Submit an Overpayment Refund Form to explain the reason for the overpayment (if you know the amount Medicare overpaid, you may also submit a check made payable to "Medicare"), or Request an immediate offset of the overpayment by submitting an Immediate Offset Form.

How long do I have to refund an overpayment?

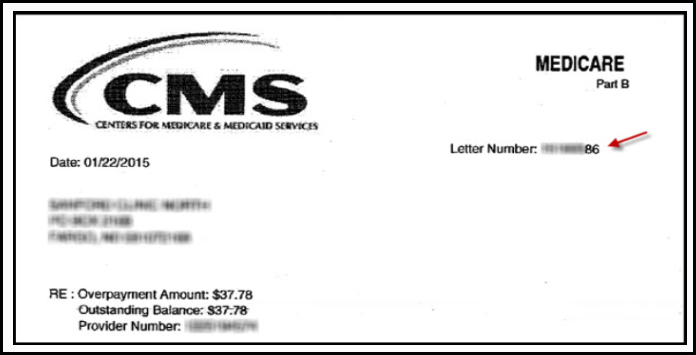

, you must report and return a self-identified overpayment to Medicare within: 60 days of overpayment identification 6 years from overpayment receipt, generally known as the “lookback period” If applicable, the cost report due date When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending

What if I overpaid Medicare?

Sep 15, 2021 · If you are refunding an overpayment for multiple claims, you may attach a listing of the individual claim details so... Part A and Part B voluntary refunds should be submitted separately with the corresponding voluntary refund form to... Voluntary refunds for Medicare Secondary Payer (MSP) ...

Are you eligible for a Medicare reimbursement?

Oct 23, 2021 · Hi. When Social Security withholds Medicare premiums for months that have already been paid out of pocket they normally refund the duplicate premiums within 60 days. However, many people have reported not receiving timely refunds, so I assume the refunds are currently taking longer possibly due to COVID related backlogs.

How can I create a refund payment?

Jul 17, 2012 · Overpayment Refund Form. Use the Overpayment Refund Form to submit a voluntary refund (please do not use this form if CGS has already requested repayment via a "demand letter"). This will ensure we properly record and apply your check. Also, if you are not sure of the overpayment amount, you may submit a request using the Overpayment Refund …

Does Medicare refund premium overpayments?

If the Medicare drug plan billed a member who should have a reduced or $0 premium and the member paid the premium, the Medicare drug plan will refund the amount overpaid as soon as possible.

How do I get an overpayment refund?

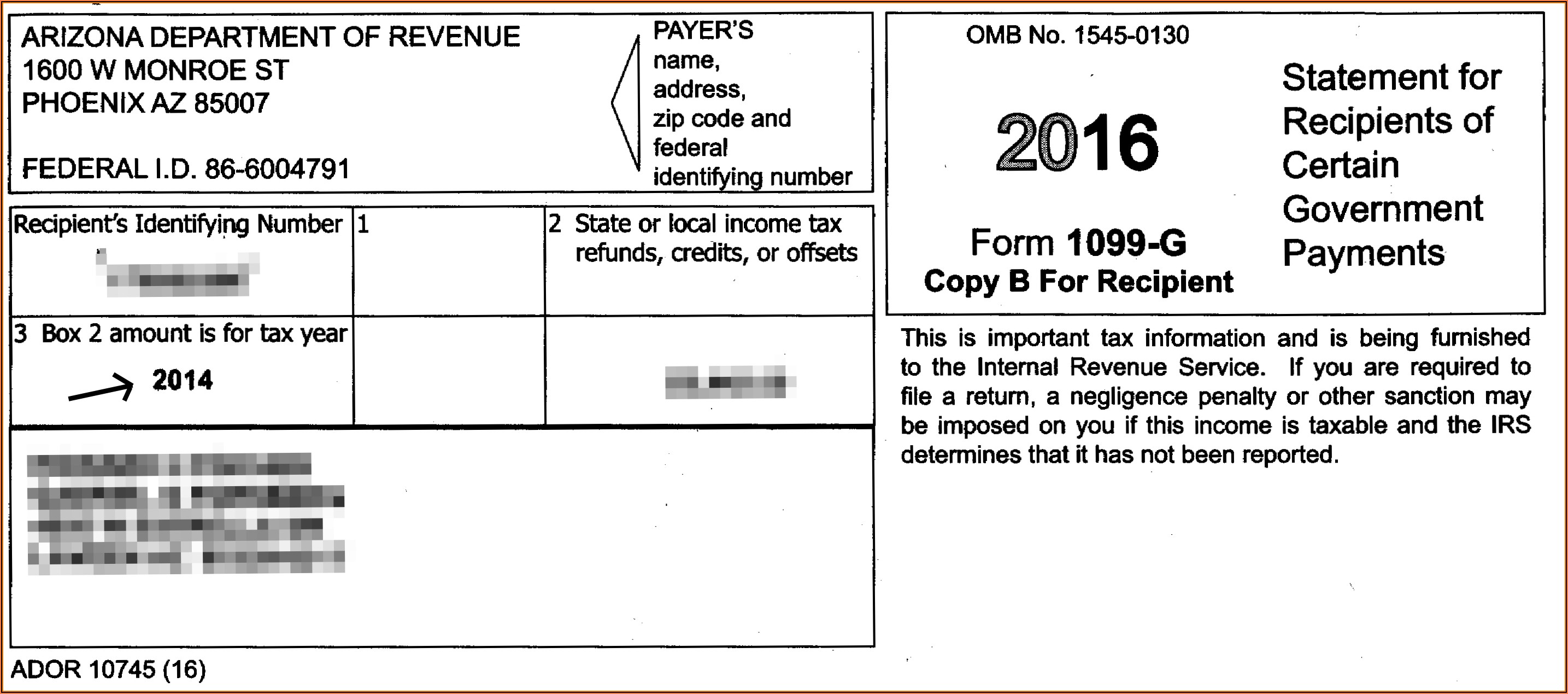

Filing an Amended Return There are two main ways to file a refund claim for overpayment of taxes. The first is to file an amended return that corrects the error you had previously made. The other option is to file a Form 843 Claim for Refund and Request for Abatement.Nov 20, 2019

What happens if I overpay my Medicare deductible?

because you'll receive bills from medical providers. And, you want to make sure you only pay the amount you're responsible for. Once you overpay, then you have to try and get your money back from the provider.May 31, 2021

What should you do if Medicare overpays you for patient treatment?

If You Find the Overpayment According to Medicare, providers must report and return self-identified overpayments to Medicare within 60 days of overpayment identification and within six years from overpayment receipt, generally referred to as the “lookback period.”Sep 19, 2019

How do I write a letter requesting a refund for overpayment?

I would request you to kindly refund the over-paid amount i.e. _________ (overpayment amount) at the earliest by _________ (mode of payment). I shall be highly obliged for your kind support.Feb 26, 2022

How do I claim a refund?

As per the Income Tax Act, a person is required to file his/her return in the relevant assessment year by July 31 (unless deadline extended) to claim the tax refund. You are eligible to receive income tax refund when you have paid more tax to the government than your actual tax liability.Jun 23, 2017

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

When a patient makes an overpayment the excess amount should be refunded by?

Under California law, if a provider does not contest a notice of overpayment, he or she is required to reimburse the insurance plan for the amount requested, within 30 working days of receipt of the notice.

How does Medicare refund work?

Medicare refunds 75% of the Schedule fee. Private health funds will pay at least the remaining 25% of the Schedule fee. Private fund gap cover (no gap or known gap) may refund part or all of the gap between the Schedule fee and the doctor's charge. You will be charged for accommodation.Apr 10, 2019

What is a Medicare overpayment?

A Medicare overpayment is a payment that exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the Federal government. Federal law requires the Centers for Medicare & Medicaid Services (CMS) to recover all identified overpayments.

How to offset Medicare overpayment?

If you would like to have the overpayment immediately offset the overpayment from your next check from Medicare, simply complete the Immediate Offset Request Form. The request may be submitted via regular mail or fax, and the request must include documentation on the overpayment to be offset.

What is MMA in Medicare?

By choosing immediate recoupment, you are waiving your right to interest under Section 935 of the Medicare Modernization Act (MMA) in the event that the overpayment is reversed at the Administrative Law Judge (ALJ) or subsequent higher levels of appeal. Other helpful tips: