, you will be charged more than the “standard,” or base, premium for Medicare Part B (health insurance) and, if you have it, Part D (prescription drug coverage).

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Who has the right to appeal a demand letter?

This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the right to appeal.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.