When you identify a Medicare overpayment, use the Overpayment Refund Form to submit the voluntary refund. This will ensure we properly record and apply your check. NOTE: Type directly into the required fields on the Overpayment Refund Form, then print.

Full Answer

How do I request a voluntary refund of my Medicare claim?

If refunding a high volume (100 or more) of claims, please use our Voluntary Refunds Spreadsheet. Save the Excel spreadsheet to a CD or USB drive and mail it with your check and “Return of Monies to Medicare” form to the appropriate address located at the top of the Return of Monies form.

How do I get a refund for Medicare overpayments?

Voluntary Refunds If you identify a Medicare overpayment and are voluntarily refunding with a check, use the Overpayment Refund Form to submit the request. This will ensure we properly record and apply your check. NOTE: Type directly into the required fields on the Overpayment Refund Form, then print.

How do I complete the physician/refund portion of the form?

Always complete the physician/refund portions and use the reason codes listed on the bottom of the form to identify the reason for your refund. When refunding for multiple beneficiaries, please be sure to include sufficient documentation to show how much money is being refunded for each claim.

What is the return of monies to Medicare form?

To facilitate prompt and accurate credit of unsolicited monies or voluntary refunds to Medicare, we developed a Return of Monies to Medicare form. Please use this form if you receive a Medicare payment in error and are returning the money via an unsolicited / voluntary refund to Medicare.

How do you refund Medicare?

To get a refund or reimbursement from Medicare, you will need to complete a claim form and mail it to Medicare along with an itemized bill for the care you received. Medicare's claim form is available in English and in Spanish.

Where do I send Medicare claims in Florida?

Medicare All state claim address and phone number list, if any modification please comment it....Medicare claim address, phone numbers, payor id – revised list.StateFloridaFLIVR #1-877-847-4992Claim mailing addressMedicare Part B Participating Providers P.O. Box 44117 Jacksonville, FL 32231-4117.22 more columns

How do I reimburse Medicare overpayment?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

What is the mailing address for Medicare in Florida?

Use current mailing addresses to prevent returned mailNew addressOld addressPart A Claims and Claims ADR FL P.O. Box 2006 Mechanicsburg, PA 17055-0733P.O. Box 2711 Jacksonville, FL 3223111 more rows

What form is used to send claims to Medicare?

Form CMS-1500Providers sending professional and supplier claims to Medicare on paper must use Form CMS-1500 in a valid version. This form is maintained by the National Uniform Claim Committee (NUCC), an industry organization in which CMS participates.

What is the claims mailing address for Florida Medicaid?

Petersburg Field Office 525 Mirror Lake Dr. N, Suite 510 St. Petersburg, FL 33701-3219 Attn: Out-of-State Exceptional Claims Each exceptional claim request submitted must include an individual letter on the provider's letterhead, explaining the request for exceptional handling.

What is a Medicare premium refund?

A. Refunding excess Medicare premiums. The law requires the Centers for Medicare & Medicaid Services (CMS) to dispose of excess Medicare premiums paid by, or on behalf of, a deceased beneficiary. The excess premiums may be for supplementary medical insurance (SMI) or hospital insurance (HI).

How long does it take to get Medicare refund?

within 60 daysThe Centers for Medicare and Medicaid Services (CMS) recently issued a final rule requiring Medicare Parts A and B health care providers and suppliers to report and return overpayments within 60 days from the date the overpayment was identified.

Does Medicare have to be paid back?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

What is the payer ID for Medicare Florida?

MR025Payer Name: Medicare - Florida|Payer ID: MR025|Professional (CMS1500)/Institutional (UB04)[Hospitals]

What is the payer ID for Medicare?

MR002Payer Name: Medicare - California (Southern California)|Payer ID: MR002|Professional (CMS1500)/Institutional (UB04)[Hospitals]

What's the number to Florida Medicaid?

If you need help finding contact information for your plan, call our Medicaid Helpline at 1-877-254-1055 or visit www.ahca.myflorida.com/Medicaid.

How to contact Medicare if you don't accept Medicare?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. If you go to a provider that does not accept Medicare assignment, you may have to pay for the service out of pocket and then file a claim to be reimbursed by Medicare.

How to file a claim for Medicare Part B?

To file a claim, fill out the Patient Request for Medical Payment form and send the completed form to your state’s Medicare contractor. Instructions for submitting your claim vary depending on the type of claim you’re filing: Claims for Medicare Part B services. Claims for durable medical equipment (DME)

What are the benefits of Medicare Advantage?

Still, there are several advantages to having a Medicare Advantage plan. For instance, many Medicare Advantage plans can offer benefits that aren’t covered by Original Medicare, including: 1 Prescription drug coverage 2 Dental coverage 3 Vision coverage 4 Hearing coverage 5 Health and wellness program benefits, such as membership to SilverSneakers

How to find Medicare Advantage plan?

To learn more about Medicare or to find Medicare Advantage plans in your area, speak with a licensed insurance agent by calling. 1-800-557-6059 . 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week. 1 Medicare.gov. Lower costs with assignment.

What is Medicare assignment?

Providers that accept Medicare assignment are required by law to accept the Medicare-approved amount as full payment for covered services. Providers that don’t accept assignment can charge up to 15 percent more for covered services, which you are typically responsible for paying. 1

What should be included in a medical bill?

The bill should include: The date of service. A description of each service. The charge for each service. The place of service. Diagnosis. Name and address of the provider. A letter explaining your reason for the claim, including why you received the medical care from the provider.

Does Medicare have an out-of-pocket maximum?

Original Medicare does not have an out-of-pocket maximum.

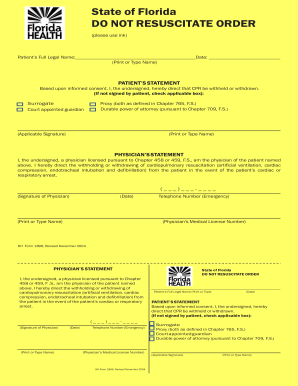

Report an overpayment

Complete an overpayment refund form to notify First Coast of an overpayment prior to receiving a demand letter.

Request immediate recoupment

Learn how to have overpayments immediately offset as funds become available. This process is a convenient and cost effective way to pay demanded debt.

Dispute

To dispute an overpayment identified in a demand letter use the appropriate overpayment redetermination request forms listed below.

Extended repayment schedule

If you are experiencing financial difficulties in repaying debt, an extended repayment schedule may be considered. Complete the following information along with all supporting documentation:

Additional resources

First Coast Service Options (First Coast) strives to ensure that the information available on our provider website is accurate, detailed, and current. Therefore, this is a dynamic site and its content changes daily.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

What happens if Medicare overpayment exceeds regulation?

Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments.

How long does it take to get an ITR letter?

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. If you don’t comply, your MAC refers the debt for collection.

What is reasonable diligence in Medicare?

Through reasonable diligence, you or a staff member identify receipt of an overpayment and quantify the amount. According to SSA Section 1128J(d), you must report and return a self-identified overpayment to Medicare within: