How to Save on Prescription Drugs With Medicare

- Understand Your Plan Formulary. A formulary is a list of drugs covered by a health plan. ... Be sure that the drugs you...

- Switch to Generic Drugs When Possible. In many cases, a generic drug can be a viable low-cost alternative to a...

- Use Network Pharmacies. If your Medicare prescription drug plan has a pharmacy network,...

- Ask about generic drugs—your doctor can tell you if you can take a generic drug instead of a brand-name drug or a cheaper brand-name drug.

- Look into using mail-order pharmacies.

- Compare Medicare drug plans to find a plan with lower drug costs.

- Apply for.

How can I save money on my Prescription drugs?

“Swing by the pharmacy and ask your local pharmacist to look over your medication list,” says Yacoub. “They will often be able to point out a few money-saving tips that you can then discuss with your doctor.”

How can I save money on Medicare costs?

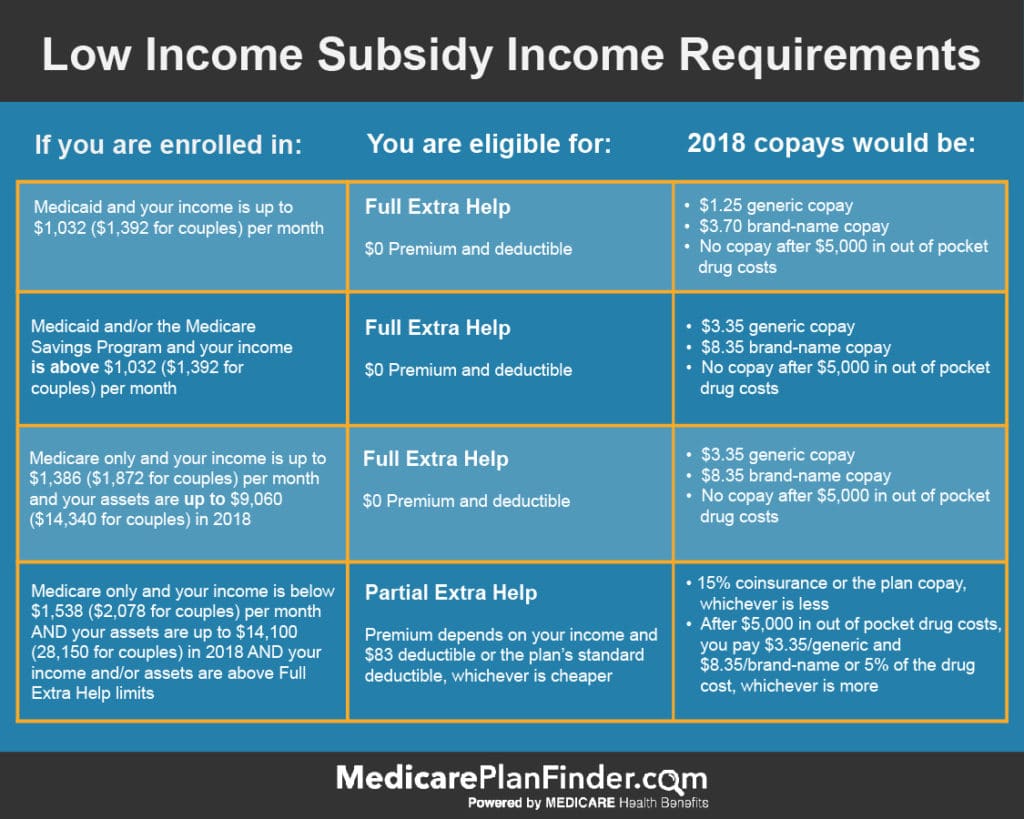

If you aren’t sure if you’re eligible, it’s worth learning more about these 3 ways to save on Medicare costs: Extra Help: If you have limited income or resources, Extra Help can help pay Medicare Part D drug costs.

Should you pay for medications with a savings card or insurance?

One point to remember: If you choose to use a savings card instead of paying through insurance, you’ll miss out on those dollars counting toward your annual deductible. Depending on your deductible and how often you’ll need the medication, consider whether paying the higher price through insurance might make more sense long-term.

How much money can you save with generic drugs?

Generic drugs prescribed in place of their name-brand equivalents can save you anywhere from 30 percent to 80 percent at the cash register according to the FDA.

How can I save $144 per month on Medicare?

Four ways to save money on your Medicare Part B premiumsSign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

How can I save my drug list on Medicare gov?

Click the “Update/print my drugs” box on the MyMedicare.gov dashboard page. Click the “Find Your Saved Drug Lists” box in new Plan Finder. In the new Plan Finder, your client can choose to skip logging into an account and still enter their prescription drugs, compare plans, and even complete an enrollment.

Why are my prescriptions so expensive with Medicare?

If you have a health condition that requires a “specialty-tier” prescription drug, your Medicare Part D costs may be considerably higher. Medicare prescription drug plans place specialty drugs on the highest tier. That means they have the most expensive copayment and coinsurance costs.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How can I lower my medication costs?

6 Ways to Reduce Prescription Drug CostsGeneric Medications. Using generic medications can provide significant cost savings and are nearly always preferred by prescription insurance plans. ... Different Medication Choice. ... Different Pharmacies. ... Coupon Savings. ... Patient Assistance Plans. ... Don't Skip Important Medications.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the average cost of Medicare Part D?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

How to save money on medicare?

Everyone likes to save money. We can help. You may be able to get help paying for your health and prescription drug costs. If you aren’t sure if you’re eligible, it’s worth learning more about these 3 ways to save on Medicare costs: 1 Extra Help: If you have limited income or resources, Extra Help can help pay Medicare Part D drug costs. If you apply and qualify for Medicaid or one of the Medicare Savings Programs above, you’ll automatically get Extra Help with Medicare drug costs. If you don’t automatically qualify for Extra Help, apply for free online. 2 Medicare Savings Programs: Medicare has 4 savings programs, which are run by each state. These programs may help you pay for your Medicare premiums and other costs. To find out if you’re eligible, call your state Medicaid program. 3 Medicaid: If you have limited income and resources, you may qualify for Medicaid—a joint federal and state program that:

How many savings programs does Medicare have?

Medicare Savings Programs: Medicare has 4 savings programs, which are run by each state. These programs may help you pay for your Medicare premiums and other costs. To find out if you’re eligible, call your state Medicaid program. Medicaid: If you have limited income and resources, you may qualify for Medicaid—a joint federal and state program that:

What is extra help for Medicare?

Extra Help: If you have limited income or resources, Extra Help can help pay Medicare Part D drug costs. If you apply and qualify for Medicaid or one of the Medicare Savings Programs above, you’ll automatically get Extra Help with Medicare drug costs.

When is open enrollment for Medicare 2021?

Medicare’s Open Enrollment running now through December 7 is a great time to make any necessary changes. Use Medicare Plan Finder to compare Medicare coverage options and find 2021 health and drug plans that meet your unique needs.

1. Get Medicare Part D Coverage

Also referred to as the Medicare prescription drug benefit, Medicare Part D is a US federal government program to subsidize the expenses of prescription drugs and their insurance premium for Medicare beneficiaries.

2. Ask About Generic Drugs

Ask your doctor if you can take a generic medication instead of a brand-name drug. It’s important to remember that generic medicines approved by the FDA work in the same way and provide the same clinical benefit and risks as their brand-name counterparts. They are the same high quality as their brand-name versions.

3. Talk to Your Doctor About Medicine Costs

Your provider may help you find a less expensive alternative. Also, if your doctor gives you a prescription for a new drug, you can ask for samples to try before filling the prescription. But you shouldn’t always count on those free samples.

4. Shop Around Local or Online

Take a look at prices at different local and online drug stores and pharmacies. Shopping around can help you find the lowest price. Remember: not everything on the internet is safe. It is very important to know which websites are reliable and safe.

5. Use Prescription Drugs Wisely

Always take the medicines for the time and the way your doctor directs you to. It can avoid illness and more out-of-pocket costs.

You can save money on Medicare Part D by simply making sure to shop around for a new plan year-to-year

For many older Americans – especially for those with multiple chronic conditions – the healthcare costs spent on prescription drugs alone can oftentimes be overwhelming. There’s really only one way to get the lowest possible prescription prices. And, while it’s easy, most people don’t do it.

Our Rx Shopping List

The six prescription drugs we compare are commonly prescribed medications used for common ailments among seniors:

Use Medicare.gov to Compare Prices

The Medicare.gov website gives you prices for all Part D plans and each plan’s prices on prescriptions. Since we’re part-way through 2017, the cost figures shown on the website will be for June through December of this calendar year. Keep in mind that all Medicare Part D plans are not available in every county and ZIP code throughout the nation.

What This Means to You

Shop wisely to save money on Medicare Part D plans. Compare prices on the exact medications you take. The prices of the plans themselves are irrelevant and pales in comparison to how much the prices of your drugs vary among those plans.

Compare Rx Prices for Medicare Advantage Plans the Same Way

Millions of people don’t have separate Part D plans, but have some kind of Medicare Advantage (or Medicare Part C) plan which includes drug coverage. The process is almost identical to comparing drug prices for Medicare Part D.

Annual Enrollment Is Your Chance to Save Big Money

Typically, you can only choose a new Medicare Part D plan or Medicare Advantage plan every October 15th through December 7th (with your new plan taking effect on the following January 1st). Don’t get stuck for 12 months with the wrong plan.

How much does a drug cost for 7 months?

The lowest possible cost for those drugs for seven months (June through December) (including the cost of the Part-D plan itself) is $760. The highest possible cost for those drugs for seven months, with a different Part-D plan, is $6,304.

Can older people get the lowest prescription prices?

For many older Americans – especially for those with multiple chronic conditions – the healthcare costs spent on prescription drugs alone can oftentimes be overwhelming. There’s really only one way to get the lowest possible prescription prices. And, while it’s easy, most people don’t do it.

Do 23 Part D plans cover the same drugs?

Keep in mind all 23 Part D plans are good, and many people own them, but as we said, all the plans don’t cover identical drugs at the same prices, to say the least.

Do people have separate Medicare Part D plans?

Millions of people don’t have separate Part D plans, but have some kind of Medicare Advantage (or Medicare Part C) plan which includes drug coverage. The process is almost identical to comparing drug prices for Medicare Part D.

Does Medicare Part D cover all drugs?

There are many Medicare-approved Part D prescription plans for sale; however, the plans don’t all cover the same drugs.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is the deductible for Part D in 2021?

Part D. Deductibles vary according to plan. However, Part D deductibles are not allowed to exceed $455 in 2021, and many Part D plans do not have a deductible at all. The average Part D deductible in 2021 is $342.97. 1.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

How much is a copayment for a mental health facility?

For an extended stay in a hospital or mental health facility, a copayment of $371 per day is required for days 61-90 of your stay, and $742 per “lifetime reserve day” thereafter.