Where do Medicare taxes go on your paycheck?

Your Medicare tax is deducted automatically from your paychecks. Where do Medicare taxes go, and how is Medicare paid for? The Medicare tax that is withheld from your paychecks helps fund health care costs for people enrolled in Medicare. Medicare is financed through two trust fund accounts held by the United States Treasury:

Do employers have to pay Medicare tax?

Employers, employees and self-employed individuals are required to pay a tax for Medicare. The government sets the tax as a percentage of gross earnings, so the more an employee makes, the more you have to withhold. As an employer, you must also match the employee’s contribution.

How is the Medicare tax calculated for employees?

The Medicare tax for an employee earning gross income of $2,400 in a pay period is calculated as follows: When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold.

What does Medicare tax look like on a pay stub?

Medicare tax may be abbreviated on your pay stub as one of the following: The Medicare tax rate for employees is 1.45 percent of covered income. There are no income limits on Medicare tax, so all covered income is taxable.

Do employers pay Medicare tax?

Medicare wages There's no wage cap for Medicare tax, which means that all of an employee's annual wages are subject to this tax. Employees and employers must each contribute 1.45%.

Is Medicare tax withheld reported on w2?

References to Form W-2 on Form 8959 and in these instructions also apply to Forms W-2AS, W-2CM, W-2GU, W-2VI, and 499R-2/W-2PR. However, for Form 499R-2/W-2PR, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box 20.

Does Medicare tax come out of your paycheck?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Is additional Medicare tax paid by employer or employee?

An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee.

How do I get my Medicare tax statement?

Call 1-800-MEDICARE (1-800-633-4227) to ask for a copy of your IRS Form 1095-B. TTY users can call 1-877-486-2048.

Does my W-2 show how much I paid for health insurance?

Health Insurance Cost on W-2 - Code DD It is included in Box 12 in order to provide comparable consumer information on the cost of health care coverage. In general, the amount reported will include the portion paid by the employer as well as the portion paid by the employee.

Why is Medicare taken from my paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

How does FICA show on my paycheck?

If you see “FICA” on your pay stub, this is the amount you are contributing to these funds. Some pay stubs will break down your contribution to the two funds separately, and some will not.

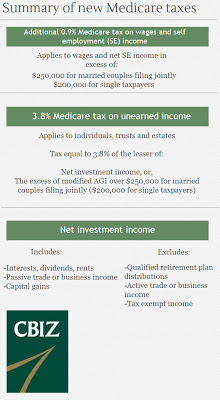

Who pays the .9 Medicare tax?

Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

What are the taxes on Medicare?

Medicare tax may be abbreviated on your pay stub as one of the following: 1 HI – Hospital Insurance 2 MWT – Medicare Withholding Tax 3 Med – Medicare

What is Medicare tax?

MWT – Medicare Withholding Tax. Med – Medicare. The Medicare tax rate for employees is 1.45 percent of covered income. There are no income limits on Medicare tax, so all covered income is taxable.

What is the tax withheld from paycheck?

Taxes withheld from your paycheck may be called “employee withholding” and taxes matched by your employer may be called “company match.”.

Do employers have to match withholdings for Social Security?

Employers also are required to match paycheck withholding amounts for Social Security and Medicare. This “match” means your employer pays the same amount you do every pay period for Social Security and Medicare withholding. Taxes withheld from your paycheck may be called “employee withholding” and taxes matched by your employer may be called ...

Is Medicare taxable income?

There are no income limits on Medicare tax, so all covered income is taxable. Note that while your employer is required to match the taxes you pay for both Social Security and Medicare, your pay stub may or may not show the employer match.

Do employers have to pay Medicare taxes?

Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs. Employers also are required to match paycheck withholding amounts for Social Security and Medicare.

What are Medicare taxes for?

Medicare is the federal government’s health insurance plan for Americans over the age of 65 and those with disabilities. It helps pay for essential medical services, including:

Who pays the Medicare tax?

Employers, employees and self-employed individuals are required to pay a tax for Medicare.

Basic Medicare tax rates

The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must:

Additional Medicare Tax rates

When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold.

Remitting the tax for Medicare

When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer (EFT).

Frequently asked questions about the Medicare tax

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act (FICA). FICA deductions help pay for both Medicare and Social Security programs.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What Are Medicare Taxes for?

- Medicare is the federal government’s health insurance plan for Americans over the age of 65 and those with disabilities. It helps pay for essential medical services, including: 1. Inpatient hospital, skilled nursing, home health and hospice care (Medicare Part A) 2. Physician services, diagnostic tests and preventive screenings (Medicare Part B) The Medicare tax helps pay for these health c…

Who Pays The Medicare Tax?

- Employers, employees and self-employed individuals are required to pay a tax for Medicare. The government sets the tax as a percentage of gross earnings, so the more an employee makes, the more you have to withhold. As an employer, you must also match the employee’s contribution.

Basic Medicare Tax Rates

- The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must: 1. Withhold 1.45% of an employee’s gross wages 2. Contribute a matching 1.45% of an employee’s gross wages Example: The Medicare tax for an employee earning gross inc...

Additional Medicare Tax Rates

- When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold. The Medicare taxes for employees earning over $200,000 are as follows: 1. Earnings up to $200,000: 1.45% 2. Earnings exceeding $200,000: 2.35% (1.45% plus 0.9%) Emplo…

Calculating The Additional Medicare Tax on Earnings Over $200,000

- Employers must start deducting the Additional Medicare Tax in the pay periodin which an employee’s wages exceed $200,000. Continue applying this surtax in each subsequent pay period until the end of the calendar year. Example #1: An employee earning $30,000 per pay period makes a total of $180,000 in the first six pay periods of the year. The Additional Medicare Tax a…

Remitting The Tax For Medicare

- When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer(EFT). You can make the payment yourself or arrange for your tax professional, payroll service or a trusted third-party to make this deposit for you.

Frequently Asked Questions About The Medicare Tax

- Is the Medicare tax mandatory?

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act(FICA). FICA deductions help pay for both Medicare and Social Security programs. It’s important to know that penalties can apply to an employer who doesn’t w… - At what income level does the Medicare tax increase?

Once you pay an employee more than $200,000 in a calendar year, you must withhold the Additional Medicare Tax. However, things look different from an employee’s perspective. The tax may or may not apply to them depending on their tax filing statusand income thresholds. Individ…