7 Perfect Rules for Shopping Medicare Part D Plans

- Be Aware of Your Shopping Window. You have time until October 15 to December 7 to shop for a new plan or modify your...

- Examine Your Medicare Advantage Plan. If you purchased a Medicare Advantage plan, you must typically get your drug...

- Examine Your Formularies and Drug Prices. Plans change their directories of...

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

How to choose the best Medicare Part D plan?

Your 5-Point Checklist for Choosing a Medicare Part D Plan

- Low or $0 Copays. Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list). ...

- Medication Home Delivery. Trips to the pharmacy can be time consuming and may require advance planning. ...

- Drug Pricing Tool. ...

- Prescription Refill Reminders. ...

Who has the best Medicare Part D plan?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What are the best Medicare Part D drug plans?

How to Shop for the Best Medicare Part D Drug Plan

- Sign Up as Soon As You Are Eligible. Unlike Parts A and B, Part D drug coverage comes from private insurance companies, with Medicare paying a portion of ...

- Make a List of Which Prescriptions You Will Need to Have Covered. ...

- Compare the Difference in Cost Among Plans. ...

- Consider Talking to a Broker or Consultant. ...

- Sign Up. ...

How can I find the best Medicare Part D plan for me?

Use Medicare.gov to find plans. Because plans can change each year and because new plans become available each year, it makes sense to shop for the best Part D coverage for you during each annual Medicare open enrollment period (Oct. 15 to Dec. 7).

How do I choose the right D plan?

Before you enroll in a Part D prescription drug plan, find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that: Features the lowest overall cost.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Can you buy Medicare Part D by itself?

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Who has the cheapest Medicare Part D plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Can I change Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

Which is the best Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the average cost of Medicare Part D?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Why do Medicare Part D plans have different premiums?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

How to select a Medicare Part D plan?

Unless you’re really comfortable using a computer and other Internet tools, the best way to select a Part D plan is to contact the government’s 1-800-MEDICARE call center and ask the customer service agent to spend some time and walk you through the process of using Medicare.gov’s online Plan Finder to select a new plan.

What is Medicare Part D?

Medicare Part D is the private sector’s first foray into a part of the Medicare program where all benefits are delivered by the private sector. To make Part D coverage palatable to budget analysts in Washington – who need to sign off before lawmakers can create something like a prescription drug benefit – the law’s authors created a “ donut hole ” (also known as the coverage gap), and you had to pay your drug costs yourself while you were in the donut hole.

How long does it take for a medicare prescription to be filled?

As an additional safeguard, your Medicare prescription drug insurer must generally offer enrollees a 90-day filling of their current medications when the plan benefits change from one year to the next – under certain circumstances. Because there are conditions attached to this policy, known as a “ transition fill ,” you should be sure to know your insurer’s rules – while ensuring the plan follows through on its obligations to support you as Medicare beneficiary.

What is the most important thing to do as a Medicare beneficiary?

From my experience dealing with frustrated Medicare enrollees, I can tell you that selecting the right prescription drug plan is one of the most important. If you make the right choices, they can save you huge sums of of money and headache, while ensuring you have access to the medications you need.

How to contact Medicare Advantage?

Call 1-844-309-3504. 2. Check your Medicare Advantage plan. If you have a Medicare Advantage plan, you usually have to receive your drug benefits through the plan rather than a separate Part D insurer. If you are one of the growing number of Medicare beneficiaries who receive their hospital and physicians benefits ( Medicare Part A and Part B) ...

Why do we need a Part D?

These are people who enrolled in Part D because prescription drugs have historically been one of the expenses that were most concerning to beneficiaries. (Nearly $1 of every $5 Medicare dollars goes toward outpatient prescription drug costs, mostly via Part D coverage.)

How many rules of the road are there for Medicare Part D?

When tackling Medicare Part D, here are seven rules of the road.

How to get a Part D plan?

Here’s what you need to do to get Part D: Enroll in Medicare Part A or Part B, or both. Live in a county where the plan is offered. And here are the ways you can get coverage.

What is Medicare Part D?

How to buy your Part D plan. Medicare Part D plans cover outpatient prescription drugs. Choose from a standalone plan or drug coverage included in a Medicare health plan.

What is a standalone Medicare plan?

A standalone plan provides coverage just for your prescription drugs. You would enroll in this type of plan if: You use Original Medicare for your health care needs and want prescription drug coverage. You have a Medicare Supplement plan. These plans don’t include outpatient prescription drug coverage, so you’ll choose a standalone Part D plan too.

What is the state health insurance assistance program?

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions. Visit medicare.gov, or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Does Medicare have a penalty if you don't have a Part D plan?

If you don’t, you’ll likely have to pay a penalty if you enroll in one later. That penalty gets added to the monthly premium and continues as long as you have a Part D plan.

Do you pay the least for prescriptions?

You pay the least amount for your prescriptions when you use a pharmacy in the network . Check the list to make sure your pharmacy, or a pharmacy you are willing to use, is part of the network.

Does Medicare cover outpatient prescriptions?

But it doesn’t include coverage for most outpatient prescription drugs, like the medicines you take every day or for short periods of time. A Part D prescription drug plan would help pay for these types of medicines.

What is the deductible for Medicare Part D?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018.

What is Medicare Part D plan Juliet?

Premiums can vary widely; as you see here, Medicare Part D plan Juliet has more than double the monthly premium that Medicare Part D plan Penelope has. A second cost that most Medicare Part D plans have is the deductible, although some plans have a $0 deductible.

What is the out of pocket limit for Medicare Part D?

Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example. All Medicare Part D plans have an out of pocket limit, which is $5,000 in 2018.

What is cost sharing in Medicare?

Cost-sharing is what you pay every time you fill a prescription. Medicare Part D plans typically arrange medications into tiers, with lower-cost medications on the bottom of tiers and higher-cost medications on the higher tiers. Here’s what Medicare Part D Plan Penelope and Medicare Part D Plan Juliet charge for prescriptions you fill:

How much would you save on copayments?

Over the whole year you would save $252 on copayments (12 times $21). Once you’ve considered how much you spend a year on copayments, the price difference between the two plans is only $42 a year.

How many times do you have to pay for a prescription?

The prescription drug you take costs $100, so you must fill it three times and pay the full $100 before your plan begins to pay. For other plans, tier 1 and tier 2 prescription drugs don’t require you to reach the deductible.

Does Medicare have a stand alone plan?

Every Medicare beneficiary has access to at least one stand-alone Medicare Part D Prescription Drug Plan in 2018, according to the Centers for Medicare and Medicaid Services (CMS). This means that you, like most other Medicare beneficiaries, will have dozens of options to choose from when you’re looking for Medicare Part D Prescription Drug ...

What is Medicare Part D?

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance.

What is Medicare Part D enrollment?

Medicare Part D enrollment is the first step in getting the coverage you need for your prescription medications. With multiple plans to choose from, it is helpful to compare plans carefully to find the right plan for you. You can start by entering your zip code on this page.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

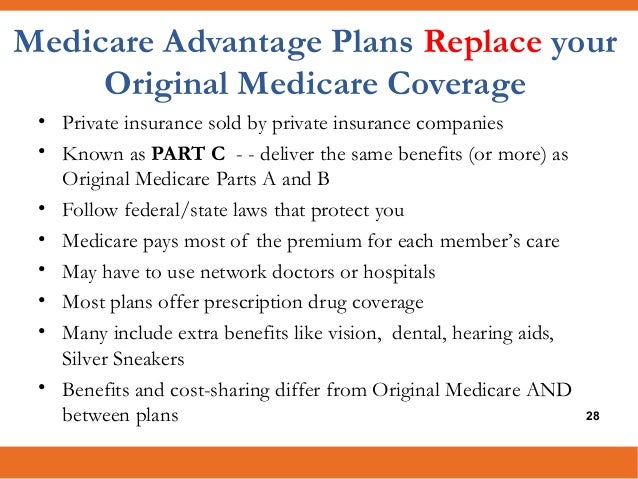

What is Medicare Advantage Plan?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

How much is Part D late enrollment penalty?

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didn’t have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

How long can you go without prescription drug coverage?

You can avoid this penalty by ensuring you don’t go without creditable prescription drug coverage for 63 days or longer .

What is a SEP in Medicare?

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

How many Medicare Part D beneficiaries will be enrolled in Humana by 2021?

A whopping 17% of Medicare Part D beneficiaries are enrolled in a Humana drug plan by 2021.

When to check prescriptions for a new prescription?

Each October, it is a good idea to check your prescription plan. This needs to be done if you have new medicines or the dosage amounts of existing ones have changed since last year.

How much does Wellcare cost?

Average monthly premiums for their plans range from $17 – $76. Click the button below to compare WellCare Part D drug plans against the other companies based on your own medications to see what your total out-of-pocket expenses will be.

How many prescription drug plans will be available in 2021?

In 2021, there were 996 prescription drug plans to choose from across the country.

Does CVS have Aetna?

The new partnership allows plan members at lower prices with any of the over 9,700 locations around America when using their pharmacy benefits – this includes all CVS pharmacies nationwide becoming preferred providers for those who are enrolled in an Aetna health insurance policy.

Is there a deductible for Tier 1 and 2 drugs?

There is no deductible for Tier 1 and 2 drugs, and in 2022 the deductible on Tires 3,4, and 5 will raise to $480.

Will Medicare Part D increase in 2022?

Medicare Part D plans in 2022 will likely increase in terms of what’s available. So what’s the best way to choose?