What happens to Medicare if the Affordable Care Act is repealed?

What are the key Medicare provisions in the ACA and how would repeal affect Medicare spending and beneficiaries? Payments to Health Care Providers. The ACA reduced updates in Medicare payment levels to hospitals, skilled nursing... Payments to Medicare Advantage Plans. Prior to …

How many people would be affected by repealing the ACA?

ACA Repeal and Replace – How it May Affect Medicare Beneficiaries In a little more than 10 years, or 2028, Medicare Part A Health Insurance Trust Fund is projected to cover about 87% of the costs for hospital care, skilled rehabilitation and home health as well as hospice care.

Would repealing the Affordable Health Care Act cost jobs?

Feb 22, 2021 · The ACA also mandates that Medicare Advantage plans are not allowed to charge providers more than Original Medicare (Medicare Part A and Part B) for chemotherapy, skilled nursing care, dialysis and other specialized services. Repealing the ACA could mean loosening these requirements. 4. Medicare Insolvency Would Likely Come Sooner

How does the Affordable Care Act (ACA) affect you?

At today’s prices that would potentially mean disastrously higher drug spending. In addition, a total repeal of the Affordable Care Act would also end a new Medicare tax that people earning $125,000 and up pay. That would erode the solvency of …

Three Ways An Obamacare Repeal Would Affect Medicare

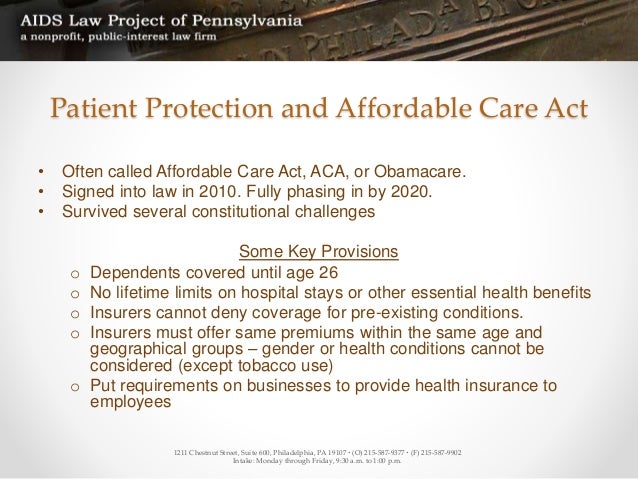

The new President and Congress are working to repeal the 2010 Affordable Care Act (ACA) — more commonly known as Obamacare. The healthcare law included many provisions that affect Medicare and the 57 million retired and disabled Americans who rely on Medicare for their health coverage.

2021 Retirement Survey

Our 2021 Retirement Survey is live. SPEAK OUT NOW! And help shape TSCL’s legislative agenda.

How much of Medicare Part C is spent on other health care?

Under the ACA, Medicare Advantage (Medicare Part C) plans are required to spend at least 85% of the revenue generated by plan premiums on other plan health care costs, and not toward company profits or overhead.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

When is Medicare Advantage disenrollment period?

For those who’ve signed up for a Medicare Advantage plan, there also is a Medicare Advantage disenrollment period that runs from Jan. 1 to Feb. 14. You have the option then of moving into basic Medicare (Parts A and B) and also getting a stand-alone Part D prescription drug plan.

Who is Tom Price?

Most of their worries are aimed at Ryan and at Rep. Tom Price, President-elect Trump’s pick to head the U.S. Department of Health and Human Services. Richtman noted that Price, a physician, is very knowledgeable about health care. “The nomination of Congressman Price is, I think, pretty dangerous,” he said.

Can insurance companies deny coverage based on pre-existing conditions?

Health care and insurance experts don’t see how any serious effort to unwind the law could proceed if it kept both the individual mandate, which requires people be insured, and the ban on insurers being able to deny coverage to a person based on pre-existing medical conditions.

Who is Phil Moeller?

Phil Moeller is the author of “Get What’s Yours for Medicare: Maximize Your Coverage, Minimize Your Costs” and the co-author of the updated edition of The New York Times bestseller “How to Get What’s Yours: The Revised Secrets to Maxing Out Your Social Security,” with Making Sen$e’s Paul Solman and Larry Kotlikoff.