How can I change Medicare Supplement insurance plans?

- Keep your current (old) plan for the 30-day free look period described above.

- If you decide you like the new plan, contact the insurance company who sold you your old plan and cancel it in writing. Follow the insurance plan’s instructions. ...

- If you decide not to stay with the new plan, you can keep your old one. ...

Full Answer

When can I switch Medicare supplement plans?

Jan 18, 2022 · Switching Medicare supplement plans requires you to simply contact the new insurance provider and apply for a plan. If your application is accepted, contact your old plan provider and request a cancellation of your policy. If switching plans within the same provider, just contact the provider and notify them you would like to switch plans.

How do I switch Medicare supplement plans?

Switch to a new Medicare Supplement plan from a different insurer. You will have a guaranteed issue right to purchase a Medicare Supplement Plan A, B, C, F, K, or L from any other insurance carrier that offers them in your state. The Bottom Line No doubt, making changes to your Medicare Supplement insurance can be confusing.

How often can I change Medicare plans?

As long as you’re still in Original Medicare Parts A & B, there’s no need to switch plans unless you feel like that’s needed for your best coverage. However, if you move states and want to switch to a different policy, you’ll have to check with your insurance company to see if they will offer you a different Medigap policy in your new area.

Which Medicare supplement plan should I Choose?

Medicare supplement. Changing to a Medicare supplement plan. If you have a different Medicare supplement plan. You can switch to a different Medicare supplement plan at any time with a new application, which can be submitted online, over the phone by calling 1-888-563-3307, or by mailing a paper application (PDF) to us.

Can I change Medicare Supplement plans at any time?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

Can you change Medicare Supplement plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

How do you change your Medicare Supplement plan?

To change Medicare Supplement insurance plans, call the insurance company that's selling the plan you want. If they accept your application, call your current Medicare Supplement insurance company and ask how to end your coverage with your current plan.

Can I change from one Medigap plan to another?

If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have to pay more for your new Medigap policy.

Which states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

Can I switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can I switch from Medicare Advantage to Medicare Supplement?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

Can I have two Medicare Supplement plans?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

What happens if you buy a Medigap policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy: Might not be a Guaranteed renewable policy. May have a bigger Premium increase than newer, standardized Medigap policies currently being sold. expand.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...

Why do people switch insurance plans?

For example, some people decide to switch plans because: 1 They are paying for benefits they don’t need, 2 They’re in need of a more comprehensive plan, potentially one that additional benefits, 3 They are not satisfied with the company they purchased their supplement from, or 4 They want to find a more affordable policy.

When is Medicare open enrollment?

You qualify for Open Enrollment during the first six months that you’re enrolled in Medicare Part B, and are 65 or older.

How long do you have to cancel Medigap?

You have the right to change your mind and cancel your new Medigap policy within the first 30 days if you are not happy with your company or coverage. This time frame is your “free-look period,” which starts the day you get your new Medigap policy.

How to switch Medicare Supplement Plan?

You can switch to a different Medicare Supplement plan at any time with a new application, which can be submitted online, over the phone by calling 1-888-563-3307, or by mailing a paper application (PDF) to us.

When can I enroll in Medicare Advantage Plan A?

You're automatically eligible for Plan A if you’re 65 or older. If you’re under age 65, you are eligible for Plan A if you’ve lost coverage under a group policy after becoming eligible for Medicare. You can also enroll if you had Plan A, then enrolled in a Medicare Advantage plan, and now would like to return to Plan A.

How long do you have to be in Medicare Advantage to return to Plan C?

You can do this as long as it’s within the first 12 months of your Medicare Advantage plan. You're automatically eligible for Plan A if you’re 65 or older. If you’re under age 65, you are eligible for Plan A ...

How to contact Blue Cross Blue Shield of Michigan?

You can call: 1-888-216-4858 from 8 a.m. to 5:30 p.m., Monday through Friday. Or send us a fax at 1-866-392-7528. You can also write us at: Blue Cross Blue Shield of Michigan. P.O. Box 44407. Detroit, MI 48244-0407. If you let us know you don't want to keep your supplement plan within 30 days of your coverage start date, send us your ID card and:

What is the phone number for MyBlue Medigap?

Just keep in mind that, if you decide to cancel your plan, we no longer offer MyBlue Medigap. You can call us at: 1-800-662-6667 from 8 a.m. to 5:30 p.m., Monday through Friday. Or email us at: [email protected]. You can also write us at:

When can I move out of Medicare Advantage?

You can only do this: During the annual election period from Oct. 15 to Dec. 7. During the annual disenrollment period from Jan. 1 to March 31. Under certain conditions; for example, you move outside your Medicare Advantage plan's service area.

Does Blue Cross Blue Shield of Michigan accept Medicare?

or its territories that accepts Medicare. You don't have to use our network. Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans.

How to switch to Medicare Advantage?

To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins. To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE. Unless you have other drug coverage, you should ...

What happens if you lose Medicare coverage?

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join.

When to sign up for Medicare Supplement Plan?

The best time for you to sign up for a Medicare Supplement plan, also called Medigap, is when you turn 65 and are covered under Medicare Part B. This six-month period, known as your Medigap Open Enrollment Period, typically starts on your 65th birthday if you’re already enrolled in Part B. During this period, you’re guaranteed acceptance into any Medicare Supplement plan available in your area without submitting to a complete medical review or being denied coverage because of pre-existing conditions. If you choose not to get Medicare Part B right away, then your Medigap Open Enrollment Period may also be delayed and will start automatically once you’re at least 65 and have Part B.

How long do you have to wait to get Medicare Supplement?

If you’re not turned down because of your health, you may have to wait up to six months to be covered ...

What happens if you no longer have a Medigap policy?

If your former Medigap policy is no longer sold, you may be able to choose a different plan with guaranteed issue. You can enroll in a Medigap Plan A, B, C, F, K, or L offered by any private insurance company in your state.

How many Medigap plans are there?

In most states, there are 10 Medigap plans — Plan A through Plan N (some plans, such as Plan E, are no longer sold).

How long do you have to change Medigap?

Other points to keep in mind when switching Medigap plans. If you decide to change Medigap plans, you have a 30-day “free look” period where you can temporarily carry both plans to see which one you like better.

How many states have Medigap?

In most states, there are 10 Medigap plans — Plan A through Plan N (some plans, such as Plan E, are no longer sold). Massachusetts, Minnesota, and Wisconsin have their own versions of Medigap.

Can you switch Medicare plans with guaranteed issue?

You may still be able to switch plans with guaranteed issue in certain situations . For example, if your Medigap company goes bankrupt or misled you, you may be able to change Medicare Supplement policies with guaranteed issue. But some states have laws that make sure certain Medigap policies are always available.

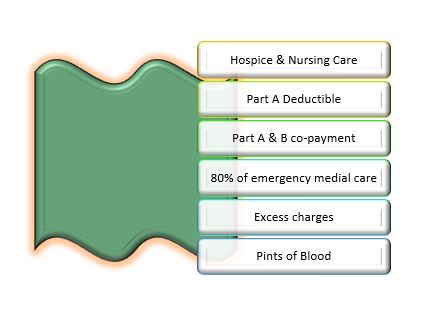

What is a Medicare Supplement Plan?

Medigap plans are designed to fill those gaps by supplementing your Original Medicare coverage to pay for certain out-of-pocket costs. A Medicare Supplement plan may pay your coinsurance or copayments from Medicare Part A and Part B.

What happens if you don't change your Medicare Supplement?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, your insurer can force you to undergo medical underwriting, and they can now assess your health history during the application process and can turn you down if it chooses.

How to avoid medical underwriting?

The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right. Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own.

What to do if you are unhappy with your Medicare Supplement?

If you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter. Call to speak with a licensed insurance agent who can help you compare Medicare Supplement plans in your area. They can help you change plans once you find the best plan for your needs.

How long do you have to keep Medicare Supplement?

The Medicare Supplement “Free Look” Period. When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect.

How long does it take to enroll in Medigap?

If you do consider enrolling in a Medigap plan Medigap plans, you should try to apply for a plan during your 6-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period is a 6-month period that starts the day you are both 65 years old and enrolled in Medicare Part B.

How long do you have to wait to switch Medigap?

Your insurance company may agree to sell you a new policy with the same basic benefits, but you may have to wait up to six months before the new plan covers any pre-existing health conditions . If any of the above situations apply to you, you can switch Medigap plans without medical underwriting.

What are the benefits of Medigap?

One of the biggest benefits of Medigap coverage is its stellar flexibility. In fact, the adaptability of Medicare Supplements frequently tip the scale in its favor when consumers are deciding between Medigap and a Medicare Advantage plan.

How long does it take to enroll in Medigap?

To enroll in Medigap, every Medicare recipient has a six-month enrollment period, during which you have free reign to enroll any time. This is likely the same time that you are enrolling in traditional Medicare (Part A and Part B) when you turn 65.

How to leave Medicare Advantage Plan?

Then you can leave a Medicare Advantage plan (during an appropriate time period described above) in one of several ways, such as: Call the Medicare Advantage plan you wish to leave and ask for a disenrollment form. Call 1-800-MEDICARE (1-800-633-4227) to request that your disenrollment be processed over the phone.

What time does Medicare return to original Medicare?

Representatives are available Monday through Friday, from 7AM to 7PM, all U.S. time zones. Leaving the Medicare Advantage plan automatically returns you to Original Medicare, Part A and Part B. Keep in mind, however, that if the Medicare Advantage plan you left included prescription drug coverage, and you still want prescription drug coverage, ...

Does Medicare Supplement have a contract?

Your plan no longer has a contract with Medicare. You might not have your choice of any of the 10 standardized Medicare Supplement plans available in most states; your choice might be limited to certain Medicare Supplement plans.

Can you change from Medicare Advantage to Medicare Supplement?

In some cases you may be able to change from a Medicare Advantage plan to a Medicare Supplement plan with guaranteed-issue rights, meaning that the insurance company must accept you as a member and cannot charge you more due to your health condition. However, in some cases the company may be allowed to impose a waiting period on coverage relating ...