If you retired before age 65, you still need health care coverage before enrolling in Medicare. You can use your HSA to pay for health care coverage purchased through an employer-sponsored plan under COBRA. You can also use your HSA to pay health insurance premiums while receiving unemployment compensation.

Can I pay my health insurance premiums with a HSA?

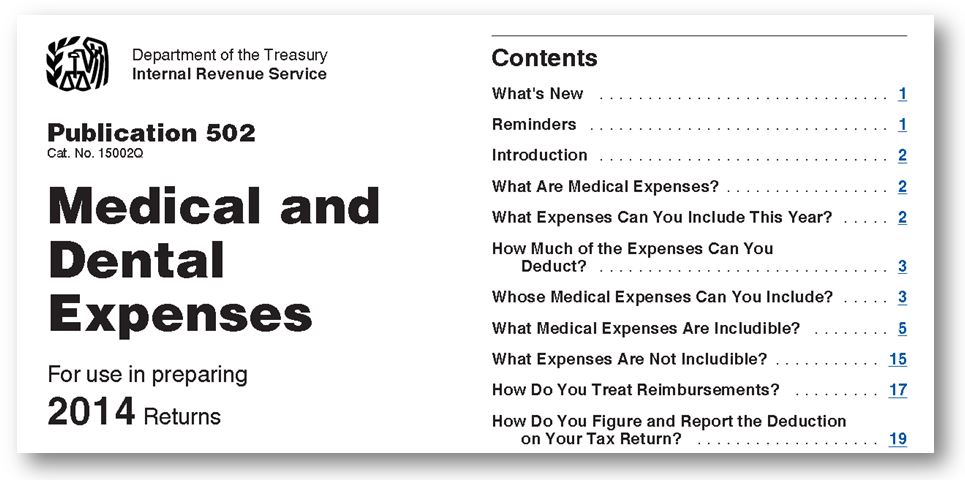

You can ONLY use your HSA to pay health insurance premiums if you are collecting Federal or State unemployment benefits, or you have COBRA continuation coverage through a former employer. See our list of Qualified HSA Expenses or refer to IRS Form 502 for more information.

How your HSA can reimburse you for Medicare premiums paid?

[ANSWER]Even though you have your Medicare premiums paid directly out of your Social Security benefits, you can withdraw money tax-free from your HSA to reimburse yourself for those expenses.

Can you pay life insurance premiums with HSA?

You may also be wondering if this item is eligible or ineligible for reimbursement with your HSA, FSA, or HRA. No, unfortunately you can't use your HSA, FSA, or HRA to pay for life insurance premiums. In fact, if you do pay for life insurance premiums with one of those accounts, you may be subject to a penalty.

Can a person on Medicare have a HSA?

savings account (HSA). Although Medicare enrollees cannot establish HSAs or make or receive contributions to their existing accounts, these individuals can withdraw any remaining balances in previously established accounts. This In Focus provides an overview of HSA rules and highlights how these rules apply to Medicare enrollees. Health Savings Accounts

What is the tax rate for Medicare after a HSA?

Excess contributions will be taxed an additional 6 percent when you withdraw them. You’ll pay back taxes plus an additional 10 percent tax if you enroll in Medicare during your HSA testing period.

What is an HSA account?

A health savings account (HSA) is an account you can use to pay for your medical expenses with pretax money. You can put money in an HSA if you meet certain requirements. You must be eligible for a high-deductible health plan and you can’t have any other health plan. Because Medicare is considered another health plan, ...

How long do you have to be on Medicare before you turn 65?

When you enroll in Medicare after you turn age 65, the IRS will consider you to have had access to Medicare for 6 months prior to your enrollment date. In general, it’s a good idea to stop HSA contributions if you’re planning to enroll in Medicare anytime soon. That way, you can avoid any tax penalties and save money.

What is Medicare Part B?

Medicare Part B (medical insurance) has standard costs, including a monthly premium and an annual deductible. Additionally, you’ll pay 20 percent of the Medicare-approved cost for most covered services. You can use the funds in your HSA toward any of these costs.

Does MSA money count toward deductible?

So while you can spend your MSA funds on a service Medicare doesn’t cover, it won’t count toward your deductible.

Is MSA the same as HSA?

This plan is similar to an HSA, but there are a few key differences. Just like a standard HSA, you’ll need to be enrolled in a high-deductible plan. With an MSA, this means you’ll need to select a high-deductible Medicare Advantage plan. Once you’ve selected a plan, things will look a little different than your HSA.

Can a 65 year old retire without Medicare?

As another example, let’s say a retired person chooses not to enroll in Medicare when they turn 65 years old. They don’t have another health plan and pay all health costs out of pocket. In this case, they’ll pay a late enrollment penalty if they do decide to enroll in Medicare later.

How long do you have to stop contributing to HSA before you can get Medicare?

According to CMS (the agency that oversee’s the Medicare program,) you should stop contributing to your HSA 6 months before you sign up for premium free Part A. This is because Premium-free Part A retroactively backdates 6 months.

How much is the high deductible plan G?

The cost of High Deductible Plan G is $38 dollars a month. This saves Tom over $720 dollars a year with no difference in coverage. Only paying the High Deductible Medicare Supplement deductible with his HSA plan instead of paying the insurance company to cover it.

How much is HDHP 2020?

According to Healthcare.gov, 2020 HDHP plans must have a minimum deductible of $1,400 for an individual and $2,800 for a family. The maximum out of pocket is $6,900 for an individual, $13,800 for a family (not including out of network service.) Due to their high deductibles, premiums for these plans are incredibly inexpensive.

Is HSA contribution tax free?

Contributions are tax-free, up to their annual limit (2020 limit is $3,550 for an individual and $7,100 for a family.) Investment gains in the HSA are tax deferred (like your 401k plan.) If you use proceeds (earnings from investments and what you contribute) on qualified medical expenses, they are non-taxable.

Is Medicare Part A free?

For most working Americans, Medicare Part A is premium free. Since there’s no cost associated with it to the beneficiary, most people sign up for Part A at age 65. This is generally a good idea. Usually, Medicare is a secondary insurance behind your work plan. That means your work plan must pay it’s portion first.

Can I use my HSA to pay my Medicare Advantage premiums?

Good news – you can use funds in your HSA to pay for Medicare Advantage insurance premiums in the form of a reimbursement. Medicare Advantage plans, also called Part C plans, also come with out-of-pocket costs, like copays and deductibles. You can pay for those costs with your HSA funds, as well.

Can I pay Medicare Supplement premiums from my HSA?

Unfortunately, you cannot pay Medicare Supplements premiums using HSA funds. Medicare Supplement premiums, or Medigap premiums, are one of the only Medicare plan types that you cannot pay for using HSA funds ( Publication 969, 2020 ).

Can I use my HSA to pay for Medicare Part D?

Yes, you can use accumulated HSA funds to pay for Medicare Part D premiums. You can also use your HSA funds to cover copays at the pharmacy.

Can I reimburse myself for past Medicare premiums?

If you have an HSA and didn’t realize you could use those funds to pay for Medicare premiums and other out-of-pocket costs, you can still reimburse yourself.

Conclusion

Contributing to an HSA in your working years is an excellent way to help plan for healthcare costs in retirement.

What is HSA 2021?

Medicare and Health Savings Accounts (HSA) Home / FAQs / General Medicare / Medicare and Health Savings Accounts (HSA) Updated on June 9, 2021. There are guidelines and rules you must follow when it comes to Medicare and Health Savings Accounts. A Health Savings Account is a savings account in which money can be set aside for certain medical ...

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.

What is an HSA?

An HSA stands for a health savings account. People who have HDHPs will often utilize HSAs as a way to save money on healthcare expenses. HDHPs are those that usually cover preventive health services and have a high deductible of at least $1,400 for an individual or $2,800 for a family, according to Healthcare.gov.

Why do people contribute to HSA?

Some people will contribute a significant amount to their HSA in preparation for their retirement. When they retire and start to receive Medicare benefits , they can then use the HSA to pay for health expenses.

What happens if you don't meet your HSA deductible?

If a person finds they do not meet their high deductible for the year, yet contributed the maximum amount to their HSA, the money can roll over and keep earning interest. When a person retires, and they have money in their HSA, they can use this money to help pay for Medicare expenses.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What happens if you don't use your HSA?

If a person does not use their HSA in a year, the funds can roll over into the next year. The HSA can earn interest, and the government will not tax a person on interest earned. Also, as long as a person uses the funds to pay for qualifying healthcare expenses, they will not pay tax on removing the funds.

Do HDHPs count towards income?

An employer can also contribute to an HSA, and the contribution does not count toward a person’s income, meaning they will not be taxed.

How does an HSA work?

HSAs work with HSA-eligible health plans to allow you to pay for qualified medical expenses. HSAs offer triple tax savings 1: 1 You can contribute pre-tax dollars. 2 You pay no taxes on earnings. 3 You can withdraw the money tax-free now or in retirement to pay for qualified medical expenses.

How long does it take for HSA to end?

When you enroll in any form of Medicare, neither you nor your employer should continue contributing to your HSA. If you enroll in Medicare after turning 65, your coverage can become effective up to 6 months earlier. You and your employer will need to end your HSA contributions up to 6 months before enrolling in Medicare since Medicare back dates ...

How long do you have to stop HSA contributions?

If you continue to work after age 65, and you or your employer is still contributing to an HSA: Stop making contributions to your HSA up to 6 months before applying for Medicare Part A only or Part A and Part B or starting your Social Security retirement benefits.

Can you be subject to tax penalties if you enroll in Medicare?

You could be subject to tax penalties if you make health savings account (HSA) contributions after you enroll in Medicare or when your Medicare coverage begins.