Social Security and Medicare Taxes. An employer generally must withhold part of social security and Medicare taxes from employees' wages and the employer additionally pays a matching amount. To figure out how much tax to withhold, use the employee's Form W-4 and the methods described in Publication 15, Employer's Tax Guide and Publication 15-A, Employer's Supplemental Tax Guide. You must deposit the taxes you withhold. See requirements for depositing.

How do you calculate Medicare withholding?

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. ...

How to calculate Medicare tax withholding?

To calculate FICA taxes from an employee's paycheck, you will need to know:

- The amount of gross pay for the employee for that pay period

- The total year-to-date gross pay for that employee

- The Social Security and Medicare withholding rates for that year (see below)

- Any amounts deducted from that employee's pay for pre-tax retirement plans.

How to calculate SS withholding?

About these Calculations

- These tax calculations assume that you have all earnings from a single employer. ...

- Self employed persons pay the same as the total of both the employee and employer taxes in total.

- * Employment related taxes are considered a deductible company expense for employers. ...

Can taxes be withheld from Social Security?

You can elect to have federal income tax withheld from your Social Security benefits if you think you'll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. 3 You're limited to these exact percentages—you can't opt for another percentage or a flat dollar amount.

How do you determine how much to withhold for Social Security and Medicare tax?

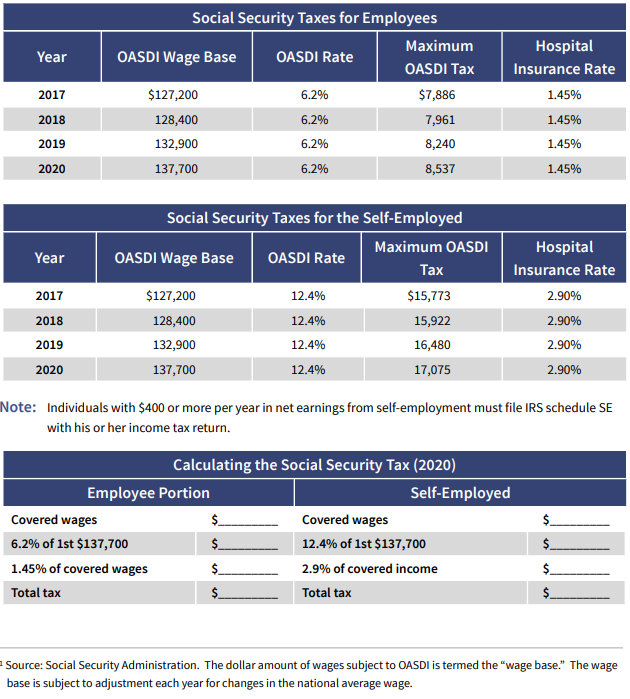

FICA Tax Withholding RatesThe Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. ... The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ... For a total of 7.65% withheld, based on the employee's gross pay.

Can you deduct Social Security and Medicare tax withheld?

The federal tax code does allow you to deduct some taxes when you file your federal tax return, such as state and local income or sales taxes, real estate taxes and property taxes, but there isn't a deduction for Social Security taxes or Medicare taxes.

How do I opt out of Medicare and Social Security tax?

To request an exemption from Social Security taxes, get Form 4029—Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits from the Internal Revenue Service (IRS). Then, file the form with the Social Security Administration (address is on the form).

Do you add Social Security and Medicare count as federal withholding?

If you check your pay stubs, you've probably noticed that in addition to income tax withholding, you also have FICA taxes withheld. FICA includes taxes to pay for Social Security benefits and Medicare benefits. Understanding how these taxes work helps you budget for how much you'll have withheld for all types of taxes.

How do I request my Social Security withholding?

You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request. (If you are deaf or hard of hearing, call the IRS TTY number, 1-800-829-4059.) When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.

Where do I deduct Social Security withholding?

Enter this total on line 12z of Schedule 3, which accompanies the 2021 tax return, and transfer the total to line 31 of your 1040.

How do I change my tax withholding?

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

What happens if I opt out of Social Security?

If you become disabled and have opted out, you won't receive any Supplemental Security Income at all, since that also comes out of the Social Security pool. Don't opt out without having a good long-term disability policy in place. Long-term care insurance.

Is paying Social Security optional?

Most people can't avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers. Just like the income tax, most people can't avoid paying Social Security taxes on their employment and self-employment income.

How do I fill out a w4 for dummies?

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Why is Social Security not being taken out of my paycheck?

Some workers are exempt from paying Social Security taxes if they, their employer, and the sect, order, or organization they belong to officially decline to accept Social Security benefits for retirement, disability, death, or medical care.

How do I send W-4V to Social Security?

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form W-4V; and give it to the payer, not to the IRS. Note. For withholding on social security benefits, give or send the completed Form W-4V to your local Social Security Administration office.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Can you deduct Social Security and Medicare taxes?

Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

Do you pay FICA taxes if you are self employed?

If you earn wages from an employer, these are called Federal Insurance Contributions Act (FICA) taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act (SECA), you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need ...

Who is Darron Kendrick?

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This article has been viewed 26,463 times.

Is Social Security split 50/50?

It is not split 50/50. Pay both FICA and SECA Social Security taxes, if necessary. If you have both wages from an employer and income from self-employment, Social Security taxes are paid on your wages first, but only if your total income is more than $127,200.

Where to file Form 843?

File Form 843 (with attachments) with the IRS office where your employer's Forms 941 returns were filed. You can locate the IRS office where your employer files his Form 941 by going to Where to File Tax Returns.

Is self employment taxed as wages?

Self-Employment Tax. Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Do non-residents pay taxes on self employment?

However, nonresident aliens are not subject to self-employment tax. Once a nonresident alien individual becomes a U.S. resident alien under the residency rules of the Internal Revenue Code, he/she then becomes liable for self-employment taxes under the same conditions as a U.S. citizen or resident alien. Note: In spite of the general rules ...

Do Social Security and Medicare taxes apply to wages?

social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer.

Can you make Social Security payments if no taxes are due?

Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Do you pay Social Security taxes to one country?

The agreements generally make sure that social security taxes (including self-employment tax) are paid only to one country. You can get more information on the Social Security Administration's Web site.

Do you have to deduct taxes on Social Security?

Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

What form do I need to change my Social Security withholding?

If you are already receiving benefits or if you want to change or stop your withholding, you'll need a Form W-4V from the Internal Revenue Service (IRS).

How to get a W-4V form?

You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request. (If you are deaf or hard of hearing, call the IRS TTY number, 1-800-829-4059 .) When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.

When to report Social Security and Medicare taxes?

How and when you’re going to report FICA taxes all depends on where you report them. The Internal Revenue Service requires employers to report these taxes along with other payroll-related tax withholdings using Form 941 every quarter. Hence the name of Form 941 – Employer’s Quarterly Tax Return.

How to file tax forms associated with Social Security and Medicare tax?

As mentioned above, you’ll need to file two tax forms, the 941 for every quarter and W2 at the end of the tax year when payroll is processed for the full tax year.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

Refund of Taxes Withheld in Error

- Determine the amount of your income subject to Social Security and Medicare taxes. If you are paying Social Security (SS) and Medicare taxes on your own, it is most likely because you are self-employed. To calculate your tax, you must first add up all of the income you earned. However, exclude:[1] X Trustworthy Source US Social Security Administration Independent U.…

- Calculate the amount you owe in Social Security taxes. Currently, Social Security taxes amou…

Self-Employment Tax

International Social Security Agreements

References/Related Topics

- If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement....