How to Set Up or Change Direct Deposit of Benefit Payment Online Log in to your account. Sign in and Select the blue Benefits & Payment Details link on the right side of the screen. Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.

How to set up direct deposit to receive payments?

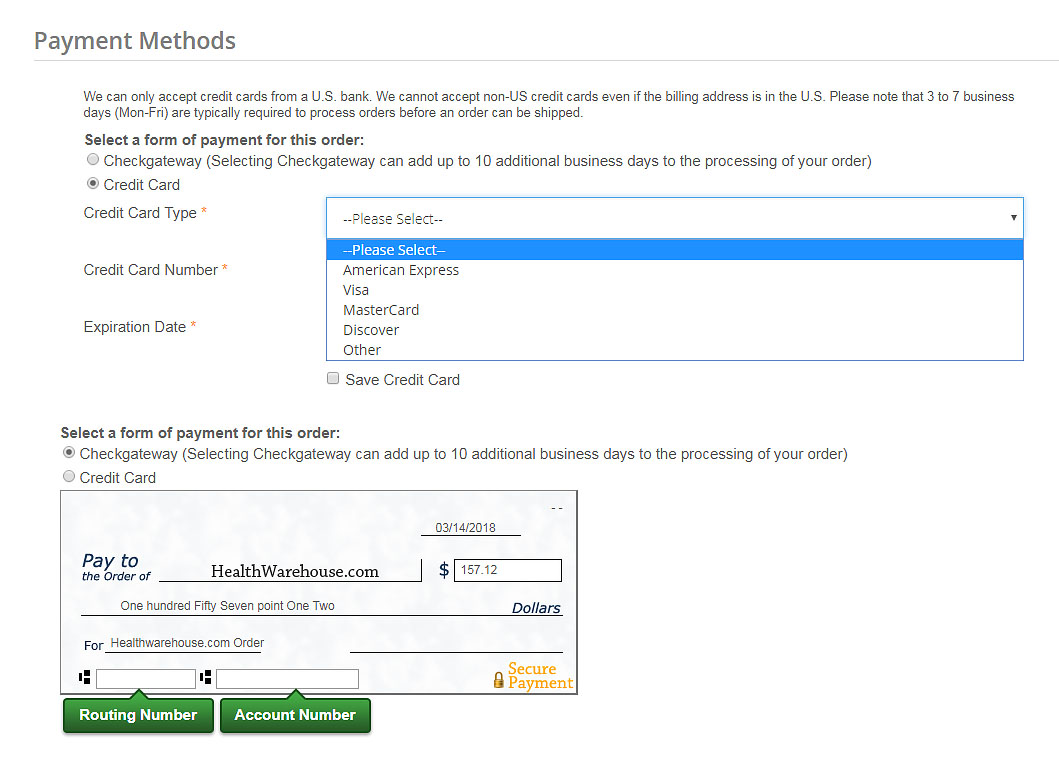

Setting Up Direct Deposit to Receive Payments 1 Bank account number 2 Routing number 3 Type of account (typically a checking account) 4 Bank name and address—you can use any branch of the bank or credit union you use 5 Name (s) of account holders listed on the account

How do I Change my Social Security direct deposit?

If you already are receiving benefits, you can create a my Social Security account and start or change Direct Deposit online. You also can sign up at your bank, credit union, or savings and loan.

How do I update my direct deposit information?

What is Direct Deposit? 1 Log in to your account . 2 Sign in and Select the blue Benefits & Payment Details link on the right side of the screen. 3 Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account. 4 Enter your bank account information and select Next. More items...

How do I Find my direct deposit number?

Alternatively, you can call your bank and ask for direct deposit information. Details are often available online as well, but it's best to log in to your account for accurate information. Your bank routing and account numbers are sensitive information, so don’t provide those numbers to anybody unless you truly trust them.

How do I make a Medicare direct payment?

Log into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit, card, or from your checking or savings account. Our service is free. Contact your bank to set up an online bill payment from your checking or savings account.

How do I change my direct deposit for Medicare?

How to change bank accounts or stop Medicare Easy Pay. There are 2 ways: Log into your Medicare account — Select "My Premiums" and then "See or change my Medicare Easy Pay" to complete a short, online form. Fill out and mail a paper form — Print and fill out the authorization form.

What are the steps to setting up a direct deposit?

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

Does Medicare issue paper checks?

Payments made via direct deposit will show up as “HHSPAYMENT.” If the provider normally receives paper checks for its Medicare reimbursements, then the provider will be issued a paper check for the relief payment, and can expect to receive the check in the next few weeks.

How long does it take to switch direct deposit accounts?

The process required to change direct deposit can be cumbersome. They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

How do I change my direct deposit from one bank to another?

The easiest way to start or change direct deposit is to contact your employer's HR or payroll department, which will have you fill out a direct deposit authorization form. This form will ask for basic information that you can find in the welcome kit from your new bank: Name of bank or credit union. Routing number.

What information is required for direct deposit?

Be prepared to provide your U.S. Bank deposit account type (checking or savings), account number and routing number, your Social Security Number, and other required information.

How do I set up direct deposit without a check?

Alternative Ways to Set Up Direct Deposit Without a Voided CheckYou can get a voided check by going to your bank and asking a teller to print one. There may be a fee for this service.Ask your bank if they have instructions on how to set up direct deposit. The information you need might be there.

Can I set up a direct deposit to myself?

Most banks offer a link on their website that says “Set up Direct Deposit” where you are able to create a customized direct deposit form. By clicking on the pre-filled form, you will add the needed information electronically and save it to start the deposit process.

How do I give Medicare my bank details?

account number.Step 1: sign in. Sign in to myGov and select Medicare. If you're using a computer, sign in to myGov and select Medicare. ... Step 2: change your bank details. Select Edit in Bank details. Update your bank details and enter your: ... Step 3: sign out. From the homepage you can complete other transactions.

How long does Medicare EFT take?

Using the Medicare online account When you submit a claim online, you'll usually get your benefit within 7 days.

Does Medicare require EFT?

A: All providers enrolling in Medicare must use electronic funds transfer (EFT) in order to receive payments. Moreover, any provider not currently on EFT that submits a revalidation application must also submit a Form CMS-588 and thereafter receive payments via EFT.

How long does it take to create a Social Security account?

Creating a free my Social Security account takes less than 10 minutes, lets you set up or change your direct deposit and gives you access to many other online services.

Is direct deposit safe?

Direct deposit is a simple, safe, and secure way to get benefits. If you do not have a bank account, the FDIC website offers information to help you open an account online or at a local bank branch. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply.

What Is A Social Security Card

Your Social Security card is an important piece of identification. You’ll need one to get a job, collect Social Security, or receive other government benefits.

Medicare Online Account Help

Learn how to update your bank account details using your Medicare online account or Express Plus Medicare mobile app.

Ways To Sign Up For Medicare Easy Pay

Fill out and mail a paper form Print the authorization Agreement for Preauthorized Payments from : PDF in English or HTML in English or PDF in Spanish or HTML in Spanish. Mail your completed form to: Medicare Premium Collection CenterPO Box 979098St. Louis, MO 63197-9000

Earn Ssa Work Credits In Some Countries

You may not have enough credits from your work in the United States to qualify for retirement benefits. But, you may be able to count your work credits from another country. The SSA has agreements with 24 countries. If you earned credits in one of those countries, they can help you qualify for U.S. benefits.

Heres How To Access Your Form Ssa

Simply login to your My Social Security Account at www.socialsecurity.gov and click on Replacement Documents on the far-right side of the screen .

Here Is What Medicare Wants You To Know About Electronic Funds Transfer

Want Medicare payments directly deposited into your bank account? Application assistance and hints are included below or view the full EFT instructions on the NSC website.

How To Change Your Social Security To Direct Deposit

A Step-by-Step Guide for Seniors to Set Up or Change Your Social Security Direct Deposit Information

What is EFT in Medicare?

Electronic Funds Transfer. With Electronic Funds Transfer (EFT), Medicare can send payments directly to a provider’s financial institution whether claims are filed electronically or on paper. All Medicare providers may apply for EFT. EFT is similar to other direct deposit operations such as paycheck deposits, and it offers a safe modern alternative ...

What are the advantages of EFT?

Providers who use EFT may notice the following benefits: •Reduction to the amount of paper in the office.

Does Medicare require EFT?

All Medicare contractors include an EFT authorization form in the Medicare enrollment package, and providers can also request a copy of the form after they have enrolled. Providers simply need to complete the EFT enrollment process as directed by their contractor.

How to set up direct deposit?

Setting Up Direct Deposit to Receive Payments 1 Bank account number 2 Routing number 3 Type of account (typically a checking account) 4 Bank name and address—you can use any branch of the bank or credit union you use 5 Name (s) of account holders listed on the account

What is direct deposit?

Direct deposit is an electronic payment from one bank account to another. For example, money may move from an employer’s bank account to an employee’s bank account, although there are several other ways to use direct deposit.

Why is direct deposit so popular?

Common Payment Method. Direct deposit has become increasingly popular because it does away with unnecessary paperwork. Billions of ACH payments take place every year. 2 For example, branches of government like the Social Security Administration, no longer print checks.

How to receive a check electronically?

To receive payments electronically, you need to provide bank account information to the organization that is paying you. They may require that you use a particular form (such as a direct deposit form) or they may ask you to provide a voided check. In some cases, you'll need to provide your account information online.

How long does it take for a direct deposit to show up in your bank account?

Direct deposits are often instantaneous, but they can take one to three days, depending on your bank and the source of the deposit. Paychecks and government benefits are typically available immediately, but they can hold the funds until the next business day. 8 If you're sending money via direct deposit, it may leave your account immediately if you're using your bank's bill pay service or Zelle. If you're using a third-party service, it might take one to three days for it to show up as a debit from your account.

What happens when you receive direct deposit?

When receiving funds by direct deposit, the funds are added to your account without any action required on your part. Whether you’re out of town or too busy to make it to the bank, your account will be credited. 4

Does direct deposit affect checking account balance?

When you receive funds via a direct deposit, your account balance will automatically increase when the payment arrives. You don’t need to accept the payment or deposit funds to your account, which would be required if you received cash or a check. Likewise, when you pay with direct deposit, your checking account balance will automatically decrease when the payment leaves your bank.

What is EFT in Medicare?

EFT is a process whereby a supplier’s Medicare payments are directly deposited into their bank account. It is safe and results in faster payment. Direct deposits also eliminate the possibility of lost or delayed checks and reduces probability of human error.

How to change bank account in EFT?

To change accounts or banks, suppliers must complete a new EFT form, using the new account information and include a voided check or deposit ticket from the new account

Can you send a starter check to a bank?

Check must be bank generated. Starter checks are not accepted. If no check, supplier may request a bank letter.

How to get direct deposit?

Direct Deposit is the best electronic payment option for you because it is: 1 Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. 2 Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy! 3 Convenient – With Direct Deposit, you no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don't have to leave your house in bad weather or worry if you're on vacation or away from home. You don't have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.

How to change from paper check to electronic check?

To learn more about how to easily switch from a paper check to an electronic payment option, visit Treasury’s Go Direct website or call the Treasury’s Electronic Payment Solution Center at 1-800-333-1795. You can also create a my Social Security account and start or change Direct Deposit online.

What is the phone number for Social Security?

If you have any questions, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778 ).

Is direct deposit safe?

Direct Deposit is the best electronic payment option for you because it is: Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. Quick – It's easy to receive your benefit by Direct Deposit.

What is NACHA file?

NACHA files are used to send banks the information necessary for electronic transactions, such as bank account numbers and deposit totals.

Why is direct deposit important?

Direct deposit benefits all employers, but it’s especially valuable to small businesses that may be operating on a tight budget. When employers distribute paychecks, they have little control over when employees deposit or cash them. This can cause a cash shortage if the employees withdraw funds at a time when rent, utilities or other expenses are due. Direct deposit minimizes this problem because it allows employers to regularly schedule the exact time that their account will be debited. In this way, they can better manage their finances and pay both their bills and their people.

What is direct deposit in banking?

As it applies to employment, direct deposit is the electronic transfer of net pay from an employer’s financial institution to an employee’s personal bank account. This exchange takes place across a network called the Automated Clearing House (ACH).

How long does it take to set up direct deposit?

Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait period applies every time new employees are added to the system.

Is direct deposit beneficial to employers?

Direct deposit is just as beneficial to employers as it is to employees. With electronic payments, businesses may be able to: