You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…Centers for Medicare and Medicaid Services

How to know if you are eligible for Medicare?

- You receive Full Medicaid benefits

- You are a Qualified Medicare Beneficiary (QMB) without other Medicaid (QMB Only)

- You receive QMB Plus

- You are a Specified Low-Income Medicare Beneficiary (SLMB) without other Medicaid (SLMB Only)

- You receive SLMB Plus

- You are a Qualifying Individual (QI)

- You are a Qualified Disabled and Working Individual (QDWI)

What is a Medicaid waiver and how does it work?

- does not cost more than the same service in a healthcare facility

- ensures a person’s health and welfare

- provides reasonable and adequate standards to meet a person’s needs

- uses an individualized plan of care centered on the person

How do I waive my medical insurance coverage?

If you waive enrollment in medical coverage:

- You cannot enroll your eligible dependents in PEBB medical, but you can enroll them in PEBB dental coverage if your employer offers it.

- The premium surcharges will not apply to you.

- You are eligible to participate in the SmartHealth wellness program, but you cannot qualify for the wellness incentives.

How can you tell if someone has Medicare?

- individual was no longer serving as a volunteer outside of the United States;

- organization no longer has tax-exempt status; or

- individual no longer has health insurance that provides coverage outside of the United States.

Can you waive Medicare coverage?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

Can I cancel my Medicare benefits?

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.

Can I decline Medicare Part B?

You can decline Medicare Part B coverage if you can't get another program to pay for it and you don't want to pay for it yourself. The important thing to know about declining Part B coverage is that if you decline it and then decide that you want it later, you may have to pay a higher premium.

Are you forced to go on Medicare?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage.

Can I cancel Medicare Part A anytime?

Canceling your Medicare Supplement insurance plan and getting a new one. You may want to cancel your Medicare Supplement insurance plan because you want to switch to a different plan. You can cancel the plan anytime as long as you notify your health insurance company in writing.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens when you opt out of Medicare Part B?

You may face a late enrollment penalty if you do not enroll in Part B when eligible. Your monthly premium may go up 10% for each 12-month period you could have had Part B but didn't.

Why was I automatically enrolled in Medicare Part B?

You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

How do I disenroll from Medicare?

Call 1-800-MEDICARE (1-800-633-4227). Mail a signed written letter to your plan's mailing address notifying them of your desire to disenroll. Submit a disenrollment request through the plan's website (if such a feature is offered).

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Do I have to pay Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

How long is the waiting period for Medicare?

People who receive SSDI benefits and are under the age of 65 can benefit from Medicare. However, there is a 2-year waiting period for most people before their healthcare coverage begins. Medicare waives the waiting period for those who have ESRD or ALS. People can find alternative healthcare coverage during the waiting period through Medicaid, ...

When does the waiting period start for Medicare?

The Medicare waiting period starts after the SSA approve an application. A qualifying individual receives their Medicare cards for Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) in the 22nd month of the waiting period. Medicare coverage will start during the 25th month.

How long does it take for Medicare to cover ESRD?

People with ESRD do not need to wait for 2 years before Medicare coverage begins. The waiting period is shorter, and Medicare begins on the first day of the fourth month of the person’s dialysis treatment. Medicare coverage may start up to a year before someone applies. Medicare calls this retroactive coverage.

How long do you have to work to qualify for SSDI?

To qualify for SSDI benefits, an individual must have worked in a job that Social Security covers. They must also have a medical condition that meets the SSA disability definition and be unable to work for a year or more. The Medicare waiting period starts after the SSA approve an application. A qualifying individual receives their Medicare cards ...

How long do you have to wait to get medicare for SSDI?

Although most people with SSDI benefits have to wait for 2 years before their Medicare coverage begins, there are certain exceptions. For example, if someone has end stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), Medicare waives the waiting period so that the person can get their healthcare benefits sooner.

How long does Medicare coverage last?

Medicare coverage may start up to a year before someone applies. Medicare calls this retroactive coverage. For example, if someone starts dialysis in a clinic on November 1 and they delay signing up for Medicare until the following June, Medicare backdates their coverage to February 1.

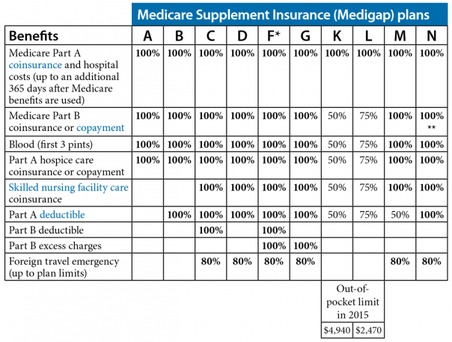

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

When are Medicare premiums due?

Pay on time to avoid coverage cancellation. Medicare premiums are due the 25th day of the month. Don’t miss more than 3 consecutive months of payments to Medicare. Coverage will end in the fourth month if payments aren’t made.

What percentage of FPL can I get for Medicare Part B?

Not have an income that is more than 200% of the FPL (You may only get partial aid if your income is between 150% to 200% of the FPL.) Part B Only: Both the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) programs will help pay for Medicare Part B premiums.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

How much does Medicare Part D cost?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

Is QMB coverage 100%?

But if you’re approved as a QMB, you are not responsible for paying any cost-sharing, according to the Center for Medicare Advocacy. This means that your Medicare costs, including your premiums, are 100% covered. To qualify for the QMB program, your income must not exceed 100% of the FPL.

Can you get Medicare out of pocket?

Each state manages MSP funds and decides who qualifies. Programs can pay for all, or just some, of your Medicare out-of-pocket expenses, which includes premiums.

What is extra help for Medicare?

Medicare offers “ Extra Help ” for Medicare enrollees who can’t afford their Part D prescription drug coverage. In 2020, if you’re a single person earning less than $1,615 per month ($2,175 for a couple), with financial resources that don’t exceed $14,610 ($29,160 for a couple), you may be eligible for “Extra Help.”.

What is the income limit for Medicare Part A?

The income limits are higher (up to $4,339/month for an individual, and $5,833 for a couple in 2020), but the asset limit is lower, at $4,000 for an individual and $6,000 for a couple.

Does Medicare cover long term care?

Medicare does not cover custodial long-term care, but Medicaid does, if the person has a low income and few assets. Almost two-thirds of the people living in American nursing homes are covered by Medicaid (almost all of them are also covered by Medicare).

Is Medicare a dual program?

Medicare-Medicaid dual eligibility. People who are eligible for MSPs are covered by Medicare, but receive assistance with premiums (and in some cases, cost-sharing) from the Medicaid program. But some low-income Medicare enrollees are eligible for full Medicaid benefits, in addition to Medicare. About 20 percent of Medicare beneficiaries are dually ...

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). 2.1. For ORM, there may be …

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of th...