Contact Social Security to sign up for Part B:

- Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). Send the completed form to your local Social Security office by fax or mail.

- Call 1-800-772-1213. TTY users can call 1-800-325-0778.

- Contact your local Social Security office.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Full Answer

How do you enroll in Medicare Part B?

5 things to do before signing up for Medicare. Ask the employer or benefits administrator how its retiree coverage works with Medicare. You’ll want to know if your (or your family’s) current benefits will change, if they offer retirement coverage or other supplemental coverage that works with Medicare, and if any drug coverage they offer is creditable drug coverage .

How do I add Part B to my Medicare?

Nov 24, 2021 · Views: 95061. If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period (SEP), you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer. You can also …

How to enroll in Medicare Part B?

Feb 22, 2021 · Signing up for Part B is easy—apply by March 31. There are 3 ways you can sign up: Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. If you get benefits from the Railroad Retirement Board, contact your local RRB office to sign up for Part B.

How can I apply for Medicare Part B?

You can take one of two courses of action, depending on if you’ve signed up for Medicare Part A only, or haven’t signed up at all yet… If You Have Medicare Part A Only. If you have Medicare Part A only when you retire, then you need the following 2 forms in order to sign up for Part B: CMS 40B – This form is the actual application for Part B. There’s a section labeled “Remarks” …

How long do I have to enroll in Medicare Part B after I retire?

8 monthsYou have 8 months to enroll in Medicare once you stop working OR your employer coverage ends (whichever happens first). But you'll want to plan ahead and contact Social Security before your employer coverage ends, so you don't have a gap in coverage.

Can Medicare Part B be added at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

How do I start Medicare Part B?

Most people get Medicare Part B (Medical Insurance) when they turn 65....There are 3 ways you can sign up:Fill out a short form, and send it to your local Social Security office.Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.Contact your local Social Security office.Feb 22, 2021

What is the fastest way to apply for Medicare Part B?

Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You'll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

How long does it take for Medicare Part B to go into effect?

Yes. You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How do you pay for Medicare Part B if you are not collecting Social Security?

You can request to have your Part B premiums deducted from your Office of Personnel Management (OPM) annuity as long as you're NOT entitled to Social Security or RRB benefits. Call us at 1-800-MEDICARE to make your request. For questions about your bill, call the RRB at 1-877-772-5772.

How do I check my Medicare Part B status?

The status of your medical enrollment can be checked online through your My Social Security or MyMedicare.gov accounts. You can also call the Social Security Administration at 1-800-772-1213 or go to your local Social Security office.

Who is eligible for Medicare Part B?

You're 65 years old You automatically qualify for Medicare Part B once you turn 65 years old. Although you'll need to wait to use your benefits until your 65th birthday, you can enroll: 3 months before your 65th birthday. on your 65th birthday.

When do you get Medicare Part B?

Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1.

How to sign up for Part B?

There are 3 ways you can sign up: Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office.

What to do if you didn't sign up for Medicare at 65?

If you did not sign up for any part of Medicare at 65, the best thing to do is either to call Social Security, or to go to your local Social Security office to enroll in Medicare A & B. They’ll ask you when you want Medicare to start, and you can coordinate it with the termination of your group plan as best as you can.

What is Medicare Supplement?

Medicare Supplement + Prescription Drug Plan (PDP) You can get a Medicare Supplement, which is also known as a Medigap policy, to go along with Medicare Parts A & B. This policy will cover most or all of the Medicare deductibles, coinsurance, and copays. You also can get a PDP to cover your prescriptions.

How long do you have to enroll in Medigap?

The enrollment periods for these plans are a bit different than those mentioned above for the MA. For Medigap plans: 1 If you have Part B already, you only have a Medigap Open Enrollment (OE) Period that lasts for 6 months after the time you are both 65 and older and have Part B effective. So if you are retiring after 65 and have had Part B effective for more than 6 months, you’re not in your OE period anymore.#N#This doesn’t mean you can’t get a Medigap plan or have to wait until later to sign up, it just means you’ll have to answer health questions and could possibly be turned down by different insurance companies for different health conditions. However, each Medigap company treats this situation of leaving employer coverage a little bit different, and each company has different health conditions that they will either accept or decline you for, so it’s best to work with an independent insurance agent who can find you the best company to go with depending on your unique situation.#N#Most Medigap companies will allow your plan to start on most days of the month, and not be confined to just starting the first day of the month, as it is with MAs. 2 If you don’t have Part B yet, your Medigap plan can start the day Part B is effective. Most Medigap companies will allow you to enroll in the 6-month period leading up to your Part B effective date.

What is Medicare Supplement?

Medicare Supplement, or Medigap, plans are optional private insurance products that help pay for Medicare costs you would usually pay out of pocket . These plans are optional and there are no penalties for not signing up; however, you will get the best price on these plans if you sign up during the initial enrollment period that runs for 6 months after you turn 65 years old.

When do you get Medicare?

Medicare is a public health insurance program that you qualify for when you turn 65 years old. This might be retirement age for some people, but others choose to continue working for many reasons, both financial and personal. In general, you pay for Medicare in taxes during your working years and the federal government picks up a share of the costs.

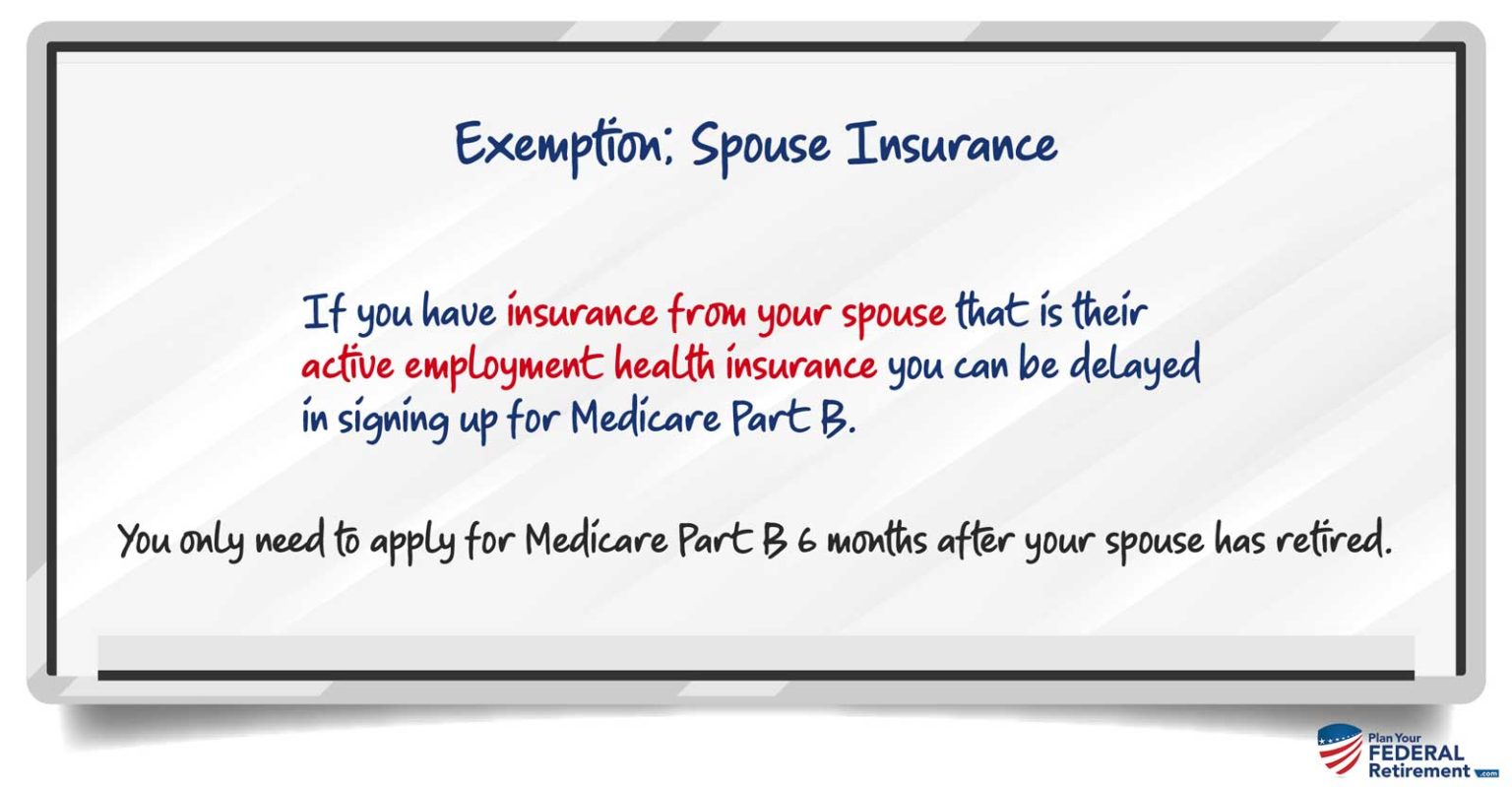

Do you have to sign up for Medicare if you are 65?

Medicare is a federal program that helps you pay for healthcare once you reach age 65 or if you have certain health conditions. You don ’t have to sign up when you turn 65 years old if you continue working or have other coverage. Signing up late or not at all might save you money on monthly premiums but could cost more in penalties later.

Is Medicare mandatory?

While Medicare isn’t necessarily mandatory, it may take some effort to opt out of. You may be able to defer Medicare coverage, but it’s important to if you have a reason that makes you eligible for deferment or if you’ll face a penalty once you do enroll.

Does Medicare cover late enrollment?

Medicare programs can help cover your healthcare needs during your retirement years. None of these programs are mandatory, but opting out can have significant consequences. And even though they’re option, late enrollment can cost you.

Is there a penalty for late enrollment in Medicare Part C?

Since this is an optional product, there is no late enrollment penalty or requirement to sign up for Part C. Penalties charged for late enrollment in parts A or B individually may apply.

Do you pay for Part A insurance?

Most people don’t pay a monthly premium for Part A, but you will still have to plan to pay a portion of your inpatient care costs if you’re admitted to a hospital for care.

When do you have to enroll in Medicare?

If you work for a smaller employer, you must enroll in Part A and Part B when you turn 65, and then Medicare pays claims first and your employer plan becomes your secondary insurance. Medicare has strict enrollment rules that affect people differently according to their circumstances.

When does the IEP start?

The seven-month initial enrollment period begins three months before the month of your 65th birthday and ends three months after that month. (So for example, if you turn 65 in April, your IEP begins Jan. 1 and ends July 31.)

How much is the penalty for not enrolling in Part B?

Because there is a 10 percent per year premium penalty for not enrolling in Part B within a few months of the deadline, annuitants are under great pressure to make a decision and about 70 percent decide to enroll. It can be surmised that this is usually an “everybody does it” rather than well-calculated decision.

Who is Walton Francis?

He is the principal author of Checkbook’s Guide to Health Plans for Federal Employees. Individuals can subscribe to the online version for $11.95 and also see a listing of the many agencies that provide free Guide access to their employees at www.guidetohealthplans.org. My Federal Retirement readers get a 20-percent discount and should use the promo code MyFederal at checkout.