There are 2 ways: Log into your Medicare account — Select "My Premiums" and then "See or change my Medicare Easy Pay" to complete a short, online form. Fill out and mail a paper form — Print and fill out the authorization form.

Full Answer

Why did my Medicare premiums go up?

My Medicare premiums went up because of my income from two years ago. My income has since gone down. Is there anything I can do? Yes. You can apply to Social Security to reduce your Medicare premium in light of changed financial circumstances.

How do I request a Medicare premium reduction?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.

How do I Mail my premium payments to Medicare?

You'll need to mail your premium payments to: Log in or create your secure Medicare account — Select "My Premiums" and then "Sign Up" to complete a short, online form. Fill out and mail a paper form — Print the authorization Agreement for Preauthorized Payments from (SF-5510): PDF in English or HTML in English or PDF in Spanish or HTML in Spanish.

When will my Medicare premium be deducted from my bank statement?

Get a sample of the new statement that will start mailing in early 2022. We'll deduct your premium from your bank account on or around the 20th of the month. Your bank statement will show a payment to "CMS Medicare Premiums."

How do I change my Medicare premium?

There are 2 ways:Log into your Medicare account — Select "My Premiums" and then "See or change my Medicare Easy Pay" to complete a short, online form.Fill out and mail a paper form — Print and fill out the authorization form. Get the form in English and Spanish.

Are Medicare premiums recalculated every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How much are Medicare premiums for 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How do you pay Medicare premiums?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What income is used to calculate Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Are Medicare premiums tax deductible in 2021?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

Can I pay Medicare premiums by phone?

Log into (or create) your Medicare account. Select “My premiums,” then, “Payment history.” Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

Can I see my Medicare premium bill online?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

When will Medicare Easy Pay deduct premiums?

We'll deduct your premium from your bank account on or around the 20th of the month.

How to sign up for Medicare online?

Log in or create your secure Medicare account — Select "My Premiums" and then "Sign Up" to complete a short, online form.

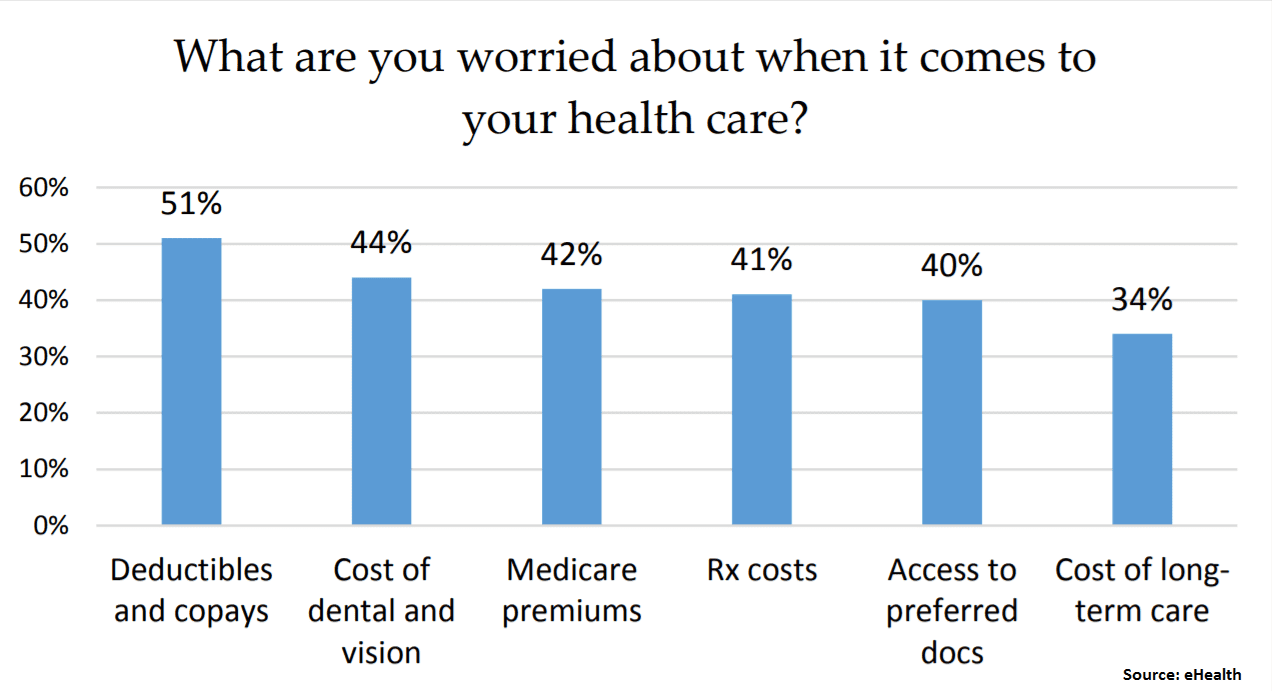

How do I change bank accounts or stop Medicare Easy Pay?

Log into your secure Medicare account — Select "My Premiums" and then "See or change my Medicare Easy Pay" to complete a short, online form.

How long does it take to get Medicare if you change your bank account?

If you stop Medicare Easy Pay: It can take up to 4 weeks for your automatic deductions to stop.

How long does it take to get Medicare Easy Pay?

Mail your completed form to: It can take up to 6-8 weeks for your automatic deductions to start. Until your automatic deductions start, you'll need to pay your premiums another way. If you can't process your Medicare Easy Pay request, we'll send you a letter explaining why.

What is Medicare Easy Pay?

Medicare Easy Pay is a free way to set up recurring payments for your Medicare premium. If you sign up for Medicare Easy Pay, your Medicare premiums will be automatically deducted from your checking or savings account each month. If you get a "Medicare Premium Bill" (Form CMS-500) from Medicare, you can sign up for Medicare Easy Pay.

How to request a reduction in Medicare premium?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.