What are some examples of medical billing fraud?

Mar 03, 2021 · Join the Senior Medicare Patrol (SMP): The SMP educates and empowers people with Medicare to take an active role in detecting and preventing health care fraud and abuse. Make informed Medicare choices: Each year during the fall Open Enrollment Period (October 15–December 7), review your plan to make sure it will meet your needs for the next year. If …

What constitutes fraudulent medical billing?

Nov 01, 2021 · If you suspect Medicare fraud you can report it online to the Office of the Inspector General or by calling 800-HHS-TIPS. The Qui Tam Provision allows a citizen to bring civil action on behalf of the government. This makes you a protected whistleblower. Also under this provision the whistleblower can awarded a share of the recovery!

What is the most common forms of Medicare fraud?

Jun 26, 2019 · There are many different types of Medicare fraud and a whistleblower can alert the government to an ongoing scheme. The whistleblower does this by filing a lawsuit against the person or company believed to have scammed the government.

How do I identify Medicare fraud?

Feb 20, 2020 · If you suspect fraud in your healthcare, report it! Call the health care provider listed on the Medicare Summary Notice or Explanation of Benefits and inquire about the questionable item (s). In many cases, it may be the result of a billing error, which can easily be corrected.

Why Is the Government So Concerned with Medicare Fraud?

Medicare fraud costs taxpayers billions of dollars. Since Medicare is a large healthcare program, the potential for fraud is rampant, and in many cases the government would not be able to carry out investigations without the assistance of whistleblowers.

How Does A Whistleblower Help Stop Medicare Fraud?

A whistleblower refers to a current or former employee who has evidence or reason to believe that Medicare fraud has occurred. There are many different types of Medicare fraud and a whistleblower can alert the government to an ongoing scheme.

What Is Medicare Fraud?

Medicare fraud can include many different schemes, but most frequently refers to:

Who Can Commit Health Care Fraud?

Medicare fraud schemes range from individuals to widespread activities carried out by a group or an institution. Anyone can be involved in Medicare fraud. Some common examples include:

What Are the Potential Outcomes of Medicare Fraud?

It is illegal to defraud the federal government. Committing Medicare fraud exposes entities or individuals to criminal, administrative or civil liability and can result in fines, imprisonment, and other penalties.

How Much Money Is Falsely Billed Through Medicare?

In June 2018, the U.S. Department of Justice (DOJ) announced the agency’s largest ever health care fraud enforcement action, during which 601 people, including dozens of doctors, were arrested for “their alleged participation in health care fraud schemes involving more than $2 billion in false billings.”

What Can Whistleblowers Do to Stop Health Fraud?

Whistleblowers can file a False Claims Act lawsuit, also known as a qui tam or whistleblower lawsuit. Whistleblowers should always seek insight from an experienced attorney before moving forward with a claim.

Is there a measure of fraud in health care?

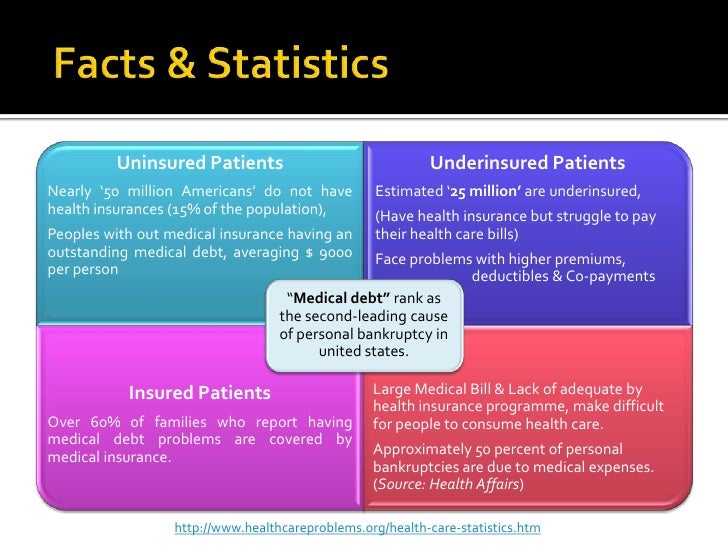

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

What does "knowingly submitting" mean?

Knowingly submitting, or causing to be submitted, false claims or making misrepresentations of fact to obtain a To learn about real-life cases of Federal health care payment for which no entitlement Medicare fraud and abuse and would otherwise existthe consequences for culprits,

What is the Stark Law?

Section 1395nn, often called the Stark Law, prohibits a physician from referring patients to receive “designated health services” payable by Medicare or Medicaid to an entity with which the physician or a member of the physician’s immediate family has a financial relationship , unless an exception applies.

What is the OIG exclusion statute?

Section 1320a-7, requires the OIG to exclude individuals and entities convicted of any of the following offenses from participation in all Federal health care programs:

What is CMPL 1320A-7A?

The CMPL, 42 U.S.C. Section 1320a-7a, authorizes OIG to seek CMPs and sometimes exclusion for a variety of health care fraud violations. Different amounts of penalties and assessments apply based on the type of violation. CMPs also may include an assessment of up to three times the amount claimed for each item or service, or up to three times the amount of remuneration offered, paid, solicited, or received. Violations that may justify CMPs include:

What are some examples of Medicare fraud?

Some examples of possible Medicare fraud are: A healthcare provider bills Medicare for services you never received. A supplier bills Medicare for equipment you never received. Someone uses another person's Medicare card to get medical care, supplies or equipment. Someone bills Medicare for home medical equipment after it has been returned.

Can you give your Medicare number to anyone?

Never give your Medicare number to anyone, except your doctor or other Medicare provider. Don't allow anyone, except your medical providers, to review your medical records or recommended services. Don't ask your doctor to make false entries on prescriptions, bills, or records in order to get Medicare to pay. Don't accept medical supplies ...

What does it mean to raise a red flag?

Raise a red flag when any provider states he or she has been endorsed by the Federal Government or by Medicare. Avoid a provider of healthcare items or services who tells you that the item or service is not usually covered, but they know how to bill Medicare to get it paid.

What are the 4 categories of CMS program integrity violations?

The 4 categories of CMS program integrity violations can result from unintentionally false or mistaken documentation submitted for reimbursement or from negligent or intentionally false documentation. Billing errors and mistakes, misclassification of a diagnosis or procedure, or improper documentation can indicate lack of program integrity education. 16, 17, 18 Inaccurate coding or errors in documentation can result from improper or incomplete interaction with the patient’s electronic health record (EHR) if the physician merely copies and pastes text, if the EHR self-populates from previous encounters, or if the algorithm prompts the physician to offer the patient potentially unnecessary or inappropriate services. 16, 17 When do these types of behaviors become fraud?

Who is Katherine Drabiak?

Katherine Drabiak, JD is an assistant professor at the University of South Florida College of Public Health and the Morsani College of Medicine in Tampa, where she is also co-director of the Law and Medicine Scholarly Concentration Program. She is currently a member of AdventHealth’s Medical Ethics Committee and has worked with the Florida Bar, the Hillsborough County Bar Association, the 13th Judicial Circuit of Hillsborough County, and the Florida Department of Health. Her teaching and research concerns health law, public health law, and medical ethics, and her scholarship has appeared in the Journal of Law, Medicine and Ethics, the American Journal of Bioethics, and popular media outlets.