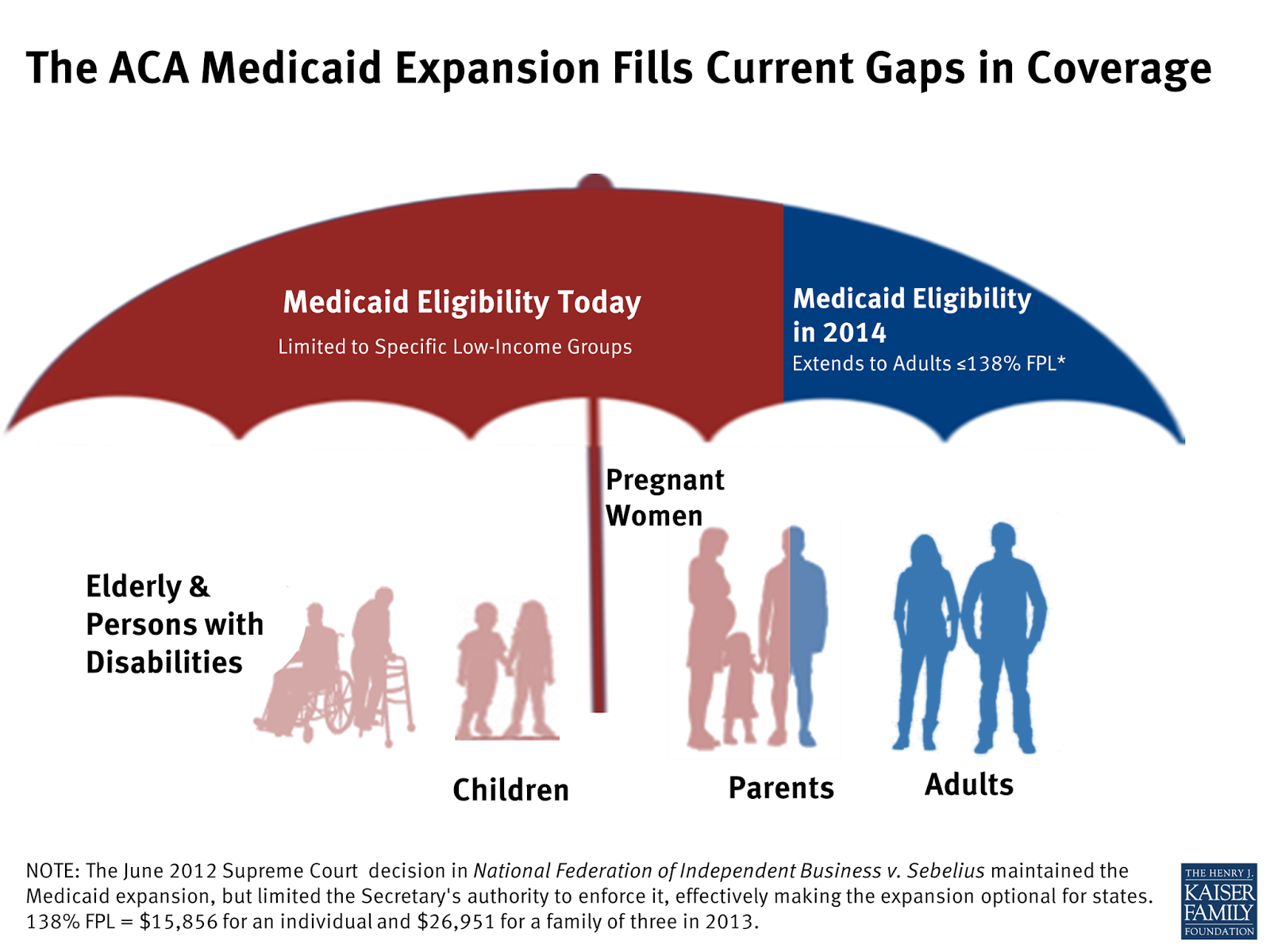

The ACA’s Impact on Medicare Among other benefits, the Affordable Care Act (ACA) helps individuals on Medicare to save money with preventative care and brand-name drugs. Starting in January 2014, Medicare began covering many preventative services with no out-of-pocket expense.

Full Answer

How does the Affordable Care Act (ACA) affect hospitals?

May 17, 2017 · While the bill that would repeal and replace the ACA—the American Health Care Act (AHCA)—does not include explicit changes to Medicare, the legislation could have a profound impact on the 11 million Medicare beneficiaries who also rely on Medicaid for key components of their care. Here’s a look at how the AHCA’s major changes in federal funding for Medicaid …

What happens to Medicare if the Affordable Care Act is eliminated?

May 18, 2017 · AHCA Would Affect Medicare, Too By Cindy Mann , Partner | Allison Orris , Counsel Editor’s Note: While the American Health Care Act (AHCA)—the bill that would replace the Affordable Care Act—does not include explicit changes to Medicare, it could have a profound impact on the 11 million Medicare beneficiaries who also rely on Medicaid for key components …

How will the AHCA impact hospital revenues?

Dec 01, 2021 · This Office of the Actuary has estimated the financial and coverage effects through 2026 of selected provisions of the “American Health Care Act of 2017” (H.R. 1628), which was passed by the House on May 4, 2017. Included are the estimated impacts on net Federal expenditures, health insurance coverage, Medicaid enrollment and spending by eligibility …

What happens to HIPAA if the ACA is struck down?

Starting in 2013, the Medicare payroll tax increased by 0.9% (from 1.45 to 2.35%) for individuals earning more than $200,000 and for married couples with income above $250,000 who file jointly. The extra tax only impacts the wealthiest fraction of the country – less than three% of couples earn $250,000 or more.

What impact is the Affordable Care Act expected to have on Medicare?

The ACA made myriad changes to Medicare. Some changes improved the program's benefits. Others reduced Medicare payments to health care providers and private plans and extended the financial viability of the program. Still others provided incentives and created programs to encourage the system to provide better care.Oct 29, 2020

What are the implications of repealing the Affordable Care Act?

In total, if the ACA were repealed, more than 20 million Americans would lose their coverage, causing the biggest health insurance loss event in recorded history. Without coverage, people cannot get both the preventive and curative care they need.Oct 1, 2020

What are the implications of repealing the Affordable Care Act for Medicare spending and beneficiaries?

Full repeal of the Medicare provisions in the ACA would increase payments to hospitals and other health care providers and Medicare Advantage plans, which would likely lead to higher premiums, deductibles, and cost sharing for Medicare-covered services paid by people with Medicare.

What happens to a couples premium with one turning 65 and on the Affordable Care Act with a subsidy?

Individual market plans no longer terminate automatically when you turn 65. You can keep your individual market plan, but premium subsidies will terminate when you become eligible for premium-free Medicare Part A (there is some flexibility here, and the date the subsidy terminates will depend on when you enroll).Oct 5, 2021

Is Obamacare still in effect for 2021?

Is Obamacare still in effect? Yes, the Affordable Care Act (also called Obamacare) is still in effect.Dec 8, 2021

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...May 13, 2021

What impact did the Affordable Care Act have on the Centers for Medicaid and Medicare CMS in their effort to focus on both quality of care and cost reduction?

The Affordable Care Act reduces the practice of paying substantially more to private insurers that contract with Medicare than it would cost Medicare to cover those individuals in traditional Medicare.

What preventive care services will Medicare beneficiaries receive as a result of the ACA?

The ACA now provides Medicare enrollees with access to specific preventive medical services at no out-of-pocket cost. These include flu shots, smoking cessation programs, an annual wellness visit for seniors, and screenings for cancer, diabetes and several other chronic diseases.

Is the Affordable Care Act part of Medicare?

The federal government pays for most Medicare costs. Affordable Care Act (ACA) plans are usually offered by private health insurance companies. So, Medicare generally costs you less. Medicare, of course, is mainly for people 65 and over, although some people qualify through disability.Aug 6, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can my wife get Medicare when I turn 65?

Yes! If you worked and paid Medicare taxes through payroll deductions for at least 10 years, then you and your spouse will both for premium-free Medicare Part A at age 65.

Can I stay on Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.Sep 21, 2016

What is the AHCA per capita cap?

The AHCA’s Medicaid per capita caps would decouple the amount of federal financial support for Medicaid from actual costs and provide up to a preset capped payment for enrolled individuals. While today the federal government shares the actual cost of Medicaid expenditures, the AHCA would set federal funding based on state historic spending trended forward using national trend rates. The Congressional Budget Office projects that per-Medicaid enrollee health costs would grow faster than the annual increase in the capped federal payments, which is how the AHCA’s federal savings are achieved.

What percentage of dual eligibles receive full Medicaid?

The 72% of dual eligibles who receive full Medicaid benefits tend to be in poorer health than other Medicare and Medicaid beneficiaries and rely on Medicaid for high-cost services.

Does a cap on medicaid affect low income?

A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. The AHCA may on paper leave Medicare alone, but millions of Medicare beneficiaries and their families—and the Medicare program itself—would feel the impact.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

How many Medicare Advantage enrollees are there in 2019?

However, those concerns have turned out to be unfounded. In 2019, there were 22 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for well over a third of all Medicare beneficiaries.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

When was Medicare Part D created?

When Medicare Part D was created in 2003, part of the legislation specifically forbid the government from negotiating drug prices with manufacturers, and that has continued to be the case. There has been considerable debate about changing this rule, but it has met with continued pushback from the pharmaceutical lobby.

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

When did Medicare pay 10 percent bonuses?

The Medicare Modernization Act of 2003 included a provision to pay 10 percent bonuses to Medicare physicians who work in health professional shortage areas (HPSAs). The ACA expanded this program to include general surgeons, from 2011 to the end of 2015.

Does Medicare have negotiating power?

Democratic lawmakers have pushed to allow Medicare to negotiate with pharmaceutical companies, and some sort of negotiating power is incorporated into most of the post-ACA health care reform proposals that have been debated in recent years (ie, various versions of single-payer or public option proposals).

What do you need to know about the Affordable Care Act?

Per the Medicare.gov website, here are the “top five things you need to know” about the Affordable Care Act (ACA) if you have Medicare: “Your Medicare coverage is protected. Medicare isn’t part of the Health Insurance Marketplace established by ACA, so you don’t have to replace your Medicare coverage with Marketplace coverage.

How long will Medicare be extended?

The life of the Medicare Trust fund will be extended to at least 2029—a 12-year extension due to reductions in waste, fraud and abuse, and Medicare costs, which will provide you with future savings on your premiums and coinsurance.”. Read more at Medicare.gov.

When will the donut hole close?

The discount is applied automatically at the counter of your pharmacy—you don’t have to do anything to get it. The donut hole will be closed completely by 2020.

Does Medicare cover mammograms?

You get more preventive services, for less. Medicare now covers certain preventive services, like mammograms or colonoscopies, without charging you for the Part B coinsurance or deductible. You also can get a free yearly “Wellness” visit. You can save money on brand-name drugs.

How much will the AHCA cut?

The American Health Care Act (AHCA), as passed by the U.S. House of Representatives, will reduce federal spending on Medicaid by more than $834 billion over the next 10 years. And the recently released Senate bill appears to cut Medicaid even more deeply.

How much will Medicaid increase in 2026?

The hospitals in the District of Columbia and the 31 states that expanded Medicaid are projected to see a 78 percent increase in uncompensated care costs between 2017 and 2026. Eleven of these states will see uncompensated care costs at least double between 2017 and 2026.

How did the ACA affect Medicare?

The ACA reduced Medicare payments to many health care providers, such as hospitals, skilled nursing facilities, hospice, and home health providers. Because the law provided new sources of coverage for the uninsured, it also reduced Medicare Disproportionate Share Hospital payments that compensate hospitals for providing care to low-income and uninsured patients. The law also reformed payments to Medicare Advantage plans, required a minimum portion of plans’ premiums be spent on medical benefits (rather than administrative costs and profits), and added bonus payments for higher-quality plans.

How would overturning the Affordable Care Act affect Medicare?

Overturning the ACA would unquestionably further erode the Medicare Trust Fund, jeopardizing the financing of beneficiaries’ hospital benefits. If parts of the law were overturned that increased federal spending for Medicare through higher payments to providers, then all Medicare premiums, deductibles, and cost-sharing would increase. Medicare payments to health care providers also would be less predictable while policymakers sorted through the various questions, adding instability to a turbulent time. While the effects of overturning the Affordable Care Act on younger adults has received significant attention, the potential effects on Medicare should not be overlooked.

What is the Texas case?

Texas, a case brought by Republican attorneys general and supported by the Trump administration that is challenging the constitutionality of the Affordable Care Act (ACA). If the Supreme Court takes a narrow approach, striking the individual coverage mandate and related provisions like preexisting condition protections, ...

What would happen if the ACA was repealed?

Full repeal of the Medicare provisions in the ACA would increase payments to hospitals and other health care providers and Medicare Advantage plans, which would likely lead to higher premiums, deductibles, and cost sharing for Medicare-covered services paid by people with Medicare.

What is the ACA payment?

Payments to Health Care Providers. The ACA reduced updates in Medicare payment levels to hospitals, skilled nursing facilities, hospice and home health providers, and other health care providers. The ACA also reduced Medicare Disproportionate Share Hospital (DSH) payments that help to compensate hospitals for providing care to low-income ...

Why is the ACA important?

The Medicare provisions of the ACA have played an important role in strengthening Medicare’s financial status for the future, while offsetting some of the cost of the coverage expansions of the ACA and also providing some additional benefits to people with Medicare.

What is the 2010 ACA?

The 2010 Affordable Care Act (ACA) included many provisions affecting the Medicare program and the 57 million seniors and people with disabilities who rely on Medicare for their health insurance coverage. Such provisions include reductions in the growth in Medicare payments to hospitals and other health care providers and to Medicare Advantage ...

How much will Medicare increase over 10 years?

Increase Part A and Part B spending. CBO has estimated that roughly $350 billion 3 of the total $802 billion in higher Medicare spending over 10 years could result from repealing ACA provisions that changed provider payment rates in traditional Medicare.

How many members are on the Medicare Advisory Board?

The ACA authorized a new Independent Payment Advisory Board (IPAB), a 15-member board that is required to recommend Medicare spending reductions to Congress if projected spending growth exceeds specified target levels, with the recommendations taking effect according to a process outlined in the ACA.

What is Medicare Advantage Payment?

Payments that Medicare Advantage plans receive in excess of their costs to provide Part A and Part B benefits are required to be used to provide benefits not covered by traditional Medicare, to reduce cost sharing, premiums, or limits on out-of-pocket spending, or both.

Judge Who Invalidated Obamacare Has Been A 'Go-To Judge' For Republicans, Critics Say

"To erase a law that is so interwoven into the health care system blows up every part of it," says Sara Rosenbaum, a health law professor at the George Washington University School of Public Health. "In law they have names for these — they are called superstatutes," she says. "And [the ACA] is a superstatute.

FACT CHECK: Who's Right About Protections For Pre-Existing Conditions?

Previously many hospitals, doctors and other health providers spent considerable time and effort figuring out how to treat — without going broke —people who lack insurance.

Medicare Trying Bundled Payments To Save Money, Improve Care

Elimination of the federal health law would take away some popular benefits the ACA conferred — everything from free preventive care to the closing of the "doughnut hole" in Medicare's prescription drug coverage.

What is the number to call for Medicare?

If your group health plan coverage was from a state or local government employer, call the Centers for Medicare & Medicaid Services (CMS) at 1-877-267-2323 extension 61565. If your coverage was with the federal government, visit the Office of Personnel Management.

What is Cobra insurance?

COBRA is a federal law that may let you keep your employer. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families. This is called "continuation coverage.". coverage for a limited time after your employment ends or you lose coverage as a dependent ...

How long do you have to sign up for Part B?

If you’re eligible for Medicare, you don’t qualify for COBRA coverage without having to pay a premium. You have 8 months to sign up for Part B without a penalty, whether or not you choose COBRA.

How many employees can you have with Cobra?

In general, COBRA only applies to employers with 20 or more employees. However, some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time.

How long does Cobra last?

COBRA coverage generally is offered for 18 months (36 months in some cases). Ask the employer's benefits administrator or group health plan about your COBRA rights if you find out your coverage has ended and you don't get a notice, or if you get divorced.