How To Help Your Loved Ones Shop For Medicare Advantage Plans

- Identify Medical Needs. Before you begin shopping for a plan, consider your loved one's current medical needs. List...

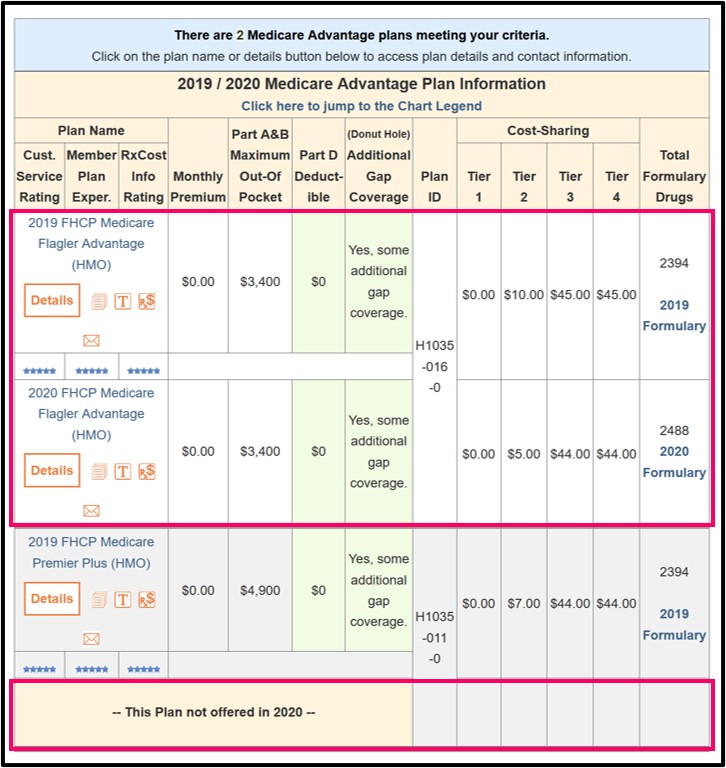

- Compare Plan Options. When comparing plans, it's important to review all of your options, including original Medicare.

- Read Plan Documents. Once you have a list of a few potential plans,...

Full Answer

What companies offer Medicare Advantage plans?

What Companies Offer Medicare Advantage Plans Currently

- Aetna Medicare Advantage Plans. ...

- Benefits of Aetna Medicare Advantage Plans. ...

- Blue Cross and Blue Shield Medicare Advantage Plans. ...

- Benefits of Blue Medicare Advantage Plans. ...

- Cigna Medicare Advantage Plans. ...

- Benefits of Cigna Medicare Advantage Plans. ...

- Humana Medicare Advantage Plans. ...

- Benefits of Humana Medicare Advantage Plans. ...

How do I choose the best Medicare Advantage plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

What are the best Medicare Advantage plans?

What to Know About the Best Medicare Advantage Plans

- Most Medicare Advantage plans are PPO and HMO. Most Medicare Advantage plans are either PPO or HMO, representing 46% and 39% of available plans. ...

- Most Medicare Advantage plans include prescription drug coverage. ...

- Vision, dental and hearing benefits are widespread. ...

- Just over half of Medicare Advantage plans have $0 premiums. ...

How to choose the best Medicare Advantage plan?

The best Medicare Advantage plan is generally the one that includes your doctors in the plan’s network and your medications on the plan’s formulary. You can find Advantage plans from major carriers like United Healthcare, Aetna, Cigna, Anthem/Blue Cross Blue Shield, Humana, and quite a few other carriers.

What should I look for in a Medicare Advantage plan?

Here are a few things to look for in a Medicare Advantage plan:costs that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

Is there a website to compare Medicare Advantage plans?

Compare plans online with MedicareAdvantage.com If you want to compare plans online and have one-on-one support from a licensed insurance agent, then you can use MedicareAdvantage.com. MedicareAdvantage.com offers an online plan comparison tool where you can review Medicare Advantage plans side by side.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do Medicare Advantage plan premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Do Medicare Advantage plans have deductibles?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

What states have 5 star Medicare Advantage plans?

States where 5-star Medicare Advantage plans are available:Alabama.Arizona.California.Colorado.Florida.Georgia.Hawaii.Idaho.More items...•

Where to start shopping for Medicare Advantage Plans?

The best place to start shopping for Medicare Advantage Plans (or a Part D or Medigap policy) is Medicare’s Plan Finder tool. After answering a few questions about your location and any financial help you might be receiving — from Medicaid, for instance — the tool will show you all available plans that meet your criteria.

What are the different types of Medicare Advantage plans?

There are five types of Medicare Advantage Plans: 1 Health maintenance organization, or HMO, plans: Require you to see an in-network provider unless it’s an emergency situation, and most require a referral to see a specialist. 2 Preferred provider organization, or PPO, plans: Allow you to see both in-network and out-of-network health care providers, although it’s usually more expensive to go out of network. 3 Private fee-for-service, or PFFS, plans: Allow you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you. You may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special needs plans, or SNPs: Provide benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. These plans also provide benefits to people with a limited income. 5 Medical savings account, or MSA, plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

What should you consider?

While you might not have an abundance of Medicare Advantage options if you live in a rural area, urban dwellers could have two dozen or more choices available. Narrow the field with these strategies:

What are the pros and cons of Medicare Advantage?

The pros of Medicare Advantage Plans include potentially lower premiums for coverage, limits on out-of-pocket costs, and additional benefits such as hearing, dental and vision care.

What is MA plan?

Also known as Medicare Part C or MA Plans, they’re offered by private insurers that have been approved by Medicare. Most plans offer additional benefits that aren’t covered under Original Medicare, which may include dental, hearing and vision coverage.

Which is better, a PPO or an HMO?

Think about your preferences. If you see specialists frequently and you don’t want to request a referral for every office visit, a PPO plan will be a better option than an HMO. If you’re a light health care user and see mostly your primary care physician, an HMO might be more affordable.

What is a special needs plan?

Special needs plans, or SNPs: Provide benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. These plans also provide benefits to people with a limited income.

Medicare Disclaimer

This page was last updated: 10/01/2021. Please call to confirm you have the most up to date information about our Medicare plans.

Let's Find A Medicare Plan That's Right For You

Since 1977, Colorado retirees like you have trusted RMHP to get the most out of their Medicare benefits. Enjoy easy enrollment, flexible options, and a large provider network when you choose RMHP. Let us help you enjoy your retirement.

What is Medicare Advantage?

Medicare Advantage Plans usually offer coverage for things that aren’t included under Original Medicare, such as dental, vision, hearing and wellness programs. With a Medicare Advantage Plan, you must use health care providers that are in the plan’s network, and you may need a referral to see a specialist.

Why is choosing a Medicare Advantage Plan so intimidating?

Choosing a Medicare Advantage Plan can be a little intimidating because there are so many plans available. “The average Medicare beneficiary has something like two dozen choices,” Gordon says. “That seems great, like, ‘Oh, you have so many options,’ but it can be really overwhelming to consumers.”.

What is Medicare open enrollment?

Open enrollment is the health care user’s chance to evaluate the plan they have, take a look at what’s on the market and update their coverage for the coming year. Open enrollment is for consumers who already have Original Medicare or Medicare Advantage.

What are the different types of Medicare Advantage plans?

There are five different types of Medicare Advantage Plans: 1 Health Maintenance Organization, or HMO, plans: This kind of plan requires you to see an in-network provider unless it’s an emergency situation. Most require you to get a referral to see a specialist. 2 Preferred Provider Organization, or PPO, plans: This kind of plan allows you to see both in-network and out-of-network health care providers, although it typically is more expensive to go out of network. 3 Private Fee-for-Service, or PFFS, plans: This kind of plan allows you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you, and you may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income. 5 Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

How many stars does Medicare Advantage have?

What’s their rating? Each Medicare Advantage Plan comes with a star rating that ranges from one star to five stars. “I talked to a consumer in Massachusetts who essentially [won't consider] any plan below a four-star plan,” Gordon says.

What is MSA insurance?

Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs. Choosing between Medicare Advantage Plans will require you to understand your health care needs and think about what each type of plan offers.

When does Medicare open enrollment take effect?

7, any changes you make will take effect on Jan. 1. During the Medicare Advantage open enrollment period, any changes you make will take effect on the first of the month after the plan receives your request.

Make sure you're prepared before you enroll

Knowing what information you need before enrolling in Medicare can help simplify things. This checklist can help.

Shop for a Plan

Medicare coverage is personal. See available plans in your area along with the benefits they offer, prescription drug coverage, health care providers and more.

How much does Medicare Advantage cost?

In 2018, Medicare Advantage plans have an average price of $30 per month – a decline of 6 percent from 2017. And many people have access to a Medicare Advantage plan that comes with no premium at all. Keep in mind, however, that you have to continue to pay your Part B premium.

How many stars does Medicare Advantage have?

Reach for the stars. Medicare has a quality rating system, known as Five Star Rating, in which Medicare Advantage and Medicare Part D plans are given anywhere from one to five stars to indicate quality. Five stars are the most a plan can receive, and one is the least.

How to contact a counselor for Medicare?

You can find your local program by visiting the Medicare.gov Medicare Helpful Contacts page or by calling 1-800-MEDICARE (1-800-633-4227) . TTY users should call 1-877-486-2048.

How long do you have to give a doctor notice if you terminate your health insurance?

"Plans are required to give beneficiaries 30 days notice if their doctor's contract is terminated," Fassieux says.

When is Medicare open enrollment?

Between Oct. 15 and Dec. 7, Medicare's Annual Open Enrollment Period, millions of Medicare beneficiaries have a chance to make changes to their coverage for the upcoming year. There are a few things you can do during this period. You can change from one Medicare Advantage or Prescription Drug Plan to another.

Can you change your Medicare plan each year?

Although experts encourage people to shop around and weigh their options each year during the Medicare Fall Open Enrollment Period, Medicare beneficiaries have a tendency to stick with their existing coverage and avoid making changes. A 2013 study by the Kaiser Family Foundation, for example, found that only about 13 percent of people with a Medicare Part D plan change their plan each year. That can be a costly mistake, experts say.

Is Medicare easy to qualify for?

Making sense of Medicare, which is the federal health insurance program, may not be easy for those who qualify if they don’t know where to find information. "It's like root canal every year having to get yourself up to speed on what's covered by your plan and what's not," admits Bob Hurley, president of eHealthMedicare.com.